[ad_1]

I learn this submit on Reddit some time in the past: Vanguard closed my account for fraudulent exercise.

I offered a property, acquired my fee through verify and determined to speculate the cash in Vanguard. I opened a Vanguard account on-line and linked my financial institution, transferred $10 to my Money Plus account, opened a brokerage account and deposited my verify on Friday to the brokerage account. The verify was accepted. On Tuesday, I acquired a name from the verify issuer that the verify cleared. I logged in Vanguard and I can see it was processed however not out there until after 7 days. The whole lot appears simple, so I assumed. Later the identical day, I attempted to log in and I obtained an error message, “Entry to your account has been disabled. Please contact us.” I known as Vanguard and spoke to a rep. They informed me my account is being reviewed by the analysis staff and they are going to be contacting me in 72 hours. I waited 72 hours and known as once more. Identical response. 2 days later, I acquired a voicemail from the Vanguard fraud staff.

“Howdy, that is the fraud staff calling to let you recognize the account you inquired about has been restricted resulting from fraudulent exercise. The makes an attempt to convey funds into the account have been rejected. Any digital financial institution switch could be recalled by your financial institution. Once more the account is completely restricted and there won’t be a follow-up to this situation.”

This poster finally obtained the cash again when Vanguard returned the cash to the verify issuer.

This sort of fraud restriction isn’t restricted to Vanguard. Constancy has had a wave of fraud assaults not too long ago. Criminals recruited current prospects as collaborators (“mules”) for a 50/50 break up to make pretend deposits and withdraw the cash.

Constancy turned up their counter-fraud measures to thwart these assaults. Many purchasers reported seeing their accounts restricted, debits declined, Invoice Pay canceled, cellular deposit restrict lower to $1,000, or the deposit maintain occasions prolonged to as much as 21 days. Little question many of those are false positives. Assaults from inside are probably the most tough to fight. It’s exhausting to differentiate who’s legit and who’s knowingly or unknowingly working with criminals.

I exploit Constancy for all my spending. As I discussed within the earlier submit Ditch Banks — Go With Cash Market Funds and Treasuries, I’ve beneath $100 in exterior financial institution accounts. All my money is in a Constancy account in cash market funds and Treasuries. All my payments are paid out of this Constancy account. It’ll trigger issues if Constancy restricts my account. I’m not involved about that risk as a result of I observe this one easy rule:

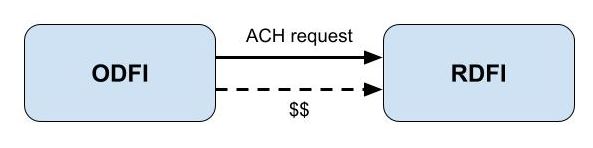

Make all deposits by ACH push.

An ACH push is initiated on the similar place the place the cash at the moment resides (see ACH Push or Pull: The Proper Technique to Switch Cash). Employer or authorities direct deposits additionally are available in by ACH push. I make all deposits to my Constancy account by ACH push. For instance, once I switch the bank card rewards earned in a Financial institution of America account to Constancy, I provoke the ACH at Financial institution of America.

Cash acquired by ACH push is trusted cash. It’s out there instantly as a result of the receiving establishment isn’t answerable for it. You don’t have anything to fret about having your account flagged for fraud when all the cash coming into the account comes by ACH push.

The Reddit poster at first of this submit didn’t observe this rule. I enterprise to say that everybody who had their Constancy account restricted not too long ago additionally didn’t observe this rule. Verify deposits and ACH pulls are untrusted by the receiving establishment. Not each verify deposit or ACH pull will get the account restricted for fraud issues however those that had their account restricted more than likely had made verify deposits or ACH pulls.

My Constancy account is functioning usually as standard. I wouldn’t have recognized this storm was taking place if I hadn’t learn Reddit. My cellular verify deposit restrict remains to be a whopping $500,000 per day though I’ve no bodily checks to deposit. All debits for estimated taxes, bank card payments, utility payments, and PayPal and Venmo funds went out with no hitch. I don’t know what the maintain time can be if I do an ACH pull proper now as a result of I don’t make deposits by ACH pull anyway. I initiated one other ACH push from Financial institution of America to my Constancy account as a take a look at. The cash arrived the following day and it was out there instantly as anticipated. No maintain.

Say No To Administration Charges

In case you are paying an advisor a share of your belongings, you might be paying 5-10x an excessive amount of. Learn to discover an unbiased advisor, pay for recommendation, and solely the recommendation.

[ad_2]