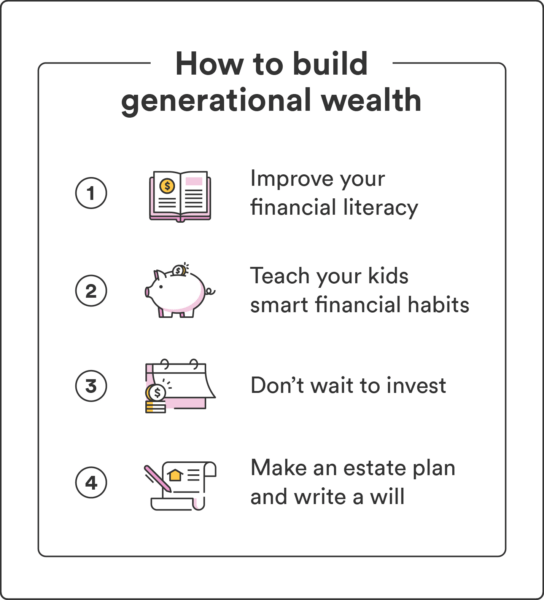

Constructing generational wealth can look totally different for everybody, however there are a couple of time-tested methods.

Enhance your monetary literacy

Efficiently constructing generational wealth begins with enhancing your individual monetary literacy. With a strong understanding of private finance, making knowledgeable choices about saving, investing, and passing on wealth to future generations could be simpler.

Your day-to-day cash habits additionally largely dictate your means to develop long-term wealth. To start, familiarize your self with primary monetary ideas, comparable to budgeting, saving, credit score, and investing. Finally, you’ll be able to transfer on to extra superior matters comparable to property planning (we’ll cowl this extra under) and tax legal guidelines to maximise your financial savings and investments.

Reap the benefits of the numerous sources accessible to enhance your monetary literacy. Learn books and articles, watch YouTube movies, or take free programs on private finance fundamentals. To get began investing, you’ll be able to deepen your understanding of matters like shares, bonds, mutual funds, and retirement accounts.

Educate your children wholesome monetary habits

Guaranteeing a financially safe future in your youngsters and future generations requires passing down extra than simply wealth. You also needs to educate wholesome monetary habits in your children whereas they’re younger.

You can be the savviest investor, however in case you cross that wealth to your youngsters with out ever educating them how you can protect and develop it, there’s a slim probability that wealth will final.

Among the best methods to enhance your children’ monetary literacy is by encouraging open and sincere conversations about budgeting, saving, and different finance matters.

That would imply discussing the distinction between desires and wishes relating to spending, the concept of paying your self first, or how you can delay prompt gratification for larger objectives sooner or later.

By selling monetary training and duty inside your loved ones, you’ll be able to assist be certain that your youngsters and future generations have the talents essential to ultimately take what you’ve began and proceed to construct it with confidence.

Make investments as quickly as potential

Investing is essential in constructing long-term wealth due to the potential of incomes larger returns than conventional financial savings accounts. The earlier you make investments, the extra time your cash has to develop and compound over time.

Opposite to widespread perception, you don’t want a ton of cash to start investing – even small investments made early on can develop considerably over time, leading to substantial wealth accumulation. The sooner you begin investing, the extra time you’ve got for compounding to work its magic and generate important returns.

There are a selection of beginner-friendly investments you may think about:

For inexperienced persons, begin by researching totally different funding choices and think about working with a monetary advisor or utilizing a robo-advisor to assist make knowledgeable choices.

Set up an property plan

With out an property plan, your property could also be topic to probate courtroom (the courtroom that oversees the dealing with of wills and estates), which could be expensive and time-consuming. With clear directions on distributing your property, your property might cross down your wealth based on your needs.

Property planning may assist reduce taxes and different bills of transferring wealth. Correct planning lets you use tax-efficient methods comparable to gifting and trusts to cross down the utmost quantity.

An property plan may assist stop household disputes over your wealth after dying. By clearly outlining your intentions and directions for a way you need your wealth distributed, you’ll be able to scale back the probability of arguments amongst relations and be certain that your legacy continues in a constructive method.

Write a will

You must write a will even in case you’re not able to create a full-blown property plan. A will is a doc that outlines how your property needs to be distributed after your dying. It’s additionally the place you would come with your needs for the care of any younger youngsters you might go away behind.

With out a will in place, you haven’t any say in how your property or property are dealt with when you’re gone – as a substitute, it’s as much as the state to determine (which might result in an costly and annoying authorized course of in your family members).

Think about elements comparable to your property, beneficiaries, and potential tax implications when writing a will. A will may embrace provisions for trusts, which may help defend your property and guarantee they’re handed down in a tax-efficient method. Working with an property planning legal professional may help you create a complete will that meets your wants and objectives.