My morning practice WFH reads:

• The worldwide inventory market rally isn’t as slender as you suppose: “For those who assign equal weights to the MSCI Europe, Japan and the US indices, that is the perfect begin to a yr since 1998, Lapthorne notes. In greenback phrases the Nikkei 225 is off to its finest begin since 1999.” (Monetary Instances)

• Meta’s ‘Twitter Killer’ App Is Coming: Meta, which owns Fb and Instagram, teased a brand new app known as Threads that’s set to tackle Twitter for real-time digital conversations. (New York Instances) see additionally So the place are all of us alleged to go now? It’s the tip of a social period on the internet. That’s in all probability factor. However I already miss the locations that felt like everybody was there. (The Verge)

• Exploiting the splendidly bizarre in a single day drift of shares: In follow the anomaly is unimaginable to simply exploit due to buying and selling prices (liquidity is way decrease in a single day, and one-day holding intervals would make it a high-turnover technique). The NightShares ETF has truly misplaced nearly 6 per cent over the previous yr, in comparison with the US inventory market’s 18 per cent achieve over the identical interval. (Monetary Instances)

• Re-Mixing Asset Allocation: Insurers Lower Bonds, Then Do a Partial Reversal: The trade is also increasing its publicity to shares and alts, amid rising charges. (Chief Funding Officer)

• TV’s Golden Period Proved Pricey to Streamers: Streaming losses and layoffs had been already resulting in an trade retrenchment. Then the writers’ strike hit. (Wall Road Journal)

• The Explosive Progress Of The Fireworks Market: The adjustments actually picked up the tempo after 1972, when Congress arrange the U.S. Client Product Security Fee (CPSC). Fireworks, with their historical past of maiming folks, had been one of many company’s first targets. The CPSC made positive for a rocket capturing off, that the bases had been stronger and longer, in order that the rockets didn’t tip over, and you then had a rocket capturing alongside the bottom at spectator. They made positive fuses had been constant. (NPR)

• Joe Biden’s $400 Billion Man: Jigar Shah, who runs the Vitality Division’s mortgage program, is attempting handy out some huge cash for green-technology tasks, whereas navigating an unforgiving political setting https://www.wsj.com/articles/green-energy-climate-loans-49fda73b

• Asking Hire Progress Flat Yr-over-year. Realtor.com: First Yr-over-year Hire Decline in Their Information (Calculated Danger)

• Nonreligious People Are The New Abortion Voters: In 2021, the share of religiously unaffiliated People (a bunch that features atheists, agnostics and individuals who determine with no faith specifically) who mentioned abortion was a crucial difficulty began to rise. And for the primary time in 2022, the yr the Supreme Courtroom overturned the federal proper to abortion in Dobbs v. Jackson Ladies’s Well being Group, the share of religiously unaffiliated People who mentioned that abortion was a crucial difficulty was larger than the share of white evangelicals who mentioned the identical. (FiveThirtyEight)

• Hollywood has a Jamie Foxx-shaped gap in its coronary heart: The actor was not on the pink carpet for the Miami premiere of ‘They Cloned Tyrone,’ however his presence was nonetheless felt. (Washington Put up)

You’ll want to try our Masters in Enterprise this weekend with Franklin Templeton CEO Jenny Johnson, which manages $1.5 trillion greenback in shopper property. She has labored at FT since 1988, and held management roles in funding administration, distribution, know-how, operations, and high-net-worth shoppers. Franklin Templeton oversees greater than 9000 workers and 1300 funding professionals. Johnson is on the record of strongest ladies (Barron’s, Forbes, American Banker, and extra). She has been CEO February 2020.

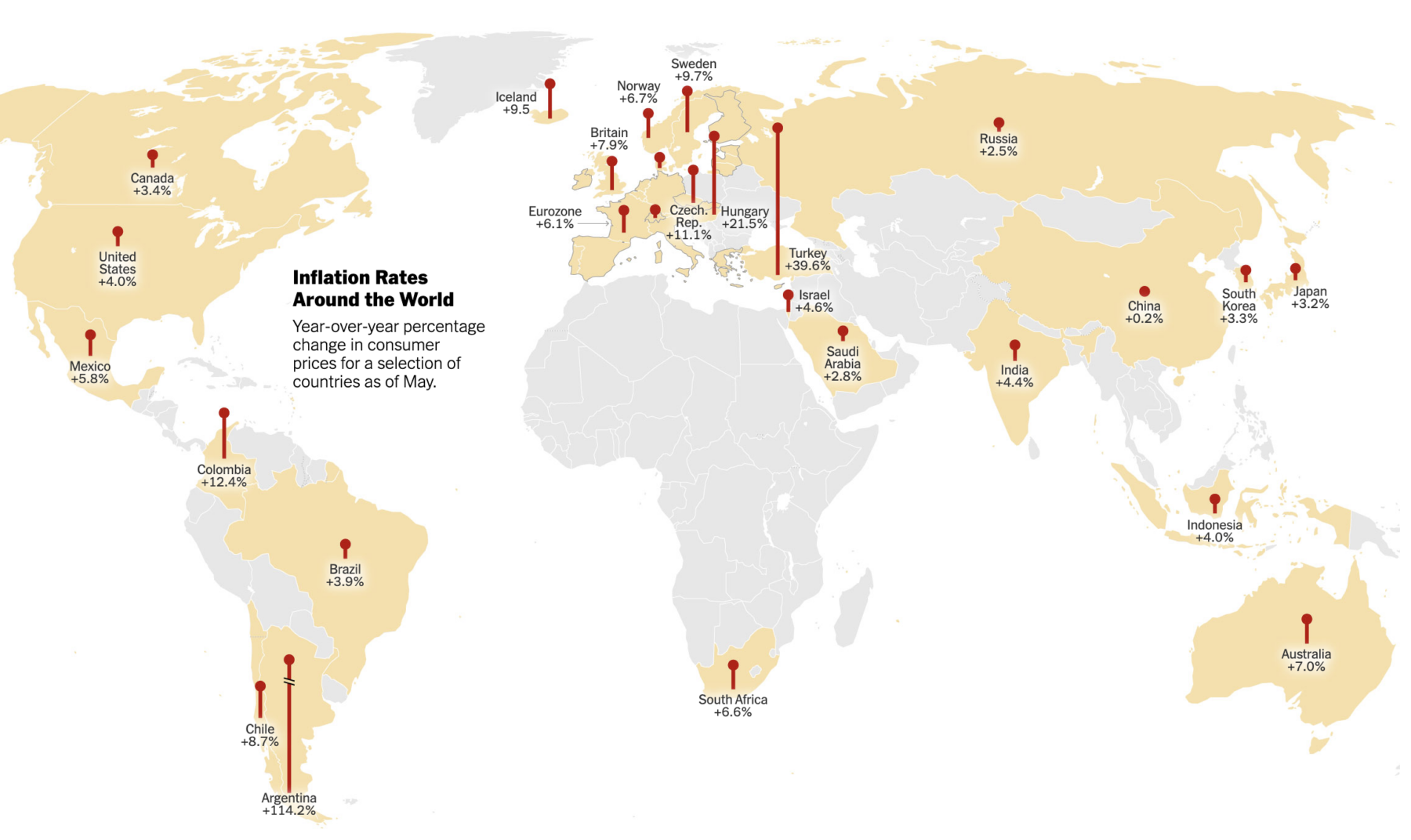

It’s a World of Inflation

Supply: New York Instances

Join our reads-only mailing record right here.