Umbrella insurance coverage is likely one of the least talked about insurances, which is extremely problematic.

Umbrella insurance coverage is a vital danger administration software, significantly for individuals who have wealth, revenue, or future revenue potential.

Plus, it’s low cost relative to most different varieties of insurance coverage!

I’m at all times amazed on the quantity of people that forgo umbrella insurance coverage or have low limits of umbrella insurance coverage protection when it may probably shield your monetary future from our lawsuit-happy society.

Whether or not you have already got umbrella insurance coverage or determined to not purchase it, this text is for you. It’ll aid you higher perceive why umbrella insurance coverage is necessary, what it covers, and what it doesn’t cowl. It’ll additionally assist reply the query of “do I want umbrella insurance coverage?”, aid you resolve how a lot umbrella insurance coverage to buy, and provide you with an thought of how a lot chances are you’ll pay.

Your Studying Information conceal

What’s Umbrella Insurance coverage?

Umbrella insurance coverage is further insurance coverage that gives further safety on high of your different insurance policies, reminiscent of auto, dwelling, and watercraft insurance coverage.

Auto, dwelling, and watercraft insurance coverage have sure limits in how a lot will probably be lined, and umbrella insurance coverage supplies further insurance coverage past these limits. Mentioned one other manner, when these limits are exhausted, umbrella insurance coverage may cowl claims in extra of these limits.

It may present further protection for lawsuits, accidents, and property injury.

For instance, in case you are in an auto accident the place you might be at fault and you might be sued, an umbrella insurance coverage coverage may assist pay for an legal professional to defend you and pay for legal responsibility claims in case your auto insurance coverage restrict is reached.

Or, if a visitor is over at your home, falls, and sues you for medical payments and misplaced wages above your house owner’s legal responsibility restrict, an umbrella insurance coverage may assist cowl the payments, misplaced wages, and legal professional’s charges to defend the lawsuit.

Umbrella insurance coverage is what may pay out when your different limits are exhausted, and it will possibly pay for attorneys to defend you.

Why Umbrella Insurance coverage Is Necessary

Umbrella insurance coverage is necessary as a result of many owners, auto, and watercraft insurances solely present limits as much as a specific amount – usually $500,000. Plus, we reside in a litigious society.

What number of instances have you ever heard a few ridiculous lawsuit and rolled your eyes?

I do know I’ve loads of instances. But, somebody is paying for no less than one legal professional to defend them from these claims.

Even when it’s a cheap lawsuit, there are conditions the place $500,000 is just not going to be sufficient to cowl a declare.

For instance, for those who trigger an accident that damages a number of automobiles and injures a number of individuals, $500,000 could also be nowhere near sufficient.

Think about hitting just a few higher-end automobiles and injuring just a few individuals who make lots of of 1000’s of {dollars} per yr. Relying on the value of the automobiles, chances are you’ll exhaust your property injury shortly. If these people are out of labor for greater than a yr, $500,000 probably isn’t going to be sufficient safety.

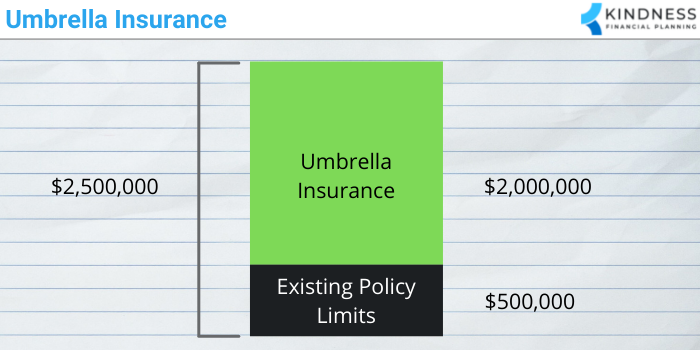

Umbrella insurance coverage sits on high of your different insurance policies to offer one other layer of safety.

As an illustration, for those who had private legal responsibility protection of $500,000 and a $2,000,000 umbrella insurance coverage coverage, your $500,000 of non-public legal responsibility protection can be used first after which as much as $2,000,000 of further protection.

This implies you’ll have a complete of $2,500,000 of non-public legal responsibility protection.

It’s low odds you’ll ever want to make use of the protection, however for those who do, it may imply the distinction between beginning over financially and protecting your similar way of life.

What Does Umbrella Insurance coverage Normally Not Cowl?

Umbrella insurance coverage doesn’t cowl every part. It picks up the place your different limits depart off, which implies in case your auto, householders, or watercraft protection don’t embody protection for one thing, your umbrella insurance coverage probably received’t both.

As with something, learn the advantageous print and ask your insurance coverage agent plenty of questions to know what it’s going to and received’t cowl.

Generally, it received’t cowl:

- Enterprise actions

- Serving on a board

- Intentional acts

- Legal acts

- Your accidents

- Harm to your private property

- Different exclusions in your coverage (i.e. accidents or property injury brought on by sure canine breeds, sure automobiles, sure actions, and so forth.)

Umbrella protection often doesn’t cowl enterprise actions. For instance, if a consumer visits you at your property for enterprise functions, falls, and has to go to the hospital for critical accidents, your umbrella insurance coverage, and certain your house owner’s insurance coverage, is just not going to cowl it. You often want particular enterprise insurance coverage protection.

Any intentional or felony acts to trigger injury are often not lined. For instance, for those who get offended and punch your grandkids’ soccer coach, the umbrella insurance coverage most likely isn’t going to assist cowl your lawsuits or accidents.

Umbrella insurance coverage additionally doesn’t shield your private property. In case your prized art work at dwelling is broken, your householders insurance coverage, and often a particular rider in your coverage is required, is probably going going to offer protection – not your umbrella insurance coverage.

One thing that generally comes up is that umbrella insurance coverage often doesn’t cowl you serving on the board of an organization, rental affiliation, or non-profit. Normally, you want to add an endorsement or acquire administrators and officers protection.

You additionally want to concentrate on different exclusions in your coverage. For instance, sure canine breeds could also be excluded from an umbrella insurance coverage coverage. For those who owned a canine breed particularly excluded within the coverage, and it bites somebody, chances are you’ll not have safety.

Learn the advantageous print. Ask your agent plenty of questions. You don’t need any surprises about what will probably be lined.

Do I Want Umbrella Insurance coverage?

The important thing query is: “Do I want umbrella insurance coverage?”

If solely all of us knew with certainty!

Do any of us really want auto, householders, or watercraft insurance coverage?

If we by no means have an auto accident and it wasn’t legally required in lots of states, one may argue auto insurance coverage was by no means wanted.

The identical goes for householders insurance coverage. If no person is ever injured at your home, it by no means burns down, and nothing ever goes mistaken, one may argue householders insurance coverage was by no means wanted.

It’s the identical for watercraft insurance coverage.

Sadly, that’s not how life or insurance coverage works.

Insurance coverage exists to assist shield you from low likelihood, high-loss occasions, reminiscent of your property burning down.

Statistically talking, the chances of needing to make use of umbrella insurance coverage is low, however for those who want it, you usually really want it.

I can’t say for sure whether or not you want umbrella insurance coverage, however when you have excessive revenue, anticipate to have excessive revenue sooner or later, or have important belongings, these are good causes to personal an umbrella insurance coverage coverage.

Instance of Why Umbrella Insurance coverage is Necessary

Give it some thought from the attitude of a private damage legal professional.

Let’s say you simply hit somebody along with your automotive, they usually rent a private damage legal professional to sue you. The legal professional finds out you reside in a pleasant neighborhood in an costly dwelling. In addition they discover out you labored as an govt at an organization for a variety of years. They drive by your home and see costly automobiles in your driveway.

Cha-ching.

The non-public damage legal professional is happy about suing you now. They know, or no less than imagine, you will have belongings that could possibly be received in a lawsuit.

For those who don’t have a pleasant dwelling, good revenue, or costly automobiles, the private damage legal professional could not take the case. You may sue, but when there are not any belongings or revenue to win, there isn’t a level for the private damage legal professional to take the case.

Widespread Mistake in Deciding Whether or not to Get Umbrella Insurance coverage

One of many frequent errors individuals make in deciding whether or not to buy umbrella insurance coverage protection is just their internet value.

I’ve heard many individuals advocate getting umbrella insurance coverage equal to 1’s internet value; nonetheless, this can be a mistake.

For instance, in case your grandkid is a health care provider who’s of their residency making round $60,000 a yr and has a detrimental internet value due to pupil loans, standard knowledge would say to not have an umbrella insurance coverage coverage.

However, medical doctors have excessive revenue potential. Let’s say your grandkid desires to enter anesthesiology and plans to make $500,000 a yr in just a few years.

Let’s return to the private damage legal professional instance.

The non-public damage legal professional does some digging after your grandkid injures somebody in a automotive accident. They discover out your grandkids specialty as a result of it’s listed on-line. They know anesthesiologists make a excessive revenue.

They could not have sued due to the detrimental internet value, however the incomes potential is profitable, even when they don’t seem to be making it but.

They resolve to sue and 25% of their wages are garnished sooner or later till the private damage settlement is paid.

For this reason it’s necessary to take note of present revenue, future incomes potential, and internet value when deciding to get umbrella insurance coverage.

Beneath are just a few eventualities the place it may make sense to have an umbrella insurance coverage coverage:

- Personal a house

- Personal a rental property

- Have excessive revenue or anticipate to sooner or later

- Have financial savings and belongings

- Apprehensive about lawsuits

- Have children

- Personal a canine

- Have a trampoline, pool, or different excessive danger construction

- Entertain individuals in your house

- Have extra publicly out there details about your self

- Take part in actions which might be extra more likely to injure others (ski, surf, hunt, and so forth.)

In case you are studying this, there’s a good likelihood you’ll profit from having an umbrella insurance coverage coverage.

It’s low cost and might present further peace of thoughts.

How A lot Umbrella Insurance coverage Do I Want?

When you’ve determined you want umbrella insurance coverage, the following query is, “How a lot umbrella insurance coverage do I want?”

As you might have suspected, it’s not a simple reply.

Widespread Rule of Thumb of How A lot Umbrella Insurance coverage Is Wanted

A typical rule of thumb individuals throw round is an quantity equal to your internet value, so in case your internet value was $2,000,000, you’ll get a $2,000,000 umbrella insurance coverage coverage.

Though not a horrible strategy to strategy the choice, you noticed how that may be problematic for individuals with a low internet value in the present day who’ve excessive future incomes potential.

It’s additionally problematic as a result of individuals can nonetheless sue for greater than your internet value.

For instance, if a baby had been hit in an auto accident and have become a quadriplegic, they’re probably going to require very costly look after the remainder of their life.

They could be much less prepared to settle a case than different varieties of accidents as a result of they’re going to want extra monetary help for longer.

How a lot umbrella insurance coverage you want comes right down to how a lot you might be prepared to danger.

Quantities of Umbrella Insurance coverage That Can Be Bought

Many insurance coverage firms will supply quantities between $1,000,000 and $5,000,000, with some going as much as $10,000,000. A number of the greater finish carriers will supply umbrella insurance coverage quantities above $10,000,000.

Since umbrella insurance coverage is comparatively cheap in comparison with the protection out there, I often err on the conservative facet and go for greater quantities.

For instance, if somebody had a internet value of $5,000,000 and was retired, I’d have a look at the price distinction between a $5,000,000 umbrella insurance coverage coverage and a $10,000,000. The $10,000,000 umbrella insurance coverage coverage is often very cheap.

Why Greater Quantities of Umbrella Insurance coverage Can Be Useful

The extra protection you’ll be able to put between your belongings and somebody suing you, the much less probably somebody will be capable of attain your belongings.

For instance, when you have a $5,000,000 coverage and a private damage legal professional thinks you might need $3,000,000 in belongings, they could be extra fascinated about settling with the insurance coverage firm for an quantity lower than $5,000,000 if it will possibly keep away from an extended, drawn out courtroom battle. Private damage attorneys often go after the simpler cash.

One other facet to bear in mind is that an umbrella insurance coverage coverage means you will have legal professional’s combating on behalf of the insurance coverage firm to assist forestall a big payout. For instance, when you have a $5,000,000 umbrella insurance coverage coverage, these legal professional’s are going to work extremely onerous to stop somebody from efficiently suing for $5,000,000, not to mention quantities above that.

Realizing an legal professional offered by the insurance coverage firm goes to defend a lawsuit could also be sufficient of a motive to get umbrella insurance coverage protection. Lawyer charges aren’t low cost.

One thing to concentrate on is that some insurance coverage carriers use your umbrella insurance coverage limits to rent and pay an legal professional to defend you whereas others pay legal professional charges outdoors of your limits.

That is necessary to concentrate on as a result of in case your legal professional’s charges are deducted out of your umbrella insurance coverage limits, you might have lower than you suppose. As an illustration, in case your legal professional’s charges quantity to $200,000 and you’ve got a $1,000,000 umbrella insurance coverage coverage, you solely have $800,000 value of protection left.

For most individuals, the peace of thoughts supplied by having a bit of further umbrella insurance coverage can outweigh the incremental price.

How A lot Does Umbrella Insurance coverage Price?

Umbrella insurance coverage is comparatively cheap as a result of the chances of utilizing it are low. It’s usually bought in increments of $1,000,000. The primary $1,000,000 is often the costliest after which every incremental $1,000,000 is cheaper.

For instance, the primary $1,000,000 may cost $150-$350 a yr after which every further $1,000,000 of protection is likely to be $75-$150 a yr.

Beneath is an instance of what varied quantities may cost.

| Umbrella Insurance coverage Protection | Instance of Annual Price |

| $1,000,000 | $150-$350 |

| $2,000,000 | $225-$500 |

| $3,000,000 | $300-$650 |

| $4,000,000 | $375-$800 |

| $5,000,000 | $450-$950 |

| $10,000,000 | $825-$1,700 |

Prices will differ relying on state, danger components, and different variables. For instance, when you have a pool, a number of teenage drivers, and a canine, your price could also be greater than somebody with out a pool, children, and a canine.

It’s best to ask your insurance coverage agent for a quote to find out what it will really price you.

Usually, you buy an umbrella insurance coverage coverage from the identical insurance coverage service as your auto and house owner’s coverage, however for those who can’t get one from them, you could possibly take into account a standalone coverage.

The hot button is to verify your underlying limits are excessive sufficient in coordination with the umbrella coverage. Most insurance coverage carriers will solely supply an umbrella coverage when you have a specific amount of underlying protection on your property, auto, or watercraft coverage.

Beneath are a pair carriers that will supply a standalone umbrella insurance coverage coverage:

Umbrella insurance coverage could be very cheap relative to the protection it supplies. For just a few hundred {dollars} per yr, you could possibly add hundreds of thousands of {dollars} of additional protection.

Last Ideas – My Query for You

Umbrella insurance coverage could be a key protection for monetary peace of thoughts.

Though many individuals don’t have it, take into account what would occur for those who acquired in an accident tomorrow and injured somebody.

Would your current protection be sufficient?

What wouldn’t it really feel like for those who wanted to rent an legal professional to defend you from a lawsuit?

What would occur for those who confronted a private damage settlement for hundreds of thousands of {dollars}?

Umbrella insurance coverage may also help in a wide range of conditions and is cheap. For just a few hundred {dollars} per yr, you could possibly add further safety and probably sleep higher realizing every part you will have labored for is best protected.

When you are at it, don’t neglect to shield your credit score.

I’ll depart you with one query to behave on.

Will you alter the quantity of umbrella insurance coverage protection you will have?