As Robinhood has grow to be more and more common amongst traders and merchants, the query of whether or not or not it’s a protected platform for buying and selling has come beneath scrutiny.

Many individuals have requested, “Is Robinhood actually protected?” With its easy-to-use interface and fee free trades, Robinhood has grow to be one of the vital common inventory buying and selling apps lately. However questions stay about how safe and dependable it’s when in comparison with conventional brokerages.

On this article we’ll check out what makes Robinhood protected and discover the dangers related to utilizing the app.

What’s Robinhood?

Robinhood is a inventory brokerage that gives commission-free buying and selling by way of its cellular app and web site. It was based in 2013 by two Stanford roommates, Baiju Bhatt and Vlad Tenev, who wished to make investing easier and extra accessible to everybody.

Robinhood permits customers to purchase, promote, and maintain shares, ETFs, choices, cryptocurrencies, and extra with no fee charges.

In addition they provide instructional sources to assist customers be taught the fundamentals of investing. Robinhood has grow to be common amongst younger traders seeking to get into the inventory market with out spending some huge cash on charges.

Is Robinhood regulated?

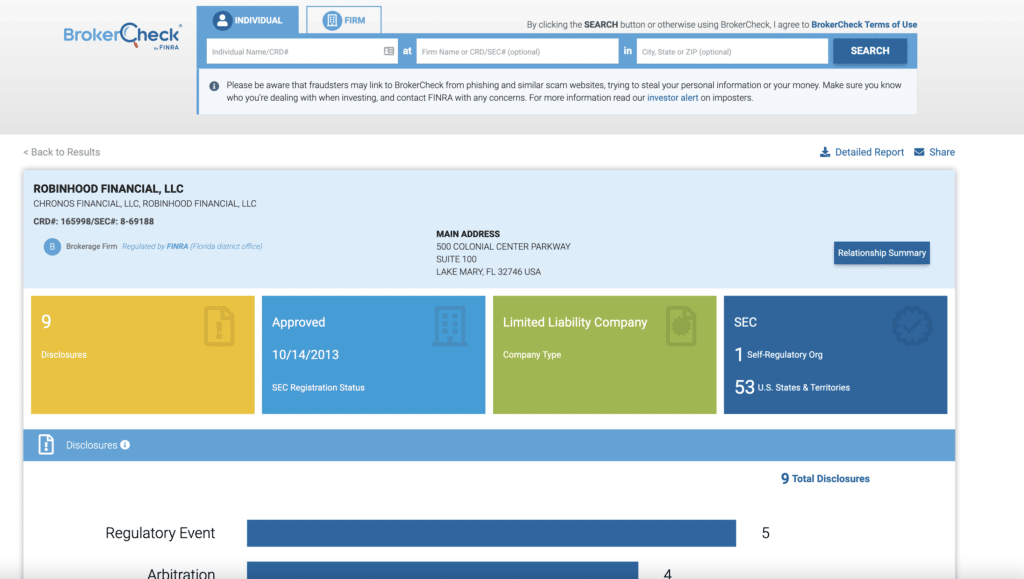

Robinhood is an SEC-registered broker-dealer and member of FINRA and SIPC, which means that it adheres to a algorithm and rules established by these organizations. Their CRD # 165998 which will be discovered on their FINRA BrokerCheck agency abstract.

These protections assist safeguard traders’ funds and securities within the occasion of a brokerage agency’s failure or different monetary losses.

Along with this safety, Robinhood additionally follows trade greatest practices reminiscent of Know Your Buyer (KYC) procedures and Anti-Cash Laundering (AML) legal guidelines by verifying buyer identities earlier than permitting them to commerce.

What about SIPC?

Robinhood’s membership in SIPC offers safety for purchasers towards broker-dealer chapter, with protection of as much as $500,000 in money and securities.

SIPC stands for the Securities Investor Safety Company. It’s a nonprofit company that gives safety to traders towards theft, fraud, and different errors by their broker-dealers reminiscent of misappropriation of funds or securities. Backside line if Robinhood have been to go bankrupt, SIPC would step in to assist out their traders.

Along with this safety, Robinhood has carried out measures to observe suspicious exercise and defend customers from monetary loss as a consequence of fraudulent exercise. These measures embrace fraud screening procedures designed to establish unauthorized trades and suspicious behaviors.

Is Robinhood Secure to Use?

Whereas the protection of any funding platform is determined by a wide range of components, Robinhood has taken a number of steps to extend its safety and enhance buyer assist.

New updates embrace issues like improved threat disclosure, further customer support channels, and instruments to assist prospects make extra knowledgeable choices.

Robinhood has improved its customer support assist with further channels reminiscent of on-line chat, e-mail and cellphone assist. This permits prospects to simply get assist once they want it most.

Moreover, the corporate has carried out measures to higher monitor suspicious exercise and try to guard customers from monetary loss as a consequence of fraudulent exercise. Finally, it’s as much as particular person customers to resolve in the event that they really feel comfy utilizing the platform or not.

How Does Robinhood Make Cash?

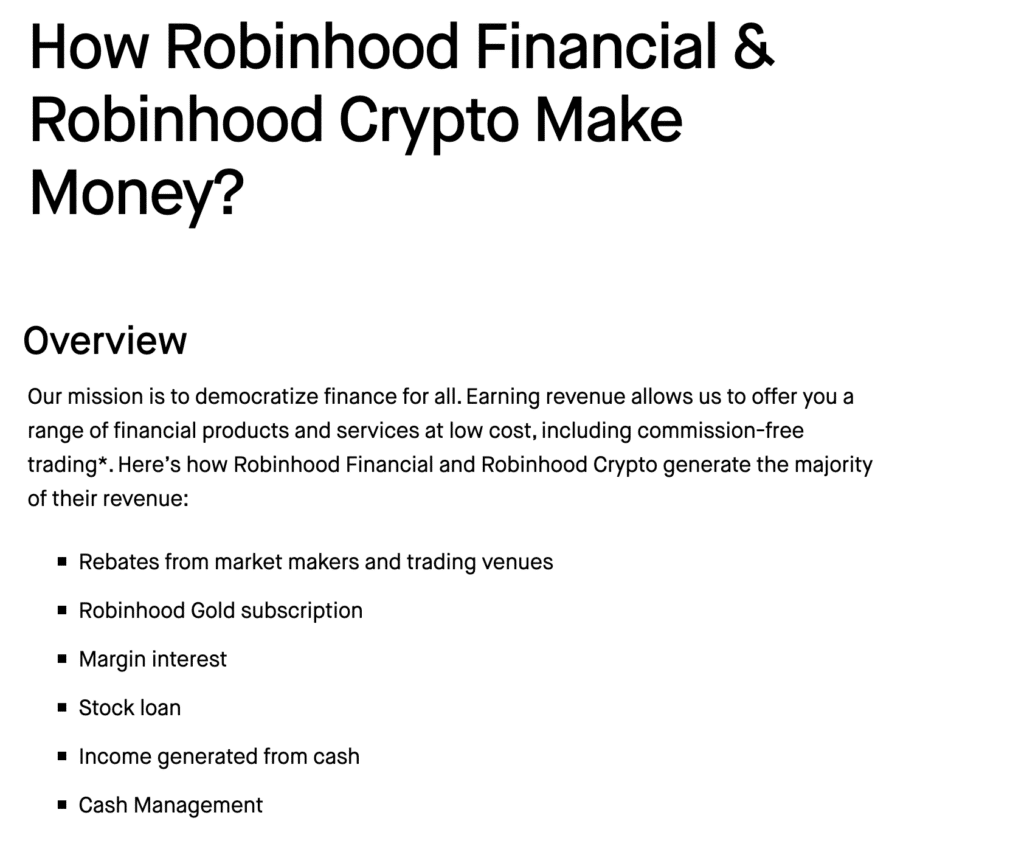

Robinhood makes cash in a number of methods. The first income for Robinhood is the curiosity they earn on buyer funds held in Robinhood accounts.

In addition they earn cash by way of choices buying and selling charges, margin curiosity, Gold subscriptions, and rebates from market makers.

Robinhood capitalizes on the explosive development of retail investing by providing commission-free trades whereas nonetheless making a revenue off its customers.

Robinhood additionally makes cash from retailers, reminiscent of when prospects purchase merchandise with their Robinhood debit card.

Moreover, they generate income by way of partnerships, reminiscent of referral charges and commissions for referring customers to different companies.

Lastly, Robinhood additionally gives in-app upgrades that give customers entry to extra superior buying and selling choices and analytics instruments. They disclose on their web site the other ways they generate income.

How Robinhood makes cash:

- The charges charged for premium accounts and companies

- Curiosity earned on buyer deposits

- Fee for order circulate, when patrons and sellers are matched with market makers

- Income from credit score merchandise reminiscent of margin lending and margin curiosity

- Promoting information to exterior companies

- Fee-free buying and selling on sure shares and ETFs

Has Robinhood Been in Bother?

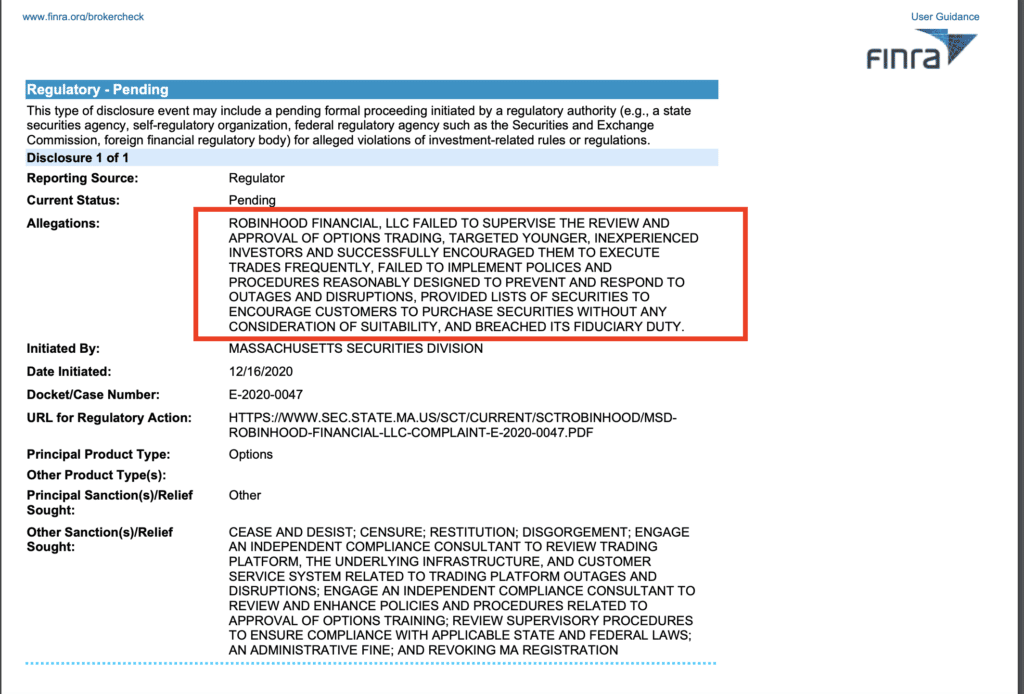

Robinhood has come beneath scrutiny for its enterprise practices, significantly with regard to customer support and threat disclosure.

In December 2020, the corporate settled with the U.S. Securities and Trade Fee (SEC) for $65 million associated to allegations of false promoting and misrepresenting their pricing construction.

Robinhood additionally confronted a public outcry after one in all its prospects, a 20-year-old school scholar, dedicated suicide. His household alleged, Alexander E. Kearns, had suffered monetary losses as a result of firm’s dangerous buying and selling practices and lack of buyer assist. Robinhood later agreed to pay an undisclosed sum to his household and launched updates to their customer support plans aimed toward offering higher help and security measures for customers.

Moreover, in March 2021 the corporate settled a lawsuit introduced by Massachusetts regulators for $26.5 million associated to its seeming “gamification” of buying and selling, which inspired prospects to commerce extra ceaselessly and take greater dangers than applicable for his or her stage of expertise or funding targets.

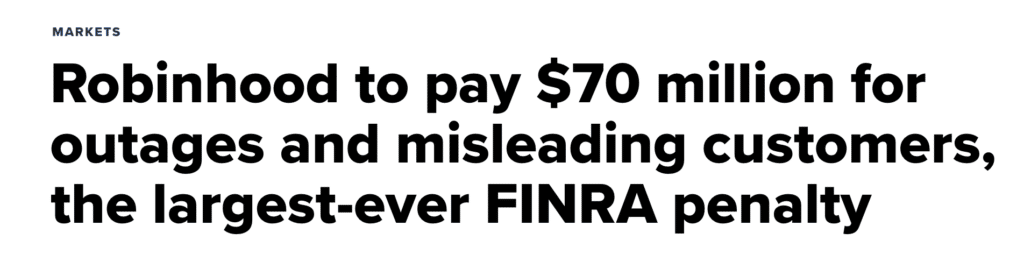

In June 2021, FINRA fined Robinhood Monetary LLC $57 million and ordered the agency to pay roughly $12.6 million in restitution, plus curiosity, to hundreds of harmed prospects for a complete of $70 million.

The sanctions characterize the most important monetary penalty ever ordered by FINRA and mirror the scope and seriousness of the violations.

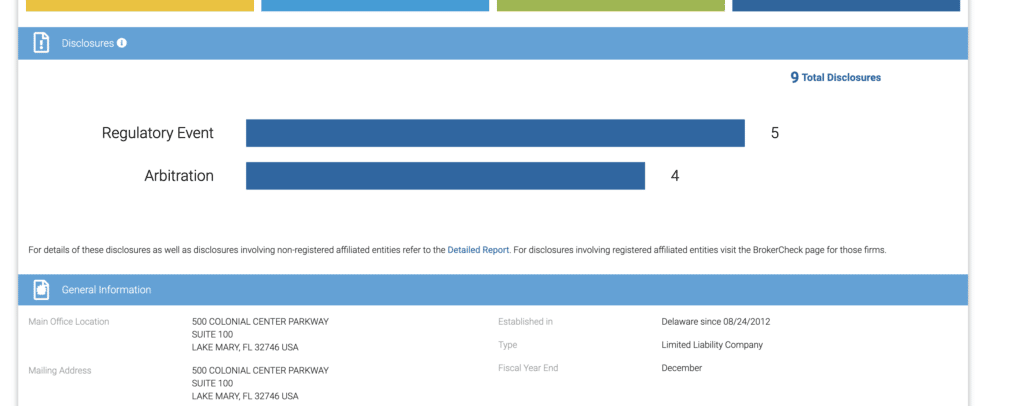

In complete, Robinhood has 9 complete disclosures of their report (see screenshots beneath):

Right here’s one in all their pending allegations on their agency abstract for:

“

FAILED TO SUPERVISE THE REVIEW AND

APPROVAL OF OPTIONS TRADING, TARGETED YOUNGER, INEXPERIENCED

INVESTORS AND SUCCESSFULLY ENCOURAGED THEM TO EXECUTE

TRADES FREQUENTLY, FAILED TO IMPLEMENT POLICES AND

PROCEDURES REASONABLY DESIGNED TO PREVENT AND RESPOND TO

OUTAGES AND DISRUPTIONS, PROVIDED LISTS OF SECURITIES TO

ENCOURAGE CUSTOMERS TO PURCHASE SECURITIES WITHOUT ANY

CONSIDERATION OF SUITABILITY, AND BREACHED ITS FIDUCIARY DUTY.

The Backside Line – Robinhood App is Secure?

There’s no denying that Robinhood is a registered broker-dealer with the Securities and Trade Fee (SEC) and is a member of the Monetary Business Regulatory Authority (FINRA).

In addition they use encryption to guard customers’ private and monetary info, and it gives two-factor authentication for added safety.

However you possibly can’t deny the quantity of bother they’ve received in since they launched their platform. Due to that I’d encourage any new investor to tread fastidiously.

FAQs on Robinhood App Security and Safety

Robinhood is a SEC and FINRA regulated platform and usually thought of protected to make use of for buying and selling.

Robinhood makes use of a wide range of safety measures to guard person accounts, together with two-factor authentication, encryption, and common safety audits.

Robinhood has not skilled any main safety breaches so far. Nonetheless, in July 2020, the corporate did disclose a knowledge breach that affected a small variety of customers, however no monetary info was compromised.

Sure, Robinhood has 9 disclosures on their FINRA BrokerCheck agency profile. A type of situations handled the favored meme inventory GameStop in January 2021.

Cited Analysis Articles

- SEC.gov (seventeenth, December 2020) SEC Expenses Robinhood Monetary With Deceptive Clients About Income Sources and Failing to Fulfill Obligation of Finest Execution (https://www.sec.gov/information/press-release/2020-321

- FINRA Orders Report Monetary Penalties In opposition to Robinhood Monetary LLC (thirtieth, June 2021) https://www.finra.org/media-center/newsreleases/2021/finra-orders-record-financial-penalties-against-robinhood-financial

- BrokerCheck Report (n.d.) ROBINHOOD FINANCIAL, LLC https://recordsdata.brokercheck.finra.org/agency/firm_165998.pdf

- CNBC Robinhood to pay $70 million for outages and deceptive prospects, the largest-ever FINRA penalty (thirtieth, June 2021) https://www.cnbc.com/2021/06/30/robinhood-to-pay-70-million-for-misleading-customers-and-outages-the-largest-finra-penalty-ever.html