You buy an digital gadget from Amazon or Flipkart. On the fee web page, you may pay upfront or you may go for No-cost EMI out of your financial institution.

What’s a No-cost EMI?

As a substitute of paying Rs 30,000 upfront, you pay Rs 5,000 per 30 days for the following 6 months. You continue to pay Rs 30,000 however you get to pay the quantity over 6 months (as a substitute of upfront). No price for you. Therefore, the title No-cost EMI.

What a very good deal, isn’t it?

However have you learnt RBI prohibits banks from providing zero curiosity EMI schemes?

If the banks can’t supply loans at 0% %, how do retailers supply such schemes then?

Are you aware the attention-grabbing math behind the No-cost EMI schemes?

Moreover, you will see No-cost EMIs for under 3, 6 or 9 months mortgage tenure? Often 3 or 6 months. Why not for 12, 18 or 24 months?

When you perceive the mathematics, you’ll have all of the solutions.

Let’s discover out.

Be aware: I additionally wrote a Twitter thread on how No-cost EMIs. In case you use Twitter, you may take a look at the Twitter thread right here. In case you just like the content material, do like/retweet/share.

How do No-cost EMIs work?

Let’s rapidly test how Amazon and Flipkart clarify this.

Right here is an excerpt from Amazon web site with respect to No-cost EMI schemes.

Amazon

The financial institution will proceed to cost curiosity on EMI as per current charges. Nevertheless, the curiosity to be charged by the financial institution shall be handed on to you as an upfront low cost on the time of your buy, successfully supplying you with the good thing about a No Value EMI. This low cost excludes GST on curiosity quantity that shall be charged by your financial institution.

Flipkart additionally explains in an identical method by an instance.

Let’s see what this implies.

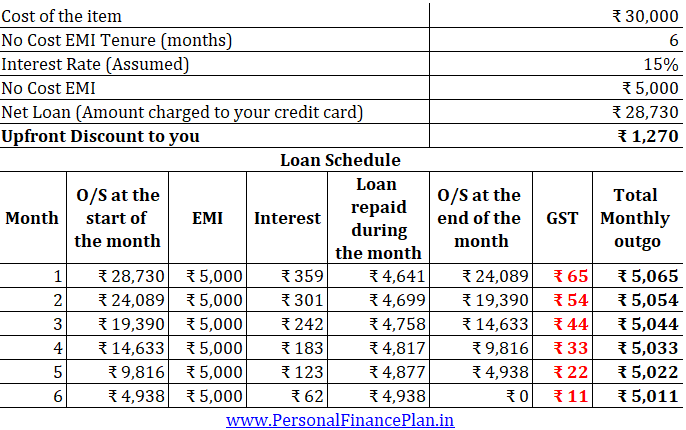

- Let’s assume the merchandise prices Rs 30,000.

- In case you go for 6-month No-cost EMI, you’ll have to pay an EMI of Rs 30,000/6 = Rs 5,000 per 30 days

- The financial institution fees rate of interest of 15% p.a. for a 6 month mortgage.

- Now, discover X such {that a} mortgage of X at 15% p.a. for six months leads to an EMI of Rs 5,000 per 30 days. Use PV components in excel to search out X.

- X = Rs 28,730

- Supply upfront low cost of Rs 30,000 – Rs 28, 730 = Rs 1,270. The service provider bears the low cost.

- Your Bank card is charged Rs X or Rs 28,730. That’s decrease than the listed worth of Rs 30,000.

- In case you work the numbers, a mortgage of Rs 28,730 at 15% p.a. for six months could have an EMI of Rs 5,000 per 30 days.

- A couple of days later, the financial institution will convert buy quantity (X) into EMIs. 5,000 per 30 days for six months.

- You’ll have to pay GST on the curiosity quantity. Now, the GST paid is an additional price to you.

Let’s attempt to perceive with the assistance of one other instance .

The price of the product is Rs 1,01,999.

You’ll be able to see No-cost EMI choices for 3-month and 6 month EMI. For longer tenure reimbursement, the no-cost EMI choice shouldn’t be accessible. We are going to see later why that’s the case.

The speed of curiosity can’t be zero as a result of that’s not acceptable to the RBI. As you may see, for the opposite EMI schemes, the speed of curiosity is 15% p.a. It’s truthful to imagine R=15% p.a.

For the three months No-cost EMI, you pay Rs 34,000 per 30 days. That makes it 1,02,000. You don’t pay something further. The distinction of Rs 1 is to rounding off.

Ditto for 6-month No-cost EMI. 17,000 X 6 = 1,02,000.

So, if you buy the merchandise for 1,02,000, you’ll have to pay Rs 17,000 per 30 days for six months.

The place is the upfront low cost?

As we now have mentioned earlier than, banks can’t supply any mortgage with out curiosity.

It’s one other matter if you don’t return the principal. 😊 All the things needs to be proper on paper.

Coming again to the subject, we have to determine the quantity X, that might end in EMI of Rs 17,000 per 30 days for six months at an rate of interest of 15% p.a.

You’ll be able to merely use PV perform on excel to search out that out. You may also check out Mortgage calculator to determine the identical.

Y = PV(15%/12,6,17000,0,0) = Rs 97,682

Your bank card shall be charged Rs 97,682.

Subsequently, the low cost (D) turns into 1,01,999 – 97, 682 = Rs 4,318

This low cost is borne by the service provider/retailer/model/vendor.

Had you opted for 3 month No-cost EMI, your bank card would have been charged Rs 99,502. The upfront low cost would have been Rs 2,497.

In case you had an choice of going for 9 month No-cost EMI, the upfront low cost would have been Rs 6,093. For a 12 month No-cost EMI, the upfront low cost shall be Rs 7,825.

The upfront goes up with the mortgage tenure.

Let’s take into account this with one other instance.

Listed worth (price) =Rs 30,000, Curiosity Fee = 15% p.a.

- 3 months No-cost EMI. X = Rs 29,265. Low cost = Rs 735

- 6 months No-cost EMI. X = Rs 28,730. Low cost = Rs 1,270

- 9 months No-cost EMI. X = Rs 28,208. Low cost = Rs 1,792

- 12 months No-cost EMI. X = Rs 27,698. Low cost = Rs 2,302

- 18 months No-cost EMI. X = Rs 26,716. Low cost = Rs 3,284

- 24 months No-cost EMI. X = Rs 25,780. Low cost = Rs 4,220

The low cost to supply you the expertise of No-cost EMI will increase as you enhance the mortgage tenure.

Because the low cost is borne by the vendor/retailer/model, the price (low cost quantity) to the service provider goes up if the reimbursement tenure is longer. And the service provider can bear solely a lot low cost.

That’s the reason No-cost EMI schemes are restricted to shorter reimbursement tenures. Often 3 to six months.

The scheme is No price for you. Nevertheless, it isn’t Zero curiosity for the financial institution (which RBI wouldn’t be pleased with).

Everybody wins.

The client will get the product in straightforward zero-cost installments.

The financial institution will get the mortgage and avoids regulatory glare. The scheme is No price for you. Nevertheless, it isn’t zero rate of interest for the financial institution.

The service provider, regardless of the low cost hit, will get enterprise.

Is the No price EMI scheme actually No-cost?

Not likely. GST performs spoilsport.

GST is charged on the curiosity portion of the EMI.

Let’s see the way it impacts your fee.

As you may see, you’re paying one thing further each month resulting from GST on the curiosity price.

Within the first month, you pay Rs 5,065 (as a substitute of Rs 5,000). That is due to 18% GST on curiosity quantity of Rs 359.

359*18% = Rs 65

The overall further fee resulting from GST over the mortgage tenure shall be Rs 229 i.e. you’ll pay Rs 30,229 (as a substitute of Rs 30,000).

This pushes the price of mortgage from 0% to 2.6% p.a.

In absence of GST, the efficient price of the mortgage would have been 0%.

Subsequently, probably not a Zero price EMI for you.

Don’t neglect the processing price

A couple of banks cost a processing price on EMI transactions, together with No-cost EMI transactions.

Such processing price might be a % of your buy quantity or a hard and fast price (regardless of mortgage quantity).

For example, ICICI and HDFC Financial institution cost Rs 199 + GST.

Your financial institution could have a special coverage. Please test together with your financial institution.

Processing price provides to the price of borrowing. Moreover, a hard and fast price may also sharply enhance the price for smaller loans.

As we now have seen above, No-cost EMIs are quick time period loans. Subsequently, the affect of processing price is unfold over a really quick interval.

Let’s return to the instance mentioned (Value =30,000, Rate of interest = 15% p.a., Mortgage Tenure = 6 months).

GST elevated the price of mortgage from 0% to 2.6% p.a.

Processing price of Rs 199 + GST will increase the price from 2.6% to five.3% p.a.

Now, the affect shall be larger for shorter length loans.

If the mortgage tenure is 3 months, the efficient price is 7.3% p.a.

Furthermore, the affect shall be larger for smaller loans.

For example, the efficient price of No-cost EMI for Rs 10,000 mortgage (Value =10,000, Rate of interest =15%, Tenure = 6 months, Processing price = 199 + GST) shall be 16.8% p.a. That’s the type of affect processing price can have on quick time period loans. That is worse than a 12% mortgage accessible at 0% processing price.

Be aware: The processing price shouldn’t be all the time disclosed on the platform (Amazon/Flipkart). The onus is on you to test with the financial institution.

Don’t ignore Misplaced cashbacks and rewards

ICICI AmazonPay Credit score Card provides 5% cashback to Prime customers (3% to Non-prime customers) on each buy on Amazon. Nevertheless, for those who purchase on EMIs, together with No-cost EMIs, you don’t get any cashback.

The identical occurs for those who purchase on EMIs utilizing Flipkart Axis Financial institution bank card.

Now, these misplaced cashbacks are a chance price for those who go for no-cost EMIs.

Do take into account these prices earlier than buying on No-cost EMIs.

Are No-cost EMI schemes good?

No-cost EMI schemes let you buy objects on EMIs with none extra price. Or a really small price.

Troublesome to search out flaws with loans with efficient price of 0% or say lower than 5% p.a.

Whole lot.

Nevertheless, do take into account the affect of processing price and the potential misplaced cashbacks/rewards earlier than you decide.

A caveat: Whereas No-cost EMIs enhance your affordability, each mortgage should be repaid. No-cost EMIs will not be a license to overspend. Don’t overborrow. Overborrowing or reckless credit score behaviour can get you into critical hassle.

Picture Credit score: Pixabay.com

The put up was first printed in August 2018 and has been up to date since.