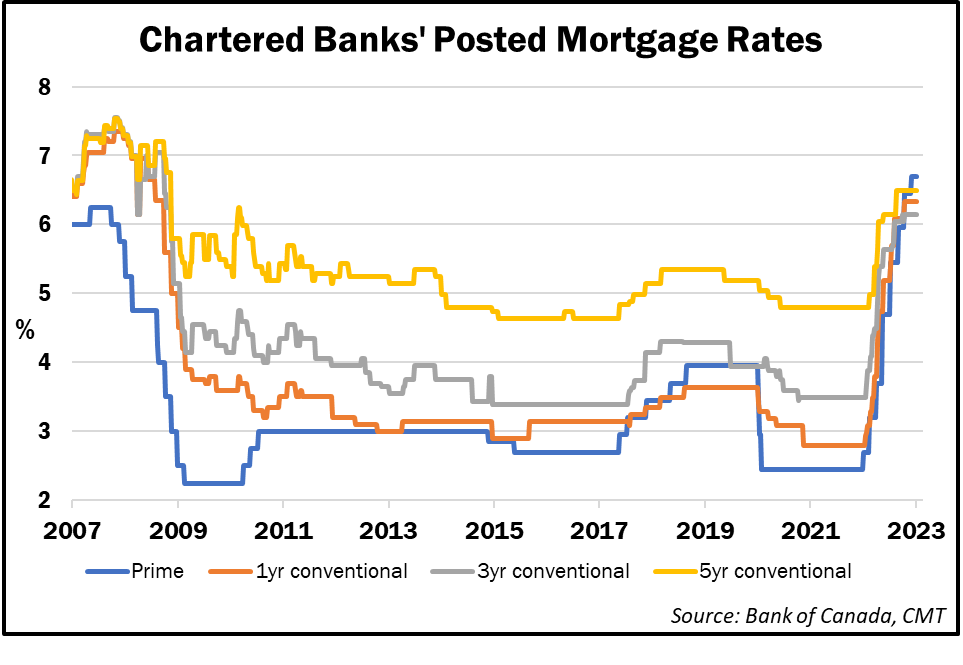

Uninsured posted charges from Canada’s Massive 6 banks have skyrocketed over the previous 12 months, in keeping with knowledge from the Financial institution of Canada.

The typical 5-year standard price rose from 4.79% in March 2022 to six.49% in the present day—a soar of 170 share factors. Shorter 1- and 3-year phrases have seen the same enhance, growing according to prime price, which has risen 425 foundation factors because the Financial institution of Canada started mountaineering charges a 12 months in the past.

The final time charges have been this excessive was in early 2009.

The Financial institution of Canada’s knowledge screens posted charges from the Massive 6 banks, that are typically increased than the discounted charges most well-qualified debtors can truly receive.

Bond yields plunge

The Authorities of Canada 5-year bond yield—which usually leads fastened mortgage charges—plunged practically 50 factors because the begin of March, and are down 40 bps this week alone.

As of this writing on Friday morning, the 5-year bond yield was hovering at round 3.17%.

So, what’s behind the sharp transfer decrease?

There are a number of causes, in keeping with Ryan Sims, a mortgage dealer with TMG The Mortgage Group and former funding banker.

One is the latest remarks made by Fed Chair Jerome Powell, who mentioned this week “The newest financial knowledge have are available in stronger than anticipated, which means that the last word degree of rates of interest is prone to be increased than beforehand anticipated.”

Powell’s feedback “made it abundantly clear (or ought to have) that the Fed goes to lift charges far increased than A ) the market thought, B) for longer than the market thought, and C ) faster than the market thought,” Sims advised CMT.

The continued slide following Friday’s morning’s employment knowledge launch suggests there was “approach an excessive amount of optimism baked into the 5-year yield,” he added.

Bond yields have a tendency to guide fastened mortgage price pricing, however don’t count on any huge strikes in mortgage charges as long as yield stay unstable.

“I’d count on the 5-year yield to bounce round within the vary, however any unhealthy information [for yields] like decrease inflation, decrease employment, and many others. will pull to the decrease finish of the three.00% vary, and any good knowledge like increased inflation, increased employment, and many others. will pull the charges in direction of the three.60% vary,” Sims mentioned, explaining that increased charges are “truly a very good factor” because it means the financial system is firing on all cylinders.

“Look to see some ‘re-pricing’ of bonds, yields, CAD, and all financial predictions popping out within the subsequent 3 to 4 weeks.”

February employment figures “nonetheless too excessive” for the BoC

Canada’s financial system added one other 22,000 jobs in February, in keeping with employment figures launched by Statistics Canada on Friday.

The entire jobs added in February have been in full-time employment, which elevated by 31,000 from the earlier month whereas part-time jobs have been down by 9,300. The unemployment price remained unchanged at 5%.

The February studying was above expectations, however effectively under the blockbuster 150,000 positions created in January.

“For the Financial institution of Canada, the headline print is perhaps extra ‘regular’ in comparison with prior months, however it’s nonetheless too excessive,” famous James Orlando of TD Economics. “Provided that the

“The BoC is in wait-and-see mode with its conditional pause, it believes that it’s only a matter of time earlier than a slowdown reveals up within the broader financial system,” he added. “However with in the present day’s labour market report, it should wait a short while longer.”

BC price range consists of $4.2B funding in housing

The federal government of British Columbia delivered its Price range 2023 final week, which included $4.2 billion in funding associated to housing.

It’s the most important three-year housing funding within the province’s historical past, and is supposed to sort out homelessness and enhance rental provide. Of that funding, $1.7 billion over three years can be allotted in direction of constructing extra houses by way of the B.C. Builds and Constructing B.C. applications.

“We have to do extra with the housing plan and that’s what this price range goes to do,” Minister of Finance Katrine Conroy mentioned.

Different housing-related initiatives introduced within the price range embody:

- A brand new property tax incentive to encourage the development of recent purpose-built leases.

- A pilot undertaking that can present financing incentives to encourage householders to develop new secondary suites on the property of their principal residence to lease to long-term renters.

- Extra helps and protections for renters, together with a renter’s tax credit score. The credit score could be income-tested, with a most quantity of $400 per 12 months for households with adjusted earnings as much as $60,000. This quantity can be listed to inflation every year.

- A plan to unlock extra houses by way of new residential zoning measures, whereas decreasing the time and price of native authorities approval processes.