Bond buyers suppose they’ve seen all of it.

They’re incorrect about that. For individuals who first started investing in bonds inside the previous 4o years – say, since 1982 – the bond market should look like a supply of perpetual, reassuring, and unrelenting achieve. Simply chuck some money into the Treasury market or investment-grade corporates, and voila! Instantaneous wealth.

In that very same interval, world fairness buyers have been slapped upside the pinnacle over 30 occasions, generally with native market crashes (the Argentine collapse in 1989) however extra usually in world corrections, panics, crashes, repricings, and bears.

Over the previous 40 years, a vanilla “core bond” portfolio generated 6.1% yearly with a typical deviation of 4.8%. In the identical interval, inflation was a meek 2.8%. In consequence, you would just about wager the farm on inflation-topping positive factors. Rates of interest had been dropping steadily and virtually relentlessly from their highs round 1980. Inflation was tame and infrequently detrimental. Freed of the necessity to fear about worth stability – one in every of their two formal obligations – the Fed might commit its huge assets and appreciable creativity to fostering full employment. And if the system had a stumble, no drawback: the Fed would repair it.

These days are gone. Whereas nostalgia is comprehensible, it’s a poor foundation for portfolio development.

Excessive inflation mixed with rising charges presents each the chance to earn an honest return on fastened earnings together with the danger of a recession. It’s unprecedented to have this mix and not using a recession. On this article, I take a look at learn how to steadiness this chance with danger. I determine twenty Lipper Bond Classes which have executed properly through the previous 5 recessions, together with as much as 4 funds every.

This text is split into the next sections:

Investor Expectations and Steepening Yield Curves

We’re in what seems to be a considerably conventional late stage of the enterprise cycle the place the Federal Reserve raises the Federal funds fee to scale back inflation. Federal Reserve Chairman Jerome Powell has laid out plans to boost rates of interest to about 5 p.c and maintain them there as I described within the MFO November E-newsletter, “Federal Reserve Charge Hikes – The Subsequent 9 Months.” Six months later, we’re approaching the tip of the speed climbing cycle as inflation has peaked however is prone to stay increased than the goal of two% for longer. The ten-year Treasury has been on a curler coaster trip peaking at 4.3% on October 24th, then falling to three.4% on December 7th, and returning above 4.0% on March 2nd.

On March 7th, Federal Reserve Jerome Powell testified earlier than the Committee on Banking, Housing, and City Affairs. The S&P 500 instantly dropped over one p.c, and the quick finish of the yield curve rose. Mr. Powell says the info “means that the last word stage of rates of interest is prone to be increased than beforehand anticipated” and that they proceed to scale back the steadiness sheet (Quantitative Tightening). I anticipate a quarter-point hike on March 22nd, however a half-point just isn’t off the desk. I then anticipate one other quarter-point hike within the second quarter.

Kathy Jones from Charles Schwab describes in “The best way to Put together for Touchdown” that investor expectations of the Federal funds fee have risen from 5.25% to five.5% by this August and begin to fall earlier than the tip of the 12 months. Ms. Jones cites the inverted yield curve, tightening lending requirements, falling demand for loans, and tight financial coverage for the rising danger of a recession. She suggests holding bonds of excessive credit score high quality and progressively including length.

Lance Roberts wrote an insightful article, “Recession Countdown Begins as Yield Curves Trough,” the place he describes the inverted yield curve as a “warning” of the potential of a recession, however the bottoming and steepening of the yield curve are what alerts a recession is approaching. Mr. Roberts believes that the “central financial institution is poised to maintain coverage tighter for longer” and the “downturn is thus liable to be worse, leaving the Fed needing to chop charges extra.” He’s chubby in money and short-term Treasuries, and will probably be growing bond durations.

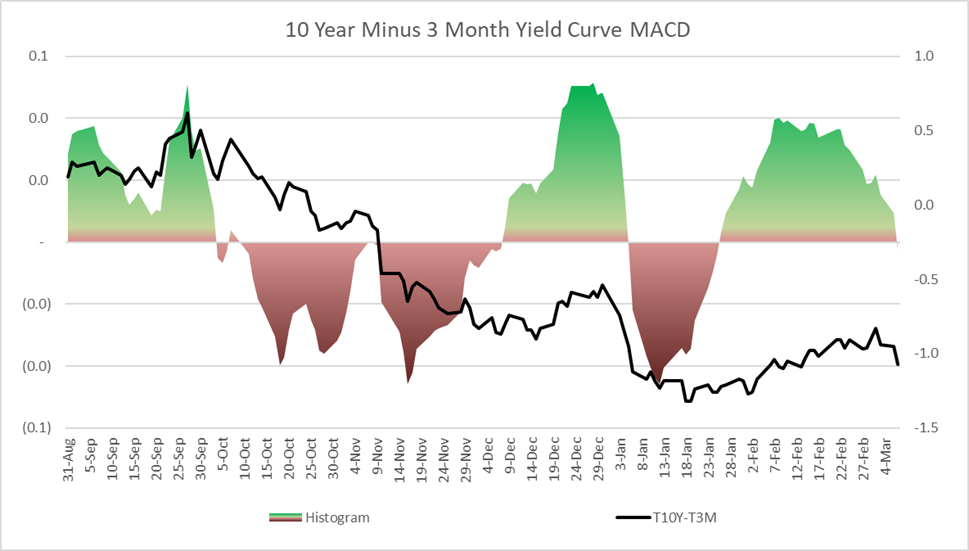

I constructed Chart #1 to trace the steepening of the ten-year to three-month Treasury yield curve utilizing the Transferring Common Convergence Divergence (MACD) momentum indicator. The chart exhibits that the yield curve remains to be inverted however has been steepening because the starting of February. There may be plenty of volatility as inflation expectations evolve, and this phase of the curve started to invert additional after Mr. Powell’s testimony.

Chart #1: 10 12 months minus 3 Month Treasury Yields Momentum (MACD)

Ten-12 months Treasury Yields vs Fed Funds Throughout Recessions

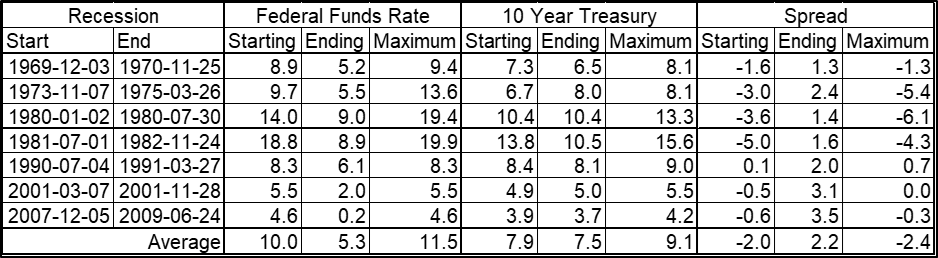

My short-term goal has been to construct a bond ladder for the subsequent eight years to lock in yields above 4 p.c on Treasuries. Desk #1 accommodates how the ten-year Treasury yield has behaved in relation to the Federal funds fee through the previous seven recessions. On common, the Federal Funds fee has fallen from 10% to five% throughout recessions whereas the ten-year Treasury has fallen from 7.9% to 7.5%. The unfold of the ten-year Treasury to Federal funds fee elevated from detrimental 2% to optimistic 2% as a result of the ten-year yield held pretty fixed whereas the Federal funds fee fell. The utmost yields through the recessions present that we might have a better Federal fund fee and ten-year Treasury yield through the recession in comparison with the beginning of the recession as a result of the beginning just isn’t declared by the Nationwide Bureau of Financial Analysis (NBER) till about 9 months afterward.

Desk #1: Fed Funds Charge and 10-12 months Treasury at Begin and Finish of Recessions

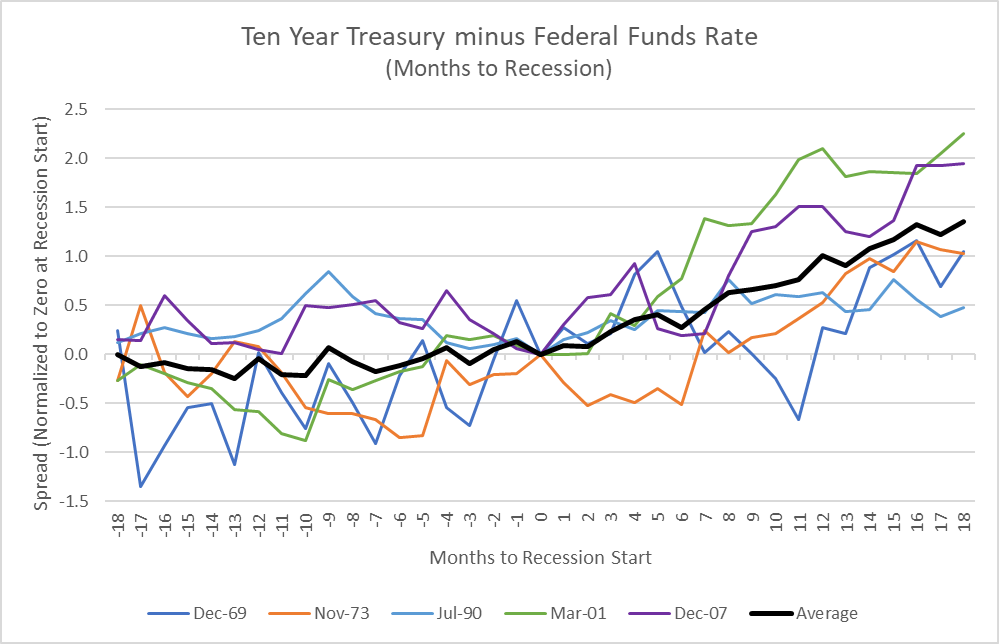

In Chart #2, I normalized the ten-year Treasury to Federal funds fee unfold to the beginning of the recession excluding the outlier recessions within the early Nineteen Eighties. The darkish black line is the common unfold. Previous to the beginning of the recession in Month “0”, the ten-year Treasury yield tends to maneuver in parallel with the Federal Funds fee with some volatility. After the recession begins, the ten-year Treasury yield tends to stay comparatively fixed whereas the Federal funds fee falls.

Chart #2: Ten-12 months vs Federal Funds Charge Unfold Throughout Recessions

This means that if the Federal Reserve raises the funds fee one other 50 foundation factors (half p.c) then the Ten-12 months Treasury yield can also rise in parallel. The volatility proven within the above chart exhibits this isn’t a dependable planning device, however there are shopping for alternatives throughout dips.

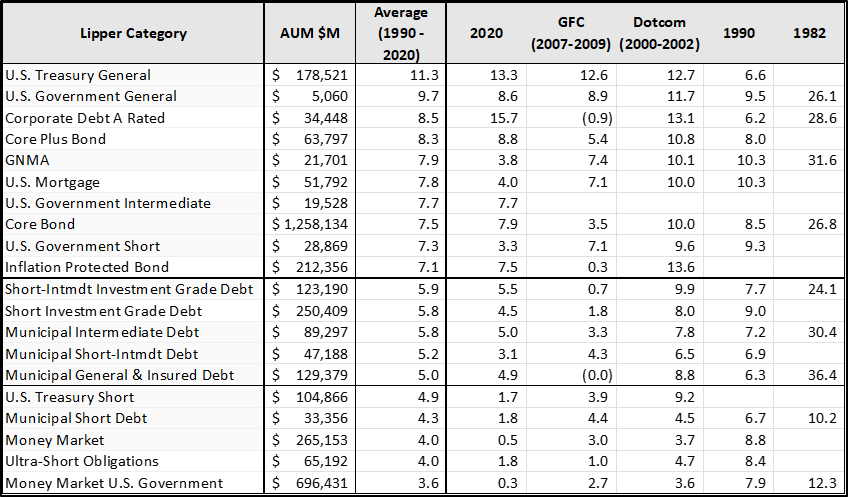

Bond Class Efficiency in Recessions with Falling Charges

I used the Mutual Fund Observer MultiSearch display screen for bond funds that outperformed throughout recessions together with falling rates of interest. Desk #2 exhibits the outcomes by Lipper Class. The info set contains BlackRock, Allianz, Constancy, State Avenue, T Rowe Value, WisdomTree, and Vanguard funds. These classes are used to pick out the funds within the subsequent part. Desk #2 accommodates principally authorities or company bonds, municipal bonds, prime quality company bonds, and shorter-term funding grade bond classes.

Desk #2: Highest and Constant Lipper Bond Class Performers Throughout Recessions

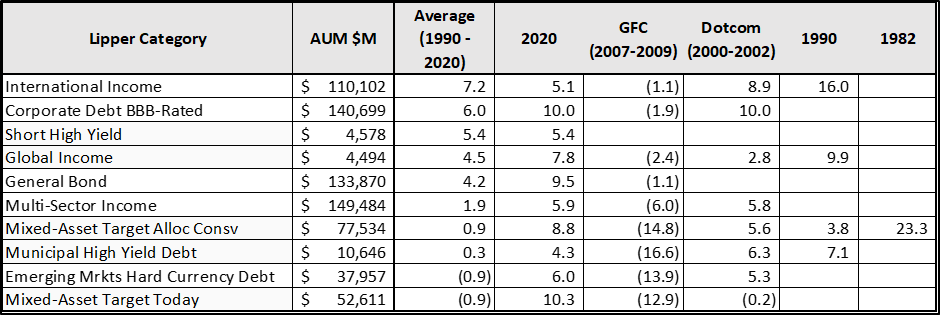

Desk #3 accommodates an inventory of riskier bond and mixed-asset fund classes that may be rewarding relying on whether or not there’s a onerous or smooth touchdown. Not proven are the riskiest of the bond classes similar to excessive yield.

Desk #3: Riskier and Much less Constant Lipper Bond Class Performers Throughout Recessions

High Notch Bond Funds (ETFs, Constancy, Vanguard & Others)

I like Professor Snowball’s terminology of “The Younger Defenders” with spectacular shorter histories however glorious danger and return metrics, and “The Wizards” which have constantly carried out properly by a number of recessions. I chosen “High Notch Bond Funds” of each Younger Defenders and Wizards utilizing MFO, Lipper, Ferguson and Reamer Rankings. I trimmed the record primarily based on expense ratios, age, and belongings beneath administration, amongst different components for the Lipper Classes recognized within the earlier part. I embrace one mutual fund for every class from each Constancy and Vanguard together with a mutual fund from a unique firm that’s accessible by Constancy and not using a no-load and with no-transaction price. I additionally embrace one ETF. The hyperlink related to the image is to Morningstar. The funds are sorted from the best Ulcer Ranking to the bottom. The Ulcer Index is a measure of the size and depth of the drawdown. Bond efficiency will enhance this 12 months in comparison with final 12 months as a result of yields are stabilizing.

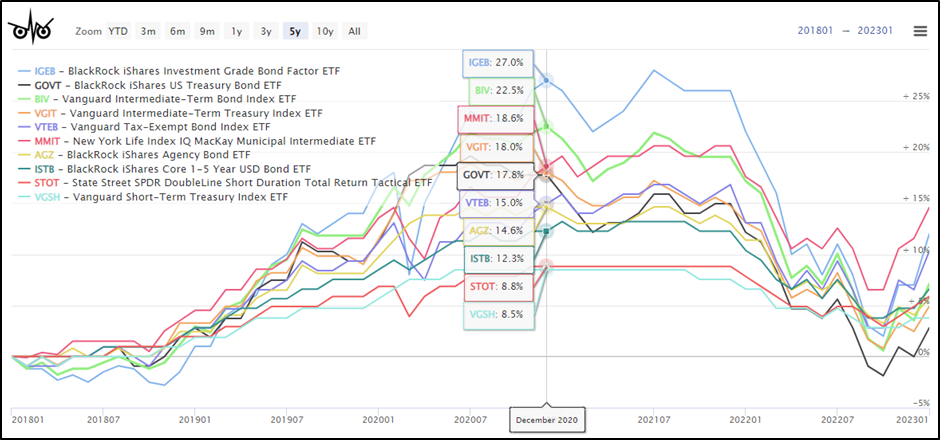

EXCHANGE TRADED FUNDS

Desk #4: High Performing ETF Bond Funds

| Image | Title | Lipper Class | High quality | Impact Maturity yr | 30d Yield % |

| IGEB | BlackRock iShares Inv Grd Bond Reality | Core Plus Bond | BBB | 9.5 | 5.02 |

| GOVT | BlackRock iShares US Treas Bond | U.S. Treasury Basic | AA | 7.9 | 3.95 |

| BIV | Vanguard Inter-Time period Bond | Core Bond | A | 7.1 | 4.14 |

| VGIT | Vanguard Inter-Time period Treas | U.S. Gov Inter | AA | 5.6 | 3.62 |

| VTEB | Vanguard Tax-Ex Bond | Muni Gen & Ins Debt | A | 14.8 | 3.05 |

| MMIT | New York Life IQ MacKay Muni Inter | Muni Inter Debt | A | 13.1 | 3.00 |

| AGZ | BlackRock iShares Company Bond | U.S. Gov Gen | A | 3.2 | 4.13 |

| ISTB | BlackRock iSh Cor 1-5 Yr USD Bnd | Shrt-Intm Inv Grd Dbt | A | 3.7 | 4.51 |

| STOT | State Avenue DL Shrt Dur Tot Rtn Tact | U.S. Gov Brief-Inter | BBB | 8.2 | 4.36 |

| VGSH | Vanguard Brief-Time period Treas | U.S. Gov Brief | AA | 2 | 4.32 |

Supply: Writer Utilizing MFO Premium database and screener

Chart #3: High Performing ETF Bond Funds

FIDELITY

Desk #5: High Performing Constancy Bond Funds

| Image | Title | Lipper Class | High quality | Impact Maturity yr | 30d Yield % |

| FUAMX | Constancy Inter Treas Bond | U.S. Treasury Basic | AA | 6.9 | 3.57 |

| FGOVX | Constancy Gov Inc | U.S. Gov Gen | AA | 12.7 | 3.39 |

| FTBFX | Constancy Whole Bond | Core Bond | A | 13.9 | 5.13 |

| FMSFX | Constancy Mortgage Sec | U.S. Mortgage | AA | 25.6 | 3.40 |

| FTABX | Constancy Tax-Free Bond | Muni Gen & Ins Debt | BBB | 16.7 | 3.46 |

| FSTGX | Constancy Inter Gov Inc | U.S. Gov Brief-Inter | AA | 5.2 | 3.54 |

| FIPDX | Constancy Infl-Prot Bond | Infl Prot Bond | AA | 7.2 | 0.60 |

| FTHRX | Constancy Inter Bond | Shrt-Intm Inv Grd Dbt | A | 7 | 4.22 |

| FLTMX | Constancy Inter Muni Inc | Muni Inter Debt | A | 12.8 | 2.80 |

| FUMBX | Constancy Brief-Time period Treas Bond | U.S. Treasury Brief | AA | 2.7 | 4.10 |

Supply: Writer Utilizing MFO Premium database and screener

Chart #4: High Performing Constancy Bond Funds

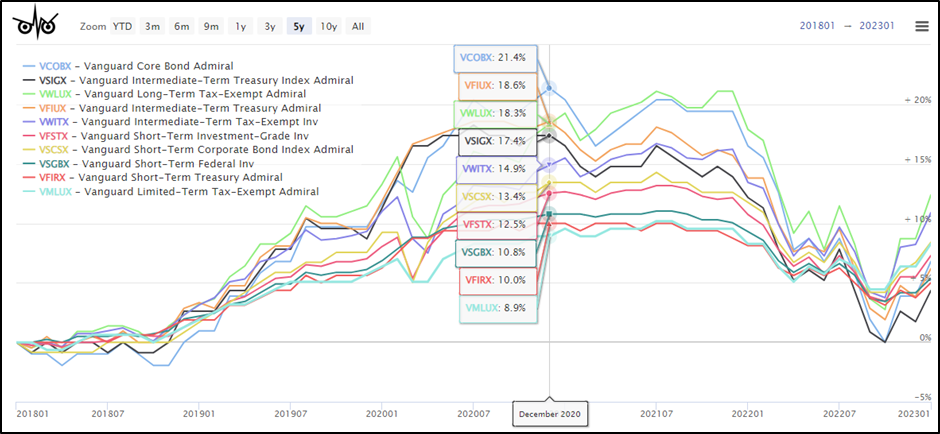

VANGUARD

Desk #6: High Performing Vanguard Bond Funds

| Image | Title | Lipper Class | High quality | Impact Maturity yr | 30d Yield % |

| VCOBX | Vanguard Core Bond | Core Bond | A | 15.2 | 4.21 |

| VSIGX | Vanguard Inter-Time period Treas | U.S. Gov Inter | AA | 5.6 | 3.58 |

| VWLUX | Vanguard Lengthy-Time period Tax-Ex | Muni Gen & Ins Debt | A | 18.8 | 3.39 |

| VFIUX | Vanguard Inter-Time period Treas | U.S. Treasury Basic | AA | 6.6 | 3.59 |

| VWITX | Vanguard Inter-Time period Tax-Ex Inv | Muni Inter Debt | A | 11.9 | 2.88 |

| VFSTX | Vanguard Brief-Time period Make investments-Grade | Shrt Make investments Grade Dbt | BBB | 3.5 | 4.55 |

| VSCSX | Vanguard Brief-Time period Corp Bond | Shrt-Intm Inv Grd Dbt | BBB | 3 | 4.77 |

| VSGBX | Vanguard Brief-Time period Federal Inv | U.S. Gov Brief | A | 4.7 | 3.85 |

| VFIRX | Vanguard Brief-Time period Treas | U.S. Treasury Brief | AA | 4.2 | 4.16 |

| VMLUX | Vanguard Lim-Time period Tax-Ex | Muni Shrt-Intmd Debt | A | 10.7 | 2.65 |

Supply: Writer Utilizing MFO Premium database and screener

Chart #5: High Performing Vanguard Bond Funds

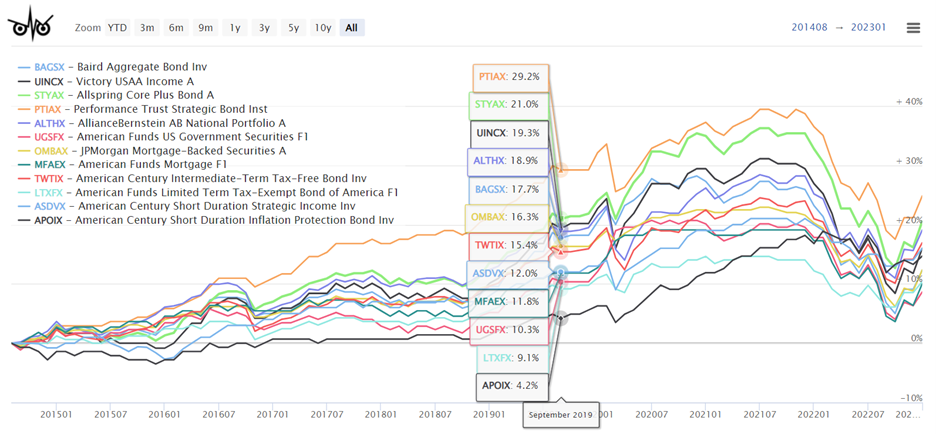

OTHER FUND FAMILIES

Desk #7: High Performing Bond Funds From Different Corporations

| Image | Title | Lipper Class | High quality | Impact Maturity yr | 30d Yield % |

| BAGSX | Baird Mixture Bond Inv | Core Bond | A | 15.1 | 3.74 |

| UINCX | Victory USAA Inc A | Corp Debt A Rated | BBB | 9.6 | 4.22 |

| STYAX | Allspring Core Plus Bond A | Core Plus Bond | A | 13.5 | 3.84 |

| PTIAX | Efficiency Belief Strat Bond Inst | Gen Bond | BBB | 14.7 | 5.80 |

| ALTHX | AllianceBernstein AB Nat Port A | Muni Gen & Ins Debt | BBB | 17.5 | 3.24 |

| UGSFX | American Funds US Gov Sec F1 | U.S. Gov Gen | AA | 11.4 | 2.12 |

| OMBAX | JPMorgan Mortgage-Backed Sec A | U.S. Mortgage | A | 21.8 | 2.78 |

| MFAEX | American Funds Mortgage F1 | U.S. Gov Inter | A | 16.9 | 3.11 |

| TWTIX | American Cent. Inter-Trm Tax-Fr Bnd | Muni Inter Debt | A | 12.4 | 2.88 |

| LTXFX | Am. Funds Lim Trm Tx-Ex Bnd of Am | Muni Shrt-Intmdt Dbt | A | 13.8 | 2.08 |

| ASDVX | American Century Shrt Dur Strat Inc | Shrt Make investments Grade Dbt | BBB | 6.9 | 4.98 |

| APOIX | American Cent. Brief Inf Prot Bnd | Infl Prot Bond | AA | 3.6 | 14.57 |

Supply: Writer Utilizing MFO Premium database and screener

Chart #6: High Performing Bond Funds from Different Corporations

All Bond Mannequin Portfolio

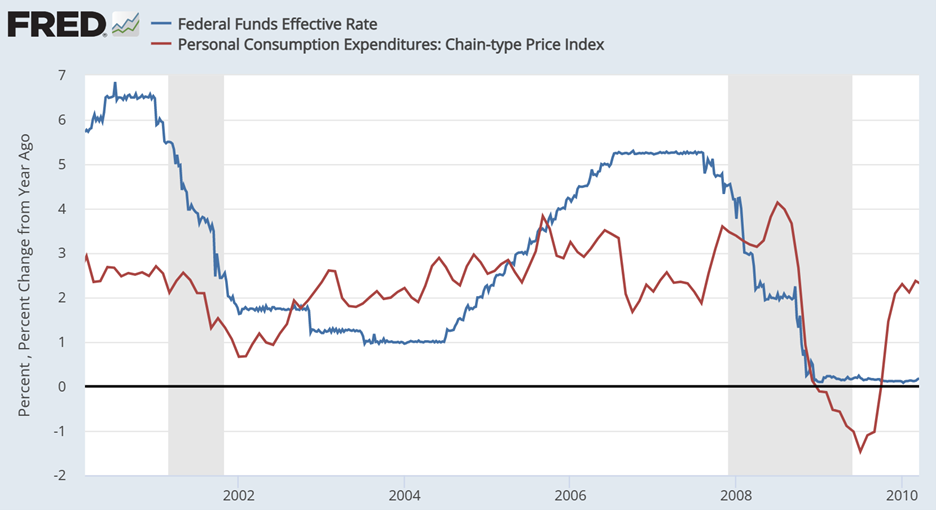

I needed to spherical off this text with some actionable suggestions. I selected to create an All-Bond Portfolio for the time interval from July 2000 although September 2011 as a result of it covers two recessions the place inflation was increased than the two% goal and two recessions when the Fed funds fee was falling. It doesn’t embrace the previous ten years which was characterised by ultra-low rates of interest and big stimulus. Observe that the “High Notch Funds” had been restricted to eight to 10 funds, however extra short-term bond funds are included within the record under. Chart #7 exhibits the Federal funds fee and inflation throughout this era.

Chart #7: Mannequin Portfolio Time Interval

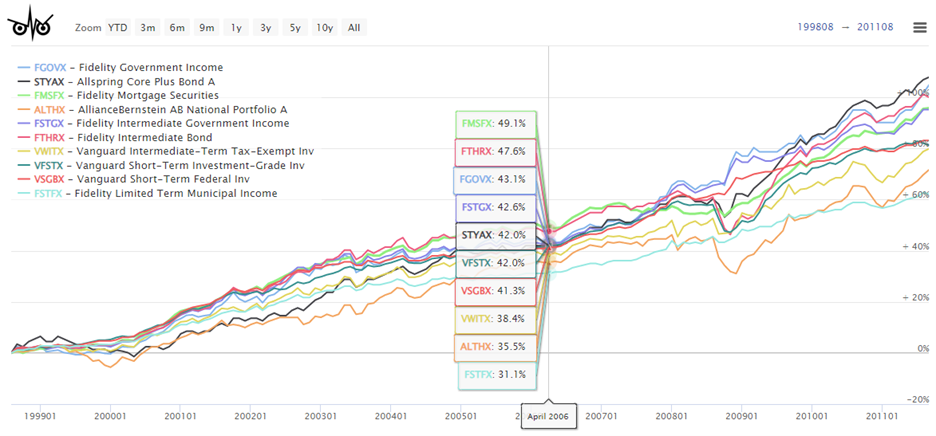

I chosen the “High Notch Funds” from this time interval. I used Portfolio Visualizer to pick out one fund from every class after which to pick out ten funds to maximise an equal weighted portfolio. The hyperlink is supplied right here. Chart #7 exhibits the ultimate ten funds for the twelve-year interval. These are the classes of bond funds that I will probably be utilizing to construct the bond portion of my portfolio all year long along with Treasury ladders to match withdrawal wants. Observe that Portfolio Visualizer is successfully constructing a bucket record of shorter-duration bond funds for stability and longer length for increased returns.

Chart #8: Funds Chosen to Construct the All-Bond Portfolio

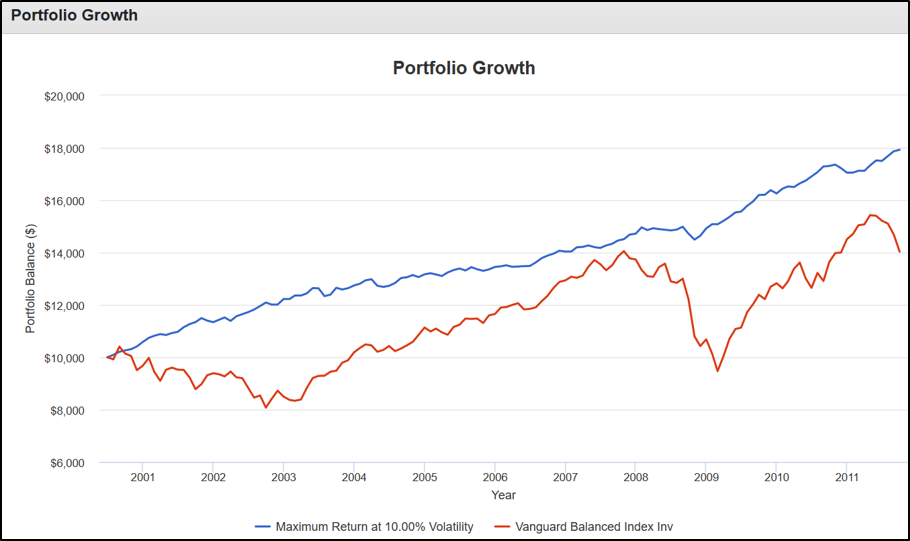

Chart #9 compares the All-Bond Portfolio to the Vanguard Balanced Portfolio (VBINX) over the twelve-year interval. Observe that the 2 bear markets on this time interval had been unusually extreme. I imagine that buyers ought to have diversified portfolios throughout a number of asset courses, however the chart means that holding extra high quality bonds over the subsequent few years or longer might end in increased returns and decrease volatility.

Chart #9: Equal Weight Bond Portfolio vs Vanguard Balanced Fund

The All-Bond Portfolio outperforms VBINX as a result of it has increased yields and continues to generate profits throughout recessions reasonably than experiencing losses.

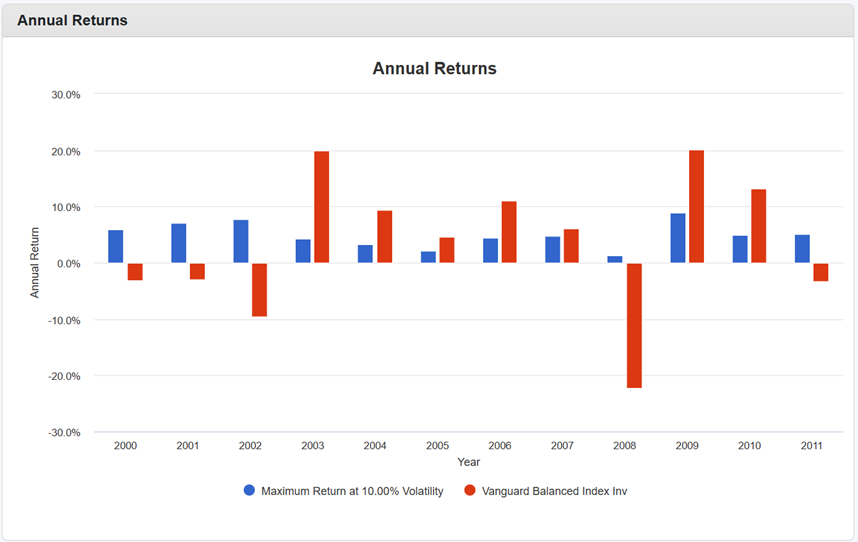

Chart #10: All-Bond Portfolio Efficiency by 12 months

Closing Ideas

Final 12 months, I purchased ladders of short-term certificates of deposits and Treasury in order that they mature each month or so. This permits me to guage the present surroundings every month and to make a small choice of whether or not to carry money, lengthen bond durations, purchase bond funds, or purchase fairness funds. I’ll full the development of bond ladders within the subsequent month or two extending over the subsequent eight years. At that time, my expectation is that I’ll change and put money into among the bond funds coated on this article.

I anticipate to stay over-weight in bonds for the rest of this 12 months, however purchase equities throughout important dips. As I discussed final month, I’ll proceed to search for alternatives so as to add to Columbia Thermostat (CTFAX/COTZX), American Century Avantis All Fairness Markets ETF (AVGE), and probably Allianz PIMCO TRENDS Managed Futures Technique (PQTAX). After growing allocations to bonds, I’ll search for alternatives to shift allocations from blended asset funds to fairness funds.

As a follow-up to earlier articles, Standpoint Multi-Asset Investor has an institutional class (BLNDX) which is out there at Vanguard with decrease charges however a better minimal requirement. The investor share class (REMIX) is out there at each Vanguard and Constancy.