Aurelia is a highschool instructor at a public faculty in Boston who lately purchased her first rental and is thrilled to be a home-owner on the age of 27! Tempering that enthusiasm, nonetheless, are her new competing monetary calls for of home upkeep prices, retirement, saving for Invisalign braces and paying off her scholar loans. Aurelia has a zest for all times and a love for her college students, however her wage doesn’t fairly match that enthusiasm. She’d like our assist figuring out the right way to prioritize her monetary targets whereas nonetheless dwelling a strong life stuffed with associates, journey and hobbies. Let’s head to Boston to dive into Aurelia’s questions!

What’s a Reader Case Research?

Case Research tackle monetary and life dilemmas that readers of Frugalwoods ship in requesting recommendation. Then, we (that’d be me and YOU, pricey reader) learn by means of their state of affairs and supply recommendation, encouragement, perception and suggestions within the feedback part.

For an instance, take a look at the final case research. Case Research are up to date by contributors (on the finish of the publish) a number of months after the Case is featured. Go to this web page for hyperlinks to all up to date Case Research.

Can I Be A Reader Case Research?

There are 4 choices for people curious about receiving a holistic Frugalwoods monetary session:

- Apply to be an on-the-blog Case Research topic right here.

- Rent me for a personal monetary session right here.

- Schedule an hourlong name with me right here.

- Schedule a 30 minute name with me right here.

→Undecided which choice is best for you? Schedule a free 15-minute chat with me to study extra. Refer a good friend to me right here.

Please be aware that house is restricted for the entire above and most particularly for on-the-blog Case Research. I do my finest to accommodate everybody who applies, however there are a restricted variety of slots out there every month.

The Aim Of Reader Case Research

Reader Case Research spotlight a various vary of economic conditions, ages, ethnicities, places, targets, careers, incomes, household compositions and extra!

The Case Research collection started in 2016 and, to this point, there’ve been 95 Case Research. I’ve featured people with annual incomes starting from $17k to $200k+ and internet worths starting from -$300k to $2.9M+.

I’ve featured single, married, partnered, divorced, child-filled and child-free households. I’ve featured homosexual, straight, queer, bisexual and polyamorous folks. I’ve featured girls, non-binary people and males. I’ve featured transgender and cisgender folks. I’ve had cat folks and canine folks. I’ve featured people from the US, Australia, Canada, England, South Africa, Spain, Finland, the Netherlands, Germany and France. I’ve featured folks with PhDs and folks with highschool diplomas. I’ve featured folks of their early 20’s and folks of their late 60’s. I’ve featured people who dwell on farms and folk who dwell in New York Metropolis.

Reader Case Research Pointers

I most likely don’t must say the next since you all are the kindest, most well mannered commenters on the web, however please be aware that Frugalwoods is a judgement-free zone the place we endeavor to assist each other, not condemn.

There’s no room for rudeness right here. The aim is to create a supportive setting the place all of us acknowledge we’re human, we’re flawed, however we select to be right here collectively, workshopping our cash and our lives with constructive, proactive solutions and concepts.

And a disclaimer that I’m not a skilled monetary skilled and I encourage folks to not make severe monetary selections primarily based solely on what one individual on the web advises.

I encourage everybody to do their very own analysis to find out the most effective plan of action for his or her funds. I’m not a monetary advisor and I’m not your monetary advisor.

With that I’ll let Aurelia, in the present day’s Case Research topic, take it from right here!

Aurelia’s Story

Hello Frugalwoods! I’m Aurelia and I’m 27 (the place does the time go?), born and now dwelling (ceaselessly!) in Boston, MA. My dad and mom dragged me to suburbia once I was younger however I’m a metropolis lady at coronary heart and have been again within the metropolis since faculty. I’m fortunately single and have an exquisite job instructing historical past to newcomer immigrants in an city highschool whereas co-running an open air membership for the children. After I’m not at work I’m often on the ballet, studying, enjoying video video games, mountaineering and tenting, bouncing, or going out (particularly consuming out) with associates. My dad and mom dwell lower than half-hour away and I spend as a lot time with them as I can, since my sibling lives in Florida. I simply grew to become a house (rental) proprietor this previous June – one thing I believed would by no means occur, particularly at a younger age – and I’m completely loving it!

What feels most urgent proper now? What brings you to submit a Case Research?

I used to be NOT imagining I’d turn out to be a home-owner and definitely not at 27! To make a protracted story as temporary as attainable: I used to be idly perusing actual property listings in my neighborhood (don’t all millennials do that?) and an income-restricted unit in a big constructing I’ve at all times favored got here up. After studying over the necessities, I noticed this might be the one time I’d be eligible to purchase on this earnings bracket AND in my neighborhood, which I’d have been priced out of in any other case, because the hire is just too rattling excessive. After speaking it over with my dad and mom to verify if I used to be loopy to even take into account it, I pulled the set off and ended up being the one provide. And right here I stand earlier than you, a home-owner… who now should determine her subsequent steps (once more)! I’m now forward of all of my associates and really feel like I’ve skipped a number of steps in how I understood life’s development to be.

Even earlier than shopping for my rental, I had a number of completely different targets I used to be juggling – retirement, journey, saving for a 2nd masters to extend my earnings (which I’ve since shelved, as I believe there are higher choices), paying off my scholar loans, and saving for Invisalign – and never notably nicely. Now enter a home and…you possibly can see how I’m a bit careworn attempting to determine what to do first and what wants to attend! I’ve landed on eliminating my scholar mortgage debt as shortly as attainable, however there are some questions I need enter on as regards to work and retirement.

What’s the most effective a part of your present way of life/routine?

Although I spent numerous my childhood in rural/suburban areas, it’s honest to say that I’m a metropolis lady at coronary heart. The convenience of having the ability to go anyplace and do something, attempt completely different cuisines, and revel in enjoyable and attention-grabbing locations (inside and out of doors) makes me very blissful. I even have an intense have to be outdoors, and Boston/New England is ideal for that! I’ve a pleasant palette of hobbies and actions to select from and associates who dwell close by that I can do them with (or on my own, if I need). Professionally, work may be “messy” generally (if you already know, you already know) however I’m on the level in my instructing profession the place I’m solely working 40 hours per week and might fortunately depart work at work. I gained’t deny that instructing, particularly this particular inhabitants, may be emotionally draining generally, so I’m blissful that I dwell alone now and have some mellower hobbies I can recharge with. I additionally love the group spirit of my constructing and my neighborhood.

What’s the worst a part of your present way of life/routine?

Work may be draining generally and the pandemic years had been tough in my faculty, not simply due to the pandemic. Because of this, I don’t get as a lot face time with my 9-5 associates in the course of the faculty 12 months as I need (being this drained may also simply be…getting older?). Instructing can be not terribly profitable, and whereas we gained an enormous wage improve in our contract, issues are tight financially.

I’ve at all times tried to dwell as frugally as attainable whereas having a full and blissful life, however including the bills of homeownership is making issues even tighter.

On the identical time, there aren’t numerous alternatives to earn extra money at work and the few out there are: a) an excessive amount of time/duty relative to the compensation provided; or b) threaten my work-life steadiness or work happiness.

I discover that the extra folks I need to work with, the unhappier I’m. I’m so not curious about work politics. I additionally must watch out managing my well being and vitality ranges as a result of I’ve some persistent sicknesses that may spiral into severe illness if I overextend myself. Nonetheless, my place exists in only a few locations and the crew I work with is great.

The place Aurelia Needs to be in 10 Years:

Funds:

- Free (or near free) of non-mortgage debt

- Paid for Invisalign

- Paid for one among my huge “initiatives” (ending the loft in my rental or occurring a big journey)

- Extra money saved for emergencies and retirement

Way of life:

-

Extra of what I’m doing now, though with extra touring (presently nothing, beforehand 1-2 lengthy weekend-style home journeys).

- I’d actually love to go to Central and South America the place all my college students are from.

- I’m presently single however I think about within the subsequent 10 years I could meet a accomplice and incur bills associated to that.

- Resulting from well being points, I’d have a troublesome time having organic kids. I’ve not dominated out adopting or fostering, however my rental will not be large enough and I’d not do it on my own. I can see myself because the aunt who spoils her nieces/nephews rotten with enjoyable journeys/occasions within the metropolis with good meals afterwards…

Profession:

- Nonetheless instructing as a result of the work is intellectually stimulating and the children are nice, however trying to maximize earnings with out compromising my values.

- I don’t wish to be an administrator having seen how a lot mine works (plus I would want to return to highschool for that).

- Subsequent 12 months I’ll apply to be a brand new instructor mentor for a wage bump (I utilized for a trip place and didn’t get it, which was discouraging).

- I considered a second MA, which I discovered on-line for an affordable worth, however I can’t justify that upfront expense proper now and truthfully… I don’t wish to return to being a scholar, as a lot as I beloved it.

- Aspect be aware: I have already got my Grasp of Arts in Instructing English as a Second Language and a BA in Historical past with a minor in dance!

- I don’t assume there’s a lot else on the market that fits my skillset and my way of life targets/goals on the identical wage level.

- The pandemic taught me the laborious means that distant work will not be satisfying for me (hybrid, perhaps).

Aurelia’s Funds

Earnings

| Item | Gross Earnings | Deductions & Quantity | Internet Earnings |

| Earnings, paid in 24 checks September – June (so it’s biweekly, however sort of not) | $5,872 | medicare: $85, PPO: $326, 457: $100, imaginative and prescient: $6, dental: $43, pension: $646, state taxes: $296, federal taxes: $508.05, union dues: $87 | $3,805 |

| be aware: December is somewhat bit larger as a result of we’ve a premium vacation, and I get roughly $100/month from my membership (however I attempt to not rely it because it’s unpredictable!) | |||

| Month-to-month subtotal: | $3,805 + $100-$150 membership | ||

| Annual complete: | $45,660 (simply wage) |

Mortgage Particulars

| Merchandise | Excellent mortgage steadiness | Curiosity Fee | Mortgage Interval and Phrases | Fairness | Buy worth and 12 months |

| Major mortgage on my rental | $317,000 | 2.75% | 30-year fixed-rate mortgage | ~$20k (not together with secondary mortgage) | $362k, bought June 2022 |

| Secondary mortgage on my rental | $23,500 | 0.00% | 30 years…type of | n/a | $0, this was the downpayment help from my metropolis once I purchased my rental. The secondary mortgage is paid off in full, interest-free, upon refinance or totally paying off the mortgage. I’d be a idiot to refinance 2.75%, so… |

| Complete: | $339,500 |

Money owed

| Item | Excellent mortgage steadiness | Curiosity Fee | Mortgage Interval/Payoff Phrases/Your month-to-month required cost |

| Federal scholar loans | $73,000 | 5.20% | I’m on an income-based reimbursement plan for Public Service Mortgage Forgiveness (PSLF). I’m nearly midway by means of my 10-year requirement and can see forgiveness (with no tax bomb) in late 2028. I’m eligible for $10k in mortgage forgiveness if it passes, however it might not change my month-to-month funds proper now. |

| Personal scholar loans | $45,000 | 4.98% | Paid biweekly to sneak additional funds in. Payoff is 2041, however I wish to be free ASAP! |

| Complete: | $118,000 |

Belongings

| Merchandise | Quantity | Notes | Curiosity/sort of securities held/Inventory ticker | Identify of financial institution/brokerage | Expense Ratio |

| Pension | $25,100 (what I’ve put in) | That is the overall of what I’ve put in up to now to my MTRS contributions.

How do I issue pension worth into retirement? If I max out my pension (at 58, eligible to retire at 60) I get 80% of my previous couple of years’ earnings in retirement. |

Necessary 11% contribution from each paycheck | MTRS (the MA state lecturers’ retirement system) | n/a |

| Roth IRA | $15,700 | I began this once I was 19! | Goal 2060 retirement fund (though I’ll realistically retire in 2055) | Vanguard | 0.08% |

| Checking Account | $7,500 | Checking account | Charles Schwab | n/a | |

| Financial savings Account | $3,000 | 4.25% | LendingClub | n/a | |

| 457 (employer plan) | $1,400 | That is my non-pension employer plan. I didn’t enroll in it till I earned PTS (tenure) out of a foolish concern that I’d be fired.

For now I put $50/month in since my tax bracket is on the bubble re: if Roth or non-Roth contributions make sense. I don’t have a great sense of what my taxes will appear like now that I’m a home-owner (!!) It’s additionally actually annoying to request adjustments in contributions so I wish to be certain I’ve extra money available. I also can contribute to this post-tax. |

Goal 2060 retirement fund | Empower | 0.07% |

| Complete: | $52,700 |

Automobiles: none!

Bills

| Merchandise | Quantity | Notes |

| Mortgage | $1,346 | Principal, curiosity, taxes. My property taxes are $30/month. Thanks metropolis proprietor occupancy deduction! |

| Personal Pupil Mortgage | $413 | Sometimes 2 biweekly funds of 155, generally 3 if it’s a 3 paycheck month. I’m sending an additional $50/cost to get out of debt sooner! |

| Financial savings: No August Wage | $400 | I get 3 paychecks in late June that are supposed to cowl July, August, and early September…clearly not sufficient cash. I’ve determined to remove uncertainty by saving cash upfront only for wage substitute. |

| Groceries | $250 | This contains family/cleansing provides and alcohol (I dwell subsequent to a sure tremendous craft cider taproom/brewery). I solely store at Market Basket (not often sneaking into Dealer Joe’s for snacks), however generally I take advantage of Amazon Contemporary as I dwell in a meals desert. |

| HOA Price | $167 | Sizzling water, widespread areas, landscaping, typical HOA issues |

| Financial savings: Home-owner Fund | $150 | In my Homebuyer 101 class we had been informed to save lots of 1% of our dwelling’s worth every year to go in the direction of enchancment and upkeep prices. Cash may be very irregular for me in the summertime so I don’t know the way a lot a month this seems like this 12 months, however by this 1% calculation it needs to be $300/month. I’m somewhat forward so it’s about 200/month. I’ve an unfinished loft that I wish to construct sooner moderately than later and my home equipment are great however older, so I wish to be prepared when these instances come.

aim is 3600 every year, present steadiness 2k |

| Boston Ballet | $100 | Paid in Could, averaged month-to-month. 2 orchestra seats to each present + $20 volunteer dues (I give excursions, amongst different issues!). I principally dwell on the Opera Home when the ballet is in season and see most reveals 4-5 instances (and get to hang around with the dancers!). I additionally obtain perks like extra free tickets, attending firm class and particular performances at no cost. I get to deal with quite a lot of particular folks in my life (they pay for meals in return). I’ve been a subscriber for 8 years now and I’ve obtained a number of seat upgrades – if I pause my subscription I’d lose my seats. |

| Good friend Dates | $100 | Averaged to account for the educational calendar (extra free time throughout breaks), however a slush fund for issues I do with my associates. I rely meals out with associates towards this quantity. This summer season I used library passes to go together with associates to many museums at no cost, however some had been solely discounted. |

| LinkPass | $90 | Limitless bus, practice and ferry. No employer transit advantages however may be deducted from taxes. 🙁 |

| Financial savings: Invisalign | $87 | I would like to start out saving for this as my enamel are crowded and getting worse. I’ve shopped round and the bottom quote (dental faculty) have quoted the work at $5.5k over a 12 months (month-to-month funds). All consults agree that the work must be finished inside the subsequent 5 years (by 2026). Dental insurance coverage covers 0%. Sadly no low cost for paying all the pieces up entrance, however I want to save a minimum of 1/2 of the quantity earlier than starting the remedy.

Aim is $2,250 by Could 2024 |

| Trampoline / Dance Lessons | $85 | Limitless bounce + cheer courses that greater than pays for itself. Essential to my bodily and psychological well being and might’t do it at dwelling! Plus I get passes to convey associates so we are able to do one thing enjoyable at a low value. |

| Home-owner Insurance coverage | $70 | |

| Electrical | $50 | Regardless of the brutal warmth wave this previous summer season, my electrical prices are fairly constant. |

| Physician Visits | $50 | copays and pressing care averaged – larger than regular as a consequence of a latest MRI |

| Household Trip | $50 | My dad and mom anticipate me to pay 1/3 of the household trip. |

| Christmas | $50 | Averaged over the previous 2 years. Features a tree, presents for associates/household, vacation bills (baking for coworkers), any journey and donations to group orgs who assist people in want of a meal. I am going frugal for folks’s birthdays so Christmas is my every year factor. |

| Financial savings: Laptop computer Fund | $50 | Saving for a brand new laptop computer. 100/600 |

| Web | $40 | |

| Drugs | $35 | generally larger relying on the sickness of the month |

| Fuel | $30 | Averaged. Nonetheless haven’t turned my warmth on as a result of huge home windows = huge solar! |

| Contact Lenses | $30 | Curse astigmatism! |

| Eating Out | $30 | After I eat out on my own, both full meals or getting treats at a espresso store. Pre-pandemic this was larger however I attempt to cook dinner extra. Normally dip into this once I’m too sick to cook dinner and desire a meal. That is a simple place to chop down (generally you simply want Dunks) |

| Furnishings / Dwelling Items | $20 | That is laborious to quantify since I made some huge ticket purchases that I cannot be making once more (as YNAB jogs my memory, my common is excessive!): this features a sofa I acquired for FREE minus the price of shifting it, a TV, a washer machine, and a brand new drying rack (sadly not free). I believe I’m finished for now… |

| Outdoorsy Issues | $20 | Averaged; if I hike with associates, covers gasoline bills or any meals/snacks we have to get. This might be larger if I get new gear, however I’m all set for now. |

| Haircut | $20 | 2x/12 months for a curly reduce, can’t go any longer between |

| HBO MAX | $16 | Don’t inform anyone that my mother has my HBO password…! |

| Last Fantasy XIV Subscription | $13 | I play often with my associates. |

| NYT Educational Subscription | $12 | |

| Amazon Prime | $12 | I’d moderately not, however I a) dwell in a meals and retailer desert and b) preserve my mom pleased with Prime Video. I order sufficient issues that the month-to-month value is decrease than what I’d pay in delivery. |

| YNAB | $6 | Sharing a household plan with a good friend! |

| Donations | $5 | Averaged, annual donation to work scholarship. |

| Clothes | $5 | The final time I purchased garments was final February? I purchased myself a really good ski bib… |

| Federal Pupil Mortgage | $0 | At present paused. When funds resume I must request a recalculated month-to-month cost, however solely after I file my taxes to see if this can be a profit or a burden.

(will probably be round $250/month beginning in June 2023) |

| Financial savings: Journey Fund | $0 | Saving to see an expensive good friend graduate in VA this spring, utilizing a mixture of factors and money. After this, saving for a visit to Canada to see one other good friend.

(fund will get topped up as spent, @ 350) |

| Financial savings: Video Recreation Fund | $0 | This has been a lot larger than regular since 2022 was a terrific 12 months for sport, and I had gone years with out shopping for any. I both watch for deep gross sales, go to the library first, or I purchase used at an area retro retailer (and get a ten% instructor low cost)! 2023 seems quieter so I’ll most likely purchase 1-2 video games and be finished for a bit.

(fund is 65, replenished when spent, had been spending 40/mo final 12 months) |

| Cell Cellphone | $0 | My mother complains in regards to the telephone invoice however refuses to take my cash? (Don’t fear, I’ve already recommended an MVNO.) |

| Gardening | $0 | On maintain proper now as I cross my fingers and watch for a group plot. Sometimes $5-10/month averaged in any other case for soil and native seedlings. |

| Month-to-month subtotal: | $3,802 | contains invisalign and house owner financial savings, however not upcoming scholar mortgage restart in june 2023 |

| Annual complete: | 45,624 | $3 beneath! |

Credit score Card Technique

| Card Identify | Rewards Kind? | Financial institution/card firm |

| Chase Freedom Limitless | Journey/Money Again | Chase Financial institution |

| CapitalOne QuickSilver | Money Again | CapitalOne |

| Residents Financial institution MasterCard | nothing (I acquired it as an AU at 16 to construct credit score and study good habits) | Residents Financial institution |

Aurelia’s Questions For You:

-

Pre-tax or Roth contributions?

- For reducing my taxable earnings (PSLF), it most likely is smart to go heavy on pre-tax retirement contributions, however I solely have 5 extra years of PSLF (Public Service Mortgage Forgiveness).

- Reducing taxable earnings is helpful usually, however at my earnings I nearly undoubtedly can’t get into the 12% bracket (nor will I see the next one, a minimum of not for some time).

- What’s a gal to do?

- How ought to I take into consideration my pension within the context of planning my different saving for retirement?

- I’m in MTRS (the Massachusetts state lecturers’ retirement system)

- If I max out my pension (at age 58, eligible to retire at 60) I get 80% of my previous couple of years’ earnings in retirement.

- Since I’m on this pension system, I gained’t obtain any Social Safety

- How do I prioritize a myriad of financial savings/debt-purging targets? To recap, my targets are:

- Paying off scholar loans

- Saving for retirement

- Paying for Invisalign braces out-of-pocket

- Saving for house owner initiatives/repairs

- Journey, a lot later

- Am I lacking one thing I haven’t considered? I’m additionally nervous about my dad and mom:

- My dad and mom have little retirement financial savings and can most likely must work till the day they die. They’re of their late 50s and each have a number of persistent well being circumstances that impair their high quality of life.

- They’ve a mortgage on a single household dwelling in metro Boston that they might simply promote for 3-4x the worth they paid and, after paying off the mortgage, have some cash to dwell on along with Social Safety. They might transfer someplace with a decrease value of dwelling and be tremendous, however I’d like for my dad and mom to be shut.

- Is it value pushing aside retirement contributions altogether to get out of debt sooner?

- I’ve taken sufficient private finance courses to know that the reply might be a staunch NO (time worth of cash, child!), however the issues of getting a pension and the curiosity in opening up money circulate make me hesitate for a microsecond…

Thanks a lot for any perception you possibly can provide, Liz and the Frugalwoods Group!

Liz Frugalwoods’ Suggestions

I really like Aurelia’s love of life! She has so many pursuits, hobbies and passions and her enthusiasm exudes from her writing. I had a smile on my face the entire time I examine all the pieces she’s curated in her life. Her Case Research additionally raises the unhappy specter that we don’t pay our lecturers sufficient on this nation. Nowhere close to sufficient. If I had been Queen of the World, I’d pay all lecturers an funding banker wage as a result of they deserve it! Sadly, nobody will elect me Queen of the World (a lot as I’ve tried… ). Given my incapability to extend Aurelia’s wage, let’s do what’s inside our management and dig into her questions!

Aurelia’s Questions #1 and #2: How ought to I take into consideration my pension within the context of planning my different saving for retirement? And, ought to I make pre-tax or Roth contributions?

The reply right here will depend on whether or not or not Aurelia thinks she is going to stay working in MA public colleges till she retires. If she does, she’s acquired a terrific deal right here. 80% of her wage yearly in perpetuity is improbable! As her present wage, she couldn’t afford to dwell on 80% of it, however her wage will improve over time and her bills will lower as she pays off her scholar loans and ultimately her mortgage.

→The most important caveat is the well being of her pension system.

Whereas I really feel extra assured in regards to the viability of a state pension system, corresponding to Aurelia’s, there stays an inherent threat of default in any pension system. Because the MA Trainer’s Retirement System Impartial Auditor’s Report on Pension Plan Schedules is publicly out there as a PDF, I learn it (nicely, a few of it). I truthfully don’t assume you guys notice how thrilling my job is…

In an audit, an out of doors auditor seems on the books of a corporation or entity (on this case, Aurelia’s pension system) and offers their opinion on how that group/entity is doing financially. The auditor on this case was charged with making assessments corresponding to: Is that this pension system more likely to default? How doubtless? How wholesome is that this pension in gentle of the variety of dwelling pensioners? And extra! Let’s see what they discovered!

The MA Trainer’s Retirement System Impartial Auditor’s Report on Pension Plan Schedules For Fiscal Yr 2021: a enjoyable read-along with Liz!

We start by taking a look at web page 7 in an effort to higher perceive the parameters of this pension system:

These necessities present for superannuation retirement allowance advantages as much as a most of 80% of a member’s highest three-year common annual charge of normal compensation. For workers employed after April 1, 2012, retirement allowances are calculated on the premise of the final 5 years or any 5 consecutive years, whichever is larger when it comes to compensation… Members turn out to be vested after ten years of creditable service. A superannuation retirement allowance could also be obtained upon the completion of 20 years of creditable service or upon reaching the age of 55 with ten years of service. Regular retirement for many staff happens at age 65. Most staff who joined the system after April 1, 2012 can not retire previous to age 60.

That is tremendous helpful information! I assume Aurelia was employed after April 1, 2012, which suggests these new provisions apply to her. To recap (in plain-er English):

- She’ll get 80% of both her final 5 years of wage OR any consecutive 5 years all through her profession–whichever has the larger wage. That is good to know as a result of it means she may probably scale down her obligations as she nears retirement since she doesn’t have to have her highest incomes years on the finish of her profession (as is the case with many pensions).

- She’ll be vested after 10 years, so she’ll undoubtedly wish to keep working within the system for no less than 10 years.

- She doubtless can not retire previous to age 60 if she needs to obtain the total 80%-of-salary profit.

Subsequent, let’s study the well being of the pension system by going to web page 9:

Be aware that these numbers are written in 1000’s, which suggests the totals are literally billions. I agree, that is very complicated, however apparently it’s normal auditing process. No marvel individuals are confused! Right here’s what the auditors report about Aurelia’s pension system:

The collective internet pension legal responsibility on June 30, 2021 was as follows (quantities in 1000’s):

Complete pension legal responsibility……………………………… $59,795,000

Much less: Plan fiduciary internet place…………………… $37,088,124

Internet pension legal responsibility………………………………… $22,706,876

Plan fiduciary internet place as a proportion of complete pension legal responsibility………………………… 62.03%

What we’re taking a look at right here is:

- How a lot cash the auditors estimate will have to be paid out of the pension system sooner or later, referred to as “Complete pension legal responsibility” ($59.8 billion)

- How a lot the pension has in property, referred to as “Plan fiduciary internet place” ($37 billion)

- The distinction between how a lot the pension owes and the way a lot the pension has, referred to as “Internet pension legal responsibility” ($22.7 billion)

The underside line is that the pension is 62% funded. For context, 100% funded can be the most effective and 0% funded can be the worst. However, a 62% funded charge will not be dangerous. Not superior, however not horrible. So how do we all know if Aurelia will get her full pension? We are able to’t know this. Nonetheless…

→The actual method to decide the probability of Aurelia’s pension being there for her is thru the lens of the political panorama of the state/entity that controls her pension.

Purpose being? This pension is backed by the total religion and credit score of the commonwealth of Massachusetts. So the query it’s important to grapple with is: how doubtless are MA state legislators to permit the state lecturers’ pension to enter default? Are they more likely to bail it out if want be? Or are they more likely to permit lecturers to not obtain their pensions? In some states, that’s tantamount to political suicide. In different states… not a lot. It’s additionally vital to keep in mind that, within the occasion of a price range disaster, it’s most unlikely Aurelia would obtain NONE of her pension–it’s more likely she’d obtain a partial proportion.

Right here’s what I imply by that:

A 62% funded charge in a conservative state is far more precarious than a 62% funded charge in a liberal, progressive state like Massachusetts.

So how will the pension get totally funded? If I needed to guess, I’d say that in some unspecified time in the future sooner or later, there’ll be a grand political discount within the state whereby the state bails out the instructor’s pension as a result of it might be politically disastrous to not (assuming the prevailing political winds haven’t drastically modified).

Nonetheless, that is an unscientific evaluation as a result of there’s no method to know what the longer term holds. That being mentioned, it’s important to do one thing to assist your self plan for the longer term. If I needed to make a prediction proper now, I’d say Aurelia’s pension is more likely to be fairly near what’s presently promised

My Advice to Aurelia:

Since Aurelia’s monetary future relies upon closely on her pension, I recommend she learn and perceive the annual Audit report on her pension (simply as we did above).

→When you don’t perceive your pension, speak along with your union rep because it’s their job to be sure you perceive it.

This goes for everybody studying this who has a pension. There may be somebody (both in your union or your HR division) whose literal JOB is to make sure you perceive your pension advantages. Don’t take “I dunno” as a solution.

Backside Line on the Pension:

If Aurelia thinks she is going to stay a MA public faculty instructor, then I believe the one factor she will be able to do is assume her pension will probably be there for her. That being mentioned, Aurelia may be very sensible to spend money on different retirement autos too since, as she famous, she’s not eligible for Social Safety and the pension will solely be 80% of her wage (in the most effective case situation).

Aurelia’s Different Retirement Investing Automobiles

Along with her pension, Aurelia has two different retirement autos out there to her:

- A 457 (by means of her employer)

- A Roth IRA

The rationale to take a position to your retirement—versus simply saving money for it—is threefold:

- There are tax benefits to using retirement accounts

- There are grave disadvantages to money (alternative value and it doesn’t sustain with inflation)

- There are benefits to investments (particularly, their anticipated charge of return)

Wait, What’s a Roth IRA Once more?

IRA stands for “Particular person Retirement Account” and there are two completely different major forms of IRAs: Roth and Conventional. The distinction between the 2 is in how they’re taxed.

- A Roth IRA is a retirement account that’s post-tax:

- Which means you pay taxes on the cash you set right into a Roth IRA, however you don’t pay taxes while you withdraw the cash in retirement.

- A Conventional IRA is a retirement account that’s pre-tax:

- Which means you don’t pay taxes on cash you set into an IRA, however you do pay taxes while you withdraw the cash in retirement.

In 2023, the overall quantity an individual can put every year right into a conventional IRA and/or a Roth IRA can’t be greater than $6,500 (or $7,500 in case you’re age 50 or older).

- An individual can have each a Roth and a conventional IRA, however their mixed annual contribution to each can’t exceed this $6,500 ($7,500 for ages 50+) restrict.

A Roth sometimes makes probably the most sense in case your earnings is on the low finish as a result of in that case, your tax charge is low and so it doesn’t matter that you just’re paying taxes in your contributions. To deal with her query, given Aurelia’s comparatively low earnings, Roth contributions most likely nonetheless makes probably the most sense for her.

What’s a 457b?

- 457bs are deferred compensation plans out there to sure authorities (and specified non-government) staff

- You may put a most of $22,500 right into a 457b every year (as of 2023)

- The cash you set right into a 457b plan is tax-deferred

- Any earnings on the cash in your 457b are tax-deferred

One factor to notice a few 457b is that it’s “deferred compensation,” which makes you a creditor of whoever runs the plan. In Aurelia’s case, that’s the commonwealth of MA. In gentle of that, there’s an argument right here for NOT utilizing the 457b since her pension can be by means of the commonwealth of MA. What meaning is that, if the state had been to default, Aurelia would lose each her pension and her 457b. As I famous above, nonetheless, I discover that most unlikely.

I’m not attempting to scare her, however I do need her to bear in mind that–not like with a 401k or an IRA (which is your cash free and clear)–a 457b is technically an IOU out of your employer stating, “I offers you this cash sooner or later.” In apply, deferred compensation is often fairly safe, particularly when it’s publicly sponsored (as Aurelia’s is). However, it’s a nuance to pay attention to.

→All that being mentioned, if it had been me, I’d most likely deal with growing my contributions to the 457b as a result of it’s extra versatile than an IRA.

In 457b plans, you might be allowed to withdraw cash penalty-free earlier than age 59.5, after you allow the employer who sponsors the plan. Therefore, if an individual deliberate to retire sooner than age 59.5, there’d be an actual benefit to having a 457b versus an IRA. Be aware that you just do pay taxes in your withdrawals, however that is often tremendous as a result of–presumably–by the point you’re withdrawing the cash you’re retired and thus, your earnings is decrease as is your tax charge.

→Query for Aurelia: Does your employer match 457b contributions?

If that’s the case, you’ll completely, 100% wish to contribute sufficient to qualify for the total employer match.

Roth IRA vs. 457b: Last Smackdown

In an ideal world, Aurelia would have a excessive sufficient earnings to max out each her IRA and her 457b (which might be a complete of $29k per 12 months). In actuality, she doesn’t. So which one ought to she deal with? To assist us out I made a useful, and in addition dandy, Smackdown Chart:

Roth IRAs:

| Execs | Cons |

| You’re answerable for the place that is invested (which brokerage) and what it’s invested in (which funds). This allows you to choose funds which are: diversified, have low charges, and appropriately matched to your threat tolerance. | Which means it’s important to handle it and choose your investments your self. |

| It’s 100% your cash. It’s not by means of an employer, so that you management it totally. | There’s no alternative for an employer match. |

| You don’t pay taxes while you withdraw the cash in retirement. | You pay taxes on the cash you set in. |

| The annual contribution restrict is low (solely $6,500 in 2023 in case you’re beneath age 50) | |

| You may’t withdraw cash and not using a penalty earlier than you’re age 59.5 |

457bs:

| Execs | Cons |

| The annual contribution restrict is excessive ($22,500 in 2023 in case you’re beneath age 50) | |

| You may withdraw cash penalty-free at any age after you allow the employer who sponsors the plan | |

| Taxes rely upon whether or not or not the plan is a Roth | |

| Your employer may match your contributions. In the event that they do, it’s best to contribute a minimum of sufficient to qualify for the match. | It’s technically an IOU out of your employer and never “your” cash till you withdraw it |

| You don’t must handle the investments your self. | You don’t management the place that is invested–your employer does. Therefore, you could be caught in higher-fee, lower-performing funds and there’s nothing you are able to do about it |

For extra on the distinction between her two choices, I recommend Aurelia take a look at this Investopedia article: Roth IRA or 457 Retirement Plan?

Aurelia’s Query #3: How do I prioritize a myriad of financial savings/debt-purging targets? To recap, my targets are:

- Paying off scholar loans

- Saving for retirement

- Paying for Invisalign braces out-of-pocket

- Saving for house owner initiatives/repairs

- Journey, a lot later

Federal Pupil Loans: don’t pay these off early. Proceed to make funds that rely in the direction of PSLF and sit up for having them forgiven in one other 5 years.

Personal Pupil Loans: these are a bit trickier since they don’t qualify for any forgiveness packages. Nonetheless, it’s nonetheless going to take advantage of sense to pay these off in response to the required schedule–and never any sooner.

Retirement: as outlined above, Aurelia has a pension to sit up for. Nonetheless, since she gained’t obtain Social Safety, she ought to plan to complement her pension through her Roth IRA and her 457b. The sooner you begin investing for retirement, the extra you’ll have ultimately. As her wage will increase, she ought to improve her contributions to those plans.

Paying for Invisalign braces out-of-pocket: Aurelia already has a system for this whereby she’s saving $87/month. I commend her for her extraordinarily organized and forward-thinking financial savings accounts and plans. Carry on preserving on!

Saving for house owner initiatives/repairs: right here once more, Aurelia may be very sensible to have month-to-month financial savings put aside for dwelling repairs. She’s not presently in a monetary place to do non-compulsory dwelling initiatives (corresponding to ending the loft she talked about), however she does must have cash put aside in case of emergency repairs. A couple of ideas:

Journey, a lot later: as these different priorities turn out to be totally funded/paid off, Aurelia can divert financial savings right into a journey fund. Jet off an take pleasure in! Since Aurelia is so organized and accountable, I recommend she get severe about journey rewards bank cards since cautious administration of these can = free flights and lodges.

Rising Earnings

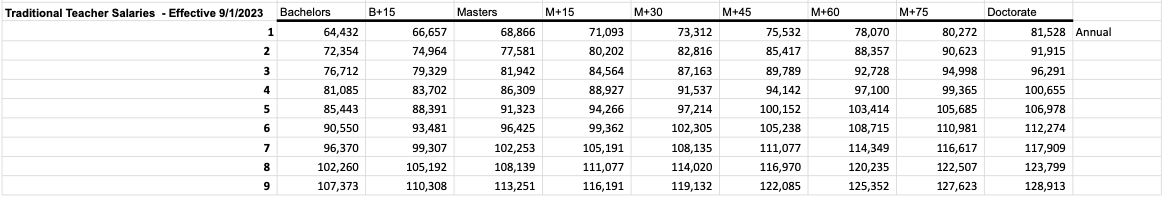

Aurelia didn’t ask about the right way to improve her earnings, however, she occurs to be in a occupation with a really simple and publicly out there schedule for wage will increase. As you possibly can most likely guess: YES, I READ IT! And you’ll too. Courtesy of the Boston Trainer’s Union, I discovered this nice PDF on instructor wage schedules and am thrilled to report that Aurelia has quite a few alternatives for will increase!

From the Boston Trainer’s Union: What this reveals is that incomes credit score hours on high of a Masters diploma = a wage improve. M+15 means a Masters plus 15 extra credit score hours + your variety of years of service (within the lefthand column) = your wage. So if a instructor had three years of service, a Masters diploma and 15 extra credit score hours, her wage can be $84,564.

What this reveals is that incomes credit score hours on high of a Masters diploma = a wage improve. M+15 means a Masters plus 15 extra credit score hours + your variety of years of service (within the lefthand column) = your wage. So if a instructor had three years of service, a Masters diploma and 15 extra credit score hours, her wage can be $84,564.

→What I don’t know from this doc is the way it differs by faculty and by place (if in any respect).

That is one thing for Aurelia to ask her union rep. I additionally don’t know if Aurelia is in a Boston public faculty or a surrounding city’s faculty, which might doubtless have a special wage schedule.

If I’m studying this accurately, Aurelia doesn’t have to truly get one other Grasp’s (or a PhD), she simply has to take credit score hours. That is advantageous as a result of that needs to be loads cheaper and simpler than enrolling in one other Grasp’s program.

One other aspect for her to analysis: it usually doesn’t matter the place you receive these credit score hours. For instance, Aurelia may go to Harvard for her persevering with ed (and pay a ton of cash) OR discover a far inexpensive on-line graduate faculty. Moreover, some districts can pay for a sure variety of credit score hours yearly. Aurelia ought to guarantee she’s using all employer-provided alternatives since each credit score hour counts in the direction of a wage improve!

After all, Aurelia must do her personal analysis and make sure all of this together with her district. However, it seems prefer it needs to be a terrific path to growing her wage! And with an elevated wage comes… an elevated pension!

Bills

After all the opposite facet of the equation are Aurelia’s bills. Nonetheless, even when she trimmed to the bone, her take-home pay would nonetheless be simply $45k. She will actually scale back discretionary classes if she chooses to, however I recommend she put extra effort into the wage improve venture since that’ll yield larger dividends.

Aurelia’s Query #5: Is it value pushing aside retirement contributions altogether to get out of debt sooner?

NOPE NOPE NOPE NOPE NOPE NOPE NOPE. The reason is: Aurelia must prioritize investing for retirement in order that she’s capable of make the most of many a long time of compounding curiosity. If she had been to pay her scholar loans off tomorrow, she’d be locking in a return on the rate of interest of her personal loans (4.98%), which is decrease than the historic common return from the inventory market (~7%). Don’t do that!

Abstract:

-

Evaluation all pension plan supplies and make sure you totally perceive your pension and any adjustments to it within the coming years.

- Decide in case your employer matches 457b contributions. In the event that they do, contribute a minimum of sufficient to qualify for the match.

- Proceed to take a position for retirement and attempt to put extra into your 457b every year. When you’re capable of attain the max contribution restrict, put cash into your Roth IRA as nicely. When you’re capable of max out each every year, take your self out to dinner to rejoice!

- Don’t repay your scholar loans forward of time. Proceed paying them off as required.

- Don’t sacrifice retirement contributions in an effort to repay the coed loans sooner.

- Examine the credit-hours-for-salary-increase potentialities by means of your district. If the above schedule is right, begin taking credit score hours as quickly as attainable. Discover out in case your employer or union can pay for any credit score hours.

- Proceed to save lots of for the Invisalign braces as you might have been.

- Asses your precise value exposures in your rental. What are you liable for repairing vs. the HOA?

- Analyze the reserves of the HOA to find out whether or not or not a expensive evaluation is probably going.

- Proceed dwelling your great life and preserve us posted!

Okay Frugalwoods nation, what recommendation do you might have for Aurelia? We’ll each reply to feedback, so please be at liberty to ask questions!

Would you want your personal Case Research to look right here on Frugalwoods? Apply to be an on-the-blog Case Research topic right here. Rent me for a personal monetary session right here. Schedule an hourlong or 30-minute name with me right here, refer a good friend to me right here, or e mail me with questions (liz@frugalwoods.com).

Questioning about hiring me for a session? Seize quarter-hour on my calendar for free to debate!

By no means Miss A Story

Signal as much as get new Frugalwoods tales in your e mail inbox.