1) SBF, FTX, WTF.

The large story of the week stays Sam Bankman-Fried and the collapse of crypto alternate FTX. I haven’t written a lot about this subject as a result of, nicely, crypto is just not practically as essential as the quantity of airtime it will get. It’s 0.5% of the world’s monetary property, however appears to get 50%+ of the media airtime. Moreover, I don’t imagine that 100+ volatility property needs to be a big a part of anybody’s financial savings so within the scope of my asset administration strategy crypto is a fringe speculative asset (like enterprise capital) and never a core a part of frequent sense portfolio building.

That stated, billions of {dollars} have been misplaced right here so I don’t need to downplay the true losses concerned. I think it’s particularly essential right here as a result of the vast majority of losses have been incurred by individuals who couldn’t afford to lose. It’s rumored that there are thousands and thousands of collectors right here which might imply that the typical account measurement for the losses was $10,000. If that’s even remotely near true then it’s actually unhappy as a result of these have been most probably novice buyers or younger buyers who purchased into the narrative that crypto was serving to to construct an entire new monetary system.

After all, we now know that this “new” monetary system is actually the outdated monetary system besides with none of the laws that make the outdated system reliable. And that’s the place I discover the media protection of this example so odd. Sam Bankman Fried isn’t simply being handled as if he’s harmless till confirmed responsible. He’s being handled as if he did nothing incorrect. And like a lot of the crypto area, it’s getting undeserved consideration as a result of it’s the present vivid shiny object that will get consideration, eyeballs and clicks. However on this explicit case it seems to be like many media retailers are protecting their butts as a result of they helped construct SBF up as this altruistic do-gooder after we now know he’s a fraudster at worst and a horrible threat supervisor at greatest.

So, ought to the media not be protecting it? After all they need to. However I don’t perceive why SBF is being given a lot presumed innocence. In spite of everything, it’s clear that SBF is responsible of fraud at worst and extraordinary negligence at greatest. He shouldn’t be given the advantage of the doubt and the media needs to be treating him far more harshly than they’re. So the entire scenario comes all the way down to an issue of belief. We are able to’t belief probably the most reliable operators within the crypto area. And we are able to’t belief the media to objectively cowl the area. And other people marvel why the “pretend information” narrative was so highly effective below the Trump administration….

2) Who can we belief about home costs?

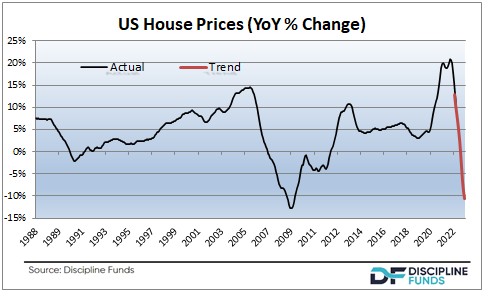

I posted an fascinating chart the opposite day on Twitter displaying that the present projected tempo of home worth declines is on tempo to rival the monetary disaster. The common response to this was “you’re simply concern mongering”. I discovered that to be fascinating within the context of the broader home worth growth. In spite of everything, we had a 40% enhance in home costs in 2 years. So a ten% decline would take us again to ranges final seen in late 2021. 10% is barely a flesh would.

However that’s the fascinating factor about home costs right here. To begin with, individuals appear to assume that home costs can not fall considerably right here. And second, they appear to assume that home worth declines wouldn’t be a giant deal. I need to agree with each of those positions and my baseline projection truly requires each, however I believe it might be extremely naive to not contemplate the potential situation the place costs fall far more than anticipated.

In truth, we’re beginning to see increasingly more analysts come round to that view. John Burns Actual Property, as an illustration, is now calling for 20% declines. Ivy Zelman says 20% is reasonable. However even a 20% decline takes us again to only 2021. Once more, we’re speaking about costs that already appeared elevated in 2021 and now most baseline views say that costs can not revert again to these ranges. I don’t know. As I stated, I need to be on the extra optimistic facet, however I undoubtedly assume there’s draw back threat to my prior 10-15% projections….

3) Who can we belief about future employment?

There’s a conflict raging in bull/bear camps about future employment. On the one hand we maintain getting comparatively sturdy employment reviews. Alternatively, there may be more and more conflicted knowledge below the floor. As an illustration, the family survey has been flat to unfavorable all yr whereas the institution survey retains displaying sturdy readings. And even whenever you have a look at the institution survey the speed of change is clearly slowing. Additional, whenever you have a look at traits like wages it seems to be like labor has extra energy than was anticipated which might throw gasoline on the wage worth spiral argument and the tight labor market argument.

However who can we belief? Properly, I believe it is a situation the place you possibly can’t battle the Fed. In spite of everything, they need larger unemployment to snuff out inflation. And I doubt they’re going to fail of their mission. They’ve been brutally clear about wanting decrease asset worth ranges and better unemployment. And I might be shocked if we don’t get that. So, even when labor stays sturdy for longer than anticipated I believe the Fed will in the end win that battle. Even when it means they must wage one other battle to get unemployment UP after they notice they’ve brought about extra unemployment than they need….