“We are usually insufficient historians.” – Robert Frey

A pair weeks in the past I lined slightly mentioned subject involving the using historic market knowledge. Specifically that it’s a must to take market returns that return to the flip of the twentieth century with a grain of salt due to the truth that prices have been a lot greater in these days so nobody was actually receiving these gross returns on a internet foundation.

The pure follow-up query to this line of considering could be — so what does inventory market knowledge going again to the 1800s actually inform us?

A reader despatched me a hyperlink to a video of a presentation given by former hedge fund supervisor and quant Robert Frey (whose agency was truly purchased out by legendary hedge fund supervisor Jim Simons within the 90s) known as 180 Years of Market Drawdowns.

Frey discusses the various adjustments which have taken place within the inventory market through the years — the creation of the Fed, financial coverage, fiscal coverage, the top of the gold customary, tax charges, valuations, the trade make-up of the markets and numerous different issues.

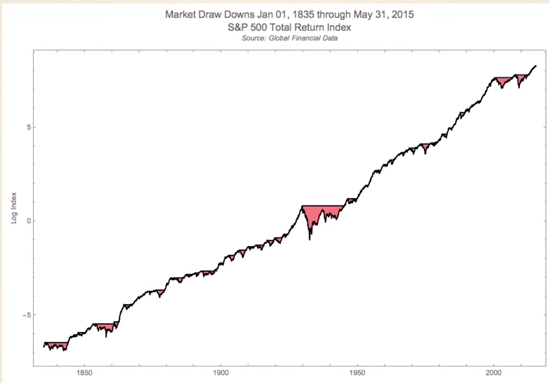

However there was one fixed going again all the best way to the early 1800s — threat. Extra particularly, drawdowns or losses. Frey introduced a few completely different charts in the marketplace to make his level. First, right here’s the long-term development of the inventory market with losses shaded in pink:

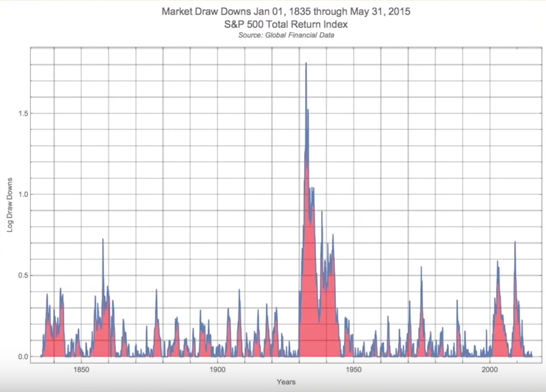

Seems fairly good to me. However now listed below are these losses visualized in one other method with out the advantage of a log scale chart:

Clearly the crash throughout the Nice Melancholy stands out right here, however take a look at how constant losses have been over each decade or financial surroundings. Losses are actually the one fixed throughout all cycles.

Frey says in his discuss that in shares, “You’re normally in a drawdown state.”

Shares don’t make new highs each single day, so more often than not you’re going to be underwater out of your portfolio’s excessive water mark. This implies there are many probabilities to be in a state of remorse when investing in shares.

This is sensible when you think about that shares are constructive just a bit over half the time when returns each day, however it may be tough to wrap your head round this truth.

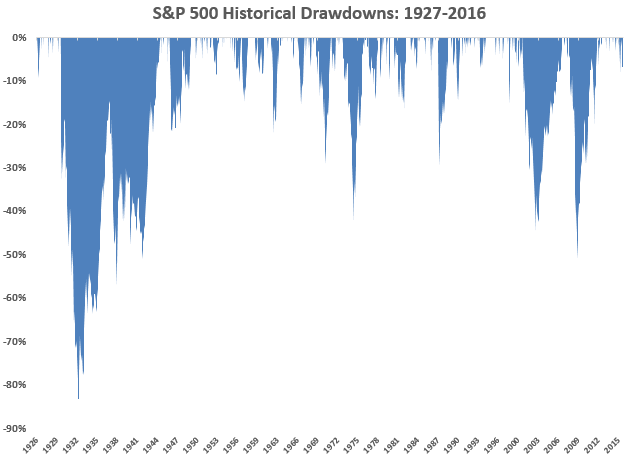

I don’t have knowledge going again to 1835, however I used to be in a position to calculate the drawdowns on the S&P 500 going again to 1927 so as to add some extra context to Frey’s chart from above:

I used month-to-month complete returns on shares for these numbers and located that an investor would have been down from a previous peak over 70% of the time. The vast majority of your time invested in shares might be spent desirous about the way you coulda, shoulda, woulda offered at that earlier excessive value (which in fact will get taken out to the upside finally).

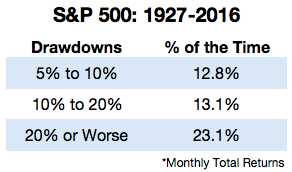

Right here’s the additional breakdown by the scale of the loss:

Over the past 90 years or so the market have been in a bear market virtually one-quarter of the time. Half the time you’re down 5% or worse. It’s tough to understand this truth when a long-term log scale inventory chart that appears to solely go up and to the precise.

For this reason shares are consistently enjoying thoughts video games with us. They typically go up however not day by day, week, month or yr.

Nobody can predict what the long run returns might be out there. Nobody is aware of what the long run holds for financial development. And we actually can’t predict how buyers will determine to cost company money flows at any given time limit out into the long run.

However predicting future threat is pretty straightforward — markets will proceed to fluctuate and expertise losses regularly. As an investor in shares you’ll spend a variety of time second-guessing your self as a result of your portfolio has fallen in worth from a beforehand seen greater degree.

In a way threat is less complicated to foretell than returns.

Market losses are the one fixed that don’t change over time — get used to it.

Supply:

180 Years of Market Drawdowns

For extra on this topic learn what Tadas Viskanta at Irregular Returns has to say on historic efficiency numbers:

Steph Curry, Michael Jordan and the fairness threat premium