The debt ceiling has been resolved. Whereas it was hanging within the air and also you had been hesitant to purchase Treasuries, you’ll have come throughout brokered CDs, which you should purchase in a brokerage account with out having to open a separate account with a financial institution. Are they value it?

What Is a Brokered CD

A brokered CD is a CD issued by a financial institution and offered via brokers. Whenever you see a CD provided in your Constancy, Vanguard, or Charles Schwab account, that’s a brokered CD.

The CD is issued by a financial institution. It has FDIC insurance coverage. In case you have different cash on the similar financial institution that points the CD, your FDIC insurance coverage restrict is aggregated throughout your direct holdings and your brokered CDs from that financial institution.

A brokered CD is protected so long as you keep underneath the FDIC insurance coverage restrict. I purchased a brokered CD from a financial institution in Puerto Rico throughout the 2008 monetary disaster. FDIC paid me in full with curiosity when that financial institution failed.

How a Brokered CD Works

Apart from having FDIC insurance coverage, a brokered CD works extra like a bond.

1 CD is $1,000 of principal. You purchase them in $1,000 increments. Constancy presents “fractional CD” on some CDs. You will notice fluctuating costs for the CD after you purchase it in your brokerage account.

Periodic curiosity funds from the CD are paid into your brokerage accounts as money. They aren’t robotically reinvested into the identical CD. You get the principal again as money when the CD matures. If you wish to get out of the CD earlier than it matures, you will need to promote it on the secondary market to a different purchaser.

Brokered CD vs Direct CD

Brokerage CDs have some benefits over CDs you purchase instantly at a financial institution or a credit score union. Additionally they have two giant disadvantages.

All the pieces In One Account

It’s extra handy to purchase brokered CDs from a number of completely different banks in a single brokerage account than to open a separate account at every financial institution. That is useful particularly whenever you purchase short-term CDs, however if you happen to’re contemplating a 5-year CD, you solely open an account as soon as whenever you purchase instantly from a financial institution or a credit score union and also you’re good for 5 years.

Aggressive Charges

As a result of banks know that brokers current brokered CDs in a desk sorted by the yield, they’ve to supply a aggressive yield to point out up on high. They’ll’t prey on clients not being up to the mark on the going charges. Many banks nonetheless provide very low charges on their web sites however they’ve aggressive charges on brokered CDs.

Not all banks provide brokered CDs although. Some banks, and particularly credit score unions, provide CD specials solely to their direct clients. You need to verify the perfect charges on DepositAccounts.com to see whether or not a financial institution or a credit score union presents a greater charge than the speed you see from a brokered CD.

No Renewal Lure

By default, a brokered CD is robotically cashed out when it matures. Some brokers provide an “auto roll” function to purchase one other brokered CD of the identical time period when one CD matures however you particularly join that function solely if you’d like it.

Most banks and credit score unions robotically renew a matured CD. The brand new CD they renew you into usually has uncompetitive charges. You’ll have to inform them to cease the renewal inside a brief window. In the event you aren’t on high of it, you’ll both be caught with a low charge otherwise you’ll need to pay an enormous early withdrawal penalty that may eat into your principal. See Beware: Banks Auto-Renew CDs with a Brief Window to Again Out.

Name Danger

Many brokered CDs are callable, which implies the financial institution has the correct to terminate (“name”) the CD earlier than the acknowledged maturity date.

Having your CD terminated prematurely is the other of you refinancing your mortgage when the market charge goes down. The financial institution has the selection to terminate the CD or not. You don’t have any proper to refuse.

Some callable CDs have preset dates when the financial institution might train its proper to terminate. Some are constantly callable, which implies the financial institution has the correct to terminate at any time after a sure date.

Naturally, the financial institution will solely terminate the CD when the going charge goes down. You had been relying on incomes the assured curiosity for the total time period. Abruptly the financial institution decides to pay you out early. You get your a reimbursement however you’ll be able to solely earn much less now as a result of the going charge is decrease. Then again, if the going charge goes up, the financial institution chooses to not terminate the CD, and also you’re caught with a below-market charge till maturity.

A callable CD offers you the worst of each worlds. Most direct CDs aren’t callable. You’re assured to benefit from the charge you locked in for the total time period whenever you purchase a CD instantly from a financial institution or a credit score union. You need to examine solely non-callable brokered CDs with direct CDs or demand a considerably increased yield from a callable brokered CD.

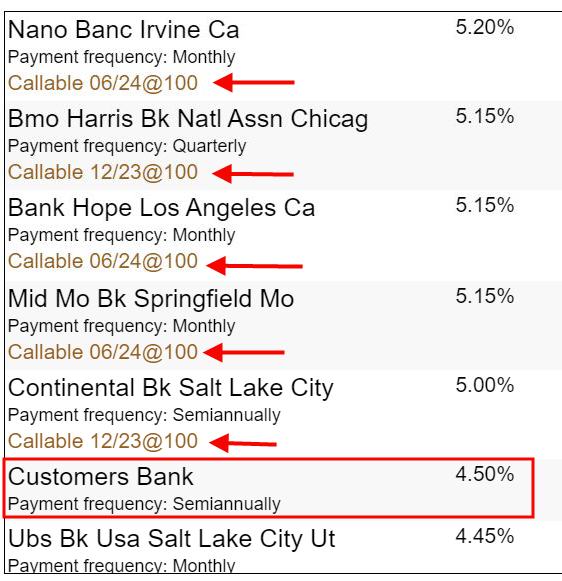

For instance, as I’m scripting this, Vanguard reveals the perfect 5-year brokered CD pays 5.2% and DepositAccounts.com reveals the perfect 5-year direct CD from a credit score union pays 4.68%. That makes brokerage CDs look enticing till you discover out that the brokered CDs with increased charges are all callable.

The most effective charge on a 5-year non-callable brokered CD is just 4.5%. That is decrease than the 4.68% yield on a 5-year CD you will get from a credit score union. You’ll have to weigh the comfort of shopping for a brokered CD towards getting a decrease yield or taking the decision danger.

Can’t Withdraw Early

A CD purchased instantly from a financial institution or a credit score union has an enormous benefit over a brokered CD as a result of you’ll be able to break it by paying a preset early withdrawal penalty. Some direct CDs don’t have any early withdrawal penalty (“no-penalty CDs”).

A brokered CD doesn’t provide an choice to withdraw early. You could promote the brokered CD on the secondary market to a different purchaser if you wish to get out early.

There will not be a purchaser on your CD whenever you need to promote. If there’s a purchaser, the value you obtain from promoting the CD is decided by the present market charge at the moment minus a big haircut. It could be a lot decrease than paying the preset early withdrawal penalty on a direct CD.

Breaking a CD isn’t just for an sudden want for money. When rates of interest go up sharply, it is smart to pay an early withdrawal penalty and reinvest at a better yield. I broke all my direct CDs final 12 months by paying the early withdrawal penalty as a result of the CD Early Withdrawal Penalty Calculator reveals that I’ll find yourself with a better worth than holding the CDs to maturity. I wouldn’t have had this feature had I purchased brokered CDs.

No Reinvestment of Curiosity

When you have got a CD instantly from a financial institution or a credit score union, you have got the choice to have the curiosity paid out to you to reinvest the curiosity into the identical CD on the similar acknowledged yield of the CD. If the going charge goes up, you select to have the curiosity paid out and earn a better yield elsewhere. If the going charge falls, you select to reinvest the curiosity on the unique increased yield.

You don’t have this feature with a brokered CD. All curiosity is paid out in money. If the going charge goes down, you’ll be able to solely earn a decrease yield on the curiosity.

Brokered CD vs Treasury

Suppose you just like the comfort of brokered CDs and also you don’t thoughts giving up a small distinction in yield and the choice to withdraw early. Nonetheless don’t pull the set off simply but. You all the time have the choice to purchase Treasuries as an alternative.

Brokers promote brokered CDs as a result of they’re paid by the banks to promote the CDs. You see extra promoting from the dealer for brokered CDs than for Treasuries however you could be higher off shopping for Treasuries anyway.

As a result of Treasuries have a direct assure from the federal government versus via a separate authorities company (the FDIC), brokered CDs should overcome a number of hurdles earlier than you take into account them. In any other case you simply purchase Treasuries.

Yield Could Be Decrease

Brokered CDs don’t all the time pay greater than Treasuries of a comparable time period. For instance, as I’m scripting this, the perfect six-month brokered CD pays 5.3% APY whereas a six-month Treasury pays 5.4%.

Don’t purchase a brokered CD solely as a result of the speed sounds enticing on the floor. At all times discover out first what a Treasury is paying for a similar time period. See How To Purchase Treasury Payments & Notes With out Payment at On-line Brokers and How you can Purchase Treasury Payments & Notes On the Secondary Market. Don’t trouble with a brokered CD when a Treasury pays extra.

No State Tax Exemption

In the event you purchase in a daily taxable brokerage account, curiosity from Treasuries is exempt from state and native taxes. Curiosity from brokered CDs is absolutely taxable by the state and native governments. Brokered CDs should pay greater than Treasuries after adjusting for this state and native tax exemption.

In case your federal marginal tax charge is f and your state and native marginal tax charge is s, the tax-equivalent yield of a Treasury with a quoted yield of t is:

t * ( 1 – f ) / ( 1 – f – s )

For instance, as I’m scripting this, the perfect 1-year brokered CD has a yield of 5.4% and a one-year Treasury has a yield of 5.24%. When your federal marginal tax charge is 22% and your state and native marginal tax charge is 6%, the tax-equivalent yield of the Treasury is:

5.25% * ( 1 – .22 ) / ( 1 – .22 – .06 ) = 5.68%

Which means a CD should have a yield of 5.68% to earn the identical quantity in any case taxes as a Treasury with a yield of 5.24%. Though the brokered CD with a yield of 5.4% seems to pay greater than the Treasury with a yield of 5.24% at first look, it really pays lower than the Treasury after you’re taking all taxes under consideration.

You don’t need to make this adjustment if you happen to’re shopping for in an IRA or if you happen to don’t have state and native taxes.

Treasuries Aren’t Callable

Many brokered CDs are callable whereas all Treasuries aren’t callable. You need to examine solely non-callable brokered CDs with Treasuries or demand a considerably increased yield from a callable brokered CD.

For instance, as I’m scripting this, Constancy reveals the perfect 5-year brokered CD pays 5.2% when the yield on a 5-year Treasury is 3.89% however the perfect yield on a 5-year non-callable brokered CD is just 4.5%.

The yield benefit shrinks additional whenever you regulate the Treasury yield for the state and native tax exemption. If we use the identical federal marginal tax charge of twenty-two% and state and native marginal tax charge of 6% within the instance above, the tax-equivalent yield of the three.9% Treasury is 4.21%. The 4.5% brokered CD solely has a slightly increased yield than the Treasury. It’s extra aggressive in an IRA and in no-tax states.

Massive Haircut When You Promote

If you wish to get out of a brokered CD earlier than it matures, you will need to promote it to a prepared purchaser. That’s the identical for Treasuries however there are far fewer consumers for brokered CDs than for Treasuries. The customer on your brokered CD will demand a considerable worth concession to take over the CD from you.

Treasuries are extremely liquid and aggressive. In the event you should promote your Treasuries earlier than maturity, you could get a cheaper price than your unique buy worth but it surely’s going to be a good worth primarily based in the marketplace situation at the moment.

Any slight yield benefit you have got from a brokered CD over a comparable Treasury vanishes rapidly if you happen to should promote earlier than maturity. Don’t even take into account brokered CDs if there’s any probability you gained’t maintain them to maturity.

***

Earlier than you discover whether or not it is smart to purchase a brokered CD, you need to:

1. Determine what time period you need as a result of promoting brokered CDs earlier than maturity can be pricey.

2. Verify DepositAccounts.com for the perfect charge on a direct CD on your time period. Weigh the comfort of brokered CDs towards giving up yield and the early withdrawal choice.

3. Verify the yield on Treasuries on your time period. Alter it for the state and native tax exemption if you happen to’re shopping for in a daily taxable account.

4. Solely examine non-callable brokered CDs with direct CDs and Treasuries. Demand a big yield distinction if you happen to don’t thoughts callable CDs.

Say No To Administration Charges

If you’re paying an advisor a share of your belongings, you might be paying 5-10x an excessive amount of. Learn to discover an impartial advisor, pay for recommendation, and solely the recommendation.