The earlier put up Shopping for CD in a Brokerage Account vs Financial institution CD or Treasury talked concerning the benefits and downsides of shopping for brokered CDs versus shopping for CDs instantly from a financial institution or a credit score union or shopping for Treasuries. It ended with these steps once you’re contemplating shopping for brokered CDs:

1. Determine what time period you need as a result of promoting brokered CDs earlier than maturity might be pricey.

2. Verify DepositAccounts.com for the very best fee on a direct CD in your time period. Weigh the comfort of brokered CDs in opposition to giving up yield and the early withdrawal possibility.

3. Verify the yield on Treasuries in your time period. Modify it for the state and native tax exemption in case you’re shopping for in a daily taxable account.

4. Solely evaluate non-callable brokered CDs with direct CDs and Treasuries. Demand a big yield distinction in case you don’t thoughts callable CDs.

Now we go into the logistics of purchase a CD in a Constancy or Vanguard brokerage account with a real-life instance.

Suppose we wish a 3-year CD as a result of we’re snug committing to holding it for 3 years.

Analysis Direct CDs

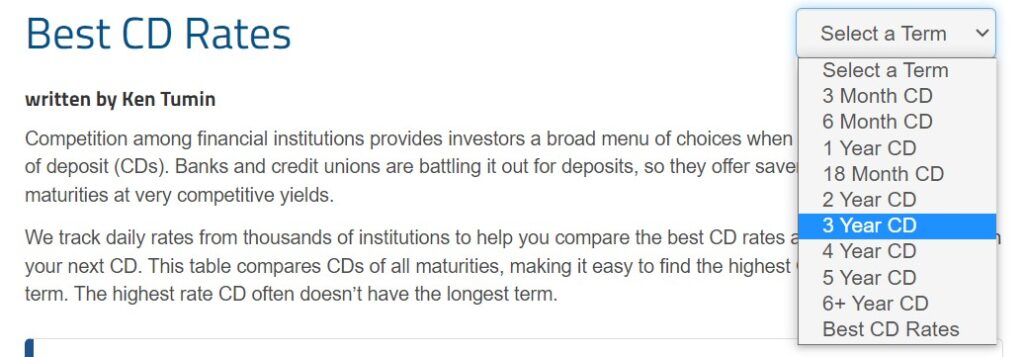

We go to DepositAccounts.com to see the present finest charges provided instantly by a financial institution or a credit score union. We would like the yield on a brokered CD to be not too far off.

We choose the 3-year time period within the time period dropdown. The very best fee provided is 5.65%. Going into the main points of the CDs that provide the best charges reveals that they’re variable-rate CDs, which suggests the speed can drop through the time period. We don’t need that.

We go down the listing to discover a CD with a hard and fast fee. We see that the very best 3-year fixed-rate CD pays 5.13%. It requires opening a brand new account at a credit score union although. We just like the comfort of utilizing our current brokerage account with out having to open one other account however we don’t wish to hand over an excessive amount of on the yield.

Analysis Treasuries

We additionally examine Treasuries. This bond yields web page from Constancy doesn’t require a login.

We see the 3-year Treasury yield is 4.36% proper now. As a result of Treasuries are exempt from state and native taxes and we’re shopping for in a daily taxable account, we calculate the Treasury’s tax-equivalent yield utilizing this formulation:

treasury yield * ( 1 – federal tax fee ) / ( 1 – federal tax fee – state tax fee )

It comes out to 4.36% * ( 1 – .22 ) / ( 1 – .22 – .06 ) = 4.72% when our federal tax fee is 22% and our state tax fee is 6%. A CD that’s absolutely taxable for each federal and state should have a yield this excessive to beat the Treasury. We don’t must make this adjustment if we’re shopping for in an IRA or if we dwell in a no-tax state.

Now we wish to see if we are able to beat the 3-year Treasury if we purchase a brokered CD and the way shut we are able to get to the very best fee from a direct CD.

There are two methods to purchase a brokered CD: new subject and secondary market. Whether or not you’re on the lookout for new points or the secondary market, it’s finest to look when the market is open. You’ll see extra selections throughout these hours.

New Challenge

Shopping for a new-issue brokered CD means shopping for a brand-new CD provided by a financial institution by the dealer. You see the speed and the phrases of the CD set by the financial institution. You pay the face worth to get the CD in case you like the speed and the phrases. The dealer doesn’t cost you a payment as a result of they’re getting paid by the financial institution to promote it.

Secondary CDs

Shopping for on the secondary market means shopping for from a vendor who purchased the CD from a earlier proprietor. The worth the vendor asks for could also be above or beneath the face worth of the CD relying on the present fee of the CD relative to the present market fee. The curiosity funds and the principal compensation from the financial institution are nonetheless primarily based on the face worth and the unique fee as a result of the financial institution doesn’t care whether or not you’re the primary proprietor or the second or the third proprietor. The CD nonetheless has FDIC insurance coverage.

The dealer prices you a fee to purchase CDs on the secondary market. The fee is often $1 per $1,000 in face worth. Paying a fee reduces the yield you get from the CD.

You additionally should pay accrued curiosity to the vendor. If the CD pays curiosity each six months and it’s been two months because the final curiosity fee date, you owe two months’ price of curiosity to the vendor. You’ll nonetheless obtain six months’ price of curiosity from the financial institution when the CD pays curiosity subsequent time, which reimburses you for the accrued curiosity you paid to the vendor.

If the value of the CD is above 100 as a result of the coupon fee of the CD is larger than the quoted yield, you’re paying greater than the face worth of the CD. The distinction above the face worth isn’t insured by the FDIC. Keep away from the sort of CD or, in case you should, solely select one from a financial institution that’s too huge to fail.

For those who’re shopping for in a daily taxable brokerage account, paying a worth above or beneath the face worth with the buying and selling fee and accrued curiosity complicates your taxes. For those who favor to keep away from this complication, keep on with new-issue brokered CDs once you’re shopping for in a daily taxable brokerage account. The tax complication doesn’t apply once you’re shopping for in an IRA.

Constancy

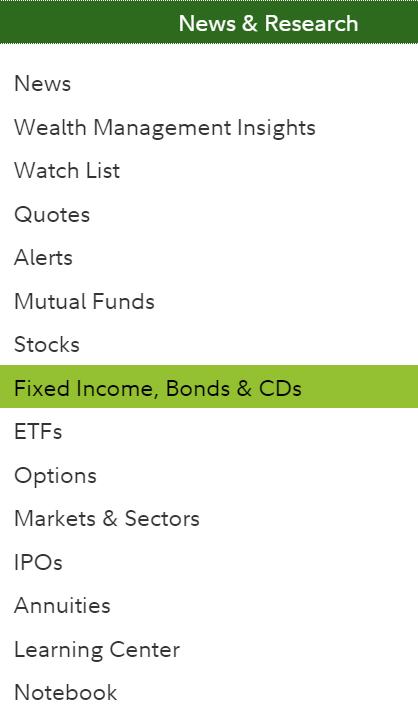

For those who use Constancy, click on on “Information & Analysis” after which “Mounted Revenue, Bonds & CDs” after you log in to your Constancy account. For those who use Vanguard, soar forward to the following part.

You get to the identical bond yields web page.

New Points

Clicking on the hyperlink below the time period we wish provides us this listing of recent subject CDs being provided:

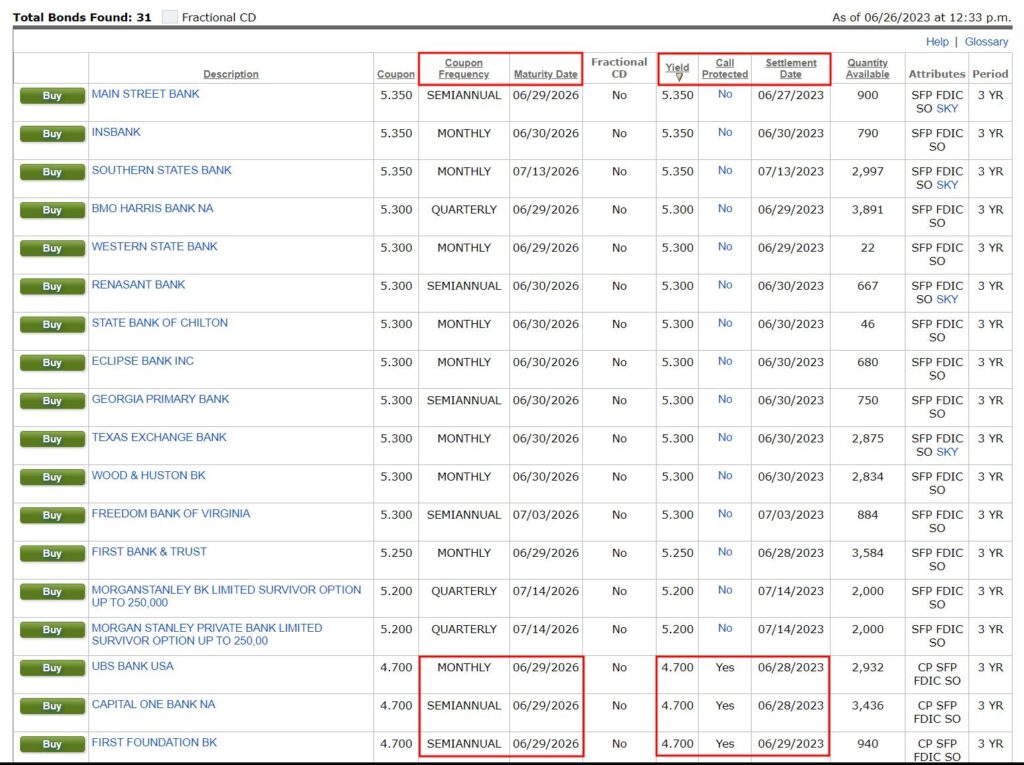

A “No” within the “Name Protected” column means the CD is callable (not shielded from a name). Typically, we wish to keep away from callable CDs as a result of though the marketed fee is larger, we’re not locked in to earn it for the total time period. We see on this listing that the best yield on a non-callable 3-year CD is 4.7%.

“Coupon Frequency” reveals how typically the CD pays curiosity. Some CDs pay month-to-month, some pay quarterly, and a few pay semi-annually. Which approach is healthier is barely private choice. We favor much less frequent funds in order that we don’t must cope with the acquired money. Some others could favor to obtain money extra steadily to satisfy money move wants.

“Maturity Date” is once we’ll get our principal again. “Settlement Date” is when our money will depart our account to purchase the CD. Our money earns curiosity within the cash market fund till the settlement date.

Suppose we wish to purchase the CD from Capital One. We see this web page after we click on on “Purchase.”

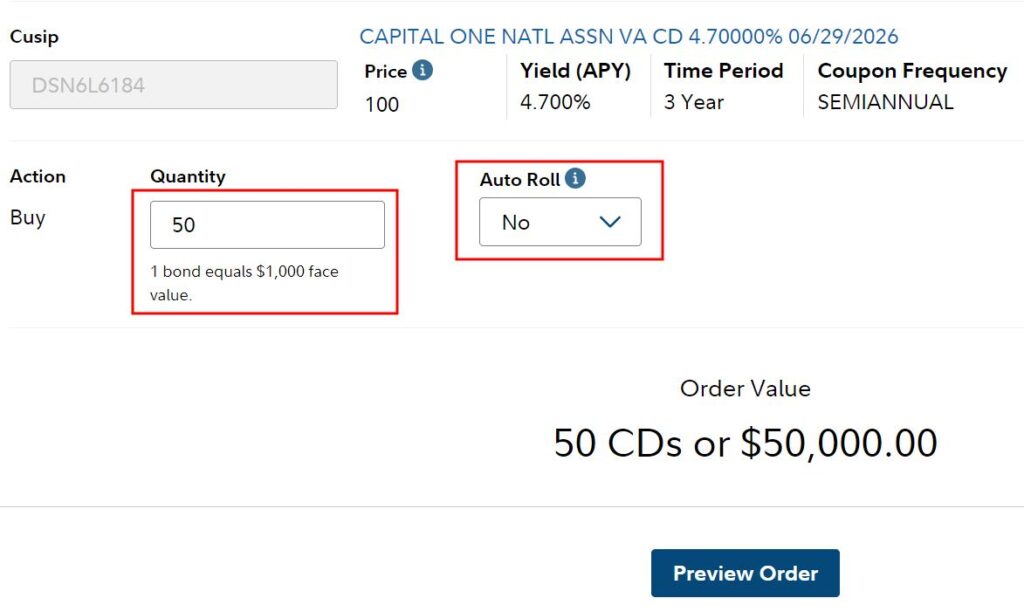

We should purchase in $1,000 increments. We enter 50 if we wish to purchase $50,000 in face worth. Constancy presents an non-compulsory “Auto Roll” function. If we select to make use of it, Constancy will routinely purchase one other brokered CD of the identical time period and curiosity fee frequency when this CD matures. We select to not use the “Auto Roll” function as a result of Constancy can decide a callable CD for the auto roll and we don’t like callable CDs. We are able to set a reminder in Google Calendar to reinvest when our CD matures.

If we’re shopping for in an IRA or if we dwell in a no-tax state, the 4.7% fee on a non-callable CD continues to be larger than the 4.3% fee on a 3-year Treasury. We are able to determine whether or not the 0.4% further yield is well worth the poor liquidity in a brokered CD. Nevertheless, once we’re shopping for in a daily taxable account, the 4.7% fee on a non-callable CD isn’t any higher than the tax-equivalent yield on a 3-year Treasury after we alter for the state and native tax exemption from the Treasury. We would as nicely simply purchase the Treasury.

Secondary CDs

Earlier than we abandon the thought of shopping for a brokered CD in favor of shopping for the Treasury, we’re curious whether or not we are able to do higher by shopping for a brokered CD on the secondary market.

We return to the bond yields web page by clicking on “Information & Analysis” after which “Mounted Revenue, Bonds & CDs.”

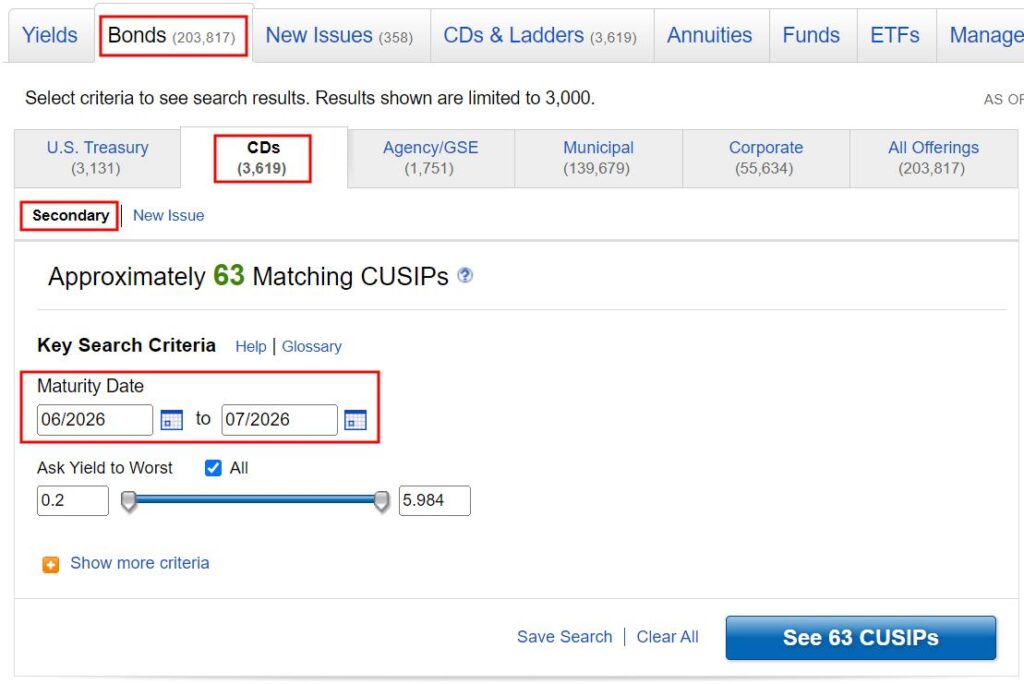

Click on on the “Bonds” tab after which the “CDs” sub-tab. We’re now trying to find CDs on the secondary market. Enter a date vary for the maturity date after which click on on “See xx CUSIPs.”

First, click on on “Yield to Worst” within the “Ask” columns to kind the listing by the provided yield.

Once we see a date within the “Subsequent Name Date” column, that CD is callable. As we nonetheless wish to keep away from callable CDs, we see the best yield for a non-callable CD is 4.751%.

The “Worth Qty(Min)” column provides us three numbers. The primary quantity is the value. It’s expressed as a share of the face worth. 99.585 means $995.85 per $1,000 face worth. We’ll have full FDIC insurance coverage when the value is beneath 100. The second quantity reveals how a lot in face worth is that can be purchased. 8 means $8,000 in face worth is offered in that one. The third quantity in parenthesis reveals the minimal buy. 1 means a minimal of $1,000 in face worth. The CD within the subsequent row at a yield of 4.750% has $95,000 in face worth out there however we should purchase at the very least $20,000 in face worth.

As a result of we should pay a fee once we purchase a secondary CD, our web yield might be decrease than the gross yield we see within the desk. This makes it not well worth the trouble to purchase a secondary CD when the 4.75% fee isn’t a lot larger than the 4.7% fee on a brand new subject CD to start with.

In abstract, our spherical of analysis reveals:

| 3-year CD instantly from a credit score union | 5.13% |

| 3-year Treasury | 4.7% (tax-equivalent), 4.3% in IRA |

| 3-year new subject non-callable brokered CD | 4.7% |

| 3-year secondary non-callable brokered CD | 4.7% |

Given these charges, if we favor the comfort of holding all the things within the brokerage account, we’ll purchase a 3-year Treasury (see How To Purchase Treasury Payments & Notes With out Price at On-line Brokers and Tips on how to Purchase Treasury Payments & Notes On the Secondary Market). We’ll purchase a CD instantly from a credit score union for a barely larger yield if we don’t thoughts opening a brand new account there. If we’re shopping for in an IRA, we’ll contemplate a brand new subject brokered CD however now we have to weigh it in opposition to the poor liquidity. Shopping for a brokered CD on the secondary market doesn’t give us a lot at this second.

The tradeoffs will change as charges change. Typically brokered CDs are extra aggressive and typically they’re much less aggressive. Typically you discover a cut price in a secondary CD and typically you don’t. The analysis course of I’m displaying on this instance will keep the identical.

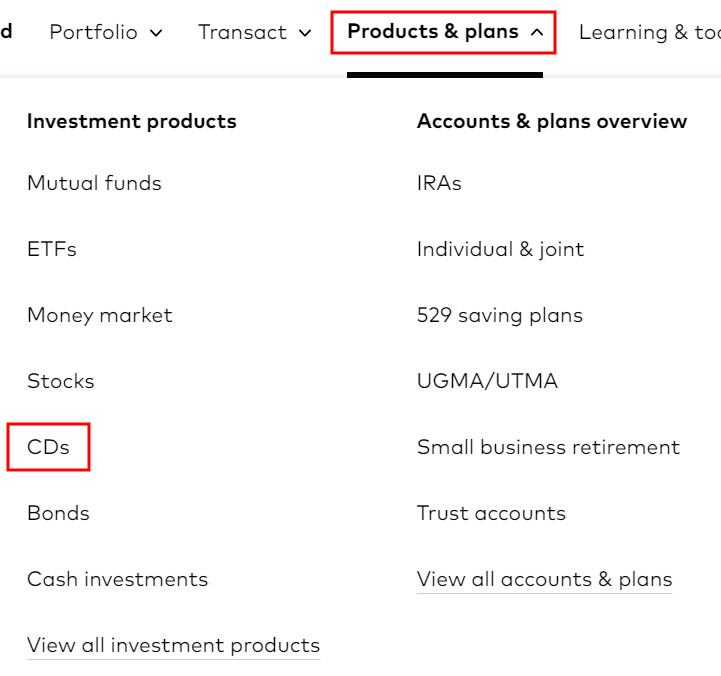

Vanguard

It really works equally in a Vanguard account. Click on on “Merchandise & plans” after which “CDs” after you log in to your Vanguard account.

New Points

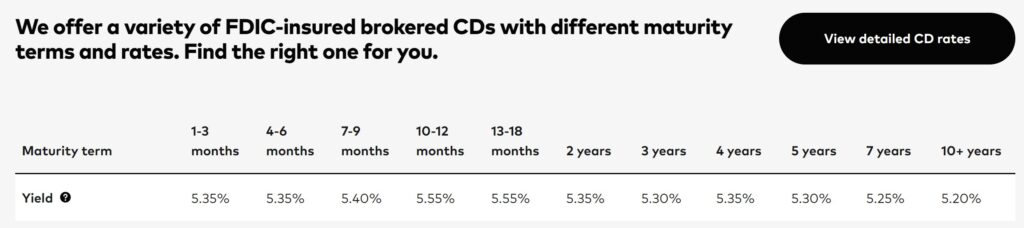

Scroll down slightly and click on on the massive “View detailed CD charges” button.

The following web page shows an old-style web page in a body. For those who’re utilizing the Safari browser on a Mac and also you don’t see something, flip off “Stop cross-site monitoring” in your Safari settings.

Discover the time period you’re inquisitive about and click on on the speed. The displayed fee could also be from a callable CD.

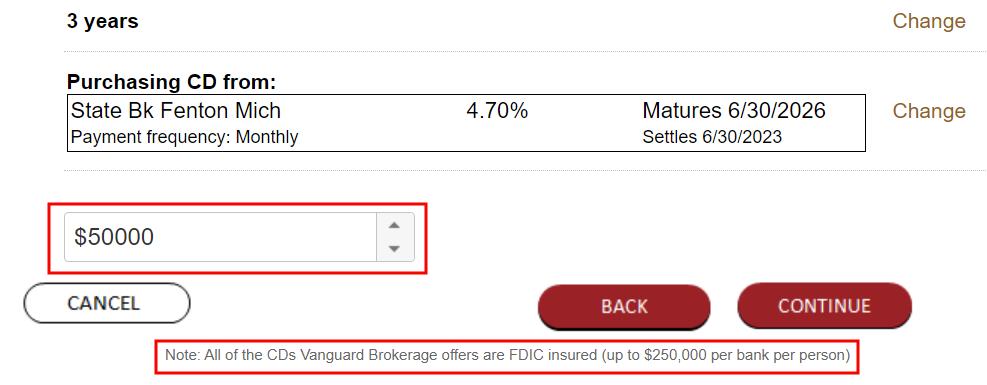

We maintain scrolling down to seek out the primary non-callable CD. It pays 4.7%. This is similar fee we see in Constancy however it’s from a unique financial institution. Suppose we wish to purchase $50,000 on this CD. We click on on that row after which the “Proceed” button. We see this order web page:

It doesn’t matter that the CD is from a financial institution we haven’t heard of as a result of it has FDIC insurance coverage. We additionally should purchase in $1,000 increments. We enter 50,000 within the amount field. Vanguard doesn’t supply an “Auto Roll” function. We are able to set a reminder in Google Calendar to reinvest when our CD matures.

Secondary CDs

We’re additionally curious whether or not we are able to discover a higher cut price on the secondary market. Click on on “Cancel” to return to the earlier web page.

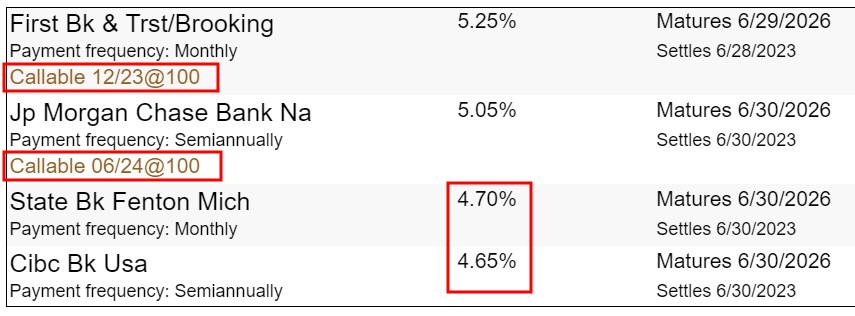

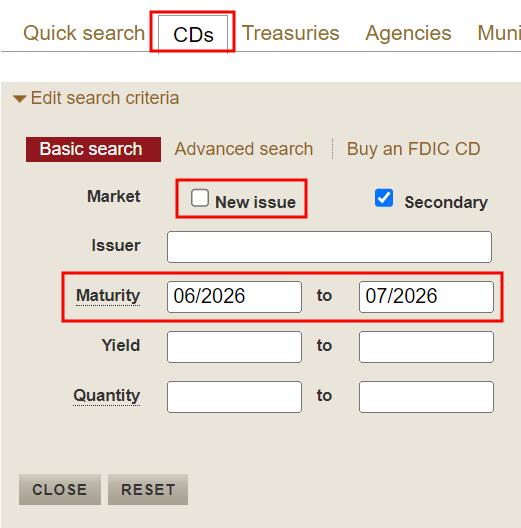

Click on on the “CDs” tab. Uncheck the field for “New subject” and examine the field for “Secondary” as a result of we’re on the lookout for secondary CDs. Enter a date vary for the maturity date and click on on “Search.”

We glance rigorously to skip the callable CDs. The second row within the “Yield to worst” column reveals the yield. The search outcomes present that the best yield out there in a non-callable CD on the secondary market is 4.772%. The second row within the “Qty” and “Min. qty” columns reveals how a lot is offered and the minimal buy quantity. 48 below “Qty” means $48,000 in face worth is offered and 25 below “Min. qty” means we should purchase at the very least $25,000 in face worth. The second row within the “Worth” column reveals the value we should pay. We wish to see a quantity beneath 100 to get full FDIC insurance coverage.

If we wish to purchase $50,000 price of CDs, that one from Cross River Financial institution solely has $48,000 out there. We’ll have to combine and match or go all the way down to the following one from Uncover Financial institution for a barely decrease yield at 4.754%. Both 4.772% or 4.754% nonetheless must be lowered by the buying and selling fee we should pay for purchasing secondary CDs.

We come to the identical conclusion utilizing Vanguard as we did utilizing Constancy:

| 3-year CD instantly from a credit score union | 5.13% |

| 3-year Treasury | 4.7% (tax-equivalent), 4.3% in IRA |

| 3-year new subject non-callable brokered CD | 4.7% |

| 3-year secondary non-callable brokered CD | 4.7% |

Given these charges, if we favor the comfort of holding all the things within the brokerage account, we’ll purchase a 3-year Treasury (see How To Purchase Treasury Payments & Notes With out Price at On-line Brokers and Tips on how to Purchase Treasury Payments & Notes On the Secondary Market). We’ll purchase a CD instantly from a credit score union for a barely larger yield if we don’t thoughts opening a brand new account there. If we’re shopping for in an IRA, we’ll contemplate a brand new subject brokered CD however now we have to weigh it in opposition to the poor liquidity. Shopping for a brokered CD on the secondary market doesn’t give us a lot at this second.

The tradeoffs will change as charges change. Typically brokered CDs are extra aggressive and typically they’re much less aggressive. Typically you discover a cut price in a secondary CD and typically you don’t. The analysis course of I’m displaying on this instance will keep the identical.

Say No To Administration Charges

If you’re paying an advisor a share of your property, you’re paying 5-10x an excessive amount of. Learn to discover an unbiased advisor, pay for recommendation, and solely the recommendation.