Australia’s month-to-month inflation price has decreased, displaying indicators that inflation could have peaked.

However the query stays whether or not the newest figures will probably be sufficient to keep away from the RBA elevating the money price once more at subsequent Tuesday’s board assembly.

The month-to-month Client Worth Index (CPI) indicator rose 5.6% within the 12 months to Could 2023, in line with the newest knowledge from the Australian Bureau of Statistics (ABS).

This breaks the pattern of annual inflation rising after it climbed from 6.3% in March to six.8% in April.

Michelle Marquardt (pictured above), ABS head of costs statistics, stated this month’s annual improve was the “smallest improve since April final yr”.

“Whereas costs have stored rising for many items and providers, many will increase had been smaller than we now have seen in latest months,” Marquardt stated.

CPI inflation is usually impacted by gadgets with unstable worth adjustments like automotive gasoline, fruit and greens, and vacation journey.

“It may be useful to exclude gadgets with unstable worth adjustments from the headline CPI indicator to offer a view of underlying inflation,” Marquardt stated.

“When excluding these unstable gadgets, the decline in inflation is extra modest. The annual improve for the month-to-month CPI indicator was 6.4% in Could, barely decrease than the rise of 6.5% recorded in April and down from a peak of seven.3% in December 2022.”

Housing rises

Probably the most important contributors to the annual improve within the month-to-month CPI indicator in Could had been housing, up 8.4%, adopted by meals and non-alcoholic drinks (+7.9%) and furnishings, family tools and providers (+6.0%).

This was partly offset by a fall in automotive gasoline (-8.0%).

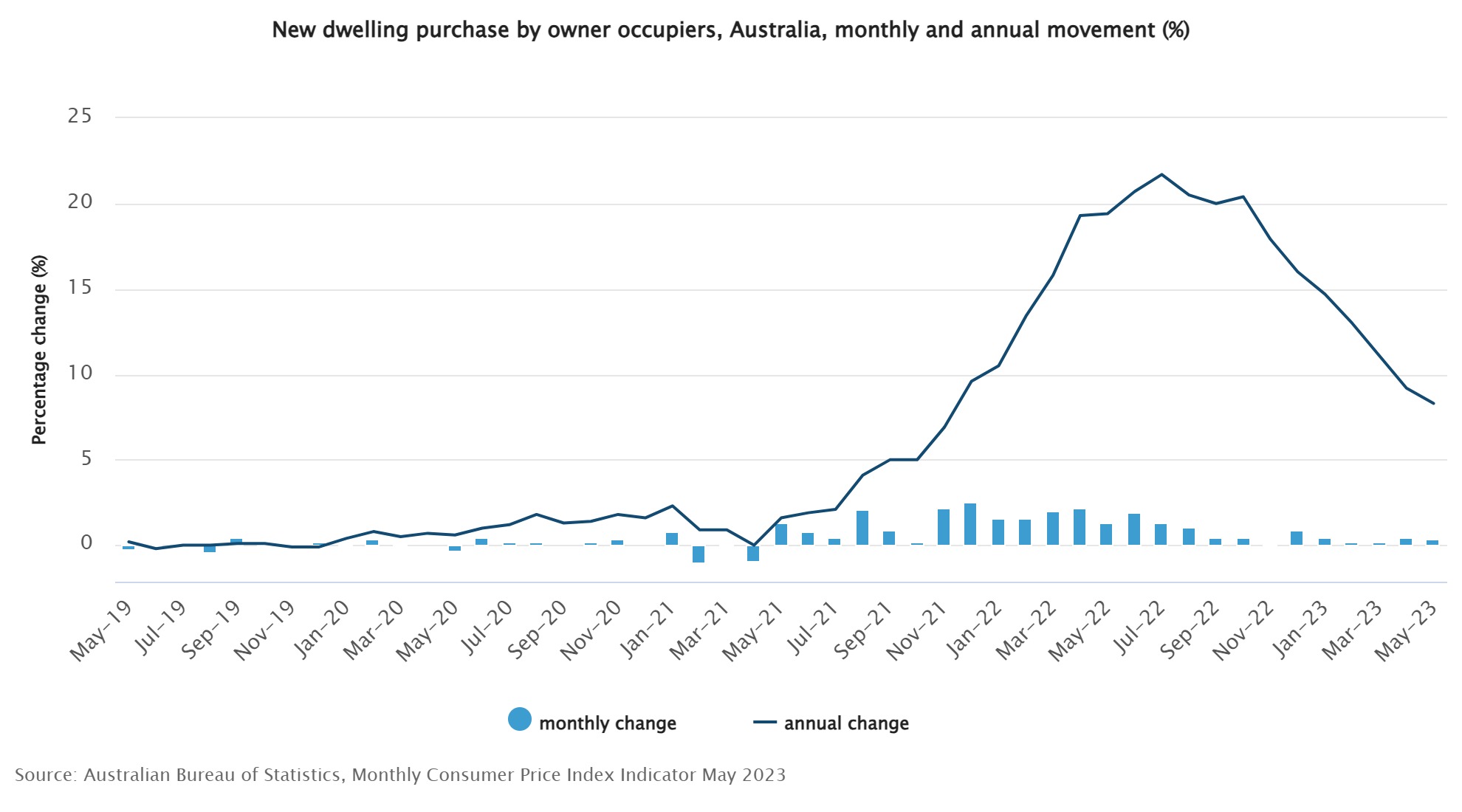

Housing’s annual improve of 8.4% was decrease than the April improve of 8.9%. This continues the decline from its peak in July final yr (21.7%), reflecting a softening in new demand and enhancements within the provide of supplies.

“Inside the housing group, new dwelling costs rose 8.3%, which is the bottom annual progress since November 2021, as constructing materials worth will increase proceed to ease,” Marquardt stated.

“Lease worth will increase went up once more from an annual rise of 6.1% in April to six.3% in Could because the rental market stays tight.”

Meals and non-alcoholic drinks costs rose 7.9% within the 12 months to Could.

“The principle contributor to this improve was meals out and takeaway meals which elevated from 7.3% in April to 7.7% in Could, as larger prices of elements, rents, utilities, and wages had been handed on,” Marquardt stated.

Worth rises for meals merchandise not elsewhere categorized (+11.5%), bread and cereal merchandise (+12.8%), and dairy and associated merchandise (+15.1%) had been additionally important contributors to the rise.

Will this end result be sufficient?

The most recent inflation knowledge follows the RBA’s resolution to carry the official money price by 4% in 13 months – the quickest rise in Australia’s historical past.

After elevating the speed in June to 4.1%, RBA governor Phillip Lowe stated inflation in Australia had handed its peak, however “at 7% was nonetheless too excessive”.

“It is going to be a while but earlier than it’s again within the goal vary,” Lowe stated. “This additional improve in rates of interest is to offer better confidence that inflation will return to focus on inside an affordable timeframe.”

Subsequently, a lot of lenders elevated their residence mortgage charges following the choice.

Earlier than the information was launched, all 4 massive banks forecasted one other price rise of at the least 25 foundation factors to 4.35%, with NAB predicting it improve to 4.6% by August.