A reader asks:

What’s the inducement right here to purchase AAA Company debt vs. simply shopping for U.S. T-bills which are yielding barely larger and are risk-free? Is that this regular?

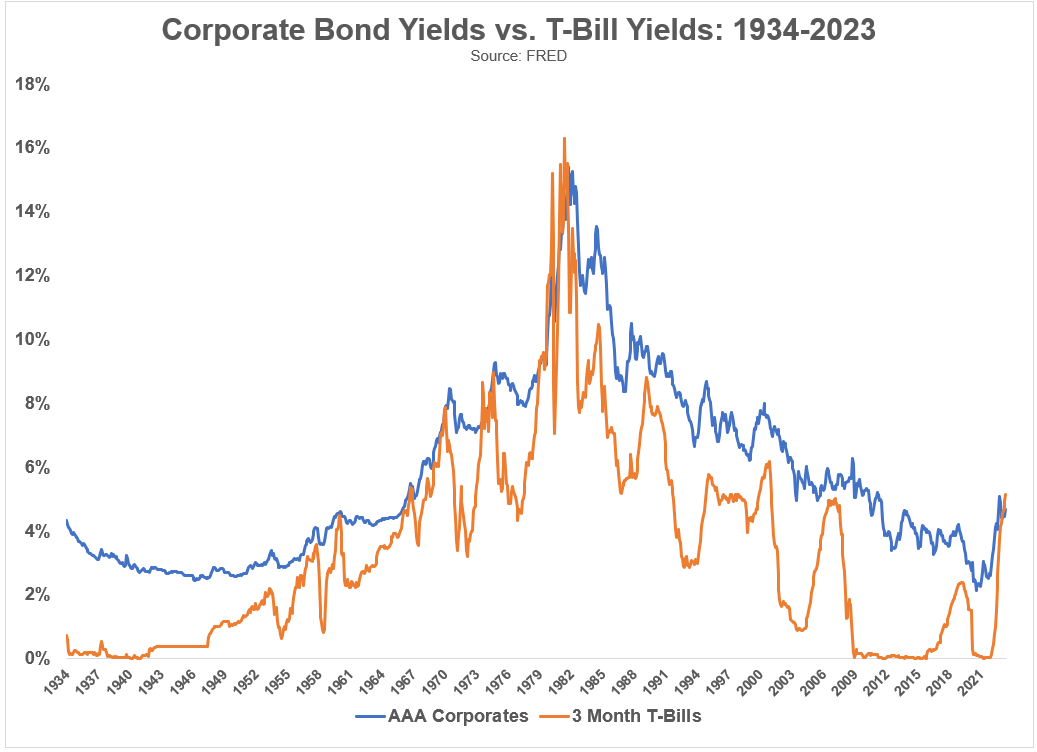

I’ve good knowledge from the Federal Reserve on AAA-rated company bond yields and 3-month T-bill yields going again to 1934.

No, it’s not regular for T-bills to yield greater than company bonds:

Out of the almost 1,100 months on this knowledge, T-bill yields have been larger than company bond yields in simply 33 months. So we’re speaking 3% of the time.

The opposite instances this occurred — within the early-Nineteen Eighties and Seventies — have been additionally intervals of rising rates of interest and excessive inflation.

The typical unfold of AAA company bond yields over t-bill yields over this timeframe is 2.4%.1

There’s a purpose for this unfold.

Company bond yields needs to be larger than T-bill yields as a result of company bonds are riskier.

Treasuries are risk-free within the sense that the U.S. authorities can print its personal forex. There’s far much less threat of default — save for a big mistake from Congress — in authorities bonds than with company bonds.

Company bonds default charges aren’t all that prime however it might occur. Corporations run into monetary bother on a regular basis. You even have the danger of credit score downgrades in company bonds which might affect their worth.

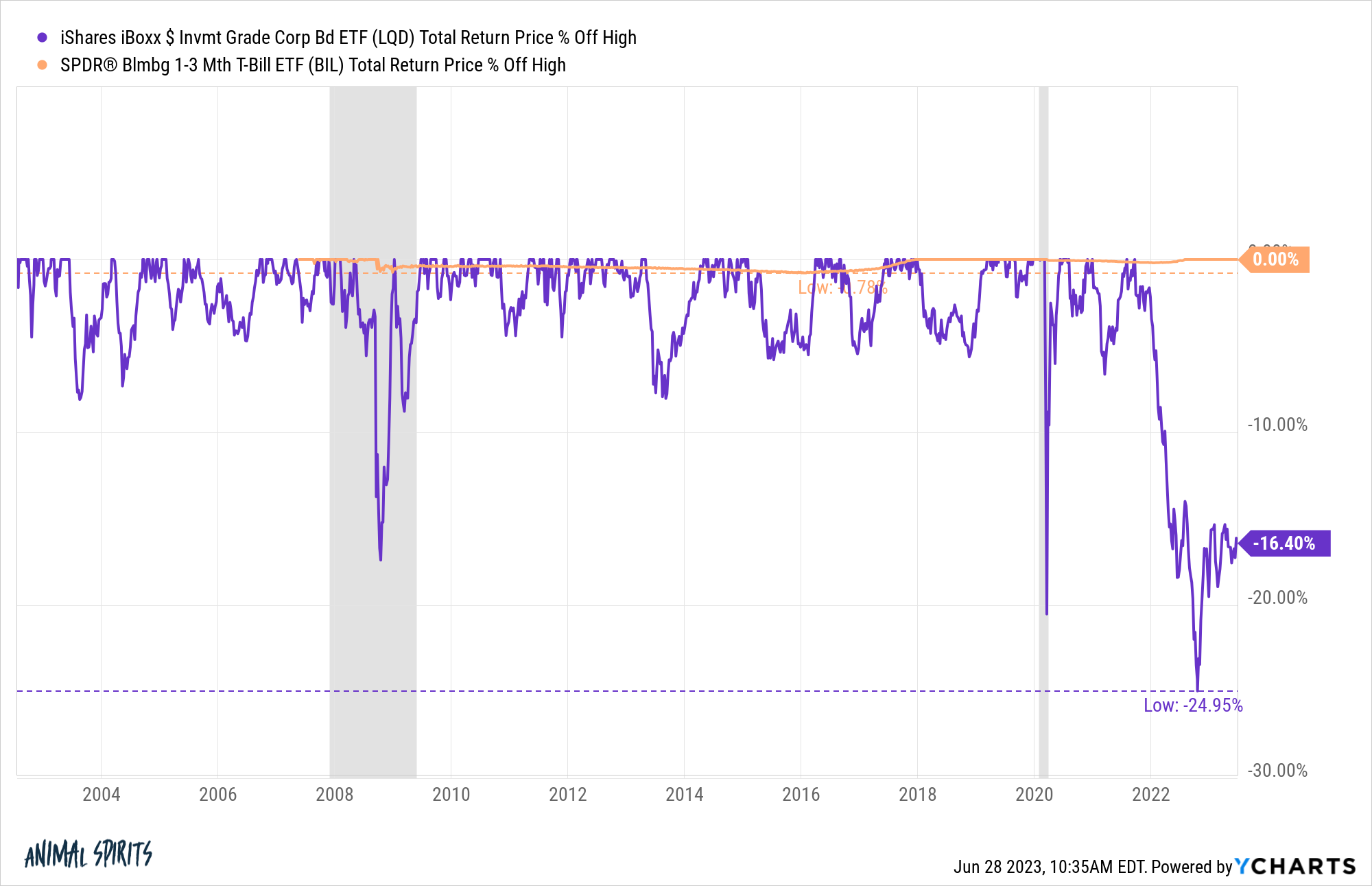

Plus, company bonds have a a lot larger drawdown threat in a recession or monetary disaster state of affairs. Simply take a look at the drawdown profile of company bonds and ultra-short-term authorities paper:

Company bonds fell greater than 17% throughout the 2008 disaster. They fell 20% throughout the Corona panic in March 2020. Then they crashed 25% final yr throughout the Fed’s aggressive fee climbing cycle.

This isn’t precisely inventory market threat however in comparison with T-bills this can be a nightmare when it comes to volatility.

Buyers ought to receives a commission to just accept default threat, credit standing threat and the danger of elevated volatility.

However now we discover ourselves in a state of affairs the place you get larger yields on T-bills than company bonds plus the anticipated volatility to modifications in rates of interest or investor panic is much decrease.

It will be onerous to make a compelling case for proudly owning company bonds over T-bills proper now, not less than within the short-term.

Nevertheless, I’d nonetheless anticipate higher long-term returns for company bonds. This irregular state of affairs led to by the pandemic, authorities spending and Fed tightening gained’t final without end.

Finally the connection between threat and reward will come again into stability.

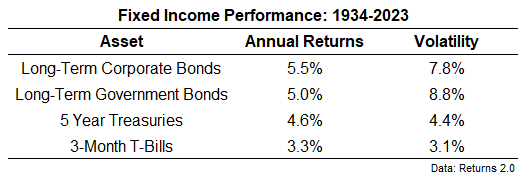

Listed below are the long-term returns for company bonds, long-term treasuries, 5 yr treasuries and 3-month T-bills going again to 1934:

The order of those efficiency numbers is smart each intuitively and when it comes to finance concept.

Company bonds have skilled larger returns than long-term authorities bonds which have skilled larger returns than 5 yr authorities bonds which have skilled larger returns than T-bills.

The shorter-term mounted earnings devices have decrease returns but additionally decrease volatility.2

So proper now, no it doesn’t appear to make a complete lot of sense to put money into company bonds over short-term treasuries. You’re getting paid the next fee for taking up much less threat in T-bills. The Fed is giving savers and stuck earnings buyers a present.

The tough half right here is the best way to allocate the mounted earnings facet of your portfolio going ahead. Life won’t at all times be this straightforward for the bond facet of your portfolio. This T-bill yield premium can’t final without end.

It actually is dependent upon your urge for food for threat and allocation modifications.

Some buyers are comfy shifting issues round with their investments to earn one of the best risk-adjusted yield at any given time.

Others would quite preserve a static allocation whatever the market atmosphere.

I don’t see a transparent proper or flawed reply relating to these sorts of portfolio administration quandaries. You simply must do what works for you.

Danger and reward are inextricably linked over the long-run. However generally that relationship hits a tough patch within the short-run.

Danger and reward may take a break once in a while however that relationship at all times finds a means ultimately.

We mentioned this query on the most recent version of Ask the Compound:

Barry Ritholtz joined me this week to speak about questions on pupil loans, making monetary selections once you really feel paralyzed, the housing market and extra.

Additional Studying:

The Largest No-Brainer Funding Proper Now?

1That unfold hit greater than 5% as soon as ZIRP kicked in and spreads blew out within the monetary disaster.

2I used to be a little bit stunned to see long-term treasuries barely larger volatility than long-term company bonds however they’re not too far off.

Podcast model right here: