That is actually the theme of the Funds 2023 specifically with private earnings taxes. And that’s the solely factor I had needs for – simplify!

Professional after knowledgeable advisable a change in 80C limits, aligning capital positive aspects taxes, rising tax slabs, and so on. The underlying thought was high quality – cut back the burden on aam junta which has suffered in occasions of inflation and Covid.

The finances delivered the identical, just a bit neatly.

Let’s take the primary most necessary factor to you – the tax slabs.

The tax slabs have been modified however solely within the new tax regime.

That is how they’ll look from April 1, 2023.

| Taxable Revenue (per yr) | Marginal Tax Fee |

| Rs. 0 to three lakhs | NIL |

| Rs. 3 to six lakhs | 5% |

| Rs 6 to 9 lakhs | 10% |

| Rs 9 to 12 lakhs | 15% |

| Rs. 12 to fifteen lakhs | 20% |

| Above Rs. 15 lakhs | 30% |

Revenue upto Rs. 3 lakhs is now exempt from tax. Additional in case your taxable earnings seems to be decrease than Rs. 7 lakhs in a monetary yr, then you’re going to get an extra rebate equal to the tax quantity. It’ll make your tax legal responsibility zero for that yr. (This clause was relevant for upto Rs. 5 lakh earnings earlier)

The customary deduction may even be accessible to salaried class and pensioners within the new tax regime.

For these incomes Rs. 5 crores or extra (eyes rolling), the surcharge is now diminished to 25% from 37% presently. This brings down tax legal responsibility fairly a bit for the very best tax payer.

Please be aware once more that all of the above proposed adjustments apply solely to the brand new tax regime or slabs as proven within the desk above. This new regime may even be the default once you file your tax returns (with an choice to return to the outdated one with all deductions).

There are NO adjustments within the OLD tax regime.

The plan is loud and clear – make the brand new regime enticing sufficient after which retire the outdated one.

What must you do?

When you have an earnings of Rs. 15 lakhs and you’ve got deductions of about Rs. 4 lakhs in varied sections corresponding to 80C (PPF, life insurance coverage premia, tax saving funds), 80D (medical insurance premium), curiosity on dwelling loans, HRA, and so on., then the outdated tax slabs would possibly swimsuit you higher. (Bear in mind to make the selection when submitting your tax returns)

If you’re not utilizing these sections, the brand new tax regime is a no brainer.

Actually, for incomes above Rs. 15 lakhs, there may be vital tax distinction (decrease taxes by Rs. 50 odd thousand) within the new regime. Go loopy!

Now, that doesn’t imply that you just cease saving or investing something that doesn’t provide you with tax advantages. Allow us to not be so tax loopy.

You continue to want life, well being and accident/incapacity insurance coverage for cover. PPF can nonetheless be a great allocation for mounted earnings.

Tax saving or no tax saving – these are necessary on your private monetary well-being.

Different tax associated adjustments within the finances 2023

- If you’re nearer to retirement and have collected numerous leaves, then rejoice. The exemption restrict for go away encashment on retirement is now as much as Rs. 25 lakhs.

- Additionally, in case you are an expert or self employed eligible to file underneath presumptive taxation (ITR 4S anybody?), the eligible turnover restrict is now up from Rs. 50 lakhs to 75 lakhs. Considering of giving up the worker tag and changing into a advisor?

A number of different tax arbitrage accessible for varied funding devices are going away. Listed below are a few of the key ones:

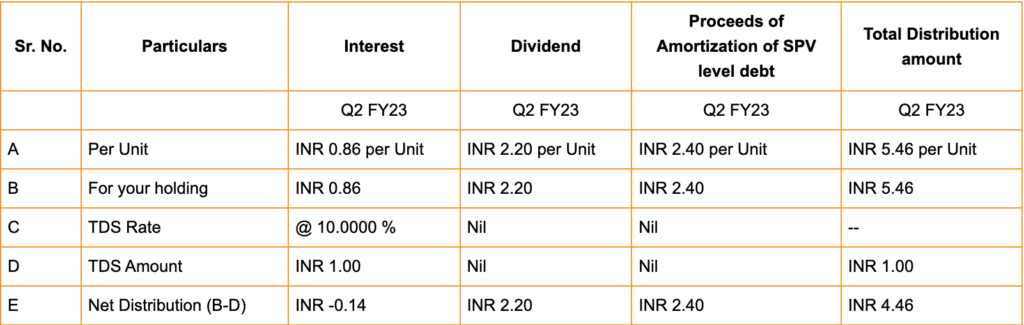

- REITs used to pay a portion of the return to unitholders within the type of Curiosity, Dividends and Debt Amortisation proceeds. The final one was tax free within the palms of the investor. No extra. All earnings to the investor from REITs and InvITs will now be taxable at marginal tax fee.

- Market Linked Debentures or MLDs which used a market linked benchmark with a bond to create a decrease tax construction will cease doing so from April 1, 2024.

- From April 1, 2023, should you purchase a life insurance coverage coverage with a premium of Rs. 5 lakh or extra, then the maturity payouts (on survival) can be taxable. Solely receipts in case of dying can be tax free. There have been too many assured, tax free return insurance policies being supplied to highest tax bracket people. Beware – pitches will go up massively until March 31, 2023!

- Lastly, capital positive aspects offset on actual property transactions is now restricted to Rs. 10 crores. Effectively, for many, this isn’t a quantity that we’ll attain simply. However it’s good to see the intention rising from this – capital positive aspects offset was not meant for wealthy individuals. When you have greater than Rs. 10 crores of realised capital positive aspects on actual property, please pay the taxes.

The Mutual Funds, not directly, get a greater deal with out even a point out of them. 🙂

Saving instrument adjustments specifically for Senior Residents in Funds 2023

- Senior Residents can make investments Rs. 30 lakhs + Rs. 30 lakhs in a joint method within the Senior Citizen Financial savings Scheme (SCSS). This has doubled from the earlier restrict of Rs. 30 lakhs. If you’re underneath Rs. 7 lakhs whole earnings, your complete curiosity from SCSS turns into tax free within the new tax slabs.

- Put up Workplace MIS restrict additionally now upped to Rs. 15 lakhs for joint.

Hopefully, over time, we’ll fear much less about taxes and extra about being profitable work for assembly our objectives.

—

If you’re all for studying the finances highlights, you possibly can obtain from right here.