Most of the choices we take are based mostly on our experiences with the previous.

From day by day choices to one-off choices, more often than not we replicate on the previous earlier than we finalize one thing. For instance, after we exit for dinner, we resolve whether or not to go based mostly on the standard of the meals final time and if it wasn’t nice final time, then we consider that it received’t be nice now and sooner or later. We’re influenced by this previous expertise.

The identical is with hiring, organizations take a look at the previous efficiency of the candidate to resolve if they might be match. Right here once more, previous expertise helps decide concerning the current and future.

And, generally, this will maintain true. Good previous expertise and efficiency most certainly predict good future expertise and efficiency as effectively.

However in Investing does the identical maintain true?

If up to now a specific fund was the best-performing fund does it imply that sooner or later additionally the identical fund would be the finest performer?

In fairness mutual funds is sweet previous efficiency sufficient to foretell good future efficiency?

Let’s discover out…

Assume you needed to spend money on fairness mutual funds at this time, which fund would you select?

The obvious alternative is to go along with the top-performing funds. You run a screener, type funds from highest to lowest 3-year returns, and discover out the present prime 5 diversified fairness funds with the best 3-year returns. Easy proper?

However right here is the place issues get a bit counter-intuitive.

To truly get the best returns from these prime 5 funds you’d have needed to spend money on these funds earlier than 3 years.

So, so that you can make investments you’d have once more appeared on the rating of the funds and what do you assume can be the rating of those prime 5 funds up to now?

Within the prime 5 or prime 10 or throughout the prime 30?

Right here comes the shock.

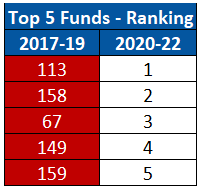

The present prime 5 funds of 2020-22 based mostly on their 3-year returns had been on a mean ranked 130 out of 168 funds in 2017-19!

Supply: MFI, FundsIndia Analysis. The desk reveals the rating of diversified fairness funds (Largecap, Midcap, Smallcap, Flexicap, Giant & Midcap, Multicap, ELSS, Worth/Contra, Centered & Dividend Yield) based mostly on 3 Yr returns. The second column on this part reveals the rank based mostly on 3Y Returns through the specified interval. The primary column reveals the rating of the identical fund within the prior 3Y Interval.

I’m positive you weren’t anticipating that.

Would you’ve chosen these funds up to now provided that they weren’t ranked within the prime 5 not even within the prime 30?

Perhaps not.

In distinction, let’s say up to now you had appeared on the funds rating and invested in top-performing funds of that point; they had been on the prime so ideally, you’d anticipate them to be among the many top-ranked funds within the current.

Let’s take a look at their present fund rating

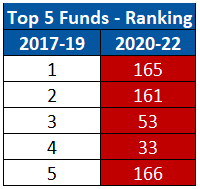

In case you had invested within the prime 5 funds of 2017-19, these funds are at present on common ranked 115 out of 200 funds!

Supply: MFI, FundsIndia Analysis. The desk reveals the rating of diversified fairness funds (Largecap, Midcap, Smallcap, Flexicap, Giant & Midcap, Multicap, ELSS, Worth/Contra, Centered & Dividend Yield) based mostly on 3 Yr returns. The primary column on this part reveals the rank based mostly on 3Y Returns through the specified interval. The second column reveals the rating of the identical fund within the subsequent 3Y Interval.

That is complicated proper, neither are the present top-performing funds ranked prime performing up to now nor are the top-performing funds of the previous ranked as present top-performing funds.

Did one thing uncommon occur within the final 3 years?

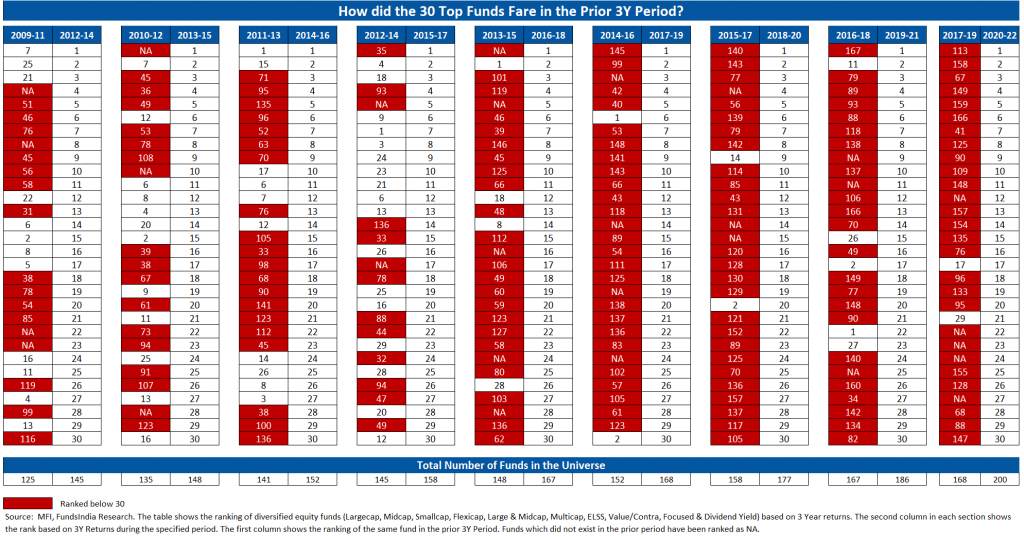

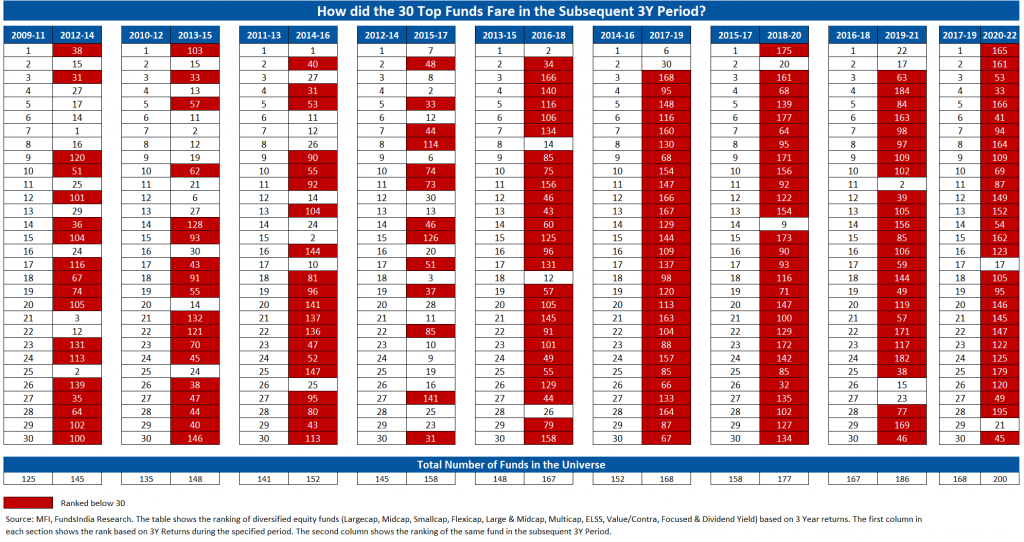

This isn’t uncommon. Beneath you’ll be able to see the rating of top-performing funds earlier than and after the efficiency section during the last 20 years.

Current top-ranked funds with their previous rating

High-ranked funds of the previous with their subsequent rating

As you’ll be able to see from historical past, selecting funds based mostly ONLY on previous efficiency will not be method.

Why does this occur?

Fairness funds undergo cycles. Completely different funding types, market cap segments, sectors, and geographies carry out effectively at totally different occasions. Attributable to this, basing the number of funds solely on returns doesn’t work effectively over lengthy durations of time. If you need to know extra about this click on right here to learn our earlier weblog on this matter.

What ought to we do?

Whereas previous efficiency is a helpful metric to guage a fund, it could possibly by no means be the one one. Ideally, you must take a look at a variety of quantitative and qualitative components to derive conviction on the longer term potential of a fund corresponding to consistency in efficiency and funding philosophy, danger administration, fund supervisor with a long-term monitor document, and so forth

Summing it up

- Previous efficiency will not be sufficient to foretell future efficiency – Keep away from Chasing efficiency

- Previous winners in fairness mutual funds might not be future winners

- Current winners in fairness mutual funds could not have been previous winners

A greater method to constructing your fairness fund portfolio can be selecting funds utilizing quantitative and qualitative parameters and diversifying your investments throughout totally different types, market caps, sectors, and geographies.

Different articles chances are you’ll like

Publish Views:

1,050