The Reserve Financial institution of India (RBI) has been chopping the key coverage charges to mitigate Covid-19 impression. Additionally, a lot of the banks and monetary establishments have already been lowering the rates of interest on their deposits schemes.

So, as extensively anticipated, the central Govt had beforehand introduced a steep minimize within the rates of interest on small financial savings schemes for the primary quarter (April to June) of FY 2020-21. Rates of interest on numerous small financial savings schemes have been minimize anyplace between 70 foundation factors and 140 foundation factors (100 foundation factors = 1 per cent).

Nonetheless, the rates of interest on small financial savings schemes have been stored unchanged by the federal government for the Second, third and fourth quarters of FY 2020-21, and in addition for the primary quarter of FY 2021-22.

The federal government has stored the submit workplace small financial savings schemes rates of interest unchanged for the July-August-September 2021 quarter as effectively. In a falling rate of interest situation, no change within the submit workplace small financial savings schemes’ rates of interest goes to be excellent news for the fixed-income traders.

The Nationwide Financial savings Schemes (NSSs) are one of many very fashionable saving schemes in India. These are regulated by the Ministry of Finance. They provide full safety of funding mixed with enticing returns.

These schemes additionally act as devices of monetary inclusion particularly within the geographically inaccessible areas as a result of their implementation primarily by way of the Submit Workplaces, which have attain far and extensive.

A number of the very fashionable schemes which fall beneath NSS are as under;

- PPF (Public Provident Fund)

- Sukanya Samriddhi Scheme

- Month-to-month Revenue Scheme (Month-to-month Revenue Account)

- Senior Citizen Financial savings Scheme

- KVP (Kisan Vikas Patra)

- NSC (Nationwide Financial savings Certificates)

- Time Deposits &

- Recurring Deposits

Newest Submit Workplace Small Saving Schemes Rates of interest Jul – Sep 2021 | Q2 of FY 2021-22

The newest charges of curiosity relevant on numerous small financial savings schemes for the quarter from July to September 2021 efficient from 1.07.2021 could be as under;

| Saving Scheme | Charges of Curiosity from 1st April 2021 to thirtieth June 2021 |

New Charges of Curiosity from 1st July 2021 to thirtieth September 2021 |

| Sukanya Samriddhi Account -Woman Youngster Scheme |

7.6% | 7.6% |

| 5 Yr Sr.CSS | 7.4% | 7.4% |

| PPF | 7.1% | 7.1% |

| Financial savings Deposit | 4.0% | 4.0% |

| 1 Yr Time period Deposit | 5.5% | 5.5% |

| 2 Yr Time period Deposit | 5.5% | 5.5% |

| 3 Yr Time period Deposit | 5.5% | 5.5% |

| 5 Yr Time period Deposit | 6.7% | 6.7% |

| 5 Yr Recurring Deposit | 5.8% | 5.8% |

| 5 Yr MIS | 6.6% | 6.6% |

| 5 Yr NSC | 6.8% | 6.8% |

| Kisan Vikas Patra (KVP) | 6.9% | 6.9% |

Newest Curiosity Charge on Sukanya Samriddhi Scheme, PPF, MIS, NSC | Quarter-2 of FY 2021-22

The revised rates of interest relevant on numerous small financial savings schemes for the primary quarter from July to September 2021 efficient from 1-07-2021 could be as under;

- The newest rate of interest on Sukanya Samriddhi Scheme (SSA ) is 7.6%.

- The brand new charge of Curiosity on PPF (Public Provident Fund) could be 7.1%.

- The rate of interest on Senior Citizen Financial savings Scheme (SCSS) has been lowered to 7.4%.

- New rate of interest on Kisan Vikas Patra (KVP) could be 6.9%.

- The speed of curiosity on 5 12 months Nationwide Financial savings Certificates (NSC) is 6.8%.

- New rate of interest on submit workplace MIS (Month-to-month Revenue Scheme) is 6.6%.

- The speed of curiosity on a 5 12 months Submit Workplace RD (Recurring Deposit) could be 5.8%.

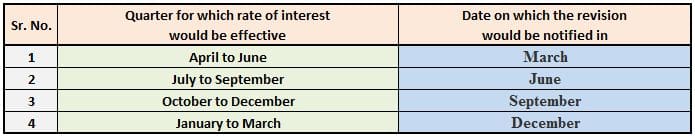

Kindly be aware that rates of interest of Small Financial savings Schemes at the moment are reviewed and reset (if any) on a quarterly foundation.

The revised charges (if any) are relevant for all the brand new investments MADE throughout the respective interval. For the prevailing investments beneath all of the schemes (EXCEPT PPF & SUKANYA SAMRIDDHI SCHEME), the contracted rate of interest stays unchanged till maturity.

Proceed studying:

- 15 Q&As on Fastened Deposit Curiosity Revenue Taxation Guidelines

- LIC New Plans 2020 – 2021 Checklist | Options, Snapshot & Assessment of all of the Plans

- Checklist of all Fashionable Funding Choices in India – Options & Snapshot

- High 15 Greatest Mutual Funds 2021 & past | High Performing Fairness Funds

- Revenue Tax Deductions Checklist FY 2020-21 | New Vs Outdated Tax Regime AY 2021-22

(Submit first revealed on : 01-July-2021)