At present’s Animal Spirits is dropped at you by American Century Investments:

See right here for extra data on American Centuries Brief Length Strategic Earnings ETF

On right this moment’s present, we talk about:

Pay attention Right here:

Suggestions:

Charts:

Tweets:

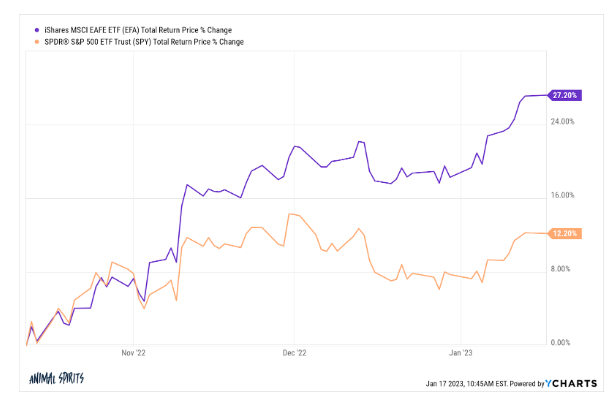

The MSCI World ex USA index is outperforming the S&P 500 by ~14 share factors on a rolling 50-trading-day foundation, the widest margin since **2009**–Dow Jones Market Information.https://t.co/JsWf54nTKT pic.twitter.com/yutBescVju

— Gunjan Banerji (@GunjanJS) January 10, 2023

Whereas economists are nonetheless predicting that GDP was unfavorable in Germany in This fall and will probably be once more in Q1, this real-time indicator from the OECD is pointing to continued progress. pic.twitter.com/uNLPyttSk6

— Jeffrey Kleintop (@JeffreyKleintop) January 10, 2023

Bond funds drew $17.5 billion of inflows over the previous week, essentially the most in *18 months* —DB pic.twitter.com/4TS0zmN8A6

— Gunjan Banerji (@GunjanJS) January 14, 2023

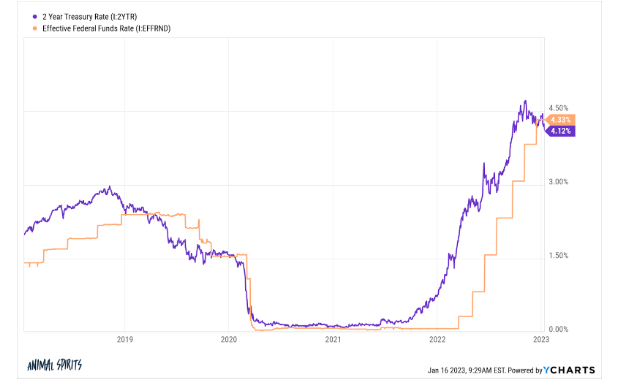

.@TruthGundlach on investor webcast says “it’s apparent the bond market is in management” and the Fed often follows the two-year Treasury notice #2023

— Jennifer Ablan (@jennablan) January 10, 2023

“In his [2011] commentary Andreessen mentioned 17 then or-since listed digital disruptors, greater than 1/3 of which have subsequently declined in market worth…he additionally referenced 10 old-economy laggards, all of

which have delivered optimistic actual returns.”https://t.co/BiImnl1MHx pic.twitter.com/n4Fpt9UB2z— Lawrence Hamtil (@lhamtil) January 13, 2023

“Buyers are operating for the hills, away from our technique.”https://t.co/xMZWDzIS8a

— Avi Salzman (@avibarrons) January 6, 2023

U Mich client sentiment present situations rose to its highest stage since April. Fuel costs down, unemployment at a 50-year low, 3-month inflation very low, again half of 2022 3%+ actual GDP progress. pic.twitter.com/fQYqlbax3i

— Conor Sen (@conorsen) January 13, 2023

Philadelphia Fed President Pat Harker says it is time to put extra weight on surveys and different delicate information.

“Candidly, an overemphasis on exhausting information can result in coverage errors.” https://t.co/yXqxSIx8Om pic.twitter.com/j3dNW6FQcs

— Nick Timiraos (@NickTimiraos) January 13, 2023

Rolls-Royce CEO: “We haven’t seen any slowdown or downturn. We haven’t seen any unfavorable influence. I’m not saying we’re immune from recessionary tendencies. We now have seen years when our enterprise was affected…I’m cautiously optimistic about us delivering one other sturdy 12 months in ’23”

— The Transcript (@TheTranscript_) January 10, 2023

Crucial inflation quantity at the moment is core-CPI ex-shelter. This was unfavorable month-to-month for the third consecutive month and is now solely up 4.4% YoY. pic.twitter.com/tToNJeDIYP

— Invoice McBride (@calculatedrisk) January 12, 2023

It truly is astonishing that core CPI is again at 3.1% on a 3-month annualized foundation from a peak of 10.0% in June 2021 (nonetheless up reasonably from 2.5% in Feb 2020) and the unemployment charge is at 3.5%. That’s some severely excellent news

— Julia Coronado (@jc_econ) January 12, 2023

Everybody retains complaining about eggs being too costly now however I am gonna zag on this one

A dozen eggs for $3.60 remains to be ridiculously low cost

That is mainly 3-4 meals of high-quality protein for <$4

My take:

Eggs have been underpriced for years and stay comparatively low cost pic.twitter.com/WWjyJZyGKz

— Ben Carlson (@awealthofcs) January 11, 2023

Let Batnick go on CNBC with this take

— Devin Bronson (@TheRealDevinB) January 11, 2023

New Mannheim used automotive costs simply dropped. Chart is from 1990. Yeah by no means seen it earlier than – 14.9% pic.twitter.com/p11pVulawv

— Tom Hearden (@followtheh) January 10, 2023

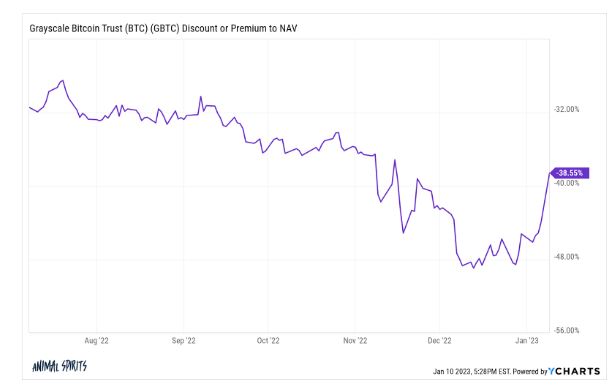

B of A: $COIN quantity in December (first full month post-FTX collapse) “have been simply $34B, lower than half of COIN’s 1Q22-3Q22 month-to-month common of ~$76B. .. we expect consensus revs for ’23 might be approach too excessive. Decrease PO to $35 ..”

Cuts to Underperform

— Carl Quintanilla (@carlquintanilla) January 11, 2023

— RYAN SΞAN ADAMS – rsa.eth 🏴🦇🔊 (@RyanSAdams) January 16, 2023

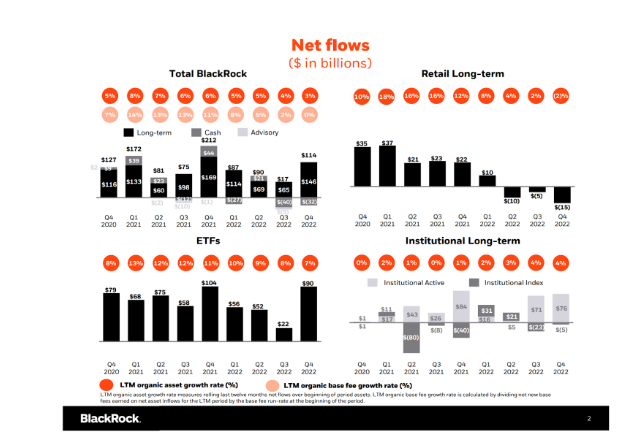

Larry Fink from Blackrock simply stated on CNBC: “I sit up for the day when all shares and bonds are tokenized so we all know each useful proprietor of each inventory and bond”

Stunning coming from Blackrock! Appears to acknowledge that we do not know BOs right this moment – an excessive amount of obfuscation.

— Dave Lauer (@dlauer) January 13, 2023

Fed economists: Residence worth positive factors over the past 2 years may have produced a wealth impact for owners that drove one third of the rise within the CPI (non-shelter costs) https://t.co/NyGi3KnNMN pic.twitter.com/rabLjhNkMG

— Nick Timiraos (@NickTimiraos) January 11, 2023

Counterpoint: Strategists at BCA Analysis notice that house worth positive factors have been so swift in 2020-21 that buyers most likely “didn’t totally regulate their spending patterns to include their newfound wealth.”

That may suggest much less of a unfavorable wealth impact as costs decline. pic.twitter.com/hwKnhmMKW1

— Nick Timiraos (@NickTimiraos) January 11, 2023

Consumers are getting extra from sellers. Final month 51.5% of all gross sales in Sacramento County had some type of a concession. Sellers are tending to provide issues like credit for closing prices, credit for repairs, charge buydowns, and so forth… Not a shocker to see this rising since Could. pic.twitter.com/cfPPli7xx5

— Ryan Lundquist (@SacAppraiser) January 13, 2023

Although the US homeownership charge has been rising since 2016, the mortgage debt service ratio of People stays close to file lows. Householders as a cohort have probably by no means been much less burdened by their month-to-month funds. pic.twitter.com/YO4PGJTWKT

— Conor Sen (@conorsen) January 14, 2023

A single share level decline in charges has the identical influence on affordability as an 11% decline in home costs. https://t.co/C6rQgL3z14

— Mike Simonsen 🐉 (@mikesimonsen) January 12, 2023

Virtually 90% of mortgage refinance quantity in 2022Q3 got here from cash-out transactions @awealthofcs pic.twitter.com/YEsIqodpDq

— Mike Zaccardi, CFA, CMT (@MikeZaccardi) January 12, 2023

This can also create a requirement downside when charges rise very quick like noticed in 2022. pic.twitter.com/2bVpFv6ugU

— Logan Mohtashami (@LoganMohtashami) January 16, 2023

A Seattle actual property agent tells me:

“For what it’s value. The primary two weeks of the 12 months have been busier with purchaser exercise than the final 3 months mixed have been.”

— Lance Lambert (@NewsLambert) January 16, 2023

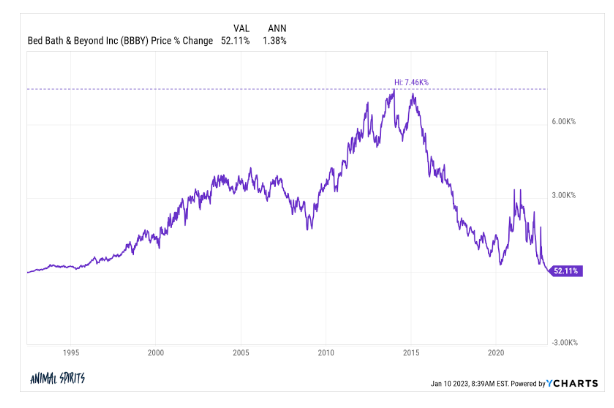

$BBBY 😳

The inventory is down -24.41% this afternoon — or $1.82/share. https://t.co/nRo7LGgYiJ pic.twitter.com/Jb4CjhIKW6

— Yahoo Finance Plus (@yfinanceplus) January 5, 2023

Not a superb signal for Mastoden.

The previous two months represented among the best environments for the service to get new customers. Information reveals few joined (comparatively talking) and a big portion of those that did be a part of are actually dropping curiosity. pic.twitter.com/CT037MK4Fb

— Neil Cybart (@neilcybart) January 9, 2023

When the Chargers went up 27-0, a bettor guess $1.4 million on them to win the sport to internet $11,200.

Jacksonville got here again and gained 31-30.@DKSportsbook has confirmed that this guess was certainly made. pic.twitter.com/TvwCNyEjyr

— Darren Rovell (@darrenrovell) January 15, 2023

Contact us at animalspiritspod@gmail.com with any suggestions, suggestions, or questions.

Observe us on Fb, Instagram, and YouTube.

Try our t-shirts, espresso mugs, and different swag right here.

Subscribe right here:

Wealthcast Media, an affiliate of Ritholtz Wealth Administration, acquired compensation from the sponsor of this commercial. Inclusion of such commercials doesn’t represent or suggest endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investing in speculative securities entails the danger of loss. Nothing on this web site needs to be construed as, and will not be utilized in reference to, a proposal to promote, or a solicitation of a proposal to purchase or maintain, an curiosity in any safety or funding product