A method to enhance your credit score rating is to be added as a licensed person on one other particular person’s credit score account(s). However what for those who don’t have one other particular person with good credit score to be added as a licensed person?

That’s the place Tradeline Provide Firm comes into the image. It’s a service that allows you to buy licensed person entry on accounts of people with good credit score. It could possibly briefly enhance your credit score rating that will help you get authorised for a mortgage elsewhere.

On this Tradeline Provide Firm Evaluation, I’ll clarify the way it works, the professionals and cons, and allow you to know who ought to think about Tradeline.

Desk of Contents

- What Is a Commerce Line?

- What Is Tradeline Provide Firm?

- How Tradeline Provide Firm Works

- Tradeline for Consumers

- Tradeline for Sellers

- Tradeline Provide Firm Pricing

- Alternate options to Tradeline Provide Firm

- Learn how to Signal Up with Tradeline Provide Firm

- Execs & Cons

- Tradeline Provide FAQs

- The Backside Line on Tradeline Provide Firm

What Is a Commerce Line?

A commerce line is the exercise file of any credit score product reported to the main credit score companies. Whenever you get hold of new credit score, like a bank card or a automobile mortgage, the lender offers your account and fee data to the credit score bureau. Every account is taken into account a commerce line.

For instance, for those who at the moment have a mortgage, automobile mortgage, and one bank card, three commerce traces are reporting in your credit score report.

Your commerce line historical past makes up a part of your credit score rating. Commerce traces open for a number of years contribute to the next credit score rating, whereas brand-new accounts have little affect.

Debtors with out longstanding commerce traces should buy them from firms like Tradeline Provide to spice up their credit score scores briefly.

What Is Tradeline Provide Firm?

Tradeline Provide Firm acts as a web-based market for credit score commerce traces. It’s a platform the place people with good credit score can promote an authorization to a number of credit score traces to a person searching for a lift of their credit score rating.

Tradeline Provide Firm, LLC is predicated in San Diego, California, and was launched in 2017. The corporate has an “A” ranking from the Higher Enterprise Bureau, the second highest ranking.

How Tradeline Provide Firm Works

You may profit from Tradeline Provide Firm in two methods: as a purchaser or a vendor. As a purchaser, you should buy entry to a number of commerce traces with the expectation of getting a lift in your credit score rating. As a vendor, you may make cash by promoting that entry to a borrower in want.

Commerce line consumers can select from lots of of credit score traces based mostly on standards like credit score restrict or the date the road opened. You may choose traces that finest match your credit score wants.

For instance, suppose you will have compromised your rating due to excessive credit score utilization. In that case, you’ll be able to select a number of tradelines with low credit score utilization within the hopes that your ratios will enhance.

In case your credit score historical past is just too current, you should buy longstanding credit score traces to spice up your rating. In fact, you’ll be searching for credit score traces with wonderful histories to enhance your fee historical past.

Commerce line sellers with wonderful credit score profiles can earn a gradual earnings by offering consumers with non permanent licensed person standing on their commerce traces. And since the standing is non permanent, you’ll be able to promote the identical commerce line repeatedly for much more earnings.

Tradeline for Consumers

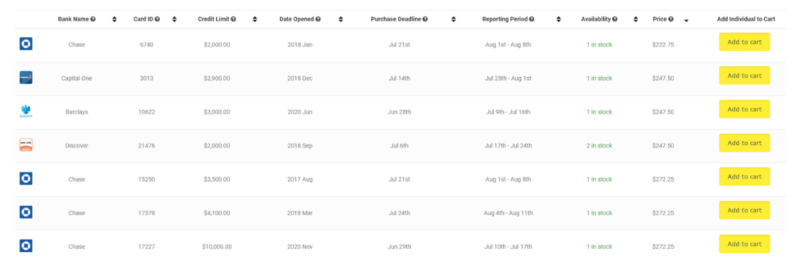

Whenever you go to the Tradeline Provide Firm web site, they are going to current you with a listing of credit score accounts and the related data for every.

Tradeline offers you with the financial institution’s identify, the precise credit score restrict, and the date the vendor opened the credit score line. The vendor can even embrace a purchase order deadline, the reporting interval of the commerce line, the provision, and the worth you should buy it for.

You should purchase as many commerce traces as you want just by clicking the yellow “Add to Cart” button on the right-hand column of every commerce line supplied.

As you’ll see once you go to the web site, Tradeline Provide Firm will will let you choose lots of of various tradelines. This wide array provides you with a superb alternative to buy the traces you imagine will profit your credit score profile.

Tradeline for Sellers

Tradeline Provide Firm offers a straightforward approach for these with good credit score and fascinating tradelines to promote non permanent entry to the traces to consumers. Add your tradeline to their web site, and it is going to be obtainable for buy.

Tradeline provides sellers direct deposit, real-time order historical past, e mail and textual content message order notifications, and round the clock entry to {the marketplace}. It’s a possibility for tradeline sellers to earn further earnings commonly and passively.

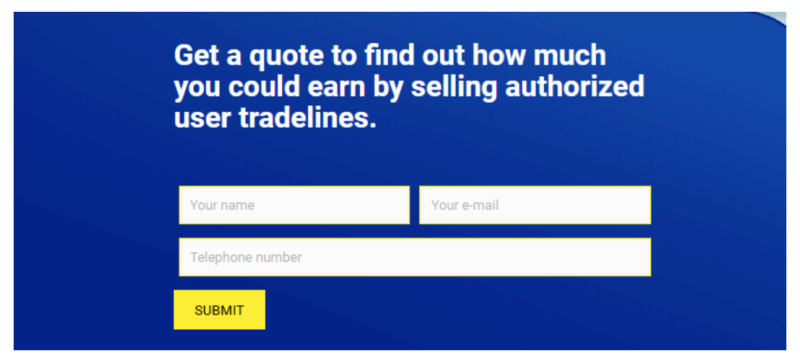

Tradeline Provide Firm provides sellers a possibility to get a quote on how a lot a tradeline is price. Merely enter your identify, e mail deal with, phone quantity, and Tradeline Provide Firm.

Tradeline Provide Firm Pricing

There is no such thing as a value to make use of the Tradeline Provide Firm service or web site. However you’ll pay a payment for every commerce line, which might run wherever from 200 hundred {dollars} to effectively over $1,000.

How a lot you’ll pay will depend upon the options and high quality of every commerce line, in addition to what number of traces you imagine you want to buy.

In keeping with the corporate web site, you should buy entry to a $45,000 credit score restrict that’s been open for ten years. That might positively affect your credit score rating greater than a commerce line with a decrease credit score restrict.

Tradeline Provide costs a $3,000 credit score line, open for 3 years, at round $275.

Be taught extra about Tradeline Provide

Alternate options to Tradeline Provide Firm

Tradeline Provide might help you increase your credit score rating, however good credit score comes at a price. Alternatively, you could need to think about cheaper choices for constructing credit score, corresponding to a secured bank card or credit score builder mortgage. Let’s check out these two Tradeline Provide options.

Secured Credit score Playing cards

With a secured bank card, the borrower should present safety upfront within the type of a money deposit equal to the credit score restrict quantity. The great factor is that the majority secured bank cards include low credit score limits, so you could solely want $100 or $200. When you activate your card and begin utilizing it, the credit score bureaus observe your fee historical past, identical to some other credit score product.

It might take longer for a secured bank card to spice up your rating, but it surely’s a inexpensive possibility than Tradeline Provide. Take the Capital One Platinum Secured Credit score Card, for instance. The cardboard has no annual payment; you will need to place a refundable safety deposit between $49 and $200. So long as you pay the stability owed in full every month, you gained’t pay any curiosity. As quickly as your credit score rating is excessive sufficient, you need to have the ability to qualify for an everyday bank card and have the safety deposit returned to you.

Credit score Builder Loans

You might also think about getting a credit score builder mortgage to enhance your credit score rating. Credit score builder companies will let you construct credit score with out going into debt. Right here’s the way it works. With a standard mortgage, you obtain the overall mortgage quantity prematurely after which make funds over a specified interval till you repay the mortgage.

A credit score builder mortgage works in reverse. You make funds to a mortgage, and the credit score builder firm stories them to the credit score bureau. You solely obtain the funds after you will have paid the mortgage in full. It’s type of like a pay as you go mortgage. As a result of the credit score bureau is recording your funds, your credit score rating improves. You do should watch out, as many credit score builder loans have excessive charges and curiosity. Be sure you know precisely how a lot you might be paying ultimately. For extra data, try our Greatest Credit score Builder Loans article.

Learn how to Signal Up with Tradeline Provide Firm

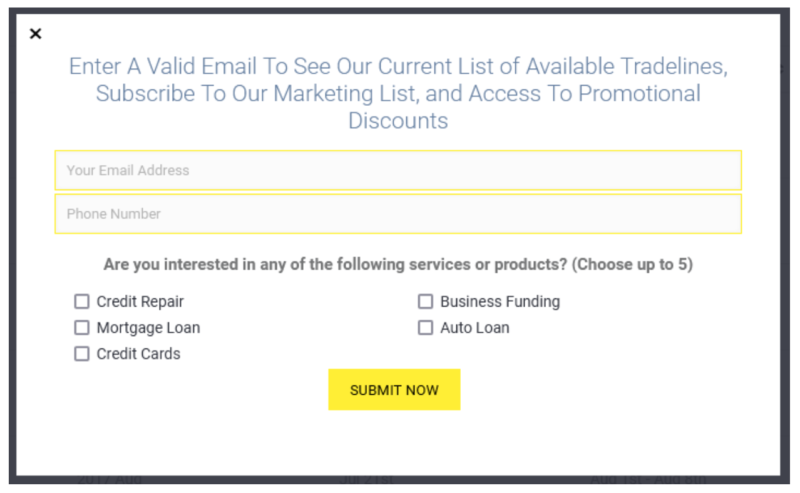

To enroll with Tradeline Provide Firm, enter your e mail deal with and cellphone quantity, then point out the precise service or product you’re interested by.

Nest, you will need to create a novel password on your account. Tradeline will then ask you to confirm your id. You may present a coloration copy of your driver’s license and your Social Safety card, although they are going to settle for a coloration copy of your passport or a state-issued ID card in lieu of a driver’s license.

There is no such thing as a payment to enroll, and also you’ll acquire entry to essentially the most present listing of obtainable commerce traces by offering your e mail deal with and cellphone quantity.

Tradeline Provide Firm permits you to lower your expenses by shopping for a number of tradelines. Because the screenshot under signifies, it can save you 10% on a second commerce line buy, 20% on a 3rd, and 30% in your fourth (or larger) buy.

You’ll want to make use of both a wire test or an eCheck out of your checking account to pay on your order. Tradeline Provide Firm doesn’t settle for bank cards.

Be taught extra about Tradeline Provide

Execs & Cons

Tradeline provides a novel product that has the potential to profit consumers and sellers. However that doesn’t imply you aren’t taking a threat, and it’s definitely not for everybody. Right here’s my listing of Tradeline Supple execs and cons:

Execs:

- Tradeline consumers should buy licensed person standing that may enhance their credit score scores.

- Alternative to pick from lots of of tradelines

- The web site is free to make use of.

- Tradeline Provide Firm provides reductions on the acquisition of a number of tradelines.

- As a tradeline vendor, you’ll promote non permanent licensed person entry and earn a probably regular second earnings.

Cons:

- Buying tradelines to enhance your credit score rating can create authorized points – see the primary FAQ under.

- No assure that buying a tradeline will enhance your credit score rating.

- The acquisition of a commerce line is a short lived transaction

- Buying a commerce line doesn’t provide help to develop good monetary habits

- Relying on the kind and variety of tradelines you want to buy, you could possibly spend lots of or hundreds of {dollars}.

Tradeline Provide FAQs

Shopping for and promoting commerce traces has turn into a acknowledged observe. But it surely’s additionally thought-about a authorized grey zone.

Experian describes it: “Shopping for tradelines could also be seen as misleading by lenders and credit score reporting companies, and will even put you in peril of committing financial institution fraud.”

Tradeline Provide Firm disputes the notion that purchasing commerce traces could be seen as committing financial institution fraud. They cite sources from the U.S. Congress, the Federal Reserve Board, and the federal commerce fee, indicating shopping for commerce traces is authorized. Nonetheless, they don’t present hyperlinks to the precise statements by any of these authorities companies, proving the purpose.

If you happen to think about shopping for or promoting a commerce line, you ought to be conscious of this risk and ready to cope with regardless of the penalties could also be.

The corporate web site signifies the next ensures:

• If you happen to purchase any tradeline by the acquisition deadline, we assure that it’ll put up in your credit score report on the subsequent “Reporting Interval,” which is listed for every Tradeline.

• On all tradelines bought, they assure that you’ll stay on the cardboard as a licensed person for 2 month-to-month reporting cycles.

• Assure that the tradelines put up to not less than two (out of three) credit score bureaus.

• They assure that each one tradelines could have an ideal fee historical past with no late funds ever reported.

• They assure that the utilization ratio will all the time be 15% or decrease.

The above however, the corporate doesn’t assure any optimistic outcomes in your credit score rating from buying any commerce traces, nor do they assure that the outcomes produced will allow you to safe the loans are different advantages you hope to achieve.

You also needs to remember that whereas they provide reside customer support, firm brokers can’t present particular steering on how a lot the acquisition of any tradeline will have an effect on your credit score rating.

Sadly, that may be a risk. And it could possibly occur underneath one in every of two eventualities.

First, buying a commerce line might decrease your credit score rating if the road is just not the precise match on your credit score profile. For instance, if lack of credit score historical past is a major motive on your low credit score rating, buying a line that’s just one or two years previous could not assist your rating and will drop by a couple of factors.

However the second risk might have an excellent higher affect. Since you might be buying the power to be included as a licensed person on a credit score line, the standard of the credit score reference relies upon totally on how effectively the first proprietor manages that account.

If you are going to buy a commerce line, and the proprietor makes a late fee after the very fact, it might trigger your credit score rating to drop.

Be taught extra about Tradeline Provide

The Backside Line on Tradeline Provide Firm

My finest recommendation on buying commerce traces is to tread evenly. This exercise falls right into a authorized gray space. Customers could reap the benefits of licensed person standing from relations, but it surely isn’t all the time profitable.

As acknowledged within the FAQs, the standard of any commerce line relies upon totally on how the first proprietor handles it. If the proprietor borrows on the credit score line or makes a late fee, your credit score rating might drop shortly. There’s additionally proof the credit score bureaus don’t give the identical weight to licensed person accounts as to main accounts.

Additionally, know that you just’ll be paying a hefty value for this service. You’ll want to judge whether or not the profit you’ll obtain might be well worth the cash you pay upfront.

Lastly, buying commerce traces to enhance your credit score rating is barely a short lived answer. The one approach to enhance your credit score rating long-term is to construct it from the bottom up. Meaning taking loans and credit score traces in your identify, paying them on time, and managing them correctly.

Buying licensed person standing by Tradeline could provide help to get authorised for a mortgage or bank card. But it surely gained’t result in a completely larger credit score rating. Solely you may make that occur, which would require effort and time.

Tradeline Provide Firm

Strengths

- Consumers have the potential to enhance credit score rating

- Choose from lots of of tradelines

- Web site is free to make use of

- Reductions on the acquisition of a number of tradelines

- Is usually a passive earnings stream for sellers

Weaknesses

- The observe falls right into a authorized gray space

- No assure that your credit score rating will enhance

- Non permanent transaction for a restricted time

- Would not provide help to construct good credit score habits

- Costly solution to construct credit score