Asset Supervisor Titans Constancy and Vanguard have choices for portfolio administration that adjust allocations throughout asset courses over time which embrace assessments of long-term market traits. Constancy has the Enterprise Cycle Method whereas Vanguard has the time-varying-asset method based mostly on the Vanguard Capital Markets Mannequin (VCMM). On this article, I briefly describe Tactical Asset Allocation (TAA), Enterprise Cycles, and secular markets summarized in Determine #1. I then dive into Constancy’s and Vanguard’s methodologies.

Determine #1: Constancy Multi-Horizon Framework

Supply: Multi-Horizon Framework, Constancy Institutional

This text is split into the next sections:

TACTICAL ASSET ALLOCATION

I arrange the Constancy ETF Screener to establish “bullish” funds that meet my standards for investing. The fundamental standards are: 1) Not Leveraged or Inverse, Internet Property over $100M, FactSet Ranking (A, B, C), Morningstar (3 to five Star), Quantity, Customary Deviation (<25), Beta (<1.5), and Value Efficiency. For Bullish Technical Occasion, I take advantage of: 1) Double Transferring Common Cross Over, 2) 21-, 50-, and 200-Day Value Crosses Transferring Common, and Triple Transferring Common Crossover. For Oscillator Technical Occasions, I take advantage of: 1) Bollinger Bands, Transferring Common Convergence Divergence (MACD), and Momentum.

My Bullish ETF Display screen normally identifies 25 to 75 funds that I would think about in the event that they match into my intermediate-term funding view. I usually load the “bullish” funds into MFO MultiSearch to research them additional. As of mid-June, Desk #1 accommodates the Lipper Classes with probably the most “bullish” funds. Overwhelmingly, what’s bullish are smaller funds, fairness earnings, and rising markets.

Desk #1: My Constancy Bullish ETF Display screen Outcomes

| Lipper Class | Rely |

| Small-Cap Core | 16 |

| Rising Markets | 9 |

| Multi-Cap Worth | 7 |

| Small-Cap Development | 7 |

| Fairness Revenue | 6 |

| Mid-Cap Core | 6 |

| Small-Cap Worth | 6 |

| Monetary Companies | 4 |

| Actual Property | 4 |

| Massive-Cap Worth | 3 |

Supply: Writer Utilizing Constancy ETF Screens and MFO Premium database and screener

Lance Roberts at RIA Recommendation wrote “Sector Rotations Start As Small And Mid-Cap Surge” during which he described the S&P500 as overbought and small-cap and mid-cap funds as having underperformed. Mr. Roberts makes the case that traits have shifted from the Expertise, Discretionary, and Communications heavy S&P500 and could also be trending towards small-size corporations investing extra in Vitality, Financials, Supplies, and Staples. His technique is to stay underweight in shares and chubby money. He appears for pullbacks to make small strikes so as to add extra to cyclical shares.

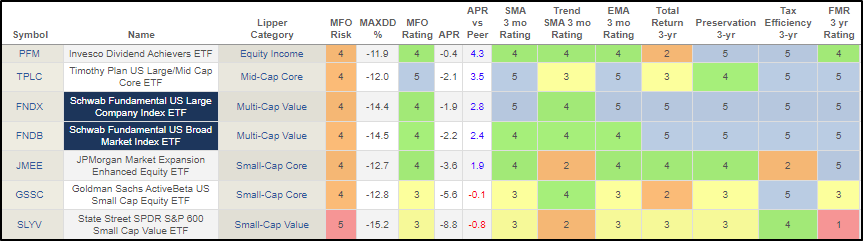

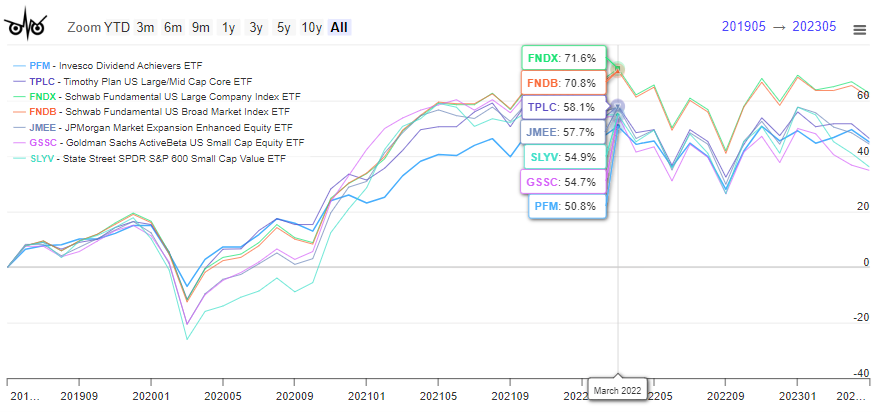

I loaded probably the most bullish funds from my Constancy “Bullish ETF Display screen” into MFO MultiSearch and additional lowered the funds based mostly on longer-term metrics and charts. Desk #2 accommodates the funds that I like probably the most.

Desk #2: Writer’s Chosen Bullish ETFs (One 12 months)

Nevertheless, the MFO charts present that even the bullish funds are trending flat or down. It’s best to attend for pullbacks so as to add to those threat belongings.

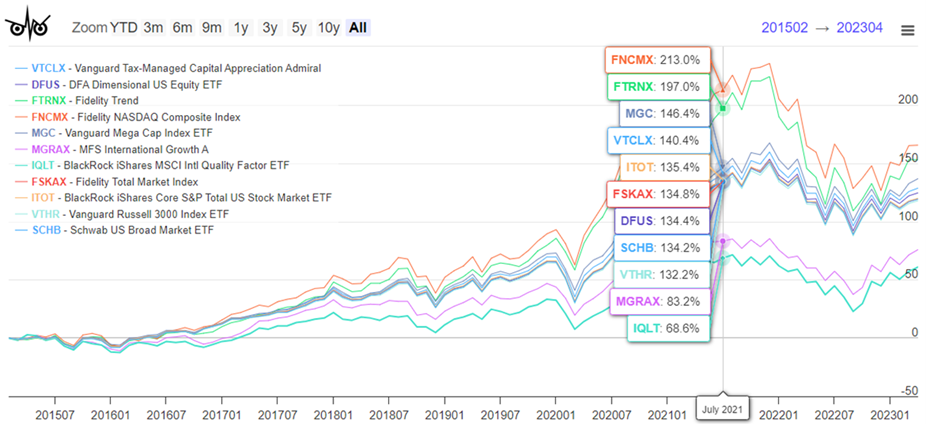

Determine #2: Writer’s Chosen Bullish ETFs

BUSINESS CYCLE APPROACH

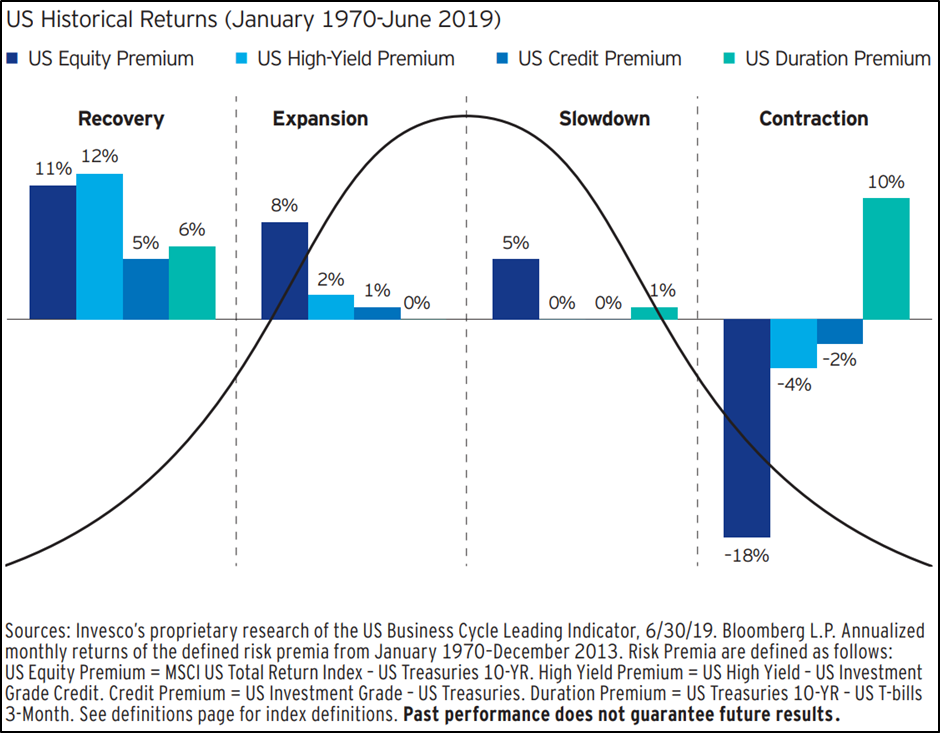

Alessio de Longis, Senior Portfolio Supervisor at Invesco Funding Options, wrote “Dynamic Asset Allocation By the Enterprise Cycle” during which he included Determine #3 displaying the efficiency of shares and bonds throughout levels of the enterprise cycle. Shares carry out greatest throughout early and center expansions whereas longer-duration high quality bonds carry out greatest throughout recessions. I view the Late Stage as a possibility to tilt my portfolio from shares to bonds.

Determine #3: Totally different Threat Premia Have Outperformed in Totally different Macro Regimes

Supply: “Dynamic Asset Allocation By the Enterprise Cycle” by Alessio de Longis, Invesco Funding Options

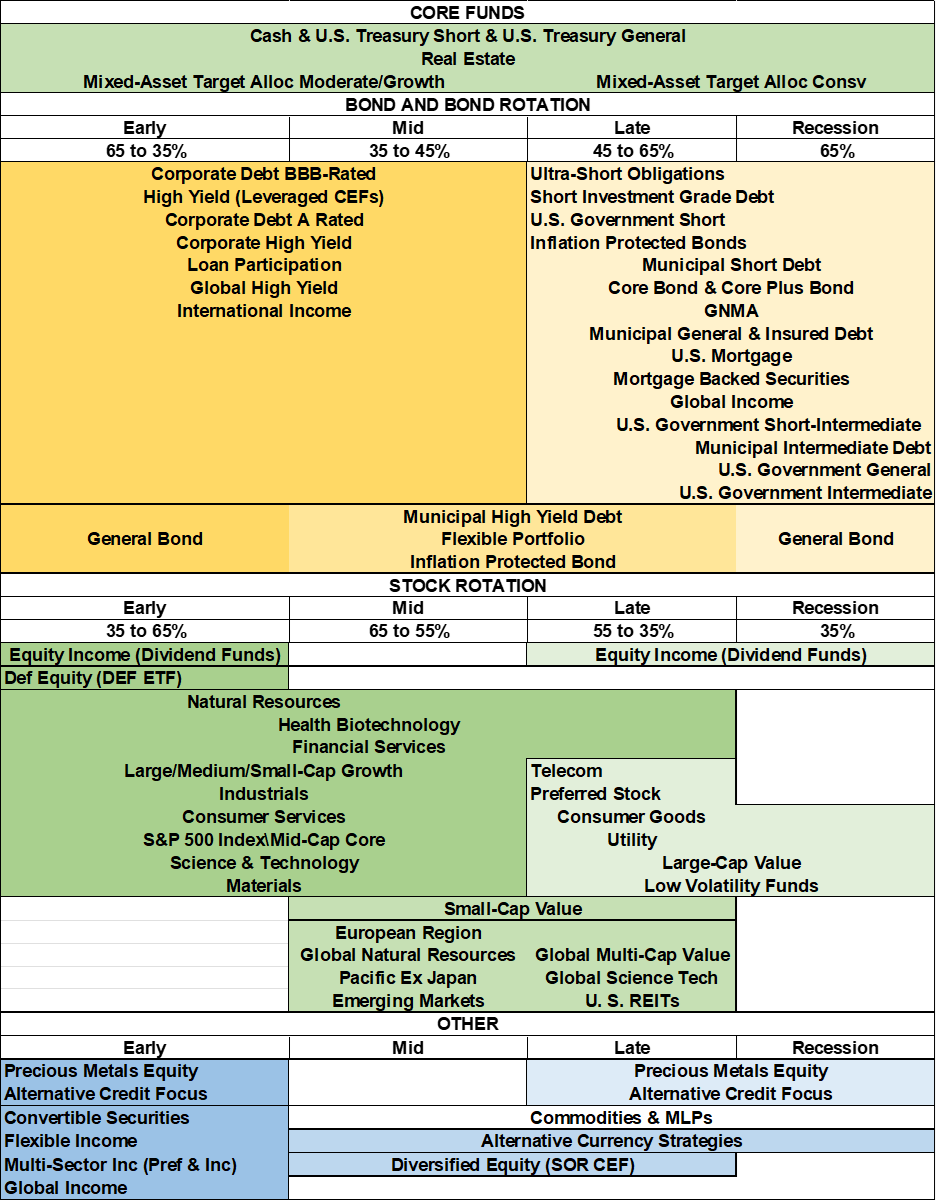

I expanded upon this idea within the December 2019 MFO article, “Enterprise Cycle Portfolio Technique” with Desk #3 describing how Lipper Classes carry out throughout levels of the enterprise cycle.

Desk #3: Lipper Classes by Enterprise Cycle Stage

I arrange MFO MultiSearch “Searches” to establish funds doing effectively by enterprise cycle levels utilizing the Lipper Classes within the desk above. I adjusted different search standards specializing in returns through the early and center levels, risk-adjusted returns within the Late Stage, preservation throughout a Recession, and short-term traits.

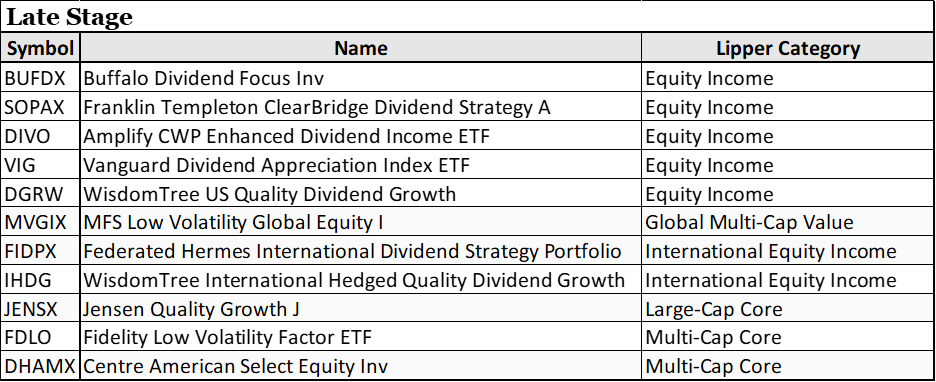

I’m most within the present “Late Stage” of the enterprise cycle, but additionally wish to have a watch on the Recession which I consider will begin within the second half of this yr and “Early” levels in case I wish to begin transitioning some funds for a restoration. The searches every yield a couple of hundred funds. I lowered these to these contained within the following tables based mostly upon metrics comparable to “Fund Circulation”, “MFO Household Ranking”, and Lipper Scores, amongst others.

Desk #4 accommodates funds recognized within the “Late Stage” display. Usually, the funds are holding up comparatively effectively, specifically Fairness Revenue.

Desk #4: Chosen Late-Stage Funds Trending Up

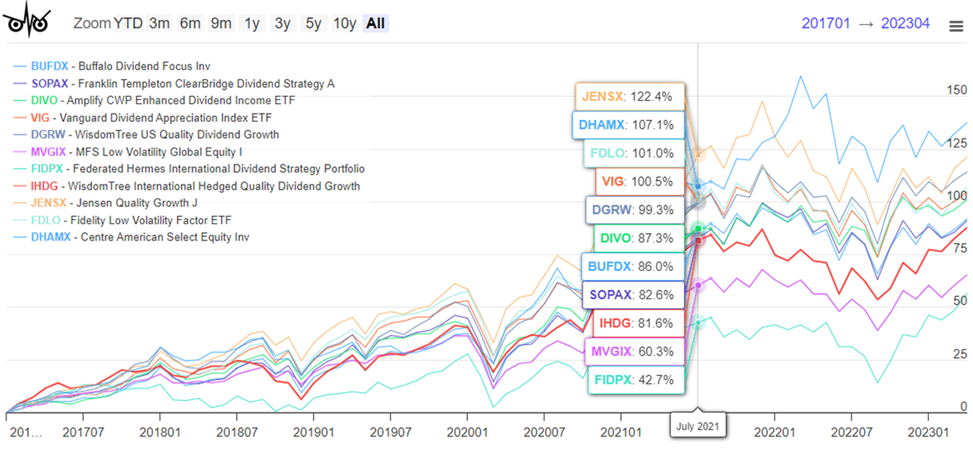

Determine #4: Chosen Late-Stage Funds Trending Up

Funds from the Recession display are additionally doing effectively.

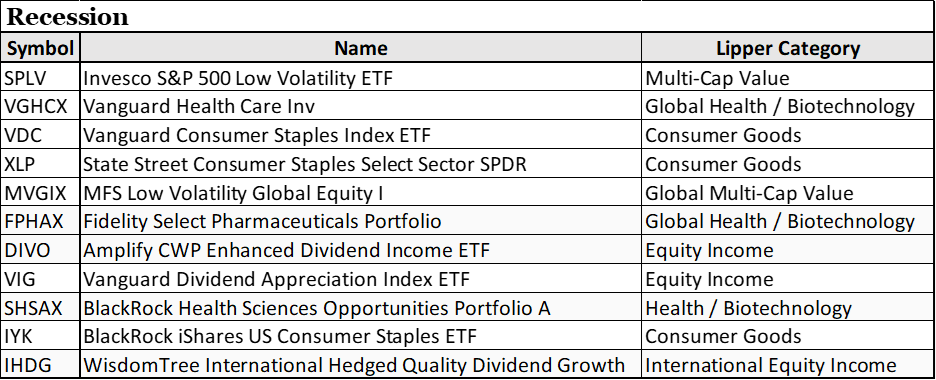

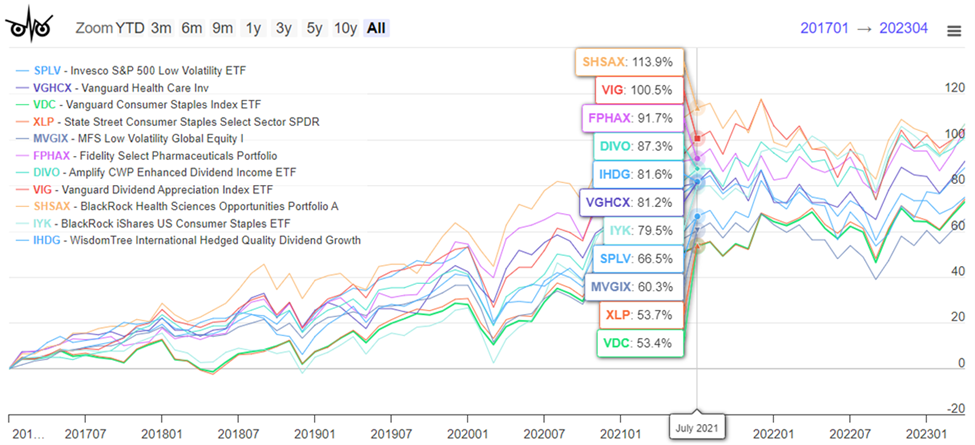

Desk #5: Chosen Funds for Recessions Trending Up

Determine #5: Chosen Funds for Recessions Trending Up

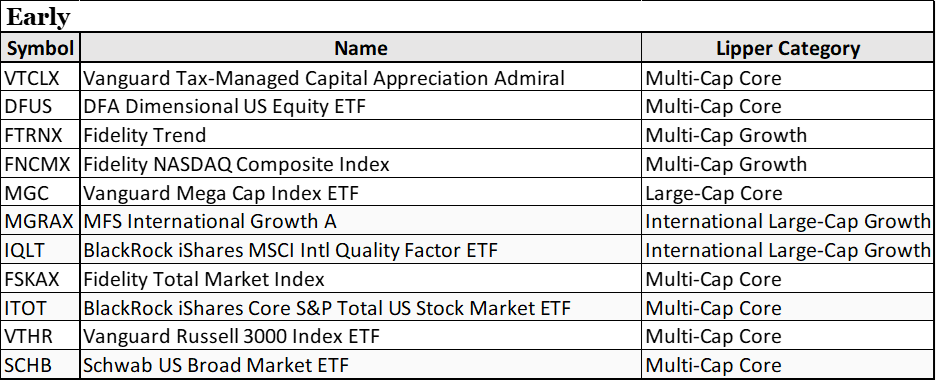

Funds from the Early Enlargement display did poorly final yr, however have began to recuperate. Those that wish to purchase the pullback or consider that the US financial system will expertise a delicate touchdown could also be excited by these funds.

Desk #6: Chosen Early Enlargement-Stage Funds Trending Up

Determine #6: Chosen Early Enlargement-Stage Funds Trending Up

SECULAR MARKETS

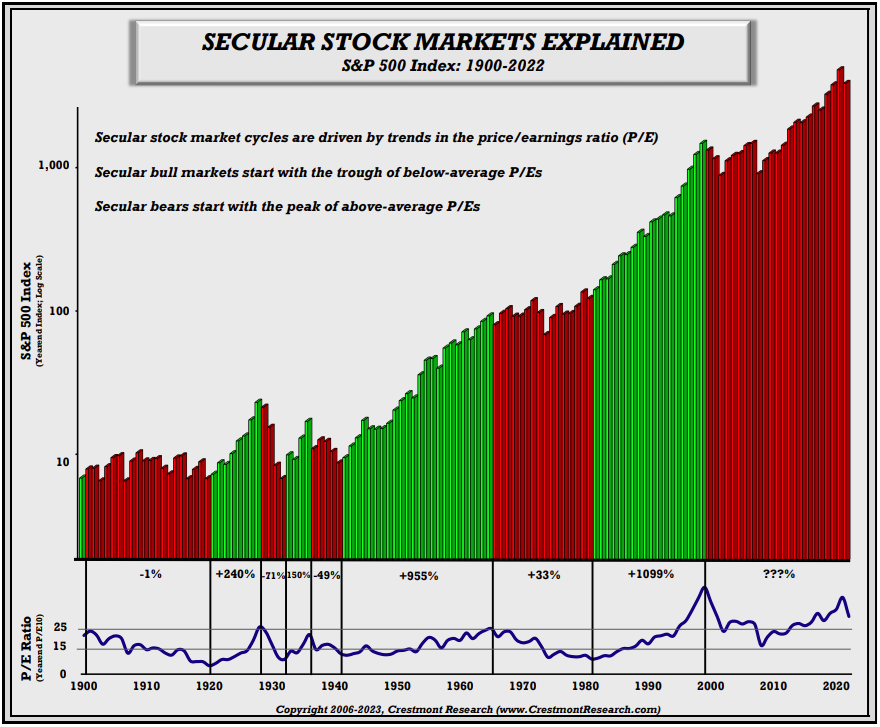

Ed Easterling, founding father of Crestmont Analysis, does a superb job of describing secular markets based mostly on valuations and inflation as proven in Determine #7. By his definition, we’re nonetheless in a secular bear market. Extraordinarily unfastened financial coverage has created bubbles. Valuations and inflation are each excessive which doesn’t bode effectively for longer-term returns. Mr. Easterling says that secular bull markets are a time to sail (passive administration), and secular bear markets are a time to row (energetic administration).

Determine #7: Crestmont Analysis Secular Markets

Supply: “Secular Inventory Markets Defined” by Ed Easterling, Crestmont Analysis

Each Constancy and Vanguard create views of how the markets will look over the following decade or two. I think about this to be necessary in organising a strategic investing plan.

Vanguard was based by John Bogle in 1975 based mostly on the precept of low-cost funds and ease that carried out extraordinarily effectively through the secular bull market of the Eighties and Nineties. Mr. Bogle wrote Sufficient: True Measures of Cash, Enterprise, and Life during which he acknowledged that top valuations would influence future returns and he lowered his asset allocation to 35% shares. Quick ahead to 2014, and Vanguard publicly launched the Vanguard Capital Markets Mannequin (VCMM) which it had been engaged on for six years. Vanguard started engaged on VCMM effectively over ten years previous to Mr. Bogle passing away in 2019. The present outlook for the following ten years from the Capital Markets Mannequin is offered right here.

Constancy Institutional wrote Capital Market Assumptions: A Complete World Method for the Subsequent 20 Years during which they describe how long-term Capital Market Assumptions (CMAs) may help “monetary advisors place their purchasers to succeed in their long-term objectives…” Constancy combines their long-time period CMAs with their shorter-term enterprise cycle analysis to “add worth via energetic asset allocation”. Constancy presents an abundance of well timed data together with Constancy Viewpoints and their newest pondering on portfolio administration.

BATTLE OF THE TITANS – FIDELITY vs VANGUARD

I’m snug with the Enterprise Cycle Method, however some great benefits of the Secular Market method are that it appears at alternatives globally and for longer intervals of time. Combining a enterprise cycle method with an overlay of secular markets is engaging. There are only a few funds with long-term monitor data for various allocations throughout asset courses which have fairly excessive returns over the long run. These are principally within the Versatile Portfolio and Different World Macro Classes.

Every particular person has totally different circumstances together with monetary literacy, threat tolerance, assured earnings via pensions and annuities, stage of financial savings, and objectives. Enter portfolio administration to customise belongings to an investor’s wants (and herald further income for the supervisor).

I started utilizing Constancy Wealth Companies just lately to handle some longer-term portfolios. I elected to have a easy method utilizing mutual funds and exchange-traded funds. They make small adjustments to portfolios and clarify why they’re making them. I meet with the advisors twice a yr.

I like diversifying throughout each Constancy and Vanguard. I’ve talked with advisors from Vanguard twice through the previous decade and elected to not use their advisory companies. After writing this text, I really feel higher ready on what to debate after I discuss to them once more.

Vanguard Capital Markets Mannequin (VCMM) and Time-Various Method

The aim of Vanguard Capital Markets Mannequin (VCMM) is to hyperlink Vanguard’s funding ideas and improvement of reasonable plans and isn’t meant to be a market timing or tactical asset allocation device. Vanguard World Capital Markets Mannequin (2015) describes how “the asset return simulation mannequin and the way its forward-looking return projections could be utilized within the portfolio building course of.” They describe the mannequin as:

“The VCMM makes use of historic macroeconomic and monetary market information to dynamically mannequin the return behaviour of asset courses. It consists of variables comparable to yield curves, inflation and main financial indicators. The mannequin estimates the dynamic statistical relationship between threat components and asset returns utilizing historic information courting way back to 1960. It then makes use of Monte-Carlo regression evaluation to foretell these relationships into the longer term.”

Supply: “Vanguard World Capital Markets Mannequin”, Vanguard, March 2015

Refined Modeling and Forecasting describes how the Vanguard Capital Markets Mannequin (VCMM), Vanguard Asset Allocation Mannequin (VAAM), Vanguard Life-Cycle Mannequin (VLCM), and Vanguard Monetary Recommendation Mannequin (VFAM) work collectively “which search to optimize anticipated investor utilities together with glide-path building, point-in-time asset allocation, energetic/passive funding, and monetary planning selections.” The Capital Markets Mannequin gives estimated efficiency of belongings over the following ten years to the Vanguard Asset Allocation Mannequin which optimizes the portfolio. The Monetary Recommendation Mannequin evaluates the methods to advocate an optimum monetary plan. Every month, Vanguard publishes their newest insights of their Portfolio Views.

One method of the Vanguard Asset Allocation Mannequin (VAAM) is what Vanguard calls “time various asset allocation”. They describe a 60% inventory/40% bond portfolio that will have different between 47% inventory to 75% shares over the 2020 to 2022 interval. I constructed my Funding Mannequin to have a goal allocation of fifty% shares inside a variety of 35% to 65%. Vanguard cautions that their method shouldn’t be for everybody.

Constancy Secular Capital Market Assumption and Enterprise Cycle Method

Constancy has an Asset Allocation Analysis Crew (AART) that “conducts financial, basic, and quantitative analysis to provide asset allocation suggestions for Constancy’s portfolio managers and funding groups.” They describe Constancy’s Enterprise Cycle Method to Asset Allocation. Further data could be present in The best way to Make investments Utilizing The Enterprise Cycle. Constancy Institutional has the 2023 Second Quarter Market Replace and the Second Quarter Enterprise Cycle Replace which I discover very informative.

Closing Ideas

There may be loads of data on the web about funding administration corporations and their funds. There may be little details about how their managed portfolios carry out as a result of they’re so customizable. To be able to get extra data, an investor should name the businesses. I select to tread slowly.

I chosen Constancy Wealth Companies to handle a portion of my belongings a few years in the past. I used to be not excited by utilizing Vanguard advisory companies till I discovered concerning the Vanguard Asset Allocation Mannequin (VAAM) and the time-varying method. Now I wish to know extra, so I’ll name Vanguard and ask to speak to an advisor. I can envision a multi-strategy method with Constancy and Vanguard managing or advising me on parts of my portfolio and with me managing the rest. Over time, I could select to consolidate accounts.