There are two guidelines in terms of inventory market aphorisms:

(1) They should be straightforward to recollect.

or

(2) They should rhyme.

Some traditional examples:

Be grasping when others are fearful and fearful when others are grasping.

Purchase when there’s blood within the streets.

The development is your pal.

Don’t attempt to catch a falling knife.

Let your winners journey and reduce your losers quick.

Purchase low, promote excessive.

Purchase the rumor, promote the information.

Purchase what you recognize.

Purchase the dip.

Promote in Might and go away.

Don’t put all of your eggs in a single basket.

Focus to get wealthy. Diversify to remain wealthy.

Skate to the place the puck goes.

I’m positive I missed a number of however this performs many of the hits.

One factor you need to discover instantly is many of those guidelines of sayings are in battle with each other. I assume that’s what makes a market.

But it surely’s additionally vital to grasp that nothing works on a regular basis. That features guidelines of thumb, pithy one-liners and rhymes that make you’re feeling all heat and fuzzy.

Right here’s one other one for the checklist that appears to be in a state of flux this yr:

Don’t combat the Fed.

There was this concept within the 2010s that shares have been solely going up due to the Fed. There was the Fed put. And the Fed was printing cash. And the Fed was offering liquidity. And the Fed was blowing bubbles but once more.

If it wasn’t for the Fed the inventory market would crash identical to 1929!

Hear, I’m not right here to let you know the Fed had nothing to do with the bull market of the 2010s. The Fed definitely made issues simpler on danger belongings by taking rates of interest to 0%.

However charges have been even decrease in Japan and Europe and so they didn’t get a raging bull market through the earlier decade.

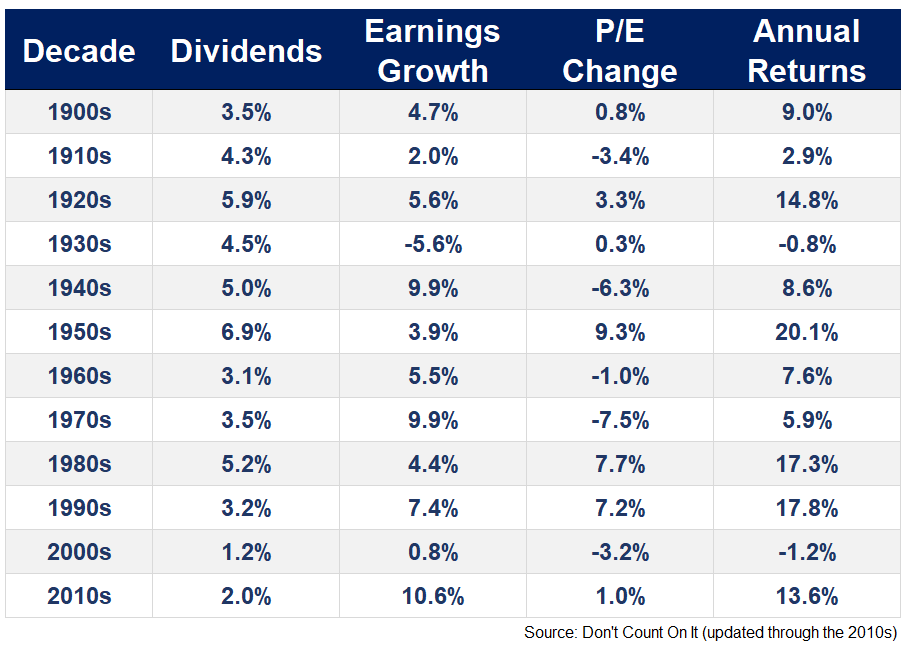

Plus, we now have the John Bogle return system that exhibits how fundamentals helped energy the inventory market within the final decade as properly:

Low charges helped however so did the elemental driver of long-run inventory market returns — earnings progress.

Final yr don’t combat the Fed made a whole lot of sense. They raised charges at a feverish tempo and we had a bear market.

However a humorous factor occurred this yr — the inventory market began combating again.

And never simply any shares. The largest winners this yr are tech shares, the very firms most individuals assumed would have the largest downside with larger charges.

The Nasdaq 100 is up virtually 40% this yr. The largest tech inventory in all of the land — Apple — is up almost 50% in 2023.

That is even though the Fed has continued elevating charges, will probably elevate them much more on the subsequent assembly or two and so they have shrunk the scale of their steadiness sheet.

Most issues within the markets (and life) exist in a state of grey, not black or white.

Guidelines of thumb will be useful in sure areas of life.

However more often than not the inventory market doesn’t conform to a phrase that sounds good or looks as if it ought to make sense.

The inventory market doesn’t at all times must make sense.

Generally meaning the Federal Reserve doesn’t matter as a lot as you suppose in terms of inventory value actions.

Additional Studying:

Are Rising Curiosity Charges Unhealthy For Tech Shares?