Updates

Fido’s conversion

![]() Constancy transformed its “disruptive” funds to ETFs. They’re Constancy Disruptive Automation (FBOT), Constancy Disruptive Communications (FDCF), Constancy Disruptive Finance (FDFF), Constancy Disruptive Drugs (FMED), and Constancy Disruptive Know-how (FDTX). As a gaggle, they aren’t terribly compelling. They started buying and selling this week.

Constancy transformed its “disruptive” funds to ETFs. They’re Constancy Disruptive Automation (FBOT), Constancy Disruptive Communications (FDCF), Constancy Disruptive Finance (FDFF), Constancy Disruptive Drugs (FMED), and Constancy Disruptive Know-how (FDTX). As a gaggle, they aren’t terribly compelling. They started buying and selling this week.

Subsequent up: the conversion of its six Enhanced Index funds into ETFs, doubtless in November 2023.

The Polar Plunge

In keeping with CityWire, FPA, and Polar Capital have agreed to settle their reciprocal lawsuits over the failed transition of two FPA funds, rechristened Phaeacian Companions, to Polar. “Pursuant to the phrases of the settlement settlement, Polar and First Pacific are every required to dismiss all claims towards the opposite.” That settlement doesn’t, nonetheless, resolve the battle between Polar and supervisor Pierre Py – they declare that his choice to reside in Switzerland quite than Los Angeles is guilty – nor does it carry Mr. Py and his group nearer to returning as skilled traders. That’s his acknowledged intent and he is actually good. We’ll preserve watch.

T. Rowe tweaks

T Rowe Value is updating its goal date funds lineup. Value gives three distinct units of target-date funds:

T Rowe Value is updating its goal date funds lineup. Value gives three distinct units of target-date funds:

Goal funds, with names reminiscent of Goal 2035.

Retirement funds, with names reminiscent of Retirement 2035.

Retirement Mix funds, with names reminiscent of Retirement Mix 2035.

All are funds-of-funds. Listed here are the important thing variations:

Retirement funds: comparatively aggressive glide path, extremely diversified portfolio, primarily actively managed funds. (Full disclosure: a big chunk of my retirement portfolio is invested in T. Rowe Value Retirement 2025.)

Retirement Mix funds: comparatively aggressive glide path (the identical as Retirement’s), diversified portfolio, a mixture of lively and passive funds.

Goal funds: comparatively much less aggressive glide path, extremely diversified portfolio, primarily actively managed funds.

We will use a single goal date from every sequence to spotlight the variations.

| Score | Fairness | E.R. | |

| Goal 2035 | 4 stars | 70% | 0.57% |

| Retirement 2035 | 5 stars | 80% | 0.59% |

| Mix 2035 | Unrated | 80% | 0.41% |

Two developments had been simply introduced. First, Value is including two hedge-like funds to the roster of funds that is perhaps included. These are T Rowe Value Dynamic Credit score and T Rowe Value Hedged Fairness. That highlights one of many sights of the Value goal date sequence. They’re research-driven and incorporate a number of small slices of belongings, together with hedging belongings, that almost all of their rivals can not or won’t duplicate. Second, in 2024, the Retirement I fund sequence is being folded into the Retirement sequence. The latter change is usually an administrative matter that displays altering rules about fund share pricing. It shouldn’t have any impression on traders.

Briefly Famous . . .

American Beacon AHL Multi-Alternate options Fund has filed a registration submitting. The fund will execute two complementary methods: a managed futures technique and a goal threat technique. A goal threat technique asks, “By which belongings can we now make investments to get the best return with out exceeding our stage of focused threat”? On this case, the managers will attempt to make investments opportunistically throughout equities, bonds, rates of interest, company credit score, and commodities which the purpose of creating as nice a return as potential with out subjecting traders to greater than 10% annualized throughout any 12-month interval. Bills fluctuate contingent upon every funding share class.

The merger of FlexShares Worldwide High quality Dividend Defensive Index Fund and FlexShares Worldwide High quality Dividend Index Fund has been suspended. The rationale for the cancellation of the proposed reorganization is that, following the reconstitution of the underlying indexes of IQDE and IQDF, there was not enough overlap within the two portfolios to help a tax-free reorganization.

SMALL WINS FOR INVESTORS

Driehaus Micro Cap Development Fund reopened to present traders, offered you meet the acknowledged circumstances, on July 10. Eligible consumers: present fund shareholders, individuals in retirement plans with the fund as an choice, and advisers whose shoppers have already got fund accounts. The roster of individuals eligible to open a brand new account is proscribed to Driehaus workers, traders who trade shares of one other Driehaus fund for shares of Micro-cap, and (don’t totally perceive this one) advisors “whose shoppers have Fund accounts.”

The fund is rated 5 stars and it has just about smushed the competitors since launch.

Comparability of Lifetime Efficiency (Since 201312)

| Identify | Annual return | Commonplace deviation | Ulcer Index | Sharpe Ratio | Sortino Ratio | Martin Ratio | MFO Score |

| Driehaus Micro Cap Development | 14.7% | 24.8 | 14.8 | 0.55 | 0.86 | 0.92 | 5 |

| Small-Cap Development Class Common | 7.4 | 19.5 | 12.1 | 0.33 | 0.49 | 0.57 | 1 |

It’s clearly a “returns story” rather more than a “threat story,” however the returns have been fairly spectacular.

Columbia Small Cap Development Fund is reopening to new traders on July 31, Morningstar charges the fund 4 stars. The fund final closed to new traders on June 1, 2021. It has a rocky three-year document however is rock-solid for the entire different time intervals we observe. The fund launched in 1996 and its longest-tenured supervisor has been on board since 2006. The ten-year document appears broadly consultant of its efficiency.

Comparability of 10-12 months Efficiency (Since 201306)

| Annual return | Commonplace deviation | Ulcer Index | Sharpe Ratio | Sortino Ratio | Martin Ratio | MFO Score | |

| Columbia Small Cap Development | 10.8 | 21.7 | 15.9 | 0.45 | 0.69 | 0.62 | 2 |

| Small-Cap Development Class Common | 8.8 | 19.2 | 11.8 | 0.41 | 0.61 | 0.71 | 1 |

As with Driehaus, whose efficiency is just not straight comparable as a result of it’s a a lot youthful fund, the story right here is in regards to the magnitude of extra returns swamping the magnitude of extra threat (each are excessive), main to actually strong risk-adjusted returns.

CLOSINGS (and associated inconveniences)

Nary a one!

OLD WINE, NEW BOTTLES

Abrdn is about to amass 4 closed-end health-related funds from Tekla. Lest you suppose “closed-end funds, aren’t these like Studebakers?” we’ll observe that the efficiency of the Tekla CEFs has been fairly strong.

In case you’re considering, “Wow! How did you get detailed info on closed-end funds so shortly,” it’s essential to try MFO Premium. It’s the one software costing lower than a automobile with additionally permits side-by-side comparisons of mutual funds, ETFs, and closed-end funds.

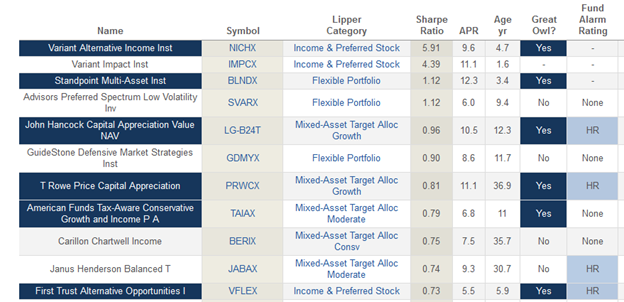

Ask: what multi-asset fund has one of the best risk-return tradeoff?

Bink:

Right here’s a display screen of all multi-asset funds, sorted by Sharpe ratio. You’ll discover that the primary two are closed-end funds which can be vastly outperforming the sphere, the third is a younger fund that we’ve profiled, whereas #4 and 6 are T Rowe Value Cap App and a clone.

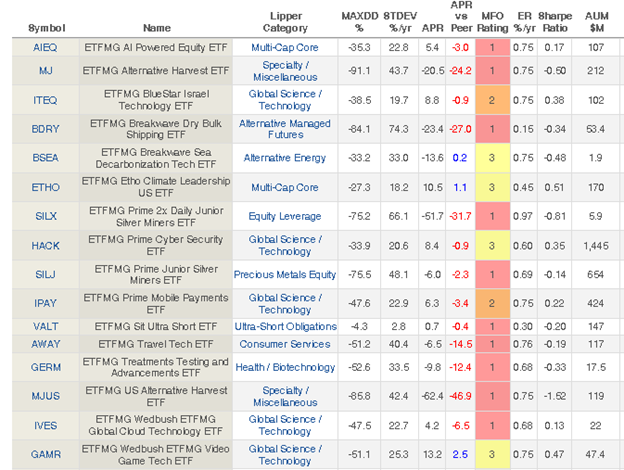

Amplify ETFs is buying the belongings from ETF Managers Group, a thematic boutique of … idiosyncratic choices. Right here’s the efficiency of the funds since inception.

Maybe the columns to concentrate on is perhaps “APR versus friends” – the quantity by which they lead or path the typical fund of their class – and “MFO Score,” a fast snapshot of risk-adjusted returns the place blue/5 cells are the easiest (see any?) and purple/1 cells are the very worst (ummm … 10?).

Brown Advisory Whole Return Fund has been reorganized into the Brown Advisory Sustainable Bond Fund efficient as of the shut of enterprise on June 23, 2023.

The Board of Trustees of FundX Funding Belief has permitted changing FundX Versatile Revenue Fund and FundX Conservative Upgrader Fund into ETFs. There might be no change to every Fund’s funding goal, funding methods, or portfolio administration on account of the reorganizations.

OFF TO THE DUSTBIN OF HISTORY

The AlphaMark Fund might be liquidated on or about July 31.

Delaware Ivy Funds is liquidating its Ivy Rising Markets Native Forex Debt and Worldwide Small Cap Funds. The liquidations will happen on or about August 31, 2023.

Frontier MFG Choose Infrastructure Fund might be liquidated on August 23.

Lazard International Mounted Revenue Portfolio might be liquidated on or about July 31.