Whenever you do your taxes in tax software program, the software program generally calculates an underpayment penalty. It thinks you owe the penalty when your tax withholding plus any estimated tax funds have been under a sure threshold (the “protected harbor“):

- Inside $1,000 of your tax obligation; or

- 90% of your present 12 months’s tax obligation; or

- 100% of your earlier 12 months’s tax obligation (110% in case your AGI within the earlier 12 months was $150,000 or extra)

In case your earnings was uneven all year long, you possibly can attempt to get out of paying the underpayment penalty by way of an advanced train utilizing the “Annualized Earnings Installment Technique.” It principally comes right down to doing all your taxes 4 instances by separating your earnings and deductions into 4 sub-periods inside the 12 months and calculating your taxes for every sub-period.

I don’t find out about you however I don’t have any urge for food for doing my taxes 4 instances.

There’s a a lot better approach. The tax software program is simply attempting to be useful in calculating the underpayment penalty for you. You’ll be able to decline its assist and let the IRS calculate the penalty and invoice you in the event that they resolve to evaluate a penalty.

The IRS really typically doesn’t assess a penalty when the tax software program thinks you owe a penalty. You don’t need to volunteer the penalty now.

Right here’s learn how to decide out of calculating the underpayment penalty in TurboTax and H&R Block software program.

TurboTax

I’m utilizing TurboTax downloaded software program. TurboTax downloaded software program is each extra highly effective and cheaper than TurboTax on-line software program.

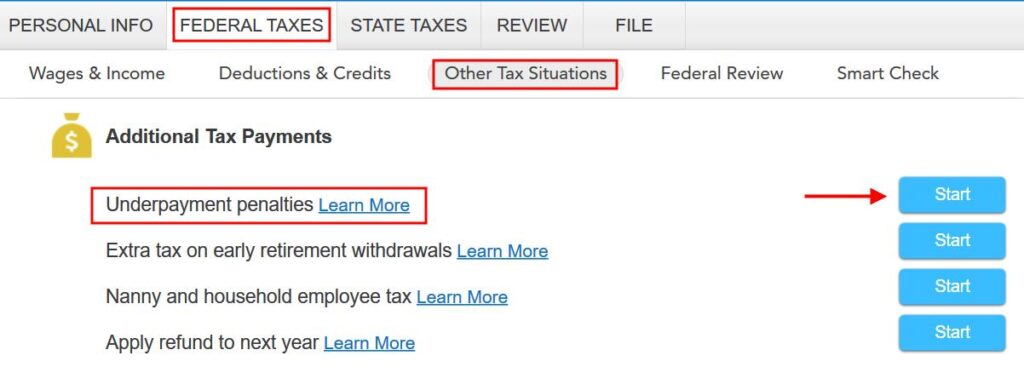

Discover “Underpayment penalties” below Federal Taxes -> Different Tax Conditions. Click on on Begin.

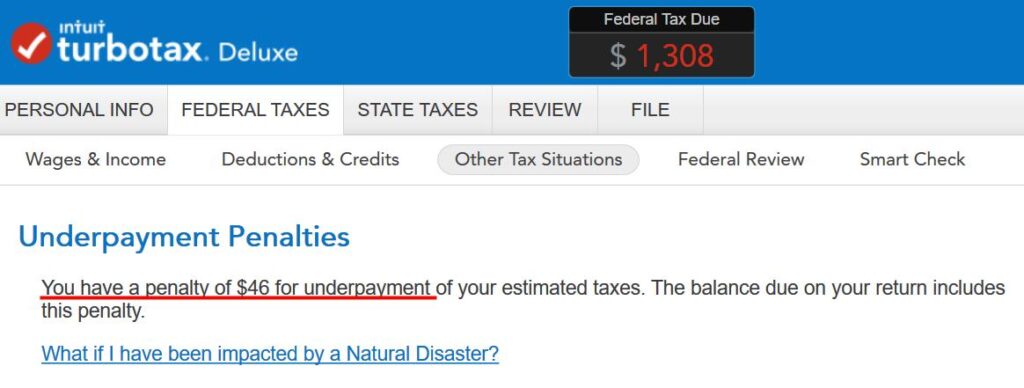

If TurboTax says you’ve got a penalty for underpayment. Click on on Proceed.

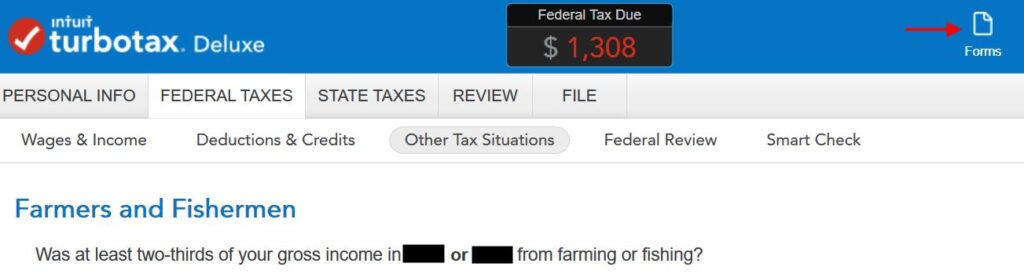

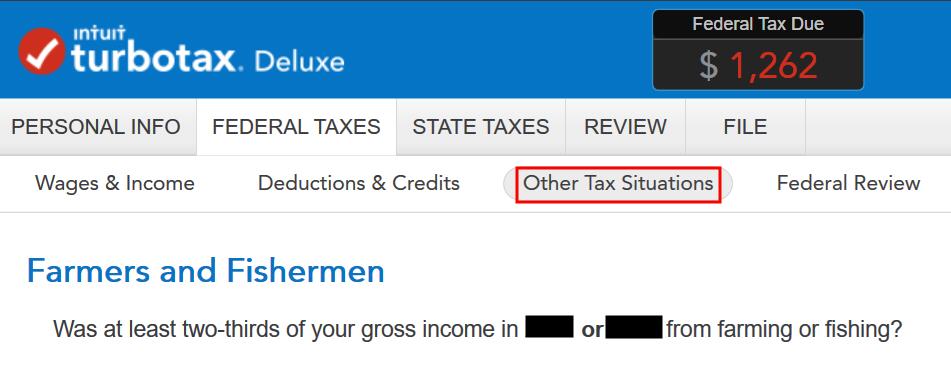

TurboTax asks you about farming or fishing, which doesn’t apply to most individuals.

You’ll be able to proceed the complicated interview with extra hoops to leap by way of nevertheless it’s a lot faster for those who change to the Varieties mode now by clicking on Varieties on the highest proper.

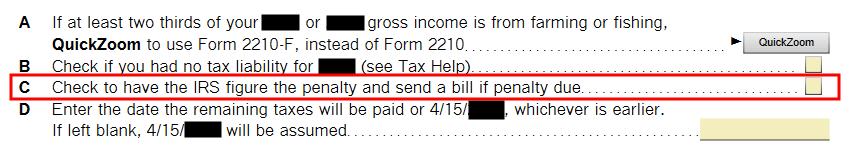

TurboTax opens a type. Test the field subsequent to merchandise C to have the IRS calculate the penalty and ship a invoice if obligatory. Likelihood is they received’t.

The underpayment penalty calculated by TurboTax is eliminated instantly after you test that field. Be aware in our instance the tax owed meter dropped from $1,308 to $1,262 after we checked the field.

Click on on Step-by-Step to return to the interview.

You’re again to the display screen about farming and fishing. Click on on “Different Tax Conditions” within the sub-menu to exit this part.

H&R Block

It’s rather more simple within the H&R Block downloaded software program. H&R Block obtain can also be each extra highly effective and cheaper than H&R Block on-line software program.

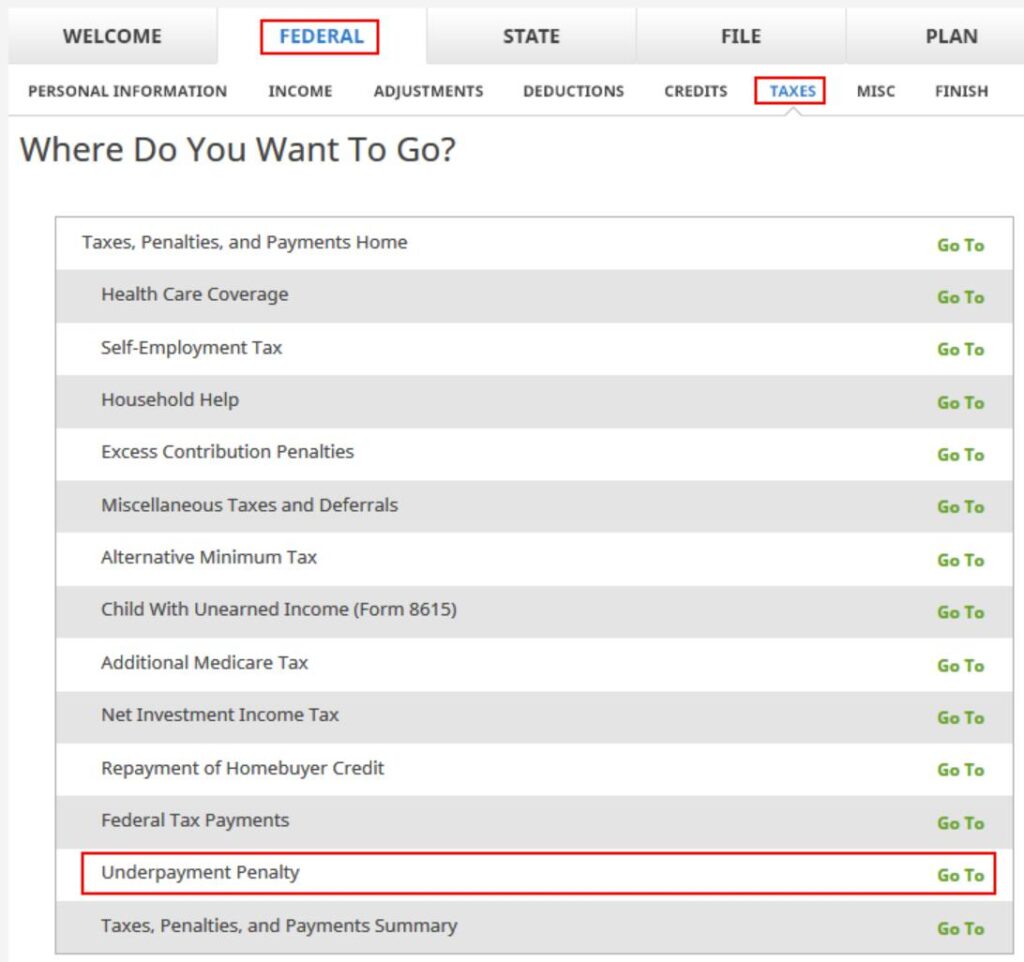

Discover “Underpayment Penalty” below Federal -> Taxes. Click on on Go To.

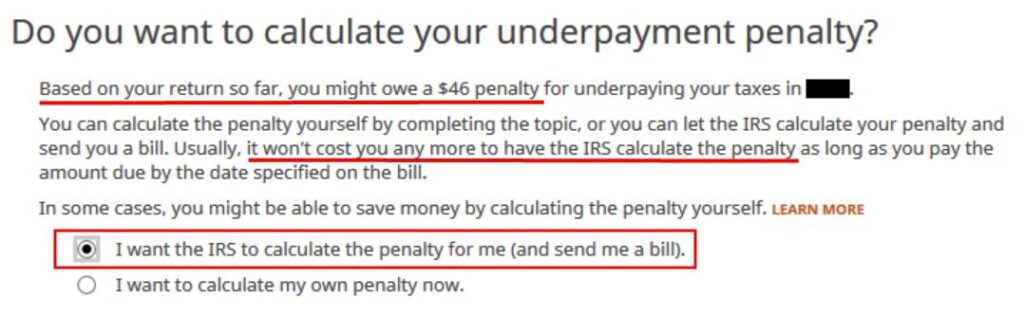

H&R Block provides the choice to let the IRS calculate the penalty immediately. The choice is chosen by default.

H&R Block explains that it received’t price you any extra to have the IRS calculate the penalty. It really will price you much less when the IRS doesn’t assess a penalty.

Say No To Administration Charges

In case you are paying an advisor a share of your property, you might be paying 5-10x an excessive amount of. Learn to discover an impartial advisor, pay for recommendation, and solely the recommendation.