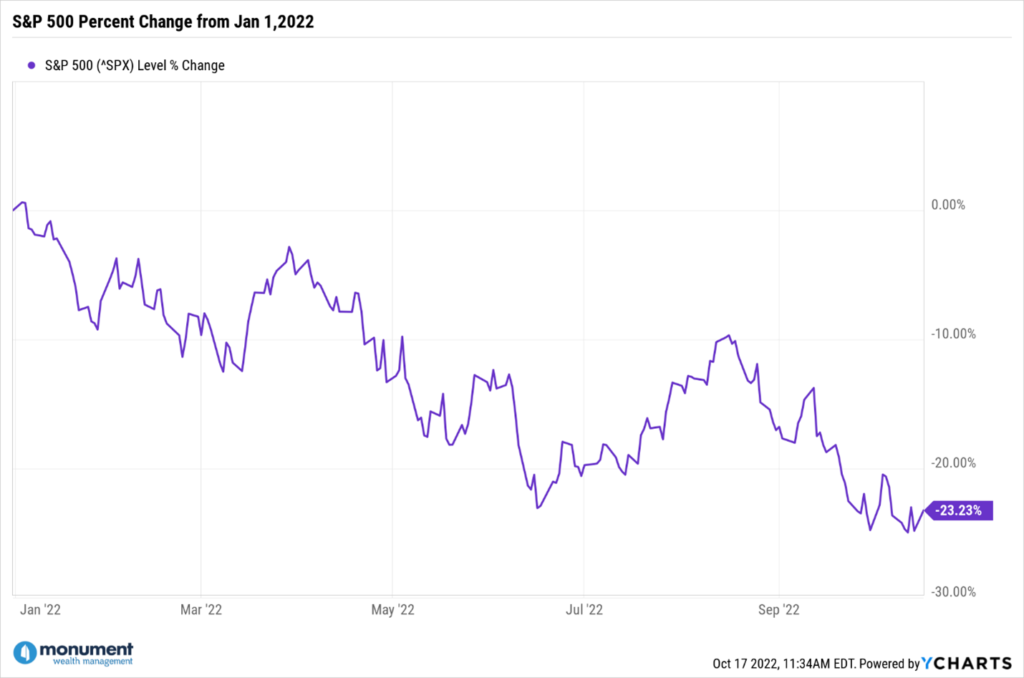

Everyone seems to be speaking about “the recession,” however I’ll argue it’s irrelevant. The S&P 500 is down round 23% off its most up-to-date excessive, and that’s what’s related.

That is why I say it’s by no means about THE recession, it ought to at all times be about A recession.

A recession is at all times on the horizon, and the market response isn’t ever precisely synced.

However the market members (you and seven billion different individuals on the planet) have already priced in all of the information and expectations, so even when we’re in a recession, the present degree displays that AND has priced in all expectations and future outcomes.

You assume the Fed will trigger a tough touchdown? It’s already in there.

You assume the Fed will hold elevating rates of interest? It’s already in there.

You assume inflation is excessive and can keep excessive? It’s already in there.

The continued warfare in Ukraine, freezing winter in Europe, the potential for Russia utilizing a nuclear weapon, oil costs going larger as a result of OPEC reductions, unrest in Iran, November U.S. elections…

It’s. All. In. There.

Right here’s the place errors get made…

Individuals at all times attempt to outthink it. To outsmart it. To seek out that recession funding technique “nugget” that nobody else sees or is aware of, after which take motion of their portfolio to account for that.

And by taking motion, I imply they commerce – i.e., promote, change securities, increase money, deploy money, panic liquidate…all of that.

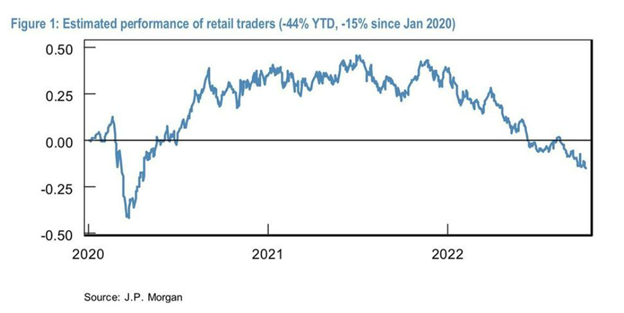

How do I do know most individuals are getting it fallacious? JP Morgan revealed this:

Don’t ask me how they figured that out; they’re JP Morgan. They’ve reams of Patagonia vest-wearing dorks that do the work, reams of shoppers who pay inflated charges, after which they make a pleasant graph for the remainder of us non-dorks.

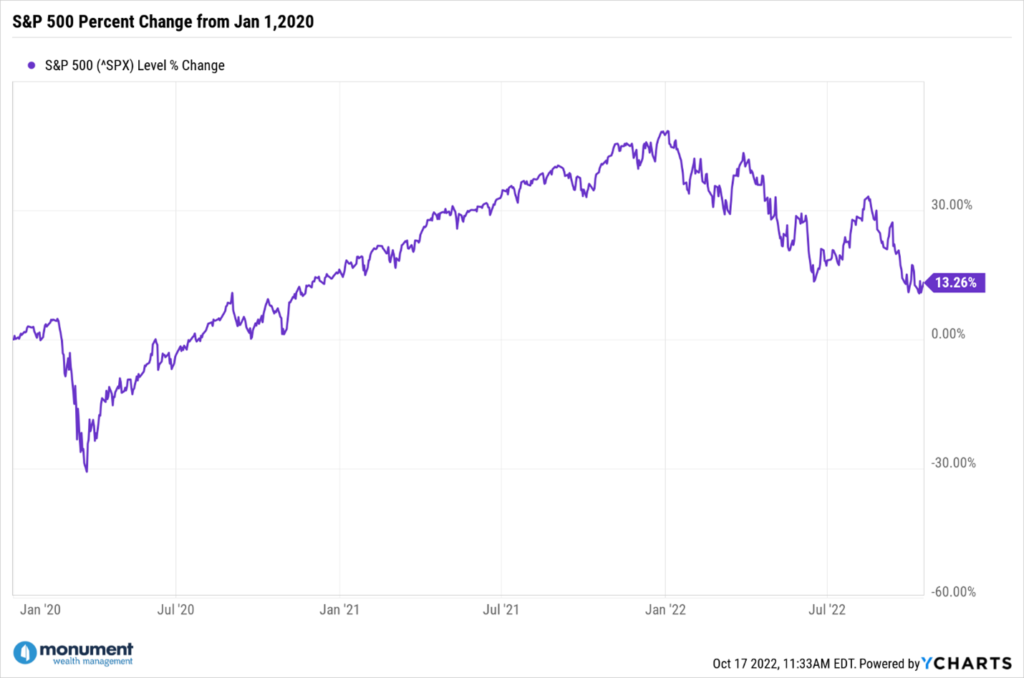

However look, retail merchants are down -44% year-to-date and -15% going again to January 2020 (so principally, all the best way from pre-covid by means of the following market rally and present pullback).

Right here’s how the S&P 500 has performed over the identical two intervals:

To seek out that recession funding technique nugget that nobody else is aware of, determine the sport you’re taking part in and decide how you need to greatest hold rating.

Preserving rating in opposition to others, Cramer, or anybody else prognosticating on TV or in print is foolish as a result of they’re in all probability not taking part in the identical sport you’re. (They’re taking part in the viewers and advert income “sport”.)

Know what the cash is for and while you want it. Get good recommendation that retains you out of hassle and out of the “retail buying and selling is down -44%” class.

Nobody likes shedding cash, and I’m not downplaying the ache, however typically one of the best time to reevaluate the way you make investments, why you’re investing, and who’s supplying you with recommendation is when the ache is actual.

Mumbling to your self, “I knew I ought to have bought in January,” is an efficient factor to recollect when the market ultimately recovers. As a result of it would — the market is undefeated over time.

Additionally, our newest podcast episode 33 is price trying out. We’ve got a free-flowing dialog concerning the market, finish of the quarter, and extra particulars on what we take into consideration inflation.

Maintain trying ahead,