Between Financial institution Mounted Deposits or a debt mutual funds, what do you want extra?

Financial institution FD provide higher security, zero volatility, and certainty of returns. Then again, debt funds provide higher extra tax-efficient returns.

Now, let’s say you’re detached between Financial institution FD and debt funds and simply need to decide one that can possible provide you with higher returns.

And the way do you discover that?

A standard means is to examine the present 1-year financial institution FD rate of interest with trailing 12-month returns of a debt mutual fund.

Nonetheless, that’s not the right method. And on this put up, we are going to see why. Now, if that’s not the right method, what do you examine 1 12 months FD returns towards?

Earlier than we get there, a fast comparability between Financial institution FDs and Debt Mutual Funds

Financial institution FDs vs Debt Mutual Funds

Security: Financial institution mounted deposits are as secure as any funding can get. No such consolation with debt funds though you possibly can cut back the danger by deciding on the appropriate kind of debt funds.

Predictability of returns and Volatility: Banks FDs rating right here too.

With financial institution mounted deposits, your returns are assured. You’ll be able to lock within the price of curiosity. No volatility.

No return assure with debt funds. Can’t lock in your return (or YTM). The closest you come to locking in your return is thru Goal maturity fund (TMF) like debt funds. Nonetheless, even TMFs will be extraordinarily risky.

Taxation: That is an space the place debt funds rating over financial institution FDs.

FD curiosity will get taxed at your slab price, which is an issue in case you are in greater revenue tax brackets. With debt funds, the taxation turns into benign in case your holding interval exceeds 3 years. You get the good thing about indexation and get taxed at a decreased price of 20% (after indexation).

In case you can’t compromise on security and predictability of returns, then FDs are a transparent winner.

Nonetheless, in case you are keen to imagine some danger and volatility in the hunt for extra tax-efficient returns, then debt funds may very well be another.

Over the previous 6 months, the rates of interest have risen.

And when the rates of interest rise, two issues occur.

#1 The bond costs fall as a result of bond costs and rates of interest are inversely associated. And since debt mutual funds maintain bonds, the NAV of debt funds falls too. And because the NAV falls, the previous efficiency deteriorates. Previous 6-month or 1-year return efficiency will go down too.

#2 Nonetheless, the potential (future) returns go up. A bond pays a set coupon (curiosity) at common intervals and mature at face worth. Coupons and face worth don’t rely on the worth you obtain the bond at.

Therefore, if you should purchase a bond cheaper than investor A, you’ll earn higher returns than investor A (if each of you maintain the bond to maturity).

Investor A: Buys the bond at Rs 100.

Let’s say the rates of interest rise and the worth of the identical bond falls to Rs 90. You purchase the bond at Rs 90. Each of you earn the identical coupon and get the identical face worth on maturity.

However you paid Rs 90 whereas investor A paid Rs 100. Thus, you earned higher returns since you paid much less for the bond.

Subsequently, when the rates of interest rise, the debt fund returns fall however the potential returns rise.

How will we estimate potential returns?

Yield-to-maturity (YTM) of a debt mutual fund (or a bond) is the very best indicator of potential returns.

Reproducing definition of YTM from Investopedia.

Yield to maturity (YTM) is the full return anticipated on a bond if the bond is held till its maturity. Yield to maturity is taken into account a long-term bond yield however is expressed as an annual price. In different phrases, it’s the inner price of return (IRR) of an funding in a bond if the investor holds the bond till maturity, with all funds made as scheduled and reinvested on the identical price.

Learn: That are the very best mutual funds when the rates of interest are rising?

However there are issues with YTMs too

YTM is a dependable indicator of your returns in case of bonds when you maintain the bond till maturity. It is because a bond has a finite life. There are not any prices in holding and you’ve got fully predictable cashflows from bonds.

YTM can also be moderately dependable for Goal maturity funds (TMFs) like Bharat Bonds (if held till maturity). These merchandise have restricted lives and have an related maturity date. As an example, Bharat Bond 2025 will mature in April 2025 and Bharat Bond 2030 will mature in April 2030.

The portfolio of such funds doesn’t want a lot churn by design. The bonds within the portfolio are such that these mature near product maturity date. Subsequently, there may be not a lot danger about reinvestment of principal. However there will be distinction between the YTM and the precise return earned because of bills, monitoring error, and the danger related to the reinvestment of coupons from underlying bonds.

Not as dependable for different debt funds. Most debt funds have infinite life. Therefore, no idea of maturity. The portfolio retains altering. Bonds mature and new ones substitute them at prevailing yields (coupon). There may be reinvestment danger for each principal and coupons. There are money inflows and outflows. Plus, your returns will rely on YTM trajectory, charges at which maturing bonds and coupons obtained invested, fund bills and the yields prevailing on the time of your exit from the fund.

Whereas YTM can by no means be as dependable as an indicator as 1-year FD returns, it is much better than previous 1-year returns.

Caveat: Rates of interest rise. Bond costs and debt fund NAVs fall. YTM rises. Nonetheless, the rates of interest can all the time rise additional. And if that occurs, bond costs and debt fund NAVs will fall much more. Extra ache. The previous efficiency deteriorates additional. And the YTM (or potential returns) will rise additional.

This may occur within the reverse path too. The rates of interest fall. The bond costs and debt fund NAVs rise. YTM falls. Nonetheless, if the rates of interest had been to fall additional, YTM would go even decrease. And bond costs and debt fund NAVs would present even greater features.

What’s the downside with evaluating 1-year FD charges with trailing 12 month returns of Debt MF?

1-year FD price is the return you’ll earn over the subsequent 1 12 months.

Previous (trailing) 12-month return of a debt mutual fund signifies how a lot you earned over the previous 1-year.

FD 1-year rate of interest is potential. This tells you precisely how a lot you’ll earn over the subsequent 1-year.

1-year debt return is retrospective. This doesn’t let you know a lot about how a lot you’ll earn within the subsequent few years.

Therefore, evaluating these two just isn’t proper, proper?

The right comparability ought to be with YTM.

Let’s have a look at the examples on this part.

If the rates of interest have gone DOWN in the course of the previous 1-year

Then FD charges would have possible gone down too in the course of the 12 months. Therefore, when you might open FD at 6% p.a. 12 months again, maybe you possibly can open immediately at 4.5% p.a. solely. So, you’ll examine competing merchandise towards this 4.5% p.a.

Throughout the identical interval, bond costs would rise because of falling charges. The debt fund NAVs would rise too, favourably impacting quick time period returns. Nonetheless, that’s the previous. Previous 1-year return received’t let you know what to anticipate within the coming 12 months or 24 months. For that, you could give attention to YTM.

One thing very comparable occurred put up the primary Covid wave (March 2020). RBI lower the repo charges sharply. FD charges additionally dropped sharply. Debt funds would profit from this.

In March 2021, when you in contrast 1-year FD returns with trailing 12 months debt fund returns, the latter would look extra compelling (capital features because of rates of interest falling).

Round that point, FD charges had been about 5% p.a. This was irritating for buyers. Many purchasers reached out with comparability of FD charges with trailing 12-month returns of debt funds (which had been shared by their RMs). Trailing 12-month debt fund returns regarded spectacular (as a result of rates of interest fell).

Nonetheless, the YTM of debt funds had been a lot decrease than trailing 12-month returns. And YTMs had been decrease as a result of these mirrored the prevailing yields within the financial system.

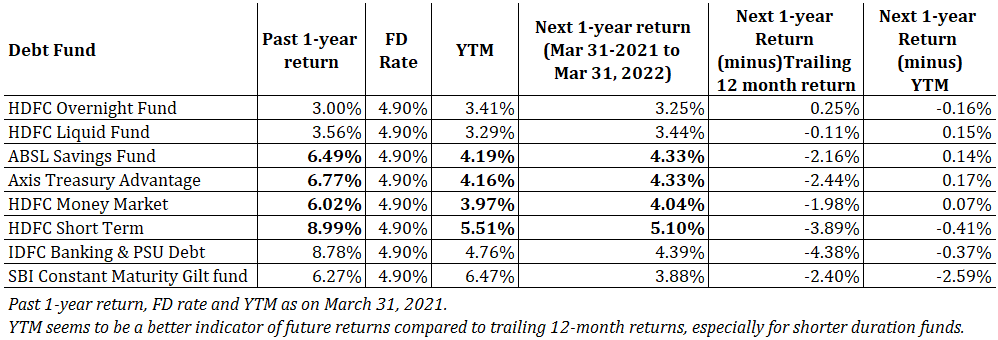

Now let’s see what occurred over the subsequent 12 months. March 31, 2021, to March 31, 2022.

As you possibly can see, YTMs proved to be a a lot better indicator of the subsequent 1-year returns, particularly for shorter length funds. In actual fact, 1-year FD has performed higher than most debt funds within the subsequent 1 12 months.

For FD charges, I depend on this publication from the Reserve Financial institution of India. Whereas the RBI presents information for 1-3 12 months length, I take the decrease finish for FD charges. 3-year FD charges will possible be greater than 1-year FD charges.

If the rates of interest have gone UP in the course of the previous 1-year

Then it’s possible that FD charges are at a better degree than they had been 1 12 months in the past.

Therefore, it’s attainable you possibly can open FD immediately at 6% p.a. however you would open it at solely 4.5% p.a. a few 12 months in the past. You’ll examine competing merchandise towards 6% p.a.

Now, the rates of interest have risen, the debt funds would have suffered due to rising charges. Thus, the latest previous efficiency would additionally look unhealthy. By the best way, the hostile impression of rising rates of interest is extra on funds that maintain lengthy length bonds (in comparison with debt funds holding shorter length bonds).

Now, let’s return to November 2021. The rates of interest have risen prior to now 12 months (from November 2021 to November 2022)..

Right here we see some divergence between YTM as on November 30 2021 and returns over the subsequent 12 months for liquid and in a single day funds. The reason being that these funds maintain very short-term securities.

In a single day (1 day) and Liquid fund (as much as 90 days). Portfolio churns in a short time. Bonds mature and get changed. Therefore, these funds profit as reinvestments occur at greater charges.

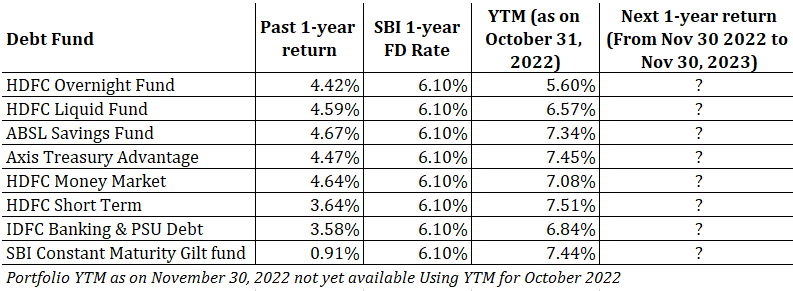

What’s the place immediately?

The rates of interest have risen over the previous 6 months, this could have an effect on debt fund returns adversely. Nonetheless, 1-year FD charges have risen. SBI provides 1-year FD at 6.1% p.a.

Whereas trailing 12-month returns are poor for debt funds, you must give attention to the YTM. Because the charges have risen, YTMs have additionally gone up.

1-year FD price > Previous 1-year return of all of the debt funds thought of.

However, as mentioned, we have to give attention to YTMs.

If you’re fearful about rates of interest rising additional (could or could not occur), decide shorter length funds or if you wish to lock-in yields, you possibly can take into account Goal maturity funds. For extra on this, check with this post.

Don’t attain a incorrect conclusion

I’m not suggesting that debt funds are higher than financial institution FDs on the present juncture (December 2022). Each have their very own deserves and demerits.

I belief your judgement.

I simply need to spotlight 2 points.

- Don’t give attention to trailing returns of debt funds whereas evaluating a debt fund to a financial institution FD. And even whereas evaluating 2 debt funds. You may go within the incorrect path. This is applicable even when you’re deciding on debt funds.

- Deal with YTM (Yield-to-maturity). Whereas YTM just isn’t failsafe, that is nonetheless the very best indicator of potential returns from debt funds, particularly for shorter length debt funds.

On the subject of predicting efficiency within the quick time period, YTM appears a extra dependable indicator for shorter length funds (in a single day, liquid, ultra-short, low length, and cash market). These funds often maintain bonds that mature inside 1 12 months. It is because such funds are much less delicate to rate of interest actions.

With longer maturity bond funds (SBI Fixed Maturity Gilt fund), sensitivity to rate of interest actions makes it tough to estimate quick time period returns until you’ve gotten a view on rate of interest actions (your view seems appropriate). By the best way, YTM can also be an honest predictor of returns for lengthy length bond funds offered you maintain the fund for an extended interval.