Edelweiss CRISIL IBX 50:50 Gilt Plus SDL Quick Length Index Fund NFO will likely be obtainable for subscription from twenty seventh January 2023 to tenth February 2023. It’s an open-ended quick period passive debt fund. Whether or not the time is true to undertake passive debt funds?

The most important considerations for any debt fund traders are default or downgrade threat on one facet and unclear definitions of funds on one other facet. Due to such unclarity, fund managers typically take undue threat to showcase greater returns. Historical past is a superb instructor for us. Actually, in a single such occasion, Liquid Fund traders had been hit closely as a result of a credit standing downgrade (Is Liquid Fund Protected and different to Financial savings Account?).

There are numerous dangerous situations in different classes of debt funds too like Franklin AMC (Franklin Templeton India Closed 6 Debt Funds – Is it proper?).

Such situations obliviously scare loads to the standard traders who’re on the lookout for debt funds both to diversify or to park their cash safely. The reply to all these considerations is the Edelweiss CRISIL IBX 50:50 Gilt Plus SDL Quick Length Index Fund.

Edelweiss CRISIL IBX 50:50 Gilt Plus SDL Quick Length Index Fund – Time to maneuver to Passive Debt Funds!!

Although there are specific passive debt funds already obtainable out there, they’re all Goal Maturity Debt Funds. Learn extra about these funds at “Record of Goal Maturity or Debt Index Funds To Put money into India in 2022“. Therefore, this appears to be a bit hindrance who’re unaware of after they want the cash or when the appropriate maturing goal maturity fund is unavailable with us.

I feel contemplating this in thoughts, Edelweiss got here out with this new fund. Many people all the time talk about the price of investing in mutual funds and such price comparability is as of now restricted to fairness funds solely. The reason being that we don’t have passive debt funds earlier (just lately TMF began). Now the time is ripe to examine the efficiency of those energetic funds and their bills additionally.

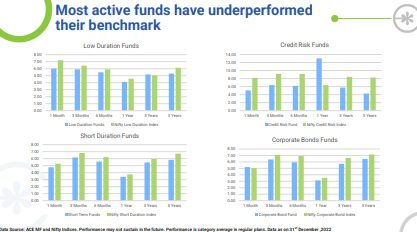

Let me share the pictures shared by Edelweiss in its presentation. Within the first picture, they confirmed the energetic debt fund underperformance with respect to their benchmark.

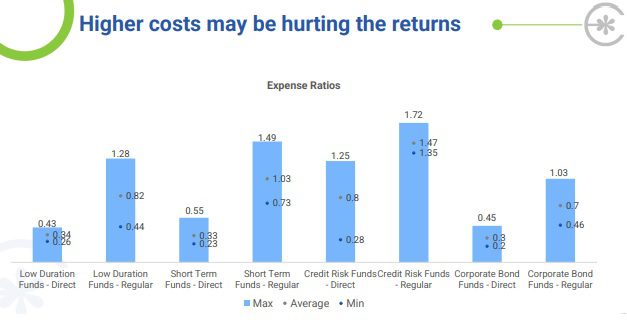

Within the beneath picture, they confirmed the price of energetic funds.

As I’ve talked about above, the credit score high quality of the funds is completely unpredictable (particularly for frequent traders).

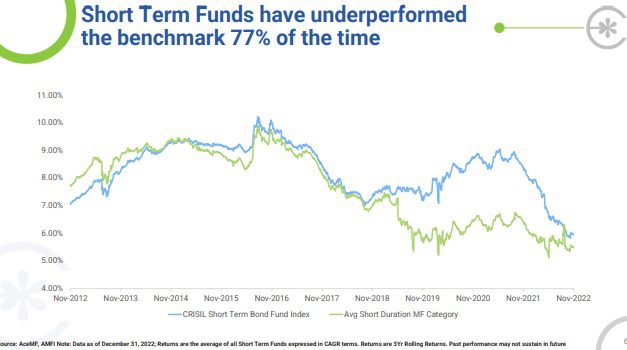

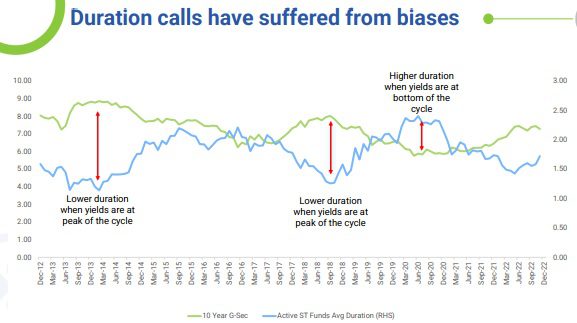

Actually, they did not time the yield additionally. Due to this, they terribly underperformed the benchmark.

Due to all these points, the truth is, even I used to assume twice to decide on debt funds. I feel now, for all these points, Edelweiss CRISIL IBX 50:50 Gilt Plus SDL Quick Length Index Fund is an answer. Hoping that different AMCs will even observe the identical path.

What’s Edelweiss CRISIL IBX 50:50 Gilt Plus SDL Quick Length Index Fund?

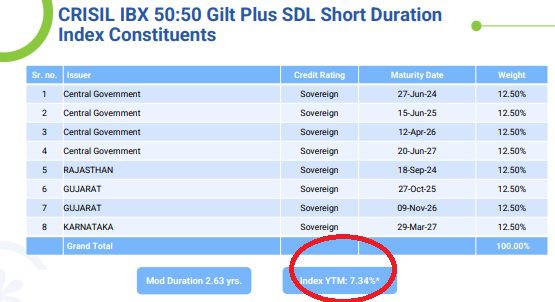

It’s an Index Fund and goals to copy the constituents of the CRISIL IBX 50:50 Gilt Plus SDL Quick Length Index. The portfolio consists of fifty% Indian Authorities Bonds (IGBs) and 50% State Growth Loans (SDLs).

The period bucket of IGB and SDL are 1-2 Yrs, 2-3 Yrs, 3-4 Yrs and 4-5 Yrs. The G-Sec are chosen by choosing most liquid G-Sec falling in every of the above period buckets with a minimal excellent of INR 10,000 Cr.

The SDL portion will likely be constructed by first choosing most liquid State issuers falling in every of the eligible period buckets. Then by choosing most liquid ISIN with minimal excellent of Rs. 500 crores from every of those shortlisted State issuers.

Liquidity rating for each IGBs and SDLs will likely be assigned primarily based on the amount traded (70%), variety of trades (15%) and days traded (15%) within the earlier quarter.

The index will likely be rebalanced each quarter with an efficient date as the primary enterprise day of the month.

The CRISIL IBX 50:50 Gilt Plus SDL Quick Length Portfolio consists of the beneath securities.

Do keep in mind that YTM talked about above is of benchmark, which fund claims that they replicate. Nevertheless, as a result of sure monitoring errors, the fund returns could also be lesser than this. Confer with my publish on what do you imply by monitoring error (Monitoring Distinction Vs Monitoring Error of ETF and Index Funds).

Edelweiss CRISIL IBX 50:50 Gilt Plus SDL Quick Length Index Fund – Do you have to make investments?

Contemplating all these options of the Edelweiss CRISIL IBX 50:50 Gilt Plus SDL Quick Length Index Fund and likewise by highlighting the energetic debt funds negativity, ought to one contemplate this fund? Think about the beneath factors earlier than you determine to take a position on this fund.

# It isn’t an alternative choice to your Financial institution FD

You seen that the Modified Length of the benchmark is 2.63 years. Modified period is a system that expresses the measurable change within the worth of a safety in response to a change in rates of interest.

It means for each 1% up and down within the rate of interest, the benchmark will go up and down by 2.63%. Therefore, regardless that you might be investing in central authorities and state authorities bonds, you may’t keep away from the rate of interest threat. Increased modified period means greater volatility to the rate of interest motion.

The rate of interest motion to bond value is inverse proportion. If there’s a fall within the rate of interest, then the bond value will go up and vice versa.

Use this specific fund provided that your time horizon is greater than 5 years or so. By no means use this fund on your lower than 3-4 years of requirement. Actually, in case you are below the upper tax bracket, then utilizing Financial institution FDs of your selection is much better (in case your requirement is lower than 3 years).

# You possibly can fully keep away from credit score and downgrade threat

As I discussed above, by investing on this fund, you may fully take away the credit score and downgrade the chance. Nevertheless, we will’t keep away from rate of interest volatility. Therefore, if you’d like peace of thoughts from such dangers, then you need to use this fund.

# Decrease Expense

As of now, it’s unclear in regards to the expense ratio of the fund. Nevertheless, I hope that contemplating passive fund, the expense will likely be less expensive than the identical varieties of energetic debt funds.

# Monitoring Error

Although Index Funds attempt their greatest to copy the returns of the benchmark, we all the time must face sure monitoring errors and monitoring variations. How profitable this fund is as of now could be a query mark.

# Make clear the portfolio

Because the fund has the mandate to put money into central and state authorities bonds, you may have readability in regards to the portfolio (which was not doable for the energetic debt funds).

# By no means make investments primarily based on present YTM

The present YTM of the benchmark is 7.34% (as on 1st Jan 2023). It doesn’t imply it can stay the identical all through your interval. Because the bond costs change on each day foundation, the YTM will even change on each day foundation. Therefore, every of your investments can have a unique YTM.

Therefore, simply because the present YTM displays as 7.34% doesn’t imply that fund gives you 7.34% returns all through the interval.

Conclusion – Personally I’m proud of this product. Primarily as a result of for me the generic definitions of debt funds are all the time used to scare (particularly publish Franklin AMC challenge). I hope that different fund homes will even observe this pattern.