Submit Views:

2,344

It’s frequent information now that benchmark Indian & US (S&P 500) indices are

down by 16% & 21% respectively with some shares down by greater than 50%. The sharp uptick in yields brought on the mark to market losses in long-term debt

devices. There may be numerous chaos not too long ago after Russia’s assault on Ukraine

and the market appears directionless & confused on the best way ahead.

On this

piece, we are attempting to know what the longer term holds and the way we are able to put together our

funding portfolio to take care of future outcomes.

However first a

fast recap.

After the

subprime disaster in 2008, many developed nations’ Central Banks began

printing cash and flooding the worldwide economies with low cost liquidity. The

quantum of cash printing jumped massively after Corona-led financial shutdowns.

US Fed elevated its stability sheet measurement from ~$4-4.5 trillion to ~$8-8.5

trillion in a span of simply 2 years.

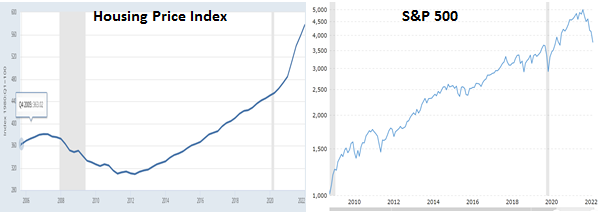

The liquidity help since 2008 and large stimulus publish March 2020 has inflated all of the asset costs be it fairness, debt, or actual property.

Stimulus

cheques and wealth impact strongly boosted demand for items

and providers whereas provide facet points that cropped up throughout lockdowns weren’t

addressed fully and relatively obtained aggravated after Russia’s assault on

Ukraine.

There may be an

eerie similarity between what’s occurring now and what occurred in 1972-73 – free

financial coverage adopted by crude shock. To raised perceive the good

inflation and resultant end result within the Nineteen Seventies, you might learn it right here.

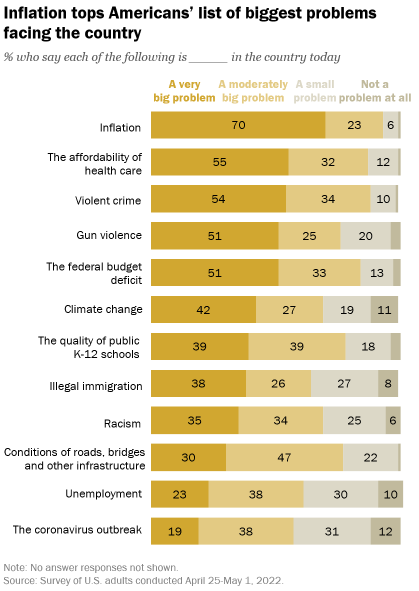

Imbalances in provide and demand resulted in rising in lots of generally used commodities. This resulted in inflation to the degrees final seen 40 years in the past in lots of developed economies.

Inflation has now turn out to be a serious political situation. To make sure the soundness of the Authorities and maintain its recognition maintained, the policymakers are pressured to work out options to curb inflation and inflationary expectations.

The answer is straightforward – reverse the elements that brought on inflation within the first place i.e., suck out the surplus liquidity and enhance the rates of interest, the train which often resulted in recession a number of instances previously. However this answer is tough to implement. Why? As a result of the huge stage of debt issuance at low-interest charges will begin getting defaulted in a good liquidity situation which may deepen the recession resulting in excessive job losses and public backlash.

Subsequently, we’re at a crossroads, and it’s very tough to determine the best way ahead. Nevertheless, we are able to consider three attainable situations forward:

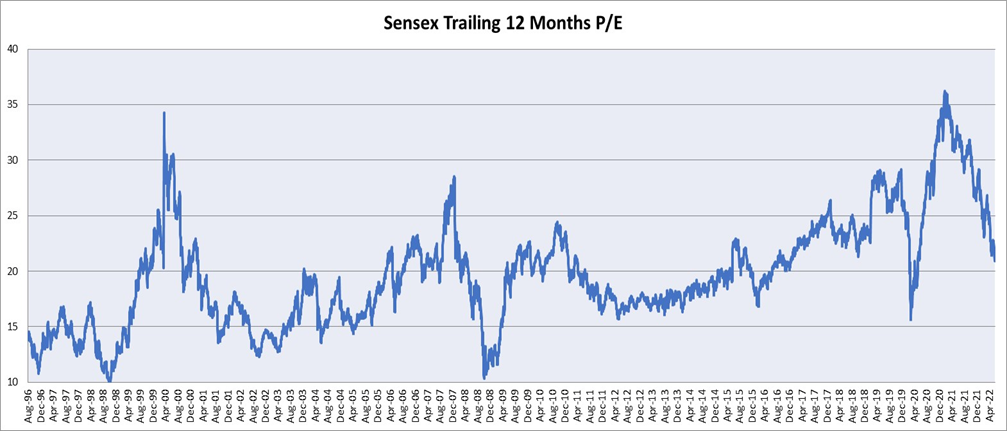

No matter what situation will pan out, fairness valuations inevitably have to regulate in keeping with the precept of imply reversion. This means one thing that has gone a lot above the long-term median ranges will go down a lot beneath the median ranges to make sure long-term median ranges are maintained.

Within the graph beneath of TTM (trailing twelve months) Sensex PE ratio during the last 22 years, Sensex PE has at all times reverted to the imply of 20x. After the peak circumstances have materialized, the backside has finally fashioned after a correction of greater than 50%.

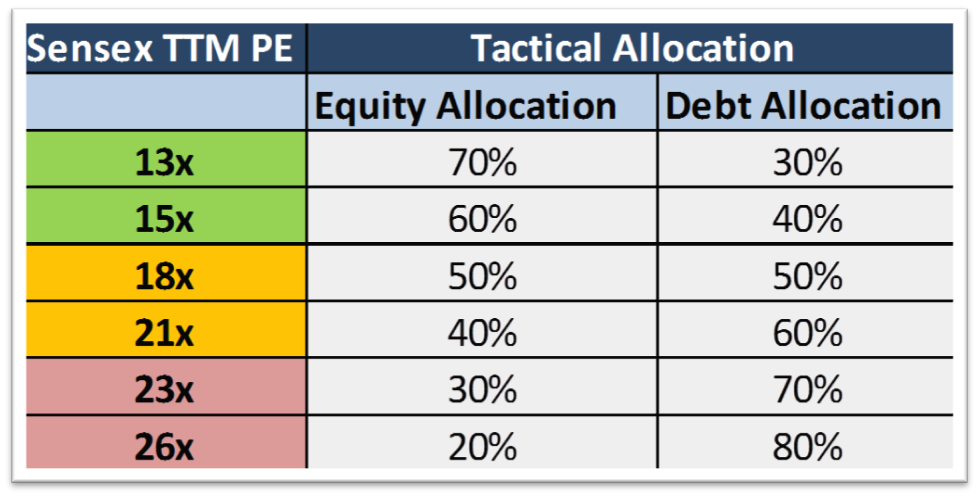

With a lot uncertainty round future outcomes, it’s at all times vital to place the portfolios based mostly on prospects relatively than certainties. The end result of the attainable situations would work higher in our favor if we align the portfolio based mostly on the danger profile (the issue we are able to considerably management) and market valuation ranges, that decide the utmost draw back threat to our investments. This technique based mostly on prospects is named tactical asset allocation which at all times results in larger portfolio returns at a given stage of threat.

Under is the pattern asset allocation plan for a reasonable threat profile investor for reference:

For extra detailed studying in regards to the dynamic asset allocation technique, click on the hyperlink right here.

Moreover, one ought to at all times bear in mind – to make long-term excessive returns from an funding portfolio with fairness publicity, one must embrace unfavorable returns through the funding journey.

Sticking to the asset allocation with utmost self-discipline when everyone seems to be shedding their thoughts is the stuff of a powerful character. Embracing unfavorable returns and benefiting from them is a part of the method of profitable investing. The realized ones know that the trail to nirvana goes via tough terrain.

PS: You can even watch the recording of the web session on this subject by clicking right here.