The Securities and Change Fee, by legislation, will get between 60 and 75 days to overview proposed new funds earlier than they are often supplied on the market to the general public. Every month we survey actively managed funds and ETFs within the pipeline. Summer season is a gradual time for brand new fund launches, with the pipeline filling up in November in anticipation of reaching the market by December 30.

Many new funds, like many present funds, are dangerous concepts. (Actually, you need an ETF that invests in a single AI inventory?) Most will flounder in rightful obscurity. That mentioned, every month brings some promising choices that buyers may select to trace.

Two, or maybe two level 5, so as to add to your radar:

Fund One: Genoa Opportunistic Earnings ETF

Genoa Opportunistic Earnings ETF (XFIX) will attempt to maximize complete return, together with each earnings and appreciation, by figuring out undervalued and opportunistic sectors and securities within the U.S. fixed-income markets. The fund is actively managed and can cost 0.45%. The technique is opportunistic and largely unconstrained – bonds, business paper, derivatives, most popular, and convertible shares are all truthful recreation – besides that it’s capped at 20% non-investment grade and 20% muni bonds. Will probably be managed by Peter Baden, Chief Funding Officer of Genoa Asset Administration, Justin Hennessy, and Marcin Zdunek of North Slope Capital.

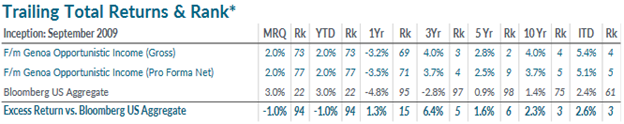

Typically, I might shrink back from funds whose funding pitch comes right down to “belief us.” That mentioned, Messrs Baden and Hennessy additionally run the f/m Genoa Opportunistic Earnings technique for personal purchasers. As of their 3/31/2023 reality sheet, the technique has steadily outperformed the mixture bond market over prolonged intervals.

The rank column is expressed as a percentile; over the previous 10 years, it’s within the high 10% of comparable individually managed accounts whereas year-to-date by way of 3/31 it’s within the backside 27%. Different knowledge within the factsheet present five-year danger metrics which are broadly favorable to the broad bond markets.

Fund Two: Dynamic Alpha Macro Fund

The Dynamic Alpha Macro Fund (DYMAX) intends to pursue above-market returns. “Macro” refers to main macroeconomic themes akin to development charges, rates of interest, and inflation that assist form the portfolio. Roughly 50% of the portfolio will likely be invested in home shares (by way of ETFs which will likely be cut up 40% development, 40% excessive div, and 20% “broad market”) and 50% in a futures buying and selling technique. That technique, at the moment embodied in a hedge fund, will opportunistically goal six asset lessons: currencies, debt, equities, vitality, metals, and agriculture. The technique holds each lengthy and brief positions.

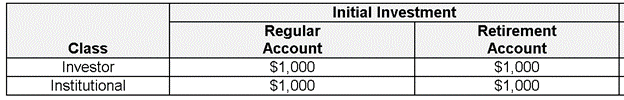

The fund’s bills are excessive (2.39% Investor, 1.99% Institutional) however the Institutional class carries a prospectus minimal of $1,000.

The fairness technique will likely be managed primarily by Bradley Barrie and the futures technique by David Johnson. Mr. Barrie has earned his CFP and ChFC credentials, is the founding father of the fund’s adviser and, in 2017, based Dynamic Alpha Group which assisted monetary advisors with funding portfolio creation and administration. Mr. Johnson manages the GCM hedge fund which, de facto, represents 50% of the portfolio. Mr. Johnson started his profession at NASA as a methods engineer on the Area Shuttle program and labored for 22 years at Honeywell Area System as an engineer and supervisor. You may be stunned as to what number of funding managers are skilled in engineering, arithmetic, or pc science quite than in conventional finance applications. Each managers are Star Trek followers and have met Captain Kirk personally.

I spoke with the staff for the higher a part of an hour in June 2023. They make wise arguments – that in investing, the entire could be better than the sum of its components if the components are (a) individually enticing and (b) uncorrelated – and declare that Mr. Johnson’s hedge fund has a considerable and spectacular efficiency file. They’re working with two units of compliance groups to determine how a lot of that data they’ll share and with whom. It’s doable, for instance, that they’ll be forbidden from sharing with poor unsophisticated “retail” buyers however permitted to supply substantiation to classy advisors and different professionals.

They’ve concluded that the hedge fund technique by itself is probably going “too spicy” for both the common retail investor or common advisor, however that the mix of the 2 methods can be far more palatable. Within the ideally suited world, they could aspire to supply – over affordable time intervals – one thing close to or above the returns of the S&P 500 with 50% of the draw back. They acknowledge the work of the Standpoint Multi-Asset Fund staff, about whom we’ve written (Standpoint Multi-Asset Fund: Forcing Me to Rethink, 2021), as consultant of the potential of the blended technique.

We’ll have an interest to see what efficiency knowledge they’re permitted by regulators to share.

Whereas they understood the final advertising and marketing attractiveness of launching this technique in an ETF wrapper, their technique just isn’t properly match to the disclosure and reporting necessities even of a semi-transparent ETF.

The fund’s bills are excessive (2.39% Investor / 1.99% Institutional), which is typical of such methods. What just isn’t typical is that the Institutional class has a $1,000 minimal.

That makes the attraction of the Investor class a bit fuzzy to me, however we take wins the place we will get them.

Nearly making the lower: Polen Capital World Progress ETF

Polen Capital World Progress ETF (PCGG) would be the ETF model of the Polen Progress Progress Fund. Will probably be a non-diversified, actively-managed exchange-traded fund holding 25 to 40 large-cap shares, together with these in rising markets. Identical administration staff, and so they combine “materials environmental, social, and governance (ESG) elements” into their analysis of an organization’s long-term monetary sustainability.

Since its inception, the fund has kind of smoked the competitors.

Comparability of Lifetime Efficiency (Since 201501)

| Annual returns | Max Drawdown | Commonplace deviation | Draw back deviation | Ulcer Index |

Sharpe Ratio |

|

| Polen World Progress | 10.4% | -35.6 | 15.9 | 10.7 | 10.7 | 0.58 |

| World Giant-Cap Progress Class Common | 9.0 | -35.5 | 17.3 | 11.5 | 11.3 | 0.46 |

Supply: MFO Premium fund screener

There are two yellow flags that made me hesitate. First, the robo-Morningstar lately downgraded the fund’s ranking from “impartial” to “adverse.” I’m skeptical of the robo-judgment however I additionally understand that it’s incorporating knowledge factors that may be materials however won’t but be instantly obvious to me. Second, the fund’s three- and five-year file towards its friends considerably lags its long-term file.

There are two yellow flags that made me hesitate. First, the robo-Morningstar lately downgraded the fund’s ranking from “impartial” to “adverse.” I’m skeptical of the robo-judgment however I additionally understand that it’s incorporating knowledge factors that may be materials however won’t but be instantly obvious to me. Second, the fund’s three- and five-year file towards its friends considerably lags its long-term file.

Polen typically could be very, very stable. I’d be hopeful in regards to the ETF and longing for the prospect of less-expensive entry to the technique. I say “hopeful” as a result of ETFs are typically marketed on value, however the draft prospectus doesn’t record an expense ratio but.