The earlier put up Choose Out of Underpayment Penalty in TurboTax coated how TurboTax calculates an underpayment penalty that the IRS might not really assess. It’s important to take an additional step to say no the penalty calculated by TurboTax. Right here’s one other instance of TurboTax offering undesirable assist that requires work to reverse.

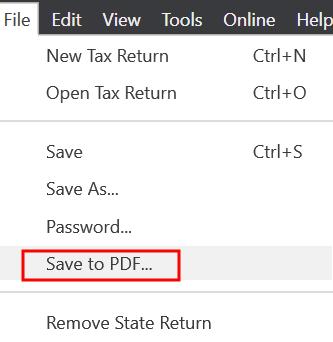

Print or Save to PDF

While you’re performed coming into all the things into TurboTax, it’s a good suggestion to print the tax types or create a PDF file with all of the types as a draft. It’s best to evaluation the types rigorously and examine them with the earlier yr earlier than you file. After you evaluation all the things and e-file, you must save the ultimate submitting to a PDF file on your data. TurboTax obtain software program has a helpful menu possibility for that: File -> Save to PDF.

Estimated Tax Cost Vouchers

TurboTax mechanically contains 4 filled-out estimated tax fee vouchers (Kind 1040-ES) while you print or save a PDF. This confuses many individuals. Most individuals pay their taxes throughout the yr by way of withholding. Having the estimated tax fee vouchers printed out or included within the PDF doesn’t imply it’s essential to pay estimated taxes now.

The estimated tax fee vouchers are additionally a relic of the previous. Even should you’re required to pay estimated taxes, sending a test with these vouchers by snail mail isn’t one of the best ways to do it anyway. You’re higher off paying electronically on the IRS web site utilizing both Direct Pay or EFTPS.

Direct Pay doesn’t require establishing an account however you possibly can’t pre-schedule funds. EFTPS requires establishing an account however subsequent funds are simpler and sooner and you may pre-schedule funds.

While you use Direct Pay or ETFPS, you get a affirmation from the IRS of your fee instantly and you realize that the fee will likely be credited to your account precisely. You might have extra possibilities of delay and errors should you ship a test by mail with a type of estimated tax fee vouchers. I take advantage of EFTPS.

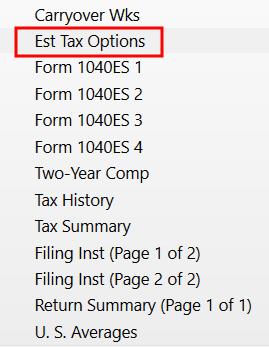

Exclude from Print or PDF

Having estimated tax fee vouchers printed out confuses you. Having them included in your tax submitting PDF clutters up your file. Should you’d wish to keep away from confusion, right here’s how one can cease TurboTax obtain software program from together with them.

Click on on Varieties on the highest proper.

Scroll down and click on on “Est Tax Choices” close to the underside of the listing of types on the left.

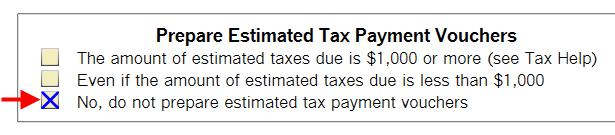

Scroll down on the fitting to seek out the heading “Put together Estimated Tax Cost Vouchers” in the course of the shape. Verify the choice “No, don’t put together estimated tax fee vouchers.”

Click on on Step-by-Step on the highest proper to get again to the place you have been.

Now save to PDF or print your types. It gained’t have these ineffective estimated tax fee vouchers.

Say No To Administration Charges

If you’re paying an advisor a proportion of your property, you might be paying 5-10x an excessive amount of. Learn to discover an unbiased advisor, pay for recommendation, and solely the recommendation.