On this article, Vijay discusses tips on the right way to construct a direct fairness portfolio. That is the second a part of the sequence. The primary half is right here: How one can construct a direct fairness portfolio – Half 1.

In regards to the writer: Vijay is an electronics engineer and administration graduate (IIM Bangalore). He has labored as a technical skilled within the automotive trade for the final 25 years. He has an energetic curiosity in topics associated to macro Economics, wealth constructing and expertise issues. He has an investing expertise of shut to fifteen years in fairness and mutual funds.

Observe: Opinions revealed by visitor authors don’t signify the views of freefincal or its editors.

In regards to the article: That is an try and assimilate the learnings associated to portfolio constructing from totally different practitioners, together with my private experiences with direct fairness investing.

Allow us to begin by defining the broader targets of Fairness portfolio constructing.

- To persistently and comfortably beat inflation (by a delta of 2-3%)

- To fulfill private targets. Objectives may be totally different for various folks relying on the chance urge for food. Instance of targets might be constructing a pension corpus for retirement investing, to generate revenue via income to purchase actual property in some years and so on. Therefore, a broad spectrum exists with buying and selling on one aspect and investing on different aspect. Even inside investing, there may be a number of methods based mostly on danger tolerance stage of particular person investor.

- If the Easy Objective of investing in Inventory market is to simply beat inflation whereas the investor doesn’t have time or wish to spend time analyzing a number of shares, then the only means can be to put money into Index Funds which have a low Expense ratio. As now we have seen above, the Nifty and Sensex would develop over a time frame enabling one to comfortably beat the inflation charges.

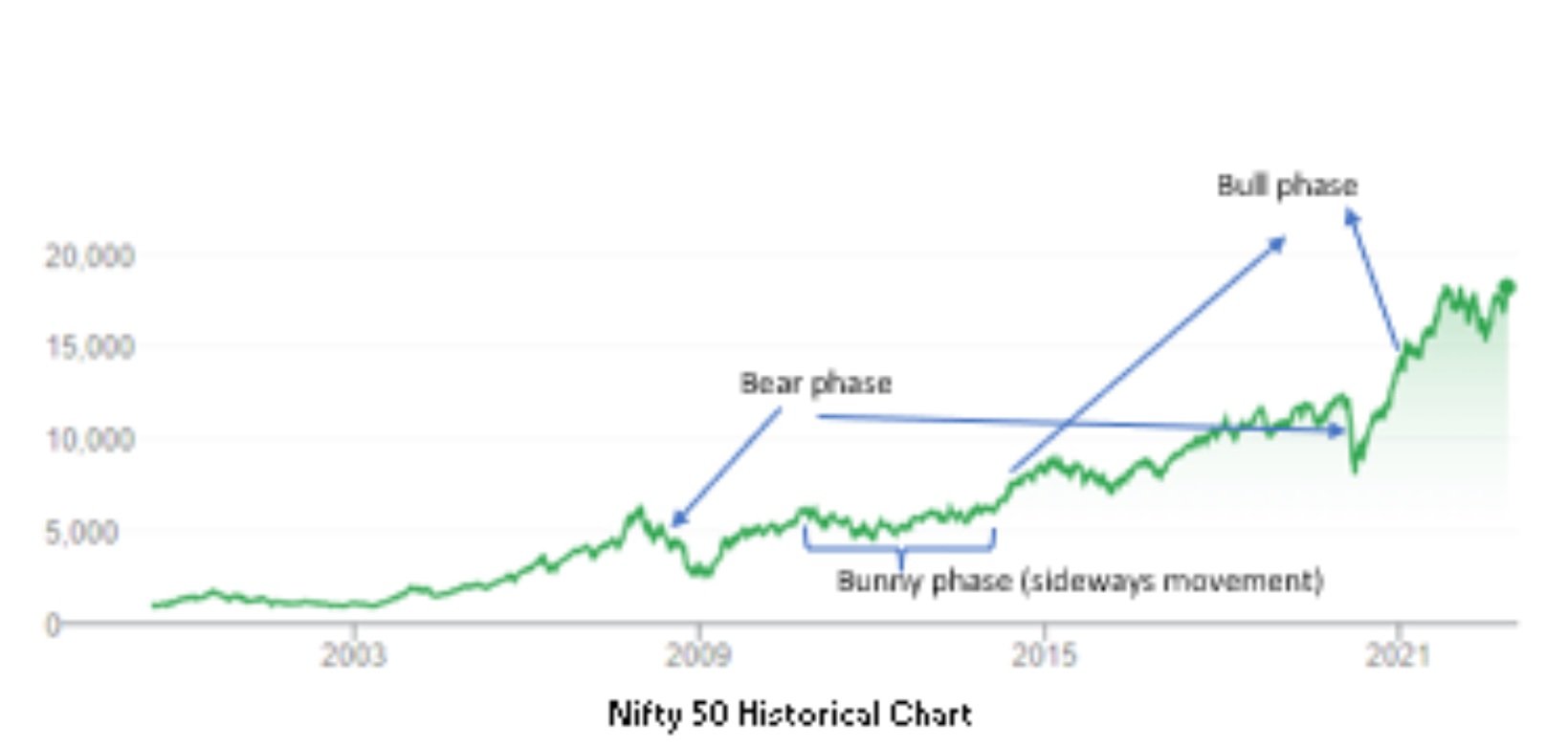

Observe: If you happen to comply with this technique, the belief is that you’re not investing your total technique of financial savings into the Index. If you happen to comply with the inventory market, there may be 3 differing types (see graphic beneath):

- Bull market: Indices preserve going up (~20% of total time horizon)

- Bear market: Indices preserve happening (~10 – 15 % of total time horizon)

- Bunny market: Aspect wards motion of indices (~70% of the time)

As there may be intervals the place Index can transfer sidewards for months as you possibly can see above, no actual progress of wealth is feasible in a shorter time-frame. Moderately in case you have invested in Index throughout Bunny market section after which a Bear market begins, you possibly can find yourself shedding cash in case you wish to withdraw the cash. Therefore, having an total money move administration technique needs to be advanced after consulting your Monetary advisor (i.e. Don’t put all eggs in a single basket).

- Throughout aspect methods motion section, it’s advisable to speculate by way of SIP’s that permits you to do averaging.

- Don’t panic throughout Bunny market or Bear market phases because the Index will go up over the long run. Therefore, it is very important preserve your SIP’s going. To borrow the well-known quote from Buffet “Be grasping when others are fearful”, do one-time investments along with your ordinary SIP’s in Bear market phases. This can will let you make higher returns when the market comes up.

- For buyers who actually look to construct a Porfolio past Index funds, you must divide the Portfolio into 2 components – Core advert Non Core.

- Core : That is the basket of shares that you’re going to determine and accumulate over the long run so as to attain your funding targets {i.e BUY and FORGET}.

- Non Core: That is an opportunistic basket the place you make some actions to benefit from brief time period market actions.If you happen to additionally do Buying and selling, then Swing Buying and selling, Intra day, Future & Choices come on this basket.

- If you happen to plan to be solely an investor, then you possibly can solely put money into Index funds and preserve this in Non core basket.

Warning: You will need to perceive that it isn’t essential to take larger danger like F&O to fill your Non core portfolio. The purpose right here is that the revenue which might be gained from this brief time period actions must be moved from Non Core to Core Portfolio. If you’re having solely Index funds in Non core, then the technique needs to be to rotate money by promoting Index funds after a breakout is completed and purchase core shares or deploy in Liquid funds (ready for reinvestment).

Money Rotation: As an investor, you additionally must have a technique of money rotation from Non core to Core. Keep in mind the way in which you develop your wealth is if you reinvest your income which once more grows. While you see markets giving clear breakout, you must wait until that bull run is completed and market finds a brand new consolidation zone. Revenue reserving shall be carried out at this level and rotate the capital to core portfolio.

Keep away from Excessive Debt firms: As a part of your core portfolio, don’t choose firms or trade which have excessive debt. Firms could make natural growth by ploughing again their operational income. One other means of growth is to take debt from Public sector banks, Non-public banks or from Bond market. When rates of interest are elevated by RBI, this might severely improve the curiosity funds for the businesses who’re extremely leveraged. We’ve seen the case of well-known industrialists who filed for chapter when they’re unable to pay the excessive money owed. Therefore, as a suggestion don’t purchase firms the place debt is fairness ratio is greater than 0.2 – 0.3

Placing a Steadiness: Don’t make investments solely in shares in an trade but to mature. At a broad stage, you possibly can classify industries into Over matured, Mature and Underneath matured. An instance of Over matured trade might be Oil or Sugar the place there isn’t any new innovation that’s occurring. Alternatively, Electrical automobiles trade in India proper now can’t be referred to as as Mature. Although you possibly can have an EV inventory as a part of your core portfolio, the recommendation right here is to not have solely shares picked from Underneath matured industries.

Portfolio diversification: When constructing a core portfolio, determine 4 – 5 sectors and choose good high quality shares in these sectors. When doing this, have a suggestion to not make investments greater than 5% – 10% in any single inventory in your core portfolio.

When choosing shares for core portfolio, select firms which might be larger in worth chain than the decrease ones. For instance, a Tyre firm or an organization that makes wiring harness for automobiles are decrease down within the worth chain (B2B) than Maruti who promote to prospects (B2C). B2B firms have much less bargaining energy than those that purchase from them when there’s good competitors. Reference: Learn Porter’s 5 forces mannequin to grasp this higher.

Endurance: Upon getting carried out analysis and picked a inventory in your Core portfolio, keep it up. Sooner or later in time, some shares in your Portfolio may be purple. We are going to deal later with the right way to choose a inventory and the essential analysis you must do. Except there are clear elementary shifts within the causes for which you selected the inventory, don’t get upset or bask in panic promoting. Keep in mind, we’re talking about long-term investing right here.

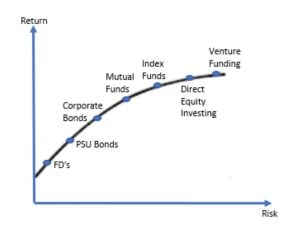

Understanding the Threat Reward curve: As you possibly can see within the risk-reward curve, direct fairness funding if carried out proper carry the next reward and therefore larger danger as properly in comparison with different investments like FD’s or Mutual Funds. As an investor ages, you must come in the direction of the left aspect of danger curve. For instance, you possibly can make investments extra in Mutual funds and Direct fairness when you’re in your 30’s whereas the main focus ought to shift in the direction of secure devices like FD’s and debt funds in your 60’s.

Conclusion: Constructing a Portfolio is a long-distance journey. The above tips on Portfolio constructing ought to maintain you in good stead. Good and constant analysis on figuring out shares that can kind your core portfolio is of paramount significance {80% of job carried out}. We are going to cope with the topic on the right way to determine good shares within the subsequent articles.

Do share this text with your pals utilizing the buttons beneath.

🔥Get pleasure from huge reductions on our programs and robo-advisory instrument! 🔥

Use our Robo-advisory Excel Device for a start-to-finish monetary plan! ⇐ Greater than 1000 buyers and advisors use this!

- Observe us on Google Information.

- Do you may have a remark concerning the above article? Attain out to us on Twitter: @freefincal or @pattufreefincal

- Be a part of our YouTube Neighborhood and discover greater than 1000 movies!

- Have a query? Subscribe to our publication with this kind.

- Hit ‘reply’ to any e-mail from us! We don’t supply customized funding recommendation. We will write an in depth article with out mentioning your title in case you have a generic query.

Discover the location! Search amongst our 2000+ articles for info and perception!

About The Writer

Dr M. Pattabiraman(PhD) is the founder, managing editor and first writer of freefincal. He’s an affiliate professor on the Indian Institute of Expertise, Madras. He has over 9 years of expertise publishing information evaluation, analysis and monetary product improvement. Join with him by way of Twitter or Linkedin or YouTube. Pattabiraman has co-authored three print books: (1) You may be wealthy too with goal-based investing (CNBC TV18) for DIY buyers. (2) Gamechanger for younger earners. (3) Chinchu Will get a Superpower! for youths. He has additionally written seven different free e-books on numerous cash administration matters. He’s a patron and co-founder of “Payment-only India,” an organisation for selling unbiased, commission-free funding recommendation.

Dr M. Pattabiraman(PhD) is the founder, managing editor and first writer of freefincal. He’s an affiliate professor on the Indian Institute of Expertise, Madras. He has over 9 years of expertise publishing information evaluation, analysis and monetary product improvement. Join with him by way of Twitter or Linkedin or YouTube. Pattabiraman has co-authored three print books: (1) You may be wealthy too with goal-based investing (CNBC TV18) for DIY buyers. (2) Gamechanger for younger earners. (3) Chinchu Will get a Superpower! for youths. He has additionally written seven different free e-books on numerous cash administration matters. He’s a patron and co-founder of “Payment-only India,” an organisation for selling unbiased, commission-free funding recommendation.

Our flagship course! Be taught to handle your portfolio like a professional to attain your targets no matter market situations! ⇐ Greater than 3000 buyers and advisors are a part of our unique neighborhood! Get readability on the right way to plan in your targets and obtain the required corpus it doesn’t matter what the market situation is!! Watch the primary lecture without cost! One-time fee! No recurring charges! Life-long entry to movies! Cut back worry, uncertainty and doubt whereas investing! Discover ways to plan in your targets earlier than and after retirement with confidence.

Our new course! Improve your revenue by getting folks to pay in your abilities! ⇐ Greater than 700 salaried staff, entrepreneurs and monetary advisors are a part of our unique neighborhood! Discover ways to get folks to pay in your abilities! Whether or not you’re a skilled or small enterprise proprietor who desires extra purchasers by way of on-line visibility or a salaried individual wanting a aspect revenue or passive revenue, we’ll present you the right way to obtain this by showcasing your abilities and constructing a neighborhood that trusts you and pays you! (watch 1st lecture without cost). One-time fee! No recurring charges! Life-long entry to movies!

Our new e book for youths: “Chinchu will get a superpower!” is now out there!

Most investor issues may be traced to a scarcity of knowledgeable decision-making. We have all made unhealthy choices and cash errors after we began incomes and spent years undoing these errors. Why ought to our kids undergo the identical ache? What is that this e book about? As mother and father, what would it not be if we needed to groom one skill in our kids that’s key not solely to cash administration and investing however to any facet of life? My reply: Sound Resolution Making. So on this e book, we meet Chinchu, who’s about to show 10. What he desires for his birthday and the way his mother and father plan for it and train him a number of key concepts of choice making and cash administration is the narrative. What readers say!

Should-read e book even for adults! That is one thing that each guardian ought to train their youngsters proper from their younger age. The significance of cash administration and choice making based mostly on their desires and desires. Very properly written in easy phrases. – Arun.

Purchase the e book: Chinchu will get a superpower in your little one!

How one can revenue from content material writing: Our new e-book for these fascinated with getting aspect revenue by way of content material writing. It’s out there at a 50% low cost for Rs. 500 solely!

Need to test if the market is overvalued or undervalued? Use our market valuation instrument (it’s going to work with any index!), otherwise you purchase the brand new Tactical Purchase/Promote timing instrument!

We publish month-to-month mutual fund screeners and momentum, low volatility inventory screeners.

About freefincal & its content material coverage Freefincal is a Information Media Group devoted to offering unique evaluation, stories, opinions and insights on mutual funds, shares, investing, retirement and private finance developments. We achieve this with out battle of curiosity and bias. Observe us on Google Information. Freefincal serves greater than three million readers a yr (5 million web page views) with articles based mostly solely on factual info and detailed evaluation by its authors. All statements made will likely be verified from credible and educated sources earlier than publication. Freefincal doesn’t publish any paid articles, promotions, PR, satire or opinions with out knowledge. All opinions offered will solely be inferences backed by verifiable, reproducible proof/knowledge. Contact info: letters {at} freefincal {dot} com (sponsored posts or paid collaborations won’t be entertained)

Join with us on social media

Our publications

You Can Be Wealthy Too with Objective-Based mostly Investing

Revealed by CNBC TV18, this e book is supposed that can assist you ask the correct questions and search the right solutions, and because it comes with 9 on-line calculators, you can too create customized options in your way of life! Get it now.

Revealed by CNBC TV18, this e book is supposed that can assist you ask the correct questions and search the right solutions, and because it comes with 9 on-line calculators, you can too create customized options in your way of life! Get it now.

Gamechanger: Neglect Startups, Be a part of Company & Nonetheless Stay the Wealthy Life You Need

This e book is supposed for younger earners to get their fundamentals proper from day one! It should additionally aid you journey to unique locations at a low value! Get it or reward it to a younger earner.

This e book is supposed for younger earners to get their fundamentals proper from day one! It should additionally aid you journey to unique locations at a low value! Get it or reward it to a younger earner.

Your Final Information to Journey

That is an in-depth dive evaluation into trip planning, discovering low cost flights, price range lodging, what to do when travelling, and the way travelling slowly is best financially and psychologically with hyperlinks to the online pages and hand-holding at each step. Get the pdf for Rs 300 (instantaneous obtain)

That is an in-depth dive evaluation into trip planning, discovering low cost flights, price range lodging, what to do when travelling, and the way travelling slowly is best financially and psychologically with hyperlinks to the online pages and hand-holding at each step. Get the pdf for Rs 300 (instantaneous obtain)