Up to date on January 16, 2023 with up to date screenshots from TurboTax Deluxe downloaded software program. For those who use different tax software program, see:

For those who did a Backdoor Roth, which entails making a non-deductible contribution to a Conventional IRA after which changing from the Conventional IRA to a Roth IRA, it’s good to report each the contribution and the conversion within the tax software program. For extra data on Backdoor Roth, see Backdoor Roth: A Full How-To.

What To Report

You report on the tax return your contribution to a Conventional IRA *for* that yr, and also you additionally report your conversion to Roth *throughout* that yr.

For instance, if you find yourself doing all your tax return for yr X, you report the contribution you made *for* yr X, whether or not you truly did it throughout yr X or the next yr between January 1 and April 15. You additionally report your conversion to Roth *throughout* yr X, whether or not the contribution was made for yr X, the yr earlier than, or any earlier years.

Subsequently a contribution made throughout the next yr for yr X goes on the tax return for yr X. A conversion finished throughout yr Y after you made a contribution for yr X goes on the tax return for yr Y.

You do your self a giant favor and keep away from a variety of confusion by doing all your contribution for the present yr and ending your conversion in the identical yr. I known as this a “deliberate” Backdoor Roth — you’re doing it intentionally. Don’t wait till the next yr to contribute for the earlier yr. Contribute for yr X in yr X and convert it throughout yr X. Contribute for yr Y in yr Y and convert it throughout yr Y. This manner the whole lot is clear and neat.

If you’re already off by one yr, catch up. Contribute for each the earlier yr and the present yr, then convert the sum throughout the identical yr. See Make Backdoor Roth Straightforward On Your Tax Return.

Use TurboTax Obtain

The screenshots under are from TurboTax Deluxe downloaded software program. The downloaded software program is method higher than on-line software program. For those who haven’t paid to your TurboTax On-line submitting but, you should purchase TurboTax obtain from Amazon, Costco, Walmart, and lots of different locations and change from TurboTax On-line to TurboTax obtain (see directions for the way to make the change from TurboTax).

Right here’s the deliberate Backdoor Roth situation we’ll use for example:

You contributed $6,000 to a conventional IRA in 2022 for 2022. Your revenue is simply too excessive to say a deduction for the contribution. By the point you transformed it to Roth IRA, additionally in 2022, the worth grew to $6,200. You don’t have any different conventional, SEP, or SIMPLE IRA after you transformed your conventional IRA to Roth. You didn’t roll over any pre-tax cash from a retirement plan to a conventional IRA after you accomplished the conversion.

In case your situation is totally different, you’ll have to make some changes to the screens proven right here.

Earlier than we begin, suppose that is what TurboTax exhibits:

We’ll examine the outcomes after we enter the Backdoor Roth.

Convert Conventional IRA to Roth

The tax software program works on revenue gadgets first. Though the conversion occurred after the contribution, we enter the conversion first.

While you convert from Conventional IRA to Roth, you’ll obtain a 1099-R kind. Full this part provided that you transformed *throughout* the yr for which you might be doing the tax return. For those who solely transformed throughout the next yr, you gained’t have a 1099-R till subsequent January. Skip all the way in which to the subsequent part: Non-deductible contribution to Conventional IRA.

In our instance, we assume by the point you transformed, the cash within the Conventional IRA had grown from $6,000 to $6,200.

Enter 1099-R

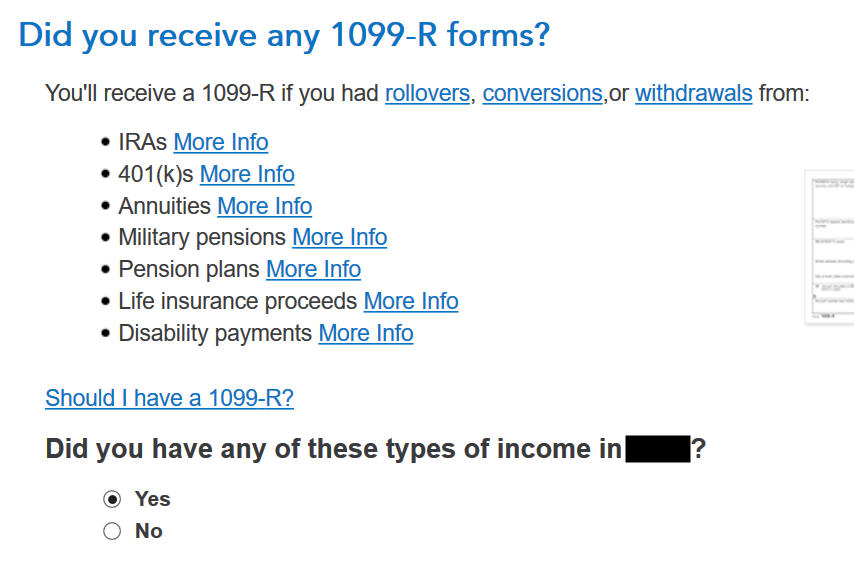

Go to Federal Taxes -> Wages & Revenue -> IRA, 401(ok), Pension Plan Withdrawals (1099-R).

As you’re employed by the interview, you’ll ultimately come to the purpose to enter the 1099-R. Choose Sure, you might have such a revenue. Import the 1099-R when you’d like. I’m selecting to kind it myself.

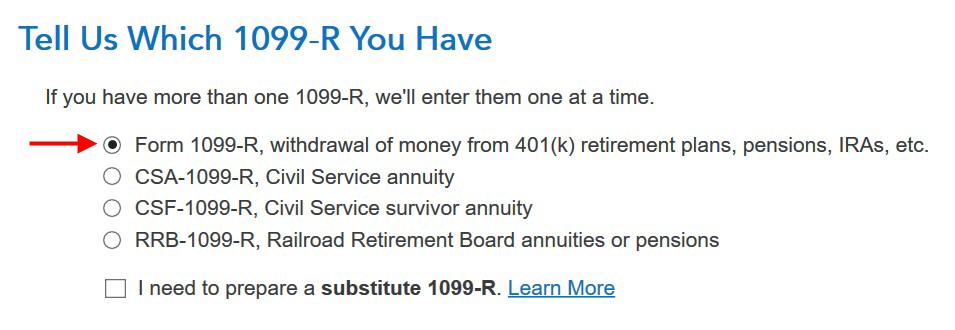

Simply the common 1099-R.

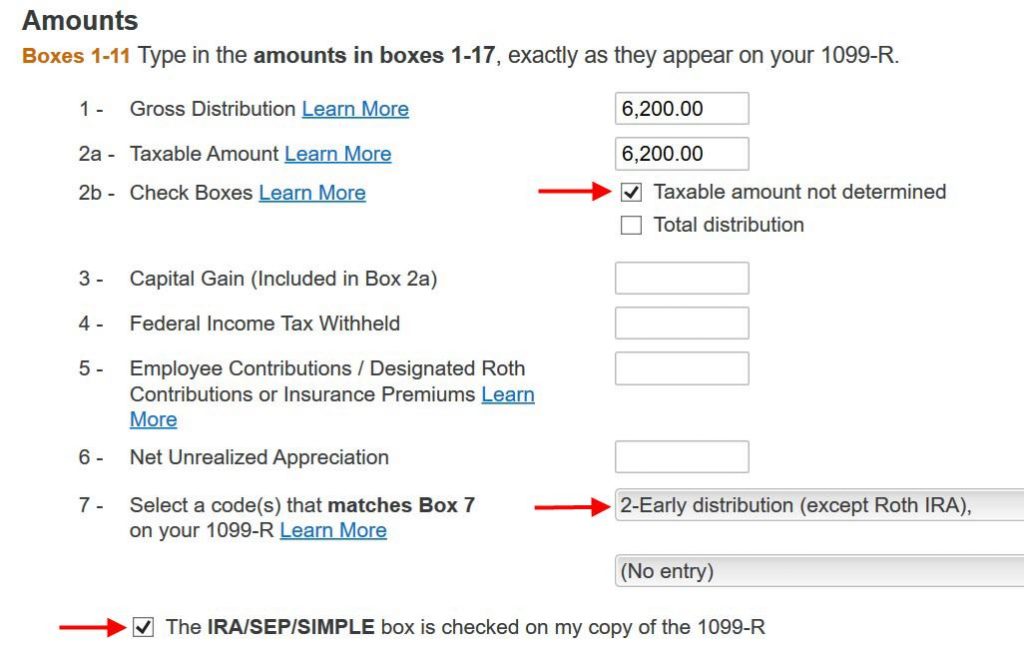

Field 1 exhibits the quantity transformed to Roth IRA. It’s regular to have the identical quantity because the taxable quantity in Field 2a when Field 2b is checked saying “taxable quantity not decided.” Take note of the code in Field 7 and the IRA/SEP/SIMPLE field. Be sure your entry matches your 1099-R precisely.

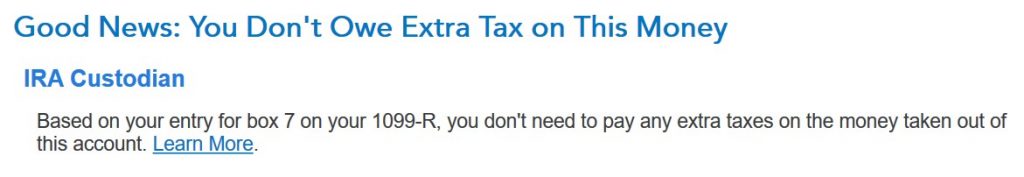

You get this Good Information, however …

Your refund in progress drops quite a bit. We went from $2,384 right down to $858. Don’t panic. It’s regular and momentary.

Transformed to Roth

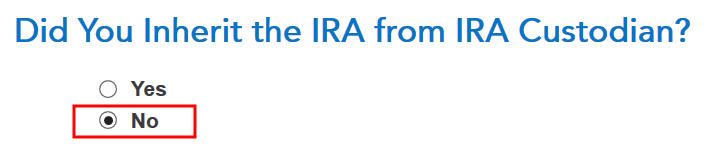

Didn’t inherit it.

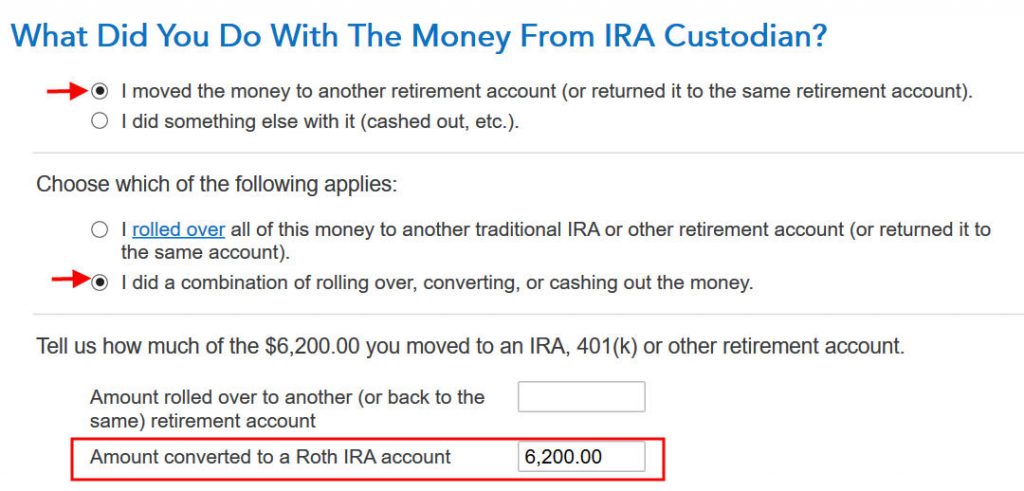

First click on on “I moved …” then click on on “I did a mix …” Enter the quantity transformed within the field. Don’t select the “I rolled over …” possibility. A Roth conversion isn’t a rollover.

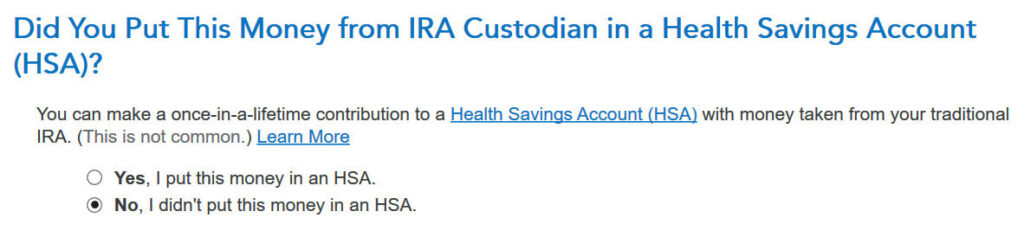

No, you didn’t put the cash in an HSA.

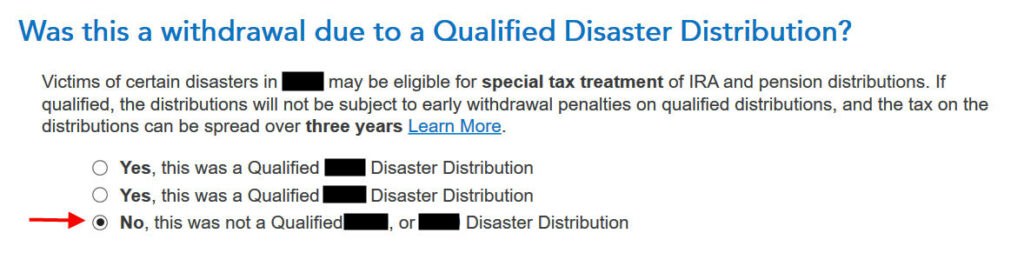

Not attributable to a catastrophe.

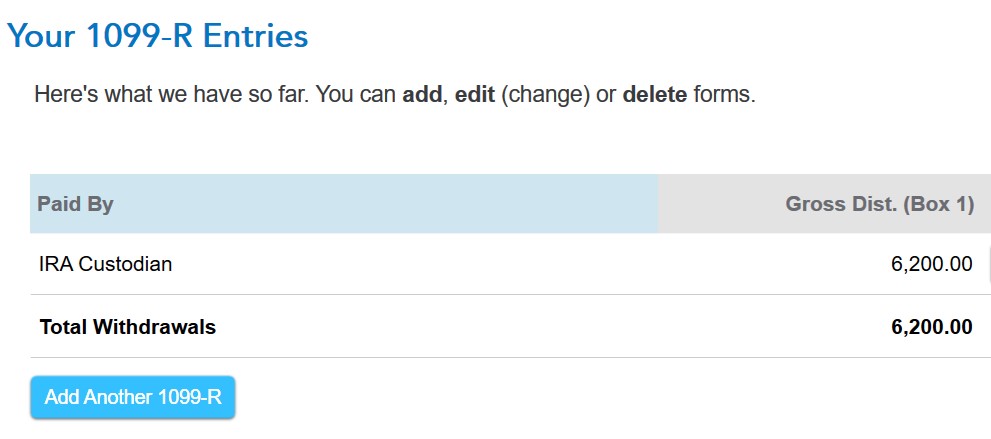

You get a abstract of your 1099-R’s. Repeat the earlier steps so as to add one other when you have multiple. For those who’re married and each of you probably did a Backdoor Roth, enter the 1099-R for each of you, however take note of choose whose 1099-R it’s. Don’t by chance assign two 1099-R’s to the identical individual.

Foundation and Finish-of-12 months Values

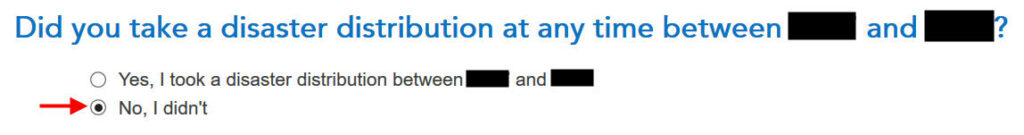

Didn’t take any catastrophe distribution.

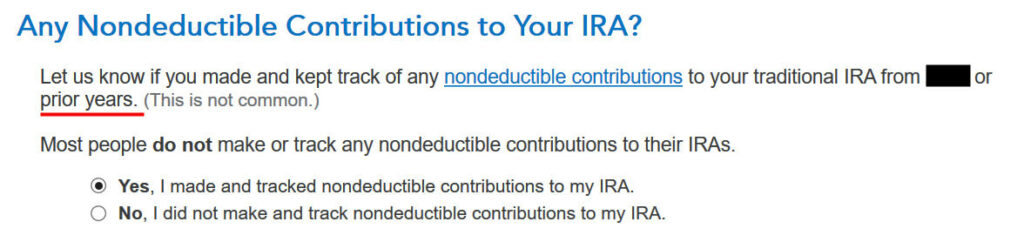

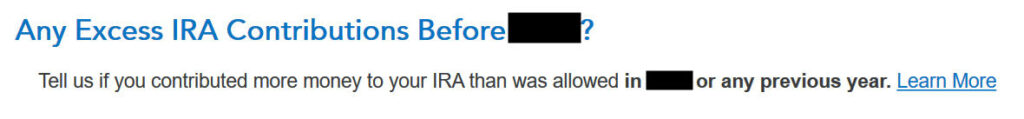

Right here it’s asking in regards to the prior yr carryover. While you’re doing a clear “deliberate” Backdoor Roth as in our instance — contribute for yr X in yr X and convert earlier than the tip of yr X — you’ll be able to reply No right here. For those who contributed for the earlier yr between January 1 and April 15 throughout yr X, reply Sure right here.

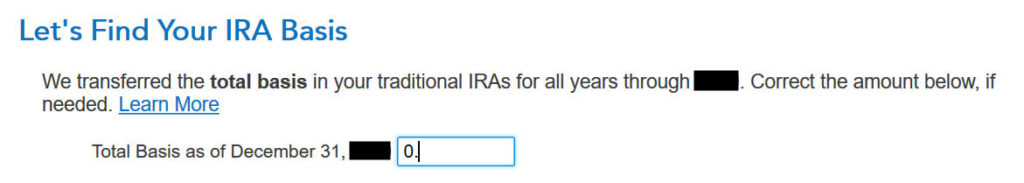

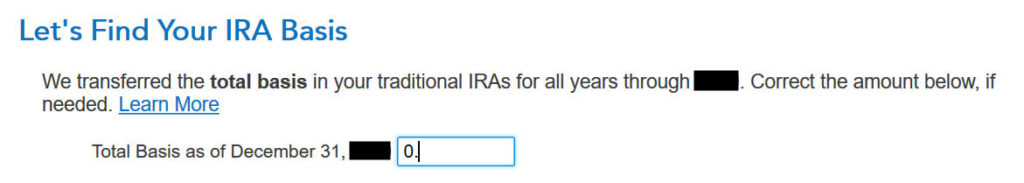

For those who answered Sure to the earlier query and you probably did your earlier yr’s return appropriately additionally in TurboTax, your foundation from the earlier yr will present up right here. For those who did your earlier yr’s tax return unsuitable, repair your earlier return first.

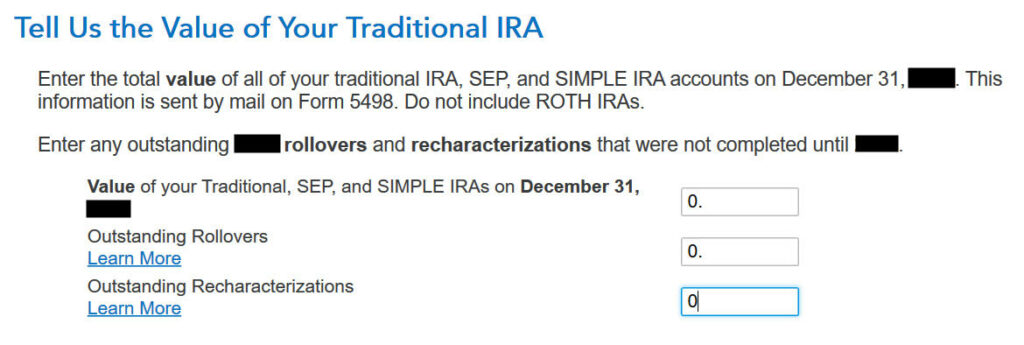

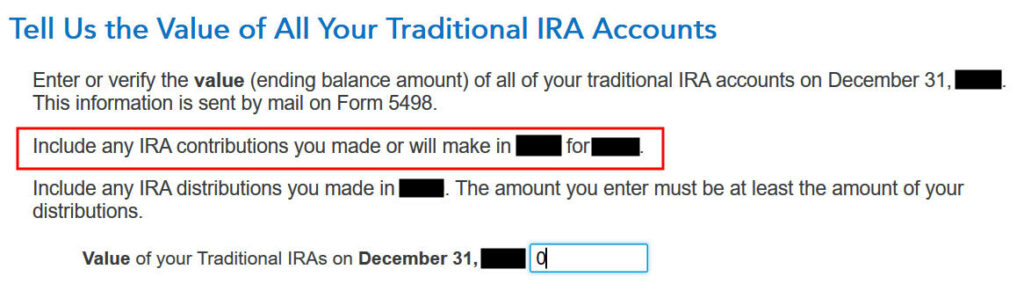

Enter the values on the finish of the yr. We don’t have something in conventional, SEP, or SIMPLE IRAs after we transformed all of it.

That’s it to this point on the revenue aspect. Proceed with different revenue gadgets. The refund in progress continues to be briefly depressed. Don’t fear. It’ll change.

Non-Deductible Contribution to Conventional IRA

Now we enter the non-deductible contribution to a Conventional IRA *for* the yr we’re doing the tax return.

Full this half whether or not you contributed earlier than December 31 otherwise you did it or are planning on doing it within the following yr between January 1 and April 15. In case your contribution through the yr in query was for the yr earlier than, be sure to entered it on the earlier tax return. If not, repair your earlier return first.

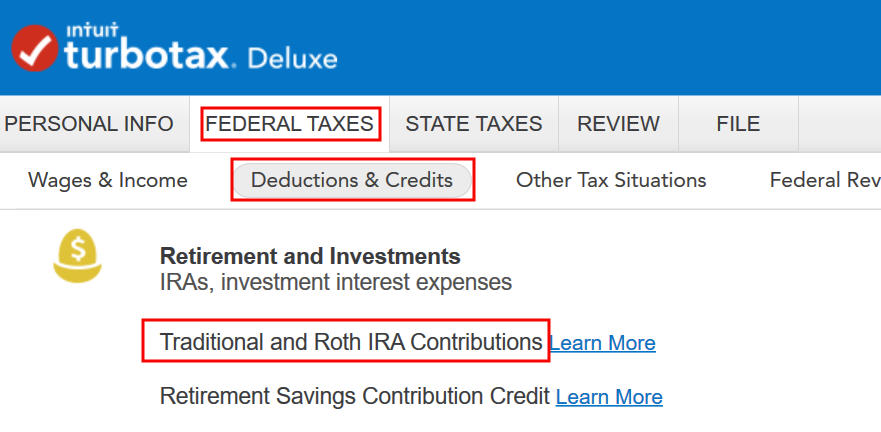

Go to Federal Taxes -> Deductions & Credit -> Conventional and Roth IRA Contributions.

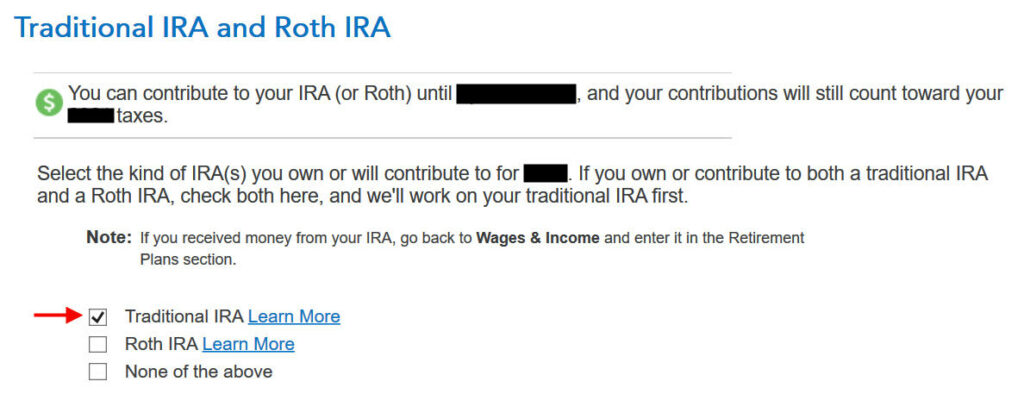

As a result of we did a clear “deliberate” Backdoor Roth, we test the field for Conventional IRA. For those who did a detour if you first contributed to a Roth IRA earlier than you realized your revenue is simply too excessive and also you recharacterized the contribution as to a Conventional IRA, test the field for Roth IRA and reply the questions accordingly.

TurboTax presents an improve however we select to remain in TurboTax Deluxe.

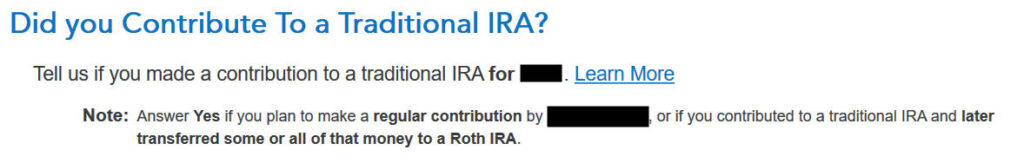

We already checked the field for Conventional however TurboTax simply desires to ensure. Reply Sure right here.

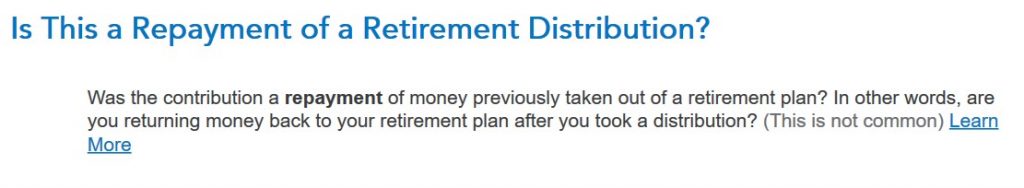

It was NOT a compensation of a retirement distribution.

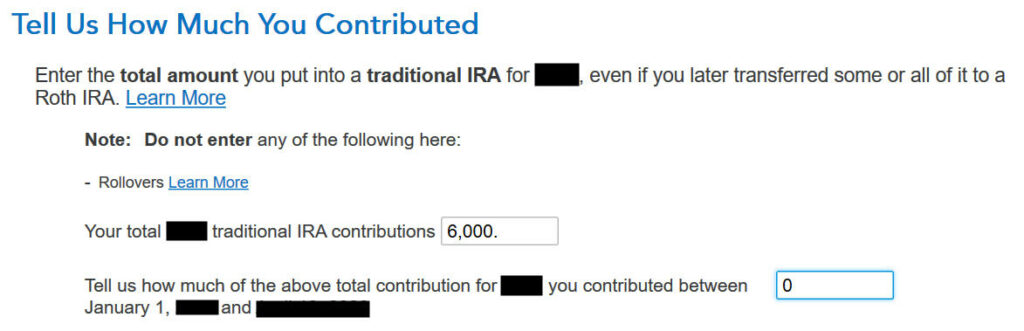

Enter the contribution quantity. As a result of we contributed for yr X in yr X, we put zero within the second field. For those who contributed for the earlier yr between January 1 and April, enter the contribution in each bins.

Instantly our federal refund in progress goes again up! We began with $2,384. It went right down to $858. Now it comes again to $2,335. The $49 distinction is as a result of we’ve got to pay tax on the $200 in earnings once we contributed $6,000 and transformed $6,200. For those who had much less earnings, your refund numbers could be nearer nonetheless.

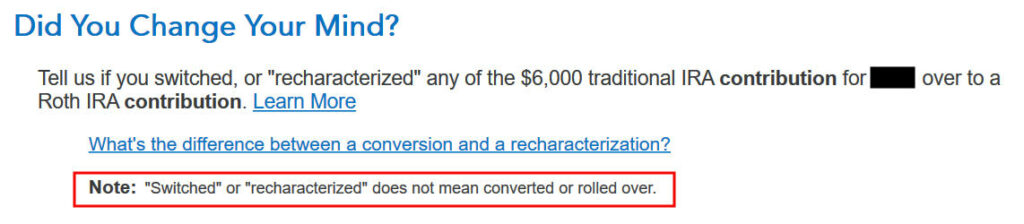

This can be a crucial query. Reply “No.” You transformed the cash, not switched or recharacterized.

Chances are you’ll not get this query when you already entered your W-2 and it has Field 13 for the retirement protection checked. Reply sure when you’re lined by a retirement plan however the field in your W-2 wasn’t checked.

No extra contribution.

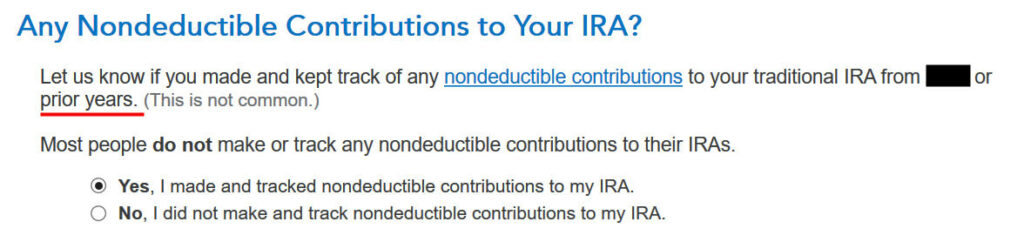

Identical query we noticed earlier than. For a clear “deliberate” Backdoor Roth, we are able to reply No. For those who made non-deductible contribution for earlier years, reply Sure.

Complete foundation by the earlier yr. For those who did your taxes appropriately on TurboTax final yr, TurboTax transfers the quantity right here. For those who made non-deductible contributions for earlier years (no matter when), enter the quantity on line 14 of your Kind 8606 from final yr.

As a result of we did a clear “deliberate” Backdoor Roth, we don’t have something left after we transformed the whole lot earlier than the tip of the identical yr.

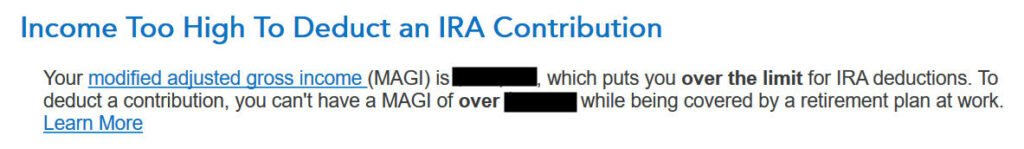

Revenue too excessive, we all know. That’s why we did the Backdoor Roth.

The IRA deduction abstract exhibits $0 deduction, which is anticipated.

Taxable Revenue from Backdoor Roth

After going by all these, would you prefer to see how you might be taxed on the Backdoor Roth?

Click on on Types on the highest proper.

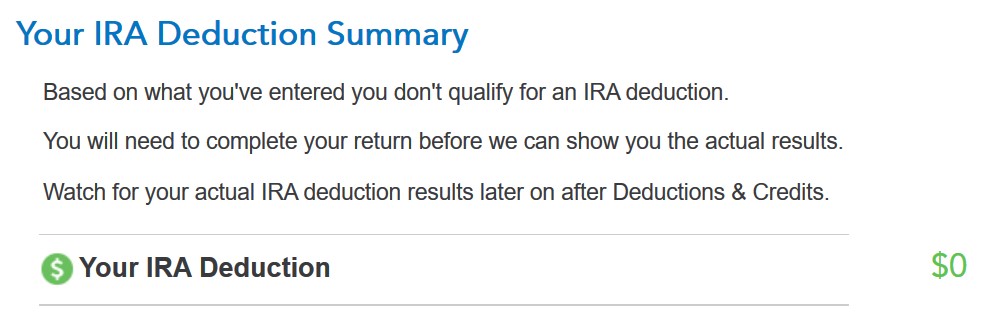

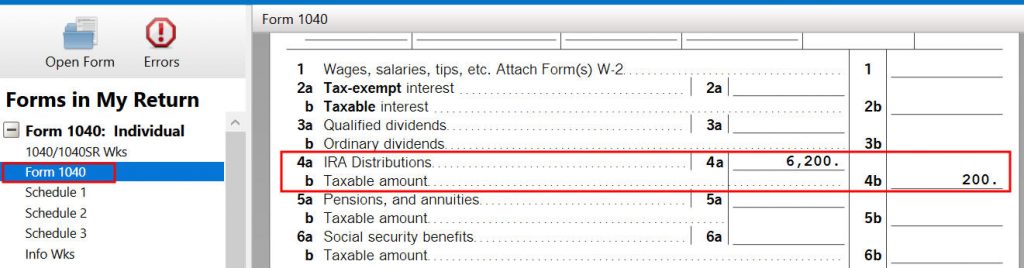

Discover Kind 1040 within the left navigation panel. Scroll up or down on the proper to seek out traces 4a and 4b. They present a $6,200 distribution from the IRA and solely $200 of the $6,200 is taxable. That’s the incomes between the time you contributed to your Conventional IRA and the time you transformed it to Roth.

While you’re finished inspecting the shape, click on on Step-by-Step on the highest proper to return to the interview.

Tah-Dah! You bought cash right into a Roth IRA by the backdoor if you aren’t eligible for contributing to it immediately. That’s why it’s known as a Backdoor Roth. You’ll pay tax on a small quantity in earnings when you waited between contributions and conversion. That’s negligible relative to the advantage of having tax-free development in your contributions for a few years.

Troubleshooting

For those who adopted the steps and you aren’t getting the anticipated outcomes, right here are some things to test.

Recent Begin

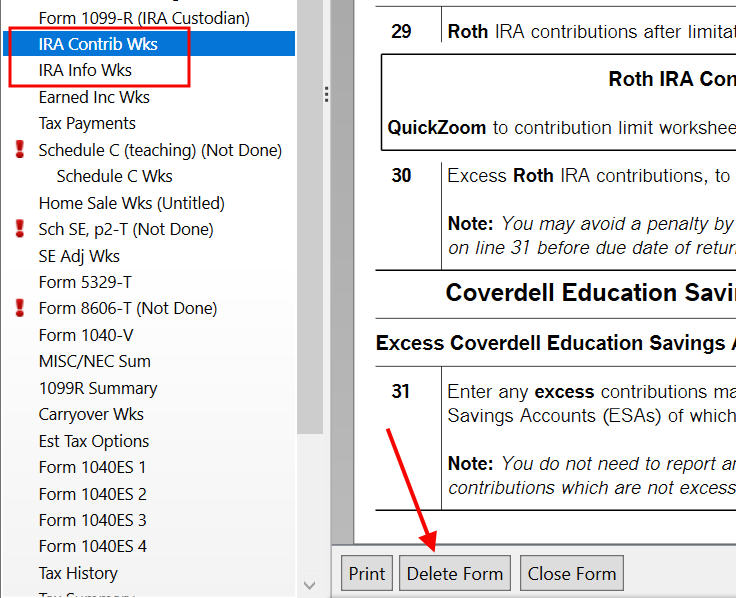

It’s greatest to comply with the steps contemporary in a single go. For those who already went forwards and backwards with totally different solutions earlier than you discovered this information, a few of your earlier solutions could also be caught someplace you now not see. You’ll be able to delete them and begin over.

Click on on Types on the highest proper.

Discover “IRA Contrib Wks” and “IRA Data Wks” within the left navigation pane and click on on “Delete Kind” to delete them. Then you can begin over by following the steps above.

W-2 Field 13

Be sure the Retirement Plan field in Field 13 of the W-2 you entered into the software program matches your precise W-2. If you’re married and each of you might have a W-2, make certain your entries for each W-2’s match the precise varieties you obtained.

When you find yourself not lined by a retirement plan at work, reminiscent of a 401k or 403b plan, your Conventional IRA contribution could also be deductible, which additionally makes your Roth conversion taxable.

Self vs Partner

If you’re married, be sure to don’t have the 1099-R and IRA contribution blended up between your self and your partner. For those who inadvertently entered two 1099-Rs issued to you rather than one for you and one to your partner, the second 1099-R to you’ll not match up with a Conventional IRA contribution made by your partner. For those who entered a 1099-R for each your self and your partner however you solely entered one Conventional IRA contribution, you may be taxed on one 1099-R.

Say No To Administration Charges

If you’re paying an advisor a proportion of your property, you might be paying 5-10x an excessive amount of. Discover ways to discover an impartial advisor, pay for recommendation, and solely the recommendation.