What funding perception do you maintain that the overwhelming majority of your friends (75%+) don’t share?

In 2019, I made a decision to start out publicly answering the query above and including to it over time. You possibly can take a look at the whole thread right here, however my latest podcast with Michael Batnick and Ben Carlson touched on the identical subject so at their ‘nudging,’ I’m sharing the whole checklist beneath too.

Apologies for offending anybody prematurely!

2019

1. Investing based mostly on dividend yield alone is a tax-inefficient and nonsensical funding technique.

See our previous guide, Shareholder Yield: A Higher Strategy to Dividend Investing, for more information, free obtain right here.

2. The Federal Reserve has performed a great job.

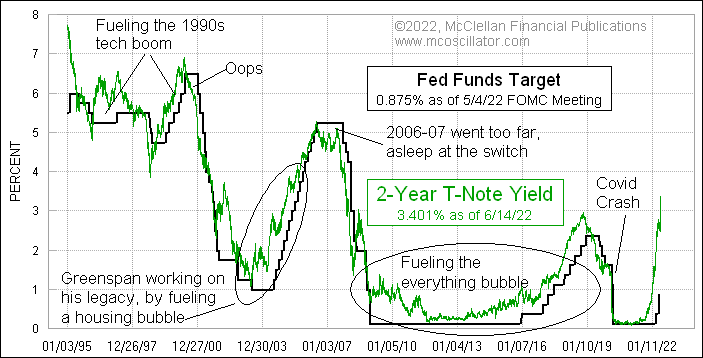

I publicly say on a regular basis that they need to simply peg the Fed Fund Charge to the 2-year, and my pal Tom McClellan has a great chart illustrating this view…

3. Pattern following methods deserve a significant allocation to most portfolios.

We now have most likely the very best pattern allocation of any RIA that I do know with our Trinity fashions, the default allocation is half!

4. A fundamental low price world market portfolio of ETFs will outperform the overwhelming majority of establishments over time.

See our previous GAA guide for more information, free obtain right here.

5. US traders must be allocating a minimal of fifty% of their inventory allocation to non-US international locations.

Take a look at our put up “The Case for International Investing” for more information.

6. 13F replication is a greater method to investing in most long-term hedge funds than investing within the hedge funds themselves.

Make investments with the Home free guide obtain right here.

7. So long as you might have a number of the predominant elements (world shares, bonds, actual property) your asset allocation doesn’t actually matter. What does matter is charges and taxes.

See our previous GAA guide for more information, free obtain right here. Plus, right here’s an previous Twitter thread on the subject.

8. A easy quant display on public shares will outperform most personal fairness funds.

Study extra about this by listening to my previous podcast episodes with Dan Rasmussen & Jeff Hooke.

9. An inexpensive time-frame to guage a supervisor or technique is 10, perhaps 20 years.

We wrote a paper on this subject, you possibly can learn it right here.

10. I don’t really feel like I’ve to have an opinion on Telsa inventory.

Though I’ve shared my opinion with Elon on different subjects earlier than (learn right here)

11. A passive index is just not the identical factor as a market cap index (anymore).

2020

12. Monetary advisors and asset managers are 4x leveraged the inventory market, and will/ought to hedge that publicity….and even personal no US shares!

Learn our longer put up on the subject right here.

13. Most endowments and pensions could be higher off firing their workers and shifting to a scientific portfolio of ETFs.

You needed to know I wrote a weblog put up about this, proper? CalPERS lastly informed me they received’t rent me to do that. I attempted…

2021

14. Everybody likes to complain about manipulation, THE FED, r/wsb, yadda yadda… Markets are functioning as they at all times have. Which is, usually. Brief squeeze? Yawn, been happening perpetually.

Jamie Catherwood had a fantastic put up on the historical past of quick squeezes.

15. Excessive inventory market valuations usually are not justified by low rates of interest.

Learn my put up about this from January 2021 right here.

16. A world diversified portfolio of property is *much less dangerous* than placing your secure cash in brief time period bonds or payments.

This is without doubt one of the subjects coated in The Keep Wealthy Portfolio put up.

2022

17. The CAPE Ratio is a helpful indicator and issue.

Right here’s my FAQ with every thing it’s essential to know concerning the CAPE Ratio.

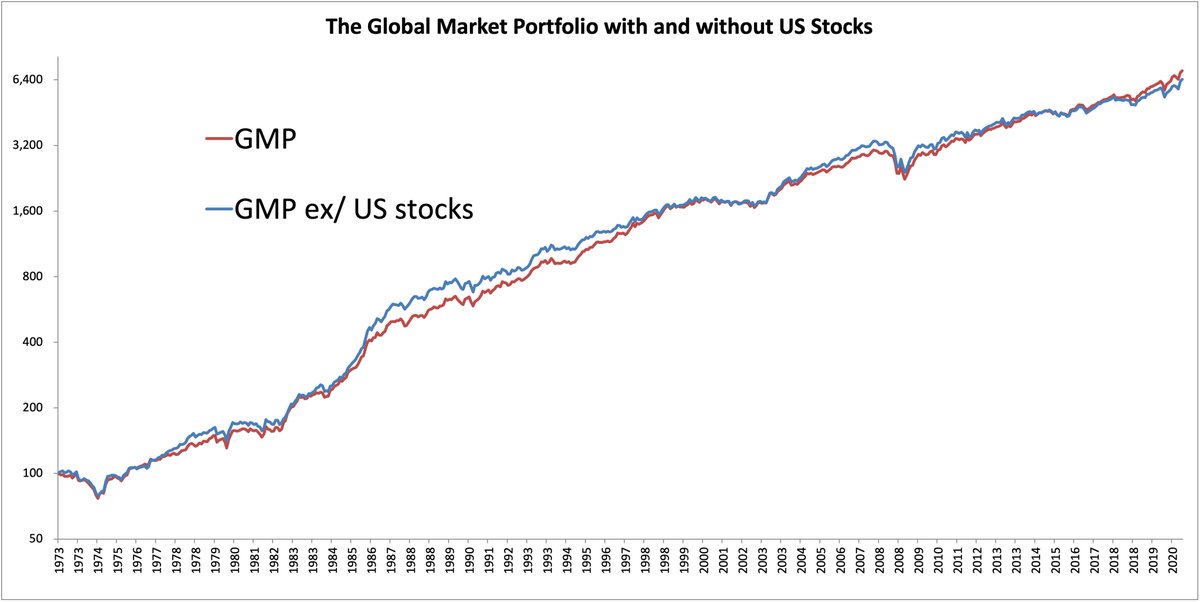

18. It doesn’t have an effect on your funding end result in the event you personal US shares. You possibly can personal 0% and just do advantageous.

Right here’s my tweet about this with the chart beneath.

19. A portfolio of sovereign bonds weighted by yield is superior to at least one weighted by market cap and complete debt issuance.

Learn our white paper on this right here.

20. Placing all your cash into one asset, just like the S&P500, is just not “boring”.

… to be continued …

Am I overestimating how a lot I disagree with others? What are beliefs you disagree along with your friends on? Be at liberty to answer to the unique thread right here.