Posted by sean

At the moment’s Animal Spirits is dropped at you by YCharts:

Enter your data right here to get 20% off YCharts (new shoppers solely)

On right this moment’s present, we focus on:

Future Proof Pageant 2023:

Pay attention Right here:

Suggestions:

Charts:

Tweets:

Vanguard’s US funds and ETFs proceed to assemble prodigious sums from investors–~$83B in web inflows in 2022 alone. However progress does seem like slowing–the funds’ 1.1% natural progress charge in 2022 is the slowest since 1999. That is doubtless a regulation of huge numbers factor however fwiw. pic.twitter.com/8pHHCCKkSH

— Jeffrey Ptak (@syouth1) January 18, 2023

Though retail gross sales misplaced momentum heading into finish of 2022, they elevated by 7.2% all through whole yr, which was strongest (nominal) annual achieve since 2004 (if excluding enormous post-lockdown leap in 2021) pic.twitter.com/9wFm6QW9un

— Liz Ann Sonders (@LizAnnSonders) January 19, 2023

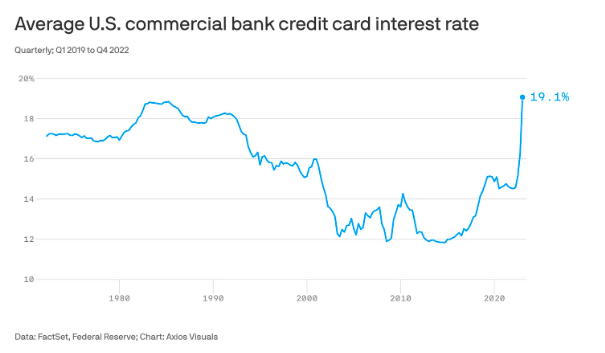

Subprime customers should not paying their automotive loans greater than *ever* earlier than.

7.11% of subprime loans have been “severely” delinquent in December — The best within the knowledge collection again to 2006.

[via Cox Automotive]

— CarDealershipGuy (@GuyDealership) January 17, 2023

Common month-to-month cost on a brand new automotive hit $777 in December.

An ALL-TIME report.

Is that this what it feels wish to hit the Jackpot? 🥴

— CarDealershipGuy (@GuyDealership) January 19, 2023

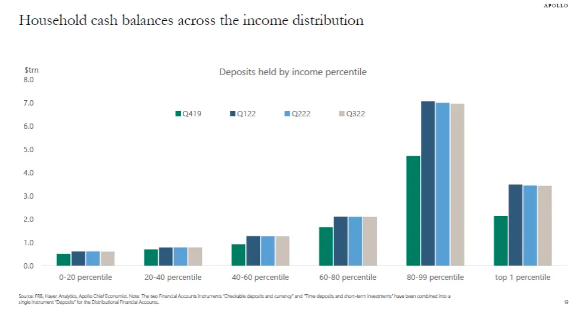

Common deposits held by the underside half of American households greater than tripled from 2019 to 2022, as pandemic support & speedy wage progress have created unprecedented respiratory room on family stability sheets (even amid excessive inflation). @Morning_Joe pic.twitter.com/S65yGFphyH

— Steven Rattner (@SteveRattner) January 19, 2023

Not a fan of the man who owns this place, however it’s value declaring that regardless of having misplaced 80% of its staff, and being all the way down to 550 engineers or so, it’s nonetheless (largely) working. Should you assume buyout corporations like Thomas Bravo aren’t noticing, you do not know your capitalism.

— Paul Kedrosky (@pkedrosky) January 22, 2023

The meme that Elon minimize 75% of Twitter and the service works simply superb is a bit off. A lot of these cuts have been within the gross sales org and income is down 40%. That is not working superb.

— Alex Kantrowitz (@Kantrowitz) January 23, 2023

Amazon, Google, Microsoft, and Meta:

2016 cumulative headcount = ~545,000

2021 cumulative headcount = ~2,020,000 pic.twitter.com/RgPgV7N6gN

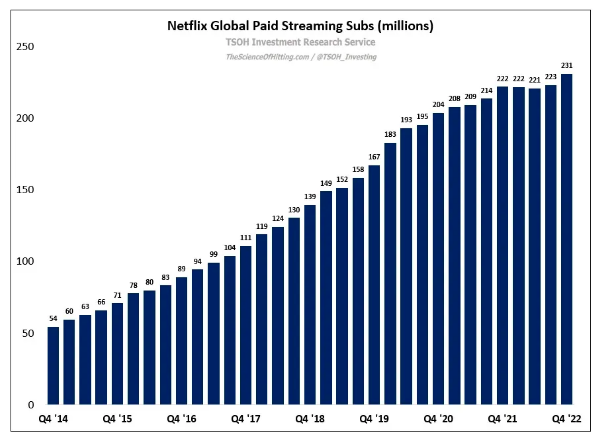

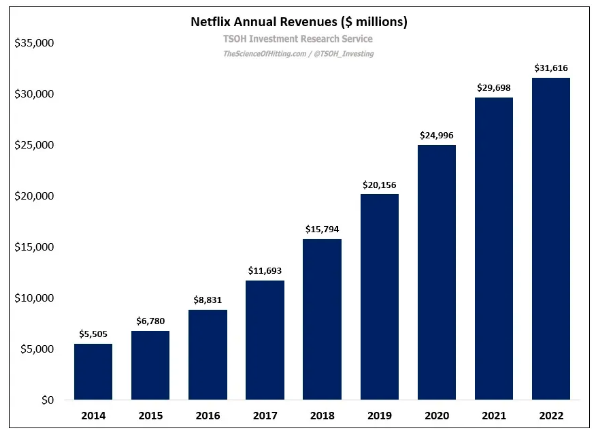

— Alex Morris (TSOH Funding Analysis) (@TSOH_Investing) January 23, 2023

Google NYC staff who arrived on the workplace early this morning stood in a line to check their badges– if gentle turned crimson, it meant you had been laid off. if inexperienced, you have been protected. 👎

— Daniel Roberts (@readDanwrite) January 20, 2023

MICROSOFT TO AXE THOUSANDS OF JOBS IN LATEST CULL BY TECH GIANT- SKY NEWS

MICROSOFT IS SAID TO BE CONTEMPLATING CUTTING ROUGHLY 5% OF ITS WORKFORCE- SKY NEWS$MSFT

— *Walter Bloomberg (@DeItaone) January 17, 2023

scoop with @Kamaron: spotify is planning to put staff off as quickly as this week, following earlier cuts at its podcast networks gimlet and parcast + layoffs at different tech and media firms https://t.co/N9Z8x14ktD

— Ashley Carman (@ashleyrcarman) January 23, 2023

Spotify plans to chop its workforce by about 6% as a part of broader cost-saving measures, the newest in a wave of tech layoffs https://t.co/u0pIofRZL4

— The Wall Avenue Journal (@WSJ) January 23, 2023

Tech layoffs are getting a number of press, however these layoffs are small, being rapidly absorbed into a decent labor marketplace for faculty+ educated expertise, and are a poor reflection of broader labor market dynamics.

At the moment’s Google layoffs brings Jan on par with Nov. Thread. pic.twitter.com/WodLiIVMge

— Bob Elliott (@BobEUnlimited) January 20, 2023

Somebody from Goldman Sachs simply despatched me this message. The complete institutional gross sales flooring was laid off yesterday. The music is about to cease. Be prepared. pic.twitter.com/nbyd5r94Nc

— Inflation Tracker (@TrackInflation) January 18, 2023

Genesis submitting reveals that 31mm of GBTC (~$300mm) was already bought by Genesis in previous couple of months. This explains why the spreads widened so aggressively and clears a big overhang from the long run.

— Hal Press (@NorthRockLP) January 22, 2023

UPDATE: Preliminary conversations/bids for @CoinDesk vary from $15M-$25M

**supply: “curiosity is coming from media properties exterior of crypto, multiples are a lot, a lot decrease than anticipated.”

— Andrew (@AP_Abacus) January 21, 2023

UPDATE: Per @GenesisTrading chapter submitting @Gemini has $600M+ out there/pledged by way of $GBTC shares worth to return to Gemini Earn prospects.

**31M $GBTC shares have already been delivered, and one other 31M have been pledged. @Gemini Earn prospects are owed $900M.

— Andrew (@AP_Abacus) January 22, 2023

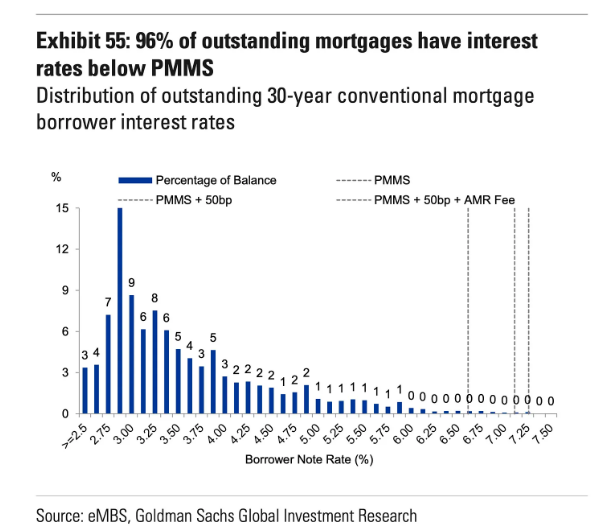

Goldman calling a housing backside already:

“We consider that the mixture drag on GDP progress from the housing sector peaked in 2022Q4”

“The unfavorable impulse of dwelling gross sales is diminishing and main indicators of dwelling gross sales have already turned greater”

cc @conorsen pic.twitter.com/XhcimmaEM8

— Neal (@termloanb) January 24, 2023

I heard that DR Horton is providing 4.8% mortgages and cash in the direction of down funds when you purchase their present stock. Know a number of first time dwelling consumers taking them up on the supply.

— Kyle Cerminara (@kcerminara) January 21, 2023

“With 11% of S&P 500 firms having reported, 57% are beating 4Q earnings (vs. 70% avg. final 4Qs, Determine 1) and 61% are beating income estimates (vs. 69%).” – JPM

— Sam Ro 📈 (@SamRo) January 24, 2023

We now have learn all of the earnings name transcripts from the main U.S. banks so you do not have to.

Let’s check out what $JPM, $MS, $GS, $BAC, $WFC, and $C needed to say about inflation, credit score ranges, FED, and the overall well being of the economic system.

Thread 🧵 pic.twitter.com/XF7ep6Zalb

— Quartr (@Quartr_App) January 18, 2023

“We’ve not seen any elevation on client debt,” says $VZ CEO Hans Vestberg. “Prospects are paying. Delinquencies are low. Shoppers waited longer throughout the vacation season however they got here simply days earlier than Christmas and did a deal.” pic.twitter.com/L7QG1vBEqH

— Squawk Field (@SquawkCNBC) January 24, 2023

Twitter says income fall 35% in This autumn – The Data

— *Walter Bloomberg (@DeItaone) January 18, 2023

SCOOP: Twitter’s advert income fell round 35% within the fourth quarter of final yr to $1.025 billion, 72% of Twitter’s personal projections. Twitter hopes to make $732 million in income in Q1.

far more particulars right here, together with This autumn income damaged out by area: https://t.co/EeYqlsFcCg

— Erin Woo (@erinkwoo) January 18, 2023

🚨BREAKING — Moderna CEO Admits On Reside Air At Davos They Had been Making A COVID-19 Vaccine In January Of 2020 Earlier than SARS-CoV-2 Even Had A Title pic.twitter.com/SMKH74NgGi

— James Cintolo, RN FN CPT (@healthbyjames) January 19, 2023

Contact us at animalspiritspod@gmail.com with any suggestions, suggestions, or questions.

Observe us on Fb, Instagram, and YouTube.

Take a look at our t-shirts, espresso mugs, and different swag right here.

Subscribe right here:

Wealthcast Media, an affiliate of Ritholtz Wealth Administration, obtained compensation from the sponsor of this commercial. Inclusion of such commercials doesn’t represent or suggest endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff.