On January 11, 2023, Matthews Asia launched Matthews Rising Markets ex China Lively ETF (MEMX). It’s an actively managed ETF that may spend money on each nation on the earth besides China, the USA, Australia, Canada, Hong Kong, Israel, Japan, New Zealand, Singapore, and many of the nations in Western Europe.

Our January situation initially, and mistakenly, recommended that the fund had launched on 12/31/2022. That was corrected as quickly as Matthew’s representatives tell us of the error. Our regrets!

The fund can be managed by John Paul Lech, the lead supervisor, and Alex Zarechnak. Mr. Lech joined Matthews in 2018 after a decade as an EM supervisor for Oppenheimer Funds. Mr. Zarechnak joined Matthews in 2020 after a 15-year stint with Wellington Administration, primarily as an analyst within the EM fairness group. He has shorter stays with Capital Group and Templeton Funds. Collectively additionally they handle Matthews EM Fairness Fund (MEGMX) and Matthews EM Fairness Lively ETF (MEM).

The ETF will observe the identical technique that the managers embody in Matthews Rising Markets Fairness Lively ETF. They describe the brand new fund as “a subset or an extension of the Matthews Rising Markets Fairness Lively ETF (MEM). We’ve saved the strategy easy. Other than excluding China, the funding strategy is identical because the MEM. MEMX employs a bottom-up stock-picking technique centered on corporations somewhat than themes and geographical markets … We hunt down high-growth, high-quality corporations throughout rising markets and throughout the market capitalization spectrum. And by using an all-cap strategy, we consider small corporations could supply enticing potential for producing alpha and that incumbency may be a bonus that compounds over time.”

The staff’s image of the items of the portfolio puzzle for the advantage of visible learners:

There are three arguments for contemplating MEMX

1. Dictatorships make for dangerous investments

Making a superb long-term funding begins with the straightforward religion {that a} agency’s managers will make their selections based mostly on their evaluation of the agency’s long-term monetary pursuits. For those who take that as your start line, then managers (or index designers) attempt to establish the managers, corporations, and industries which embody one of the best financial prospects.

Investing in a dictatorship performs hobs with that first precept. In a dictatorship, selections are made based mostly on the dictator’s imaginative and prescient of the place they need to take your complete nation; particular person corporations – whether or not state-owned enterprises or not – are merely alongside for the experience. Managers do what the federal government directs and are compelled to dwell with the implications of the federal government’s decisions.

Underneath such circumstances, neither dissent nor unbiased thought is way tolerated, a lesson embodied by the previous Russian oligarchs – Wikipedia actively tracks the deaths of Russian oligarchs, about 30 of whom have died since January 2022 – and former Chinese language billionaires – with Forbes wryly commenting on China’s “disappearing” billionaires. That deteriorating rule of legislation has made such nations “uninvestable” within the judgment of some skilled buyers.

2. Present EM – ex China choices are fairly restricted

The typical EM fund invests about 32% of its portfolio in China.

US buyers who want to have vibrant rising markets publicity have few enticing choices. Together with MEMX, we recognized 10 funds that promised rising markets however foreswore China.

| 2022 | ||

| WisdomTree Rising Markets ex-China Fund (XC) | n/a | It didn’t launch till 9/22/2022 |

| Attempt Rising Markets Ex-China ETF (STXE) | n/a | Launched 1/30/2023 |

| abrdn Rising Markets Ex-China Fund | n/a | Launched in August 2000 as Aberdeen World Fairness, however didn’t grow to be an EM ex China fund till Feb 28, 2022 |

| GMO Rising Markets Ex-China Fund III | -32.9 | Institutional fund, minimums vary from $5M – $750M |

| KraneShares MSCI EM ex China ETF | -19.3 | Tracks a mid- to large-cap index holding 282 shares |

| iShares MSCI Rising Markets ex China ETF (EMXC) | -19.3 | Tracks a mid- and large-cap index, excludes state-owned enterprises |

| Columbia EM Core ex-China ETF XCEM | -17.6 | Index fund holding 256 mid- to large-cap shares with about 60% in Taiwan, India & Korea |

| DFA EM ex China Core Fairness | -15.8 | With 3800 shares, that is extra like EM-all-equity than EM-core-equity. Like most DFA merchandise, it has measurement and worth tilts and is advisor-sold solely |

| Freedom 100 Rising Markets ETF (FRDM) | -14.4 | A freedom- and liquidity-weighted index of 100 shares from “nations with greater human and financial freedom scores” |

| Benchmarks and comparisons | ||

| MSCI ex China index | -19.3 | |

| MSCI EM index | -18.5 | |

| Matthews EM | -20.9 | Not explicitly ex-China however carries one-third the China weight of its friends, about 10% |

| Seafarer Abroad Progress & Revenue | -11.8% | Not explicitly ex China however carries simply an 11% weighting there |

Of the ten funds, two are unavailable to unbiased retail buyers (GMO, DFA), 4 have a monitor report of below one 12 months, and three monitor the identical or related mid- to large-cap indexes.

Two stand out. The Freedom 100 Rising Markets ETF appears to take “ex-China” to a different degree by investing “ex-any-stinkin’-dictatorship.” It tracks a specialised index that weights rising markets by their diploma of freedom, then invests within the 10 most liquid, not-state-owned firms of their high markets. It’s managed by a former Constancy adviser.

3. Matthews has a stable monitor report

The opposite standout is Matthews Rising Markets ex-China Lively ETF. Whereas the fund is new, it makes use of the identical staff and follows the identical funding self-discipline embodied in an energetic mutual fund and ETF. The fund will not be fairly three years previous however has carried out fairly solidly.

Matthews EM Fairness Fund, Lifetime Efficiency (Since Might 2020)

| APR | MAXDD | STDEV | DSDEV | Ulcer Index | Sharpe Ratio | Sortino Ratio | Martin Ratio |

|

| Matthews EM Fairness | 9.50 | -35.41 | 19.77 | 12.10 | 16.64 | 0.44 | 0.72 | 0.52 |

| EM Fairness friends | 3.8 | -36.5 | 20.3 | 13.2 | 16.5 | 0.22 | 0.39 | 0.38 |

The interpretation: since inception, the fund has returned an annualized 9.5%, two-and-a-half instances the return of its common peer. Its volatility – measured by drawdown, customary deviation, and draw back deviation – has been corresponding to, or a bit higher than, its friends. That leaves it with stronger risk-adjusted returns, measured variously by the Sharpe, Sortino, and Martin ratios.

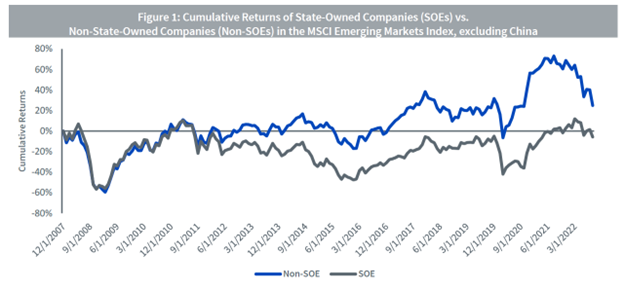

The very best quick exposition of the “rising markets with out China” argument was made by WisdomTree in “The Case for Rising Markets ex-China Fund” (2022), which holds that state-owned enterprises are underperformers and, on the entire, low-quality enterprises.

For these looking for an apolitical evaluation, it’s nicely price studying. Goldman Sachs makes the case at higher size (EM ex-China as a separate fairness asset class, 2021), although it too soft-pedals any geopolitical judgments.

Likewise, Matthews affords an prolonged dialogue of the MEMX technique and prospects on their web site.