It’s that point of the 12 months when it’s important to submit the Funding Proofs (Tax saving investments) to your employers. It’s also the suitable time for many of the Life Insurance coverage / Monetary advisors to push monetary merchandise within the identify of tax profit and insurance coverage cowl.

LIC has launched its first new plan of 2021 referred to as – LIC Bima Jyoti on twenty second Feb, 2021. LIC Bima Jyoti (Plan No.860) is a Conventional, Non-linked, Non-participating, Restricted Premium Fee and Life Insurance coverage Financial savings Plan.

With none doubt, this plan could create fairly a buzz available in the market. The reason is its distinctive doable promoting level (characteristic) – “pay premiums for restricted interval and get assured additions (returns) in your Sum Insured.”

Given the low rate of interest state of affairs, many of the retail buyers would love to select an funding possibility which supplies them a greater fee than Financial institution Mounted Deposits.

Below this plan, Assured Additions shall accrue on the fee of Rs 50 per Rs 1,000 Fundamental Sum Assured on the finish of every coverage 12 months all through the coverage time period. That’s a 5% return! Wow!

At present, an FD with one 12 months tenure could not fetch you 5% return. So, Can LIC Bima Jyothi plan give you higher funding Returns? Is it one of the best LIC Financial savings Plan? What are the professionals and cons of LIC’s new plan – Bima Jyoti Coverage, let’s perceive..

What’s a Restricted Premium Fee Insurance coverage Plan?

A restricted premium fee plan is a plan the place you pay the premium for a shorter span of time and luxuriate in the advantages of an insurance coverage cowl for a very long time.

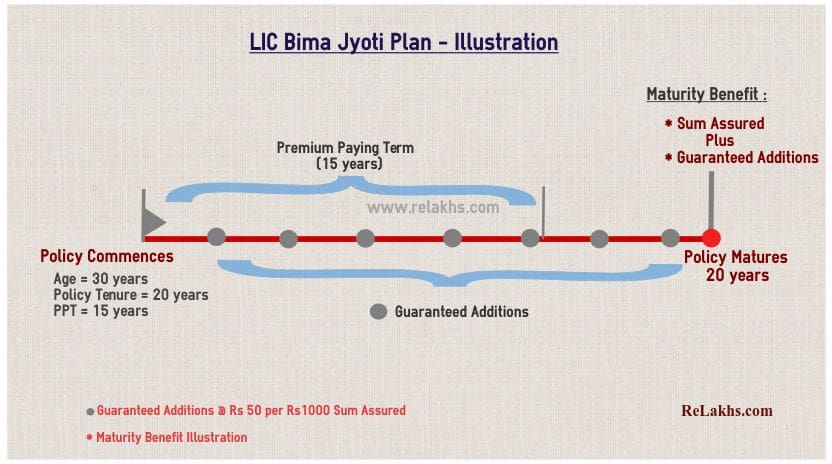

The PPT underneath Bima Jyoti plan is Coverage tenure minus 5 years. For instance – in case your coverage time period is 20 years then PPF can be 15 years.

What are Assured additions?

The Assured Additions are payable together with the Fundamental Sum Assured on the time of declare.

Below LIC Bima Jyoti plan, Assured Additions are payable on the fee of Rs 50 per Rs 1,000 Fundamental Sum Assured on the finish of every coverage 12 months all through the coverage time period. That is a part of your maturity profit.

Associated Article : Several types of Conventional Life Insurance coverage Plans | Which one do you have to purchase?

Eligibility Situations underneath LIC Bhima Jyoti Coverage

Under are the fundamental eligibility circumstances of Bima Jyoti Plan;

| Minimal Sum Assured | Rs 1,00,000 |

| Most Sum Assured | No Higher Restrict |

| Coverage Tenure | 15 (or) 20 years |

| Premium Paying Time period (PPT) | 10 (or) 15 years |

| Minimal Entry Age | 90 days |

| Most Entry Age | 60 years |

| Minimal age at maturity | 18 years |

| Most age at maturity | 75 years |

Illustration of LIC Bima Jyoti Plan

Assuming a person takes Bima Jyoti coverage with a tenure of 20 years for Rs 10 lakh sum assured. The premium paying time period is 15 years.

A set GUARANTEED ADDITION on the fee of Rs 50 per thousand Fundamental Sum Assured will get accrued on the finish of every coverage 12 months until twentieth 12 months.

On the finish of coverage tenure and on the life assured surviving to the top of the coverage time period, “Sum Assured on Maturity” together with accrued Assured Additions, shall be payable as maturity profit. (The place “Sum Assured on Maturity” is the same as the Fundamental Sum Assured.)

Maturity Profit = Rs 10 lakh (Sum Assured) + Rs 10 lakh (Assured Additions)

Assured Additions Calculation = (Rs 50 x 20 x 1000000) / 1000

Kindly word that Bima Jyoti plan doesn’t pay you any bonuses.

LIC Bima Jyoti Plan Returns Calculation

Allow us to think about an instance – Mr Gupta (30 12 months) desires to spend money on LIC’s new plan Bima Jyoti coverage, with a Coverage Time period of 20 Yrs, Premium Paying Time period 15 Yrs and for Sum Assured Rs 10 Lakh. The anticipated yearly premium can be Rs 82,545 (inclusive of rider premiums & taxes).

Allow us to now calculate Inner Price of Return by contemplating the assured additions which can be payable for 20 years.

As per the above calculation, the anticipated returns from LIC Bima Jyoti plan can be round 4%.

Associated Articles :

LIC Bima Jyoti Plan – Do you have to Make investments? | My Opinion

Kindly think about the beneath factors earlier than investing in LIC’s newest plan – Bima Jyoti plan;

- Assured Additions are accrued : The Assured additions provided underneath this coverage do not need compounding impact. Within the above illustration, LIC pays GAs of Rs 50 per 1000 of sum assured annually for 20 years. So, for a Rs 10 lakh SA coverage, a complete GA of Rs 10 lakh is payable on the maturity of coverage. These assured additions are simply accrued until the maturity of the coverage and compounding doesn’t come into the image. That’s the reason why the returns should not 5% pa however they’re round 4% solely.

- Doubles your Sum Assured? : Your insurance coverage advisor could spotlight a degree that your Sum Assured will double by the top of the coverage tenure. Within the above instance, the SA is Rs 10 lakh and the GA is Rs 10 lakh. Please word that it’s only a gross sales pitch!

- Life Insurance coverage Cowl : The premium charges on Conventional plans are a lot larger than the time period insurance coverage. If you’re shopping for an Endowment plan or money-back coverage for all times cowl then kindly word that you’re paying a really excessive premium for a low life cowl. You may think about taking a web-based Time period plan to get an satisfactory life insurance coverage cowl.

- Tax saving is a further profit : Insurance coverage is primarily for Safety and never for saving Taxes. Kindly word that Tax saving is a further profit and shouldn’t be THE deciding issue when shopping for an insurance coverage coverage. Additionally, in case you are choosing the brand new tax regime, word that you simply cannot declare tax deductions u/s 80c.

- Erosion of wealth : Life insurance coverage insurance policies are long-term contracts. When you find yourself investing for long-term, would you prefer to get first rate inflation adjusted returns or not? Your endowment or money-back plans are low-yielding investments. These could provide you with adverse inflation adjusted returns.

- Returns : If you’re proud of 4 to five% returns in your funding (with nearly no threat issue & tax-free revenue), you possibly can think about investing in these sort of plans. Else, you could have plethora of funding avenues to contemplate.

I’m positive you at the moment are very clear on how a lot returns can we anticipate from these sort of conventional insurance policies. The Funding Returns of round 4% that too over a interval of 15 to twenty years sounds very low for me. Kindly concentrate on the professionals & cons monetary merchandise earlier than you make investments. Let me know your views. Do share your feedback. Cheers!

Proceed studying :

- LIC New Plans 2020 – 2021 Record | Options, Snapshot & Evaluation of all of the Plans

- High 5 Greatest On-line Time period Life Insurance coverage Plans | Comparability & FAQs

- Revenue Tax Deductions Record FY 2020-21 | New Vs Previous Tax Regime AY 2021-22

(Put up first revealed on : 19-February-2021)