LIC not too long ago (On twenty third June 2023) launched a single premium and assured endowment coverage known as LIC Dhan Vriddhi (Desk No. 869). It’s a conventional endowment single premium plan with a GUARANTEED tag hooked up to it. Must you make investments?

Allow us to first attempt to look into the options and advantages of the LIC Dhan Vriddhi Plan (869).

LIC Dhan Vriddhi Plan (869) Options and Eligibility

- LIC Dhan Vriddhi is a single premium plan.

- Right here, you could have two choices to select from concerning the sum assured. Possibility-1 is 1.25 instances of the one premium and Possibility-2 is 10 instances the one premium. You don’t have any choice to alter these choices through the coverage interval. In easy, if the policyholder dies throughout the time period of the Coverage Dying Profit paid to the Nominee i.e.

- Possibility 1 = 1.25 instances of Fundamental Sum Assured + Accrued Assured Bonus

- Possibility 2 = 10 instances of Fundamental Sum Assured + Accrued Assured Bonus

- The time period of the coverage is – 10, 15, or 18 years.

- The minimal entry age is 8 years for a 10-year coverage time period; 3 years for a 15-year coverage time period; and 90 days for an 18-year coverage time period.

- The utmost maturity age is 60 years for Possibility 1, 32 years for Possibility 2 (18 years coverage), 35 years for Possibility 2 (15 years coverage and 40 years for Possibility 2 (10 years).

- The minimal primary sum assured is Rs.1.25 lakh for the coverage and there’s no higher restrict on the utmost sum assured.

- Two optionally available riders can be found below this plan:

- (a) LIC’s Unintended Dying and Incapacity Profit Rider, and

- (b) LIC’s New Time period Assurance Rider.

- Date of Graduation of Threat: Within the case of youngsters whose age is lower than 8 years danger graduation begins both from 2 years of taking the coverage or 8 years previous which is earlier.

- You’ll be able to give up at any time (topic to situations).

- A mortgage facility is offered after 3 months below this coverage.

- Cooling-off Interval – If a policyholder is just not happy with the ‘Phrases and Circumstances” of the coverage, he/she could return the coverage inside 15 days from the date of receipt of the coverage.

LIC Dhan Vriddhi Plan (869) – Advantages

# Survival Profit:

On Life Assured survive as much as the coverage interval, then the policyholder will obtain the “Fundamental Sum Assured” together with accrued Assured Additions might be payable.

The Policyholder/Life Assured shall have the choice to obtain the Maturity Profit in lumpsum as specified above and/or in installments (Settlement Possibility).

The installments shall be paid prematurely at yearly or half-yearly or quarterly or month-to-month intervals, as opted for topic to minimal installment quantities for various modes of funds being as below:

Month-to-month – Rs.5,000, Quarterly – Rs.15,000, Half-Yearly – Rs.25,000, and Yearly – Rs.50,000.

If the Web Declare Quantity is lower than the required quantity to offer the minimal installment quantity as per the choice exercised by the Policyholder/Life Assured, the declare proceeds shall be paid in lumpsum solely.

For exercising the Settlement Possibility in opposition to Maturity Profit, the Policyholder/Life Assured shall be required to train the choice for fee of the web declare quantity in installments at the very least 3 months earlier than the due date of the maturity declare.

Nonetheless, after a sure interval, if somebody needs to discontinue this selection, then the long run funds arrive at as we speak’s discounted worth, and accordingly the remaining quantity is payable as a lump sum.

# Dying Profit:

On the dying of the Life Assured, through the coverage time period after the date of graduation of danger however earlier than the maturity date, then the nominee will obtain “Sum Assured on Dying” together with accrued Assured Additions.

“Sum Assured on Dying” for each choices are outlined as below:

Possibility 1: 1.25 instances of Tabular Premium for the chosen Fundamental Sum Assured

Possibility 2: 10 instances of Tabular Premium for the chosen Fundamental Sum Assured

the place Tabular Premium shall be primarily based on the age at entry of the life assured, coverage time period, and the choice chosen however earlier than permitting for any rebate. It doesn’t embody taxes, further premiums, and rider premium(s), if any.

Nonetheless, in case of minor Life Assured, whose age at entry is under 8 years, on dying earlier than the graduation of Threat, the dying profit payable shall be a refund of premium(s) paid (excluding taxes and additional premium(s), if any) with out curiosity.

That means of graduation of Threat –

In case the age at entry of the Life Assured is lower than 8 years, the danger below this plan will start both 2 years from the date of graduation of coverage or from the coverage anniversary coinciding with or instantly following the completion of 8 years of age, whichever is earlier.

For these aged 8 years or extra at entry, danger will start instantly from the Date of issuance of the coverage.

What’s GUARANTEED in LIC Dhan Vriddhi Plan (869)?

The attention-catching tagline of this product is GUARANTEED. Allow us to see what’s assured.

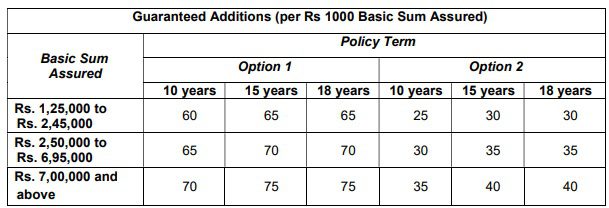

Let me provide you with an instance of how this may work out. Allow us to assume that you’ve opted for a primary sum assured coverage of Rs.2,00,000 and a time period of 18 years. When you have chosen choice 1, then yearly LIC will add the assured addition of Rs.13,000 to your coverage as much as the subsequent 18 years.

Give up Possibility of LIC Dhan Vriddhi coverage

The coverage may be surrendered by the Policyholder at any time through the coverage time period. On give up of the coverage, the Company shall pay the Give up Worth equal to the upper of Assured Give up Worth and Particular Give up Worth.

The Assured Give up Worth (GSV) payable below the coverage shall be:

- Throughout the First three coverage yr: 75% of the Single Premium

- Thereafter: 90% of the Single Premium Single premium referred above shall not embody taxes, further premiums and rider premium(s), if any.

As well as, the give up worth of accrued Assured Additions i.e. accrued Assured Additions multiplied by GSV issue relevant to the accrued Assured Additions, shall even be payable. These GSV elements expressed as percentages will rely upon the coverage time period and coverage yr through which the coverage is surrendered and are given under:

How a lot returns can we anticipate from LIC Dhan Vriddhi Plan (869)?

As all the pieces on this coverage is GUARANTEED, allow us to take an instance and calculate how a lot returns we are able to anticipate by investing on this coverage.

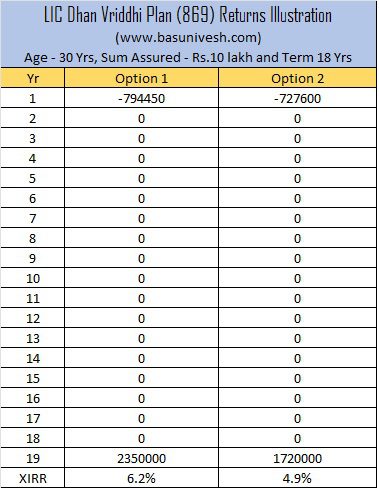

Allow us to assume {that a} 30-year-old man is buying this coverage of Rs.10,00,000 sum assured. For this, the premium he has to pay is Rs.7,94,450. Assume that he has opted the Possibility 1. Then, the sum assured at dying might be –

Sum Assured on Dying is 1.25 instances X Single Premium (earlier than GST) = Rs.9,93,062.

If the dying occurs through the coverage interval, then his nominee will obtain Rs.9,93,062 + Accrued Assured Bonus.

Now allow us to assume that the individual is surviving for the subsequent 18 years, then as per the above-guaranteed bonus desk, the coverage will get Rs.75 as GA (Assured Addition) per Rs.1,000 sum assured. Because the sum assured opted is Rs.10,00,000, the policyholder will get Rs.75,000 as GA to be ADDED TO HIS POLICY (which policyholder will get this maturity or dying occurs then to the nominee).

Therefore, at maturity, the policyholder will obtain Rs.75,000*18 Yrs = Rs.13,50,000 as GA + Rs.10,00,000 Sum Assured = Rs.23,50,000.

Now assume that he has opted the Possibility 2. The premium for that is Rs.7,27,600. Then, the sum assured at dying might be –

Sum Assured on Dying is 10 instances X Single Premium = Rs.72,76,000.

If the dying occurs through the coverage interval, then his nominee will obtain Rs.72,76,000 + Accrued Assured Bonus.

Now allow us to assume that the individual is surviving for the subsequent 18 years, then he’ll obtain yearly GS as per the above desk is Rs.40 per Rs.1,000 Sum Assured. Because the sum assured opted is Rs.10,00,000, the policyholder will get Rs.40,000 as GA to be ADDED TO HIS POLICY (which policyholder will get this maturity or dying occurs then to the nominee).

Therefore, at maturity, the policyholder will obtain Rs.40,000*18 Yrs = Rs.7,20,000 as GA + Rs.10,00,000 Sum Assured = Rs.17,20,000.

Now allow us to attempt to perceive the IRR or return on funding from each variations of this coverage.

Woow…from Possibility 1, you might be getting round 6.2% returns proper? Maintain on…there’s a catch right here. This 6.2% return is just not tax-free!!. However the choice 2 returns are tax-free.

As per Part 10(10D) of the Revenue Tax Act, if the coverage premium is bigger than 10% of the Sum Assured, then the maturity quantity is taxable. However within the case of choice 1, it’s simply 1.25 instances the premium you paid. Therefore, choice 1 maturity proceeds are taxable as per your tax slab and choice 2 maturity proceeds are tax-free.

Additionally, the yearly mixture premium needs to be lower than Rs. 5 lakhs (efficient from 1st April 2023) to avail of the tax-free maturity from this coverage. Therefore, this new rule is relevant for each Possibility 1 and Possibility 2. To know the taxation of insurance coverage insurance policies, then confer with my article “Insurance coverage Coverage Tax Advantages – Below New / Outdated Tax Regime“.

It’s now clear from the above tax guidelines that if go for Possibility 1, then the earnings is taxable which reduces your post-tax returns (In case you are below 30% tax slab, then post-tax it’s 4,34%). Nonetheless, in the event you invested greater than Rs.5 lakh, then irrespective of no matter choice you select, the returns are taxable.

LIC Dhan Vriddhi Plan (869) GUARANTEED Plan – Must you make investments?

You observed that although GUARANTEED is the large tagline with this product, the returns are pathetic. Nonetheless, in case you are proud of round 4% to six% (6% potential provided that the policyholder chooses Option1 and stays throughout the primary tax exemption restrict on the time of maturity and in addition the premium paid is lower than Rs.5 lakh) returns by investing for 18 years, then clearly you possibly can select it!!. As a result of the phrase GUARANTEED is there and the model LIC is related to it 🙂

Liquidity can be at all times a priority in such insurance policies because the GSV guidelines cut back returns.