LIC Jeevan Azad (868) was launched on nineteenth January 2023. Nonetheless, contemplating the options, eligibility and return expectations, must you make investments?

LIC’s Jeevan Azad is a Non-Linked, Non-Collaborating, Particular person, and Financial savings plan which presents a mixture of financial savings and safety plan.

This plan is obtainable solely by OFFLINE mode.

Eligibility of LIC Jeevan Azad (868)

The eligibility situations are as beneath.

- Minimal age at entry – 90 days

- Minimal age at maturity – 18 years

- Most age at entry – 50 years

- Most age at maturity – 70 years

- Coverage Time period – 15 years to twenty years

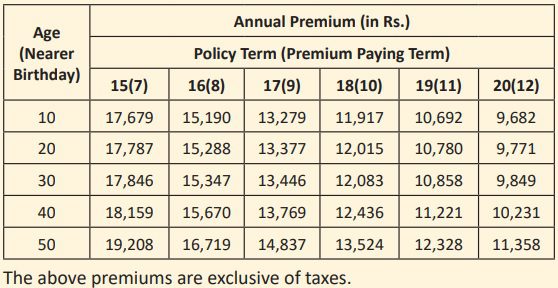

- Premium paying time period – Coverage Time period minus 8 years. Therefore, if you happen to select 15 years coverage, then the coverage cost time period can be 7 years and for 20 years coverage, it will likely be 12 years.

- Minimal Sum Assured – Rs.2 lakh

- Most Sum Assured – Rs.5 lakh

- The full Primary Sum Assured underneath all insurance policies issued to a person underneath this plan shall not exceed Rs 5 lakh.

- This plan presents a settlement possibility (to get the maturity advantages in installments).

- This plan presents the loss of life profit additionally in installments.

- Premiums might be paid repeatedly at yearly, half-yearly, quarterly or month-to-month intervals (month-to-month premiums by NACH solely) or by wage deductions.

Advantages of LIC Jeevan Azad (868)

# Maturity Profit

On Life Assured surviving the stipulated Date of Maturity, ’Sum Assured on Maturity’ which is the same as ‘Primary Sum Assured’ shall be payable.

# Demise Profit

The loss of life profit payable on the loss of life of the life assured throughout the coverage time period after the date of graduation of danger however earlier than the date of maturity shall be “Sum Assured on Demise” the place “Sum Assured on Demise” is outlined as greater of ‘Primary Sum Assured’ or ‘7 occasions of Annualized Premium’.

This Demise Profit shall not be lower than 105% of “Complete Premiums Paid” as much as the date of loss of life.

Nonetheless, within the case of minor Life Assured, whose age at entry is beneath 8 years, on loss of life earlier than the graduation of Threat (as laid out in Para 2 beneath), the Demise Profit payable shall be a refund of premium(s) paid (excluding taxes, further premium and rider premium(s), if any), with out curiosity.

How a lot returns you possibly can anticipate from LIC Jeevan Azad (868)?

Allow us to take an instance from the LIC brochure itself.

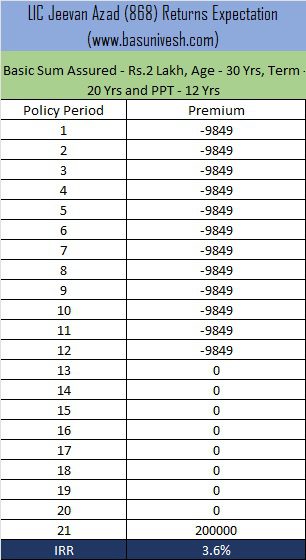

Now allow us to take an instance of a 30-year-old man choosing 20 years coverage. Therefore, his premium paying time period is 12 years. Primarily based on that if we calculate the returns on funding, it’s equal like your financial savings account rate of interest!!

If we add the tax, then returns will once more cut back. I’m not positive why LIC launched this plan the place nothing is new and within the present greater curiosity regime, who can go for such insurance policies?

LIC Jeevan Azad (868) – Why you could NOT make investments?

Allow us to take into account this as pure insurance coverage merchandise (for time being ignore the returns half), you then observed that the utmost sum assured is simply Rs.5 lakh. Assume for what number of years your loved ones can survive in your absence with this loss of life profit. A 12 months or to the utmost two years. Then how this plan goes to be thought of a safety plan??

If we think about the returns half, you then observed from the above calculation that it’s lower than 4%. Regardless of no matter method you calculate, the returns won’t cross past 5%. When within the present situation of high-interest charges enticing merchandise can be found means why one will make investments for 15 to twenty years and fulfill with a meager financial savings account charge.

LIC has a historical past of launching a brand new product throughout the month of December or January. Primarily to focus on tax-saving people. This plan I feel a hurriedly launched product targetting such people.

Contemplating all these pointers, I strongly counsel you keep away from this product. Investing in merchandise like PPF provides you a superior return than this product.

HOWEVER, IF YOU ARE HAPPY WITH 4% TO 5% RETURNS FOR YOUR LONG-TERM INVESTMENT OF 15-20 YEARS, THEN PLEASE GO AHEAD AND INVEST!!