Introduction

Warren Buffet has an extended historical past of sharing sharp, colourful reflections on inflation and its position in controlling your earnings.

Earlier than we drown in a sea of self-congratulation, an additional – and essential – statement should be made. Just a few years in the past, a enterprise whose per-share web price compounded at 20% yearly would have assured its homeowners a extremely profitable actual funding return. Now such an end result appears much less sure. For the inflation price, coupled with particular person tax charges, would be the final determinant as as to if our inner working efficiency produces profitable funding outcomes – i.e., an affordable acquire in buying energy from funds dedicated – for you as shareholders.

That mixture – the inflation price plus taxes – might be considered an “investor’s distress index”. When this index exceeds the speed of return earned on fairness by the enterprise, the investor’s buying energy (actual capital) shrinks although he consumes nothing in any respect. We have now no company resolution to this downside; excessive inflation charges won’t assist us earn greater charges of return on fairness. (italics in authentic, Shareholder Letter, 1979)

He would possibly properly have written these phrases as he munched his Large Mac and Coke, which that 12 months value $1.34 collectively.

Excessive charges of inflation create a tax on capital that makes a lot company funding unwise – at the least if measured by the criterion of a constructive actual funding return to homeowners. This “hurdle price” – the return on fairness that should be achieved by an organization with a purpose to produce any actual return for its particular person homeowners – has elevated dramatically in recent times. The common tax-paying investor is now working up a down escalator whose tempo has accelerated to the purpose the place his upward progress is nil. (Shareholder Letter, 1980).

His instance was roughly, if inflation is 12% and the short-term capital beneficial properties price is 37% (the 2022 charges), any firm with a return on fairness beneath 16.5% – a excessive normal – is shedding cash for his or her traders.

… our views relating to long-term inflationary tendencies are as detrimental as ever. Like virginity, a secure worth degree appears able to upkeep, however not of restoration.

Regardless of the overriding significance of inflation within the funding equation, we won’t punish you additional with one other full recital of our views; inflation itself will likely be punishment sufficient. (Shareholder Letter, 1981)

An extra, notably ironic, punishment is inflicted by an inflationary setting upon the homeowners of the “dangerous” enterprise. To proceed working in its current mode, such a low-return enterprise often should retain a lot of its earnings – it doesn’t matter what penalty such a coverage produces for shareholders. Motive, in fact, would prescribe simply the other coverage.

However inflation takes us by way of the trying glass into the upside-down world of Alice in Wonderland. When costs repeatedly rise, the “dangerous” enterprise should retain each nickel that it will probably. Not as a result of it’s engaging as a repository for fairness capital, however exactly as a result of it’s so unattractive, the low-return enterprise should observe a excessive retention coverage. If it needs to proceed working sooner or later because it has previously – and most entities, together with companies, do – it merely has no selection.

For inflation acts as a huge company tapeworm. (Shareholder Letter, 1981)

Two years later, he was “as pessimistic as ever on that entrance” (1983). That 12 months’s inflation price – 3.2%, although on the time of his letter he feared it could be nearer to 4.4% – is decrease than what we but face at this time, about 4.9%.

Tapeworms, virgins, escalators, and burgers, oh my! What’s a prudent investor to do?

On this article, I’ve tried to go deeper into a few of Warren Buffet’s current feedback with charts and information. I’ve tried to attach a few of his historical past classes from round World Conflict II, the present market setting, and the way that explains a few of Berkshire’s market positions. Lastly, if one is to not use this as a short-term timing message, interested by his insights has helped me settle for why holding shares could also be okay regardless of the pessimism from sharp market minds.

Background: a well timed however uncharacteristic point out

Warren Buffett writes an annual letter to the shareholders of Berkshire Hathaway. This letter often arrives in February, just a few months earlier than the annual shareholder assembly, in Could, and is an efficient place to peg Warren Buffett’s and Charlie Munger’s views on investing, markets, and the economic system at giant. As an investor in Berkshire, I look ahead to each the annual letter and the assembly.

When the 2022 Letter was launched this 12 months on the 25th of February, there was an uncharacteristic point out on runaway inflation. Particularly, Buffett wrote, “Berkshire additionally affords some modest safety from runaway inflation, however this attribute is much from excellent. Enormous and entrenched fiscal deficits have penalties.”

Charlie Munger has been outspoken concerning the government-led giveaway in the course of the pandemic. Up to now, Buffett had all the time defended fiscal spending as wanted as a result of nobody knew how dangerous the choice may very well be. That tune modified with this 12 months’s letter and assembly.

Runaway inflation will not be a time period for use flippantly, and I used to be puzzled by how somebody so cautious along with his phrases as Buffett would come with that time period in his letter. I had wished for some extra mild on this in the course of the annual assembly. He didn’t disappoint.

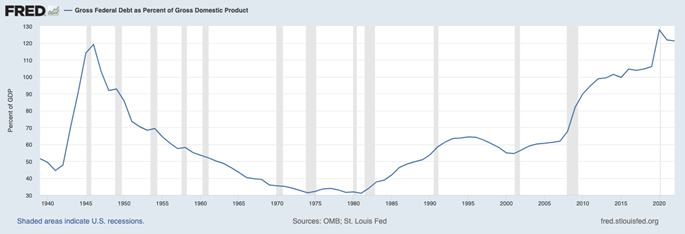

Public Debt to GDP: WW 2 and Immediately

At varied factors within the Q&A, Buffett introduced up the similarity of US debt round WWII and the current time. The image beneath exhibits Gross Public Debt as % of GDP. We’re remarkably on the similar degree of debt to GDP as we have been again then – at round 120%. Economists inform us why giant and sustained public deficits aren’t too wholesome. Funding these deficits crowds out different investments. As Rates of interest rise, traders really feel safer in 5% mounted earnings. Who must danger cash in an all the time nerve-wracking inventory market?!

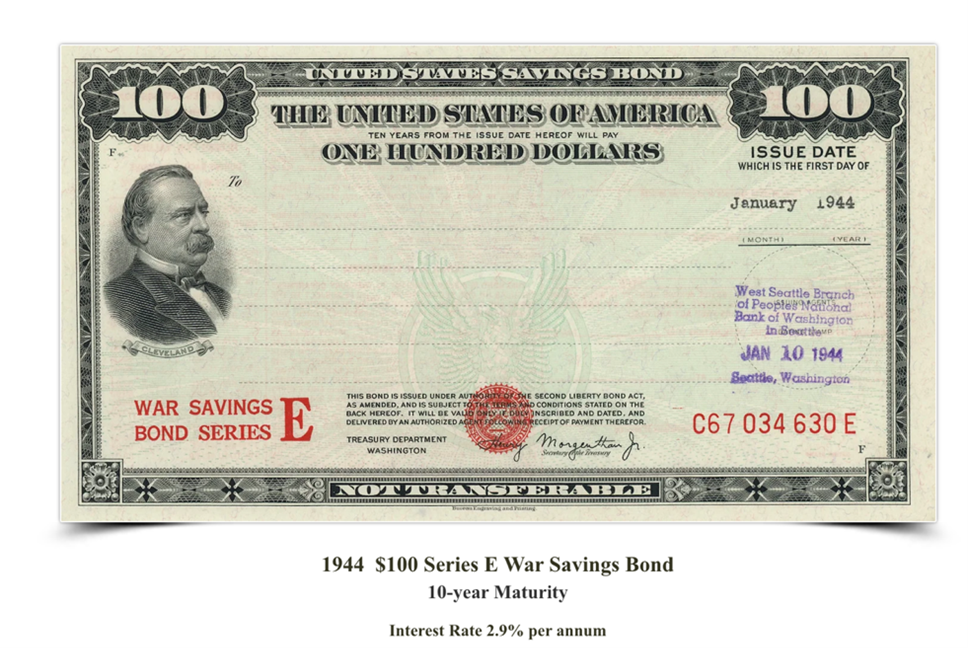

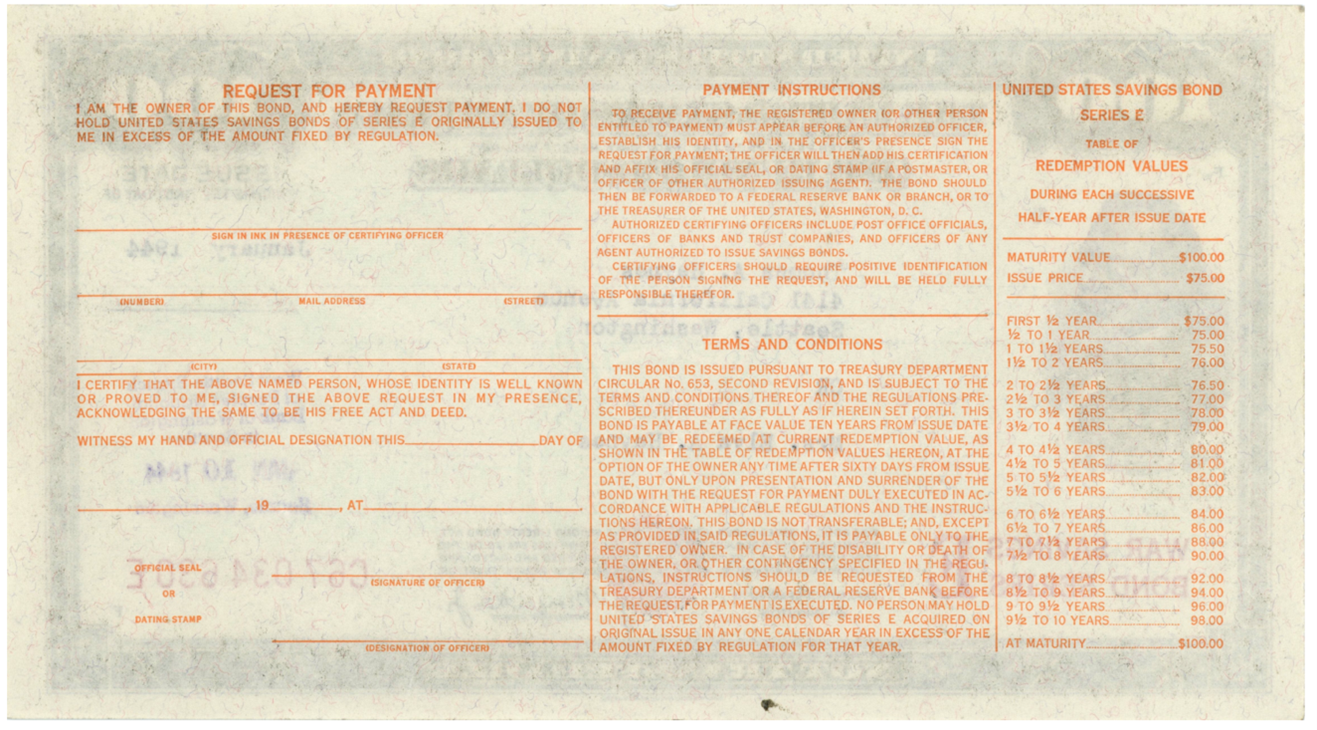

Conflict Financial savings Bonds

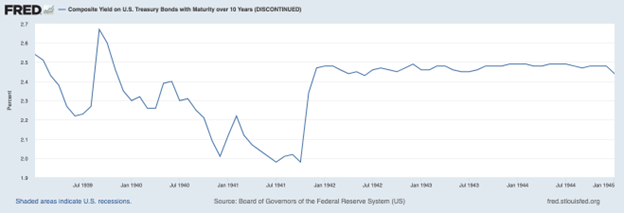

To fund WWII spending, the US federal authorities wanted some huge cash. Conflict Financial savings bonds was one of many solutions. The Joe I. Herbstman Memorial Assortment of American Finance has good data on Financial savings Bonds from 1941 to 2007, together with some historical past. These bonds have been forefathers to our current day Collection EE financial savings bonds. In line with the web site, “Recognized initially as Protection Bonds and Conflict Financial savings Bonds, these securities helped elevate some $185 billion for WWII alone. Six million volunteers helped to promote some one billion particular person securities for the warfare effort.” The 1944 Conflict Financial savings bond apparently had a 10-year Yield to maturity of two.92% annualized.

To match the yield on these bonds, it could assist to take a look at the yield obtainable on 10-year US Treasury Bonds within the early Forties. Buffett talked about that he (simply 11 years outdated on the time of the Pearl Harbor assault), lots of his younger pals (nerd alert!), and a complete lot of different traders rushed to purchase Conflict Financial savings Bonds, largely due to the incessant calls from Donald Duck and warfare widows to help our boys and defend freedom, but in addition as a result of the two.92% yield from the Conflict Financial savings Bonds regarded engaging in comparison with what was obtainable elsewhere.

Is there a parallel at this time?

WSJ reporter Lori Ioannau in an article dated Could 6th, 2023, “What Traders Ought to Know About Cash-Market Funds and CDs,” reviews:

- About $488 billion has poured into money-market mutual funds this 12 months by way of April 27, in response to Crane Information. These funds now maintain a file $5.687 trillion in belongings, up from $4.941 trillion a 12 months in the past.

- Balances in CDs skyrocketed to about $577 billion in March from $36.6 billion in April 2022, in response to the Federal Reserve.

For the primary time in virtually 15 years, traders are getting over 5% in CDs and money-market devices. The final time round, in 2007, was God’s present to those that purchased and saved themselves from the Nice Monetary Disaster. It seems to be like traders aren’t going to overlook the chance this time.

What bond traders acquired mistaken with WWII bonds then and what may go mistaken now: Inflation

Within the years that adopted within the Forties, noticed inflation was a lot greater than traders anticipated. This greater inflation eroded the worth of cash. US Shopper Value Index clocked 18% in 1947, 8.8% in 1947, 5.9% in 1950, and 4.3% in 1951. The CAGR for inflation from the beginning of 1944 to the top of 1955 was about 4%, or a full level greater than the engaging yield in Conflict bonds.

US Shopper Value Index Desk (as inferred from Y-Charts).

| 1941 | 9.93% | 1948 | 1.69% |

| 1942 | 7.64% | 1949 | -2.07% |

| 1943 | 2.96% | 1950 | 5.93% |

| 1944 | 2.30% | 1951 | 4.33% |

| 1945 | 2.25% | 1952 | 0.75% |

| 1946 | 18.13% | 1953 | 1.13% |

| 1947 | 8.84% | 1954 | -0.74% |

(*I’ve used the US Shopper Value Index (I:USCPINM) ticker from Y-Charts. A spot examine to FRED Information exhibits the sequence is in the correct ballpark.)

This brings us to current Inflation:

| 2019 | 2.3% |

| 2020 | 1.4% |

| 2021 | 7.1% |

| 2023 | 6.4% |

Buffett believes that Jay Powell, the Federal Reserve Chair, is totally the correct man for the job, and he utterly will get the inflation state of affairs. But, he fears the extent of nationwide debt and public deficit and the associated penalties have develop into very actual. The inflation monster would possibly simply be very tough to slay. In contrast to WWII Financial savings Bonds and his fast attraction to the upper yield, this time, Buffett desires to watch out. So, what’s he doing?

-

T-Payments: Berkshire holds $125 Billion in Treasury Payments, that’s, US Authorities Debt lower than one 12 months in maturity. Others name this “dry powder.”

Rolling short-term Treasury Payments permits Berkshire to perform just a few issues:

- Earn 5% annualized yields with negligible danger;

- Have the assets to maneuver decisively to take advantage of a market panic; and,

- Earn even greater yield if the Federal Reserve is compelled to lift charges additional.

When requested why he doesn’t maintain longer-duration bonds, he replied that he’s not good at predicting the long run path of long-term rates of interest, and he doesn’t know anybody who is nice at it both. Take these phrases significantly.

Maybe, he’s unwilling to decide to long-dated mounted coupon bonds as a result of he doesn’t see sufficient worth in them. With T-Payments, he’s fortunately incomes $6 billion a 12 months on the $125 Billion pile at a 5% price. Maybe, he’s additionally unwilling to spend money on TIPS, given their illiquidity, regardless of their inflation safety attribute. When he wants the cash, with T-Payments, he can have the cash.

-

The Largest Shareholder’s Fairness of any American Firm:

Buffett likes to remind traders that Berkshire’s Shareholders’ Fairness is the most important of any American firm.

As of Q1 2023, Berkshire has Belongings of $997 Billion vs $480 Billion in Liabilities. The Whole Shareholder’s Fairness of $513 Billion. The desk from Y-charts and whereas the numbers could also be barely completely different, the sizes are comparatively current and largely in the correct ballpark.

Berkshire owns extra web belongings, together with bodily belongings – belongings that may revalue greater in a excessive inflation setting – than some other US company. By way of vitality investments, by way of railroad infrastructure, by way of direct personal holdings of corporations, and thru oblique funding in publicly listed corporations, Berkshire is positioned for a relative lack of buying energy of cash and a corresponding improve in actual world belongings. That is “removed from an ideal hedge,” however a hedge however towards runaway inflation.

On one finish, Berkshire has extremely liquid T-Payments, which, at $125 Billion, stand at round 25% of Berkshire’s Shareholder’s fairness. On the opposite finish, Berkshire owns $388 Billion of Internet Belongings biased in the direction of private and non-private fairness holdings. It’s a tough approximation, however we will name it 75%. (I’m oversimplifying the Steadiness sheet.) What did Buffett study from the Forties that he thinks utilized now?

How did equities do within the Forties and Fifties too?

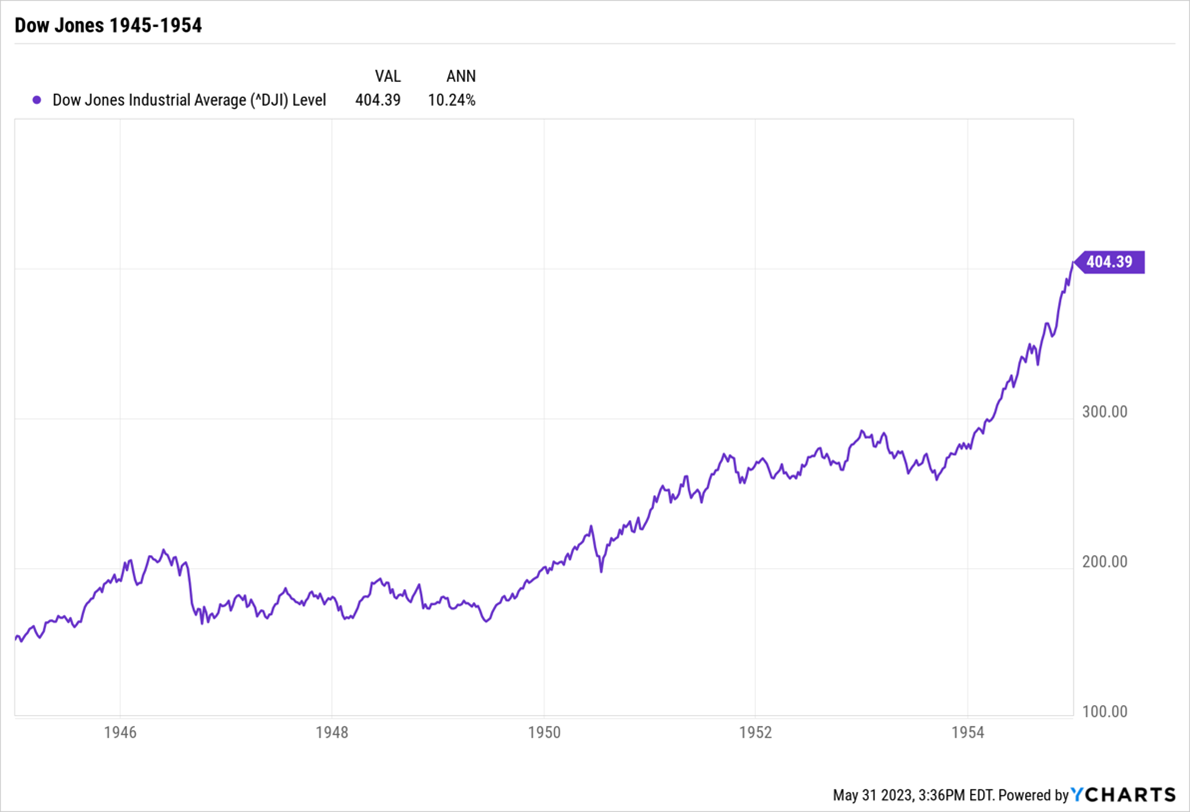

The annualized return on shares was 10.2% on the Dow Jones Industrials within the years from the beginning of 1944 to the top of 1954. Throughout the identical time, public debt went from 120% of GDP to 70%, Conflict Financial savings Bonds yielded 2.92%, and inflation clocked at a median 3.9%.

Excessive deficits to GDP and excessive inflation will surely have created the identical form of bearish mindset as many traders discover it trendy to sport proper now. However runaway inflation may also be a fertile floor for a grudging fairness tape greater as the worth of cash erodes.

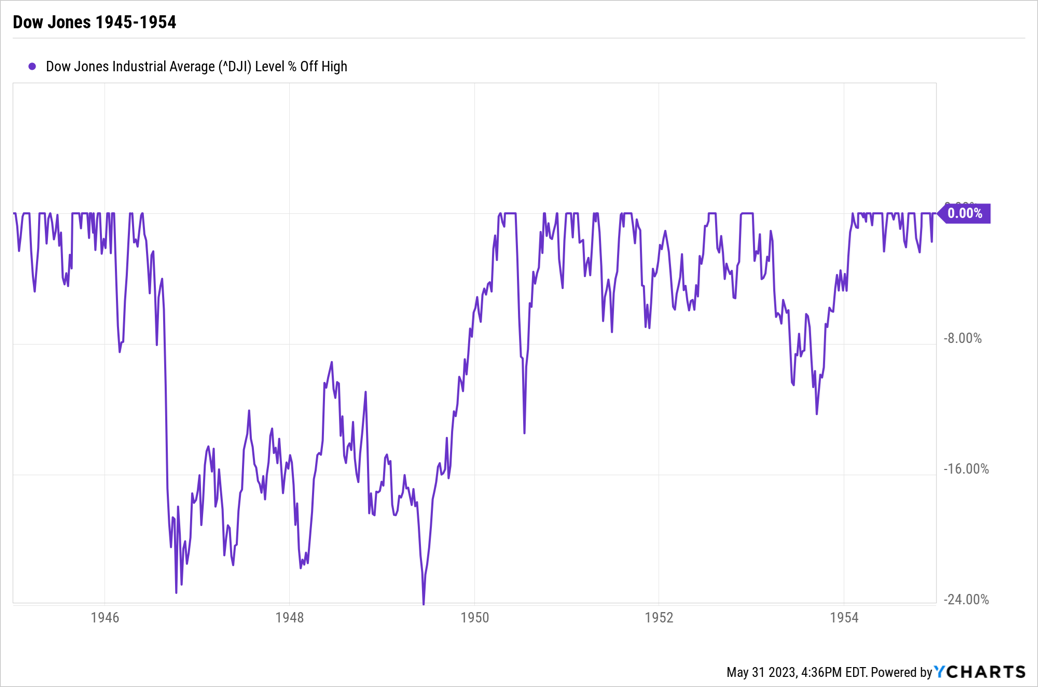

This isn’t a market-timing name. Because the chart exhibits, equities tred water from 1946 to 1949.

In addition they went by way of a 24% bear market. There are not any simple solutions.

Equities at this time

Everyone knows the story. Shares presently have a nasty breadth downside. NVIDIA, Microsoft, and a handful of different giant know-how corporations with a concentrate on Synthetic Intelligence have risen tremendously whereas the remainder of the inventory market has not. Not a single day goes by with out some pundit increasing on how “if solely somebody have been to inform you XYZ, would you continue to suppose the inventory market can be up right here?”

I get it. There’s actually a pleasant little mini bubble in shares centered on AI. But when dangerous breadth within the inventory market bothers traders, they should acquaint themselves with this 2018 analysis paper: “Do Shares Outperform Treasury Payments.”

Professor Hendrik Bessembinder, the writer, summarizes within the Summary: When acknowledged by way of lifetime greenback wealth creation, the best-performing 4 p.c of listed corporations clarify the web acquire for your complete U.S. inventory market since 1926, as different shares collectively matched Treasury payments.

Unhealthy breadth, apparently, is a function of US inventory returns. Fairness returns are shaped not as a result of the world is a good place however exactly as a result of it’s an unfair place with monopolistic or oligopolistic pricing. Perhaps the rising tide lifts just a few boats a lot greater than different boats.

Conclusion

When all is finished and dusted, shares would possibly nonetheless supply modest safety towards inflation. Because the world clamors for CDs, watch out to not lean too exhausting towards shares on a everlasting foundation.

There’s a probability we might not see a repeat of the Nice Monetary Disaster.

We might have to revalue shares greater as cash will get slowly (typically not so slowly) devalued. Simply be open to the chance that perhaps the following crash may not be as large as what the purists would really like. Perhaps shares do win in the long term. Merchants are on their very own, however longer-term traders is perhaps okay by way of inflation.

For readers who need a actually readable examination of the performances of each fairness and fixed-income in numerous inflation regimes – from deflation to “extreme” inflation – from 1900 to 2010, there are few snapshots higher than “Inflation and the US Inventory and Bond Market” (2011) from O’Shaughnessy Asset Administration. Whereas the essay is greater than a decade outdated, we haven’t seen a critical inflation menace – aside from the cycle we’re simply in – since its publication. Backside line: Devesh and Warren are proper. You’ll be okay.