Many owners refinanced to a sub-3% mortgage when rates of interest have been low a few years in the past. The mortgage curiosity most individuals pay isn’t giant sufficient to make them itemize their deductions. They simply take the usual deduction. Those that can nonetheless deduct their mortgage curiosity are inclined to have a big mortgage.

Restrict on Deduction

The Tax Cuts and Jobs Act of 2017 diminished the restrict on the mortgage steadiness on which you’ll deduct the mortgage curiosity from $1 million to $750,000. The decrease restrict applies to houses acquired after December 15, 2017. The big enhance in dwelling costs lately makes lately purchased houses in high-price areas extra more likely to exceed the $750,000 restrict.

Nevertheless, lenders nonetheless report 100% of the mortgage curiosity paid on the 1098 kind with out adjusting for both the previous $1 million restrict or the brand new $750,000 restrict. In case your mortgage steadiness is over the restrict, deducting the mortgage curiosity is extra sophisticated than simply utilizing the quantity from the 1098 kind.

It isn’t merely multiplying $750,000 by your rate of interest both when your mortgage steadiness began above $750,000 and ended under $750,000 or whenever you took out the mortgage in the course of the yr.

Common Mortgage Steadiness

A key idea is your common mortgage steadiness throughout the yr. When your common mortgage steadiness exceeds the restrict, your deductible mortgage curiosity is:

Mortgage Restrict / Common Mortgage Steadiness * Precise Mortage Curiosity Paid

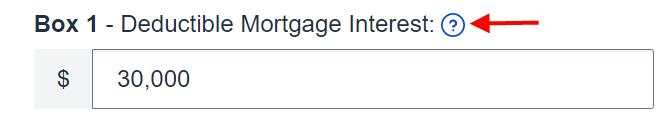

In case you paid $30,000 in mortgage curiosity on a median mortgage steadiness of $1,000,000 and also you’re topic to the $750,000 restrict, your deductible mortgage curiosity is pro-rated to:

$750,000 / $1,000,000 * $30,000 = $22,500

IRS Publication 936 offers a number of methods to calculate your common mortgage steadiness:

- Common of first and final steadiness methodology

- Curiosity paid divided by rate of interest methodology

- Mortgage statements methodology

The primary methodology is easier and it offers you a barely bigger deduction however you should utilize it provided that you didn’t prepay a couple of month’s principal throughout the yr.

Right here’s the way it works in TurboTax, H&R Block, and FreeTaxUSA tax software program.

TurboTax

The screenshots under are taken from TurboTax Deluxe downloaded software program. The TurboTax downloaded software program is each cheaper and extra highly effective than TurboTax on-line software program. In case you haven’t paid in your TurboTax on-line submitting but, you should buy TurboTax obtain from Amazon, Costco, Walmart, and plenty of different locations and change from TurboTax on-line to TurboTax obtain (see directions for find out how to make the change from TurboTax).

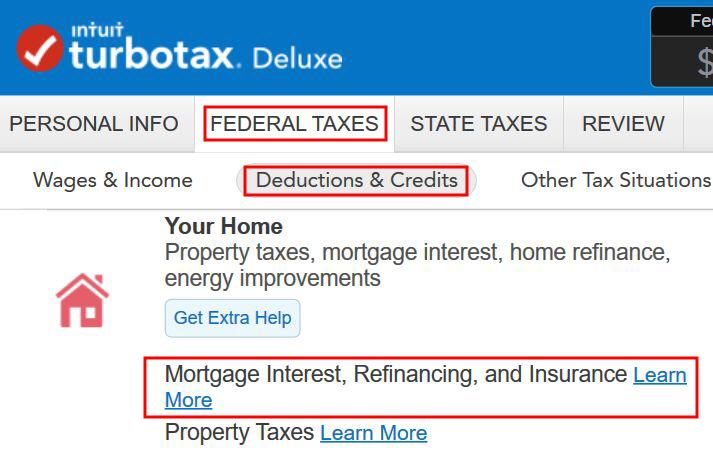

Discover the mortgage curiosity subject within the Your Residence part beneath Federal Taxes -> Deduction & Credit.

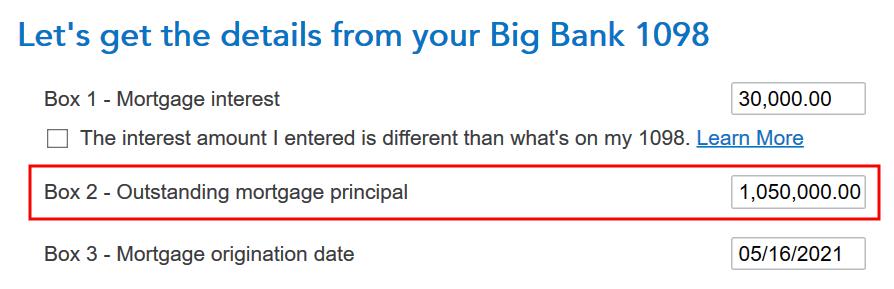

Type 1098

When it asks you to enter info out of your 1098 kind, enter the numbers as they seem in your kind. If Field 2 is clean in your 1098, enter the mortgage steadiness on the starting of the yr (or your starting mortgage steadiness for those who took out the mortgage throughout the yr).

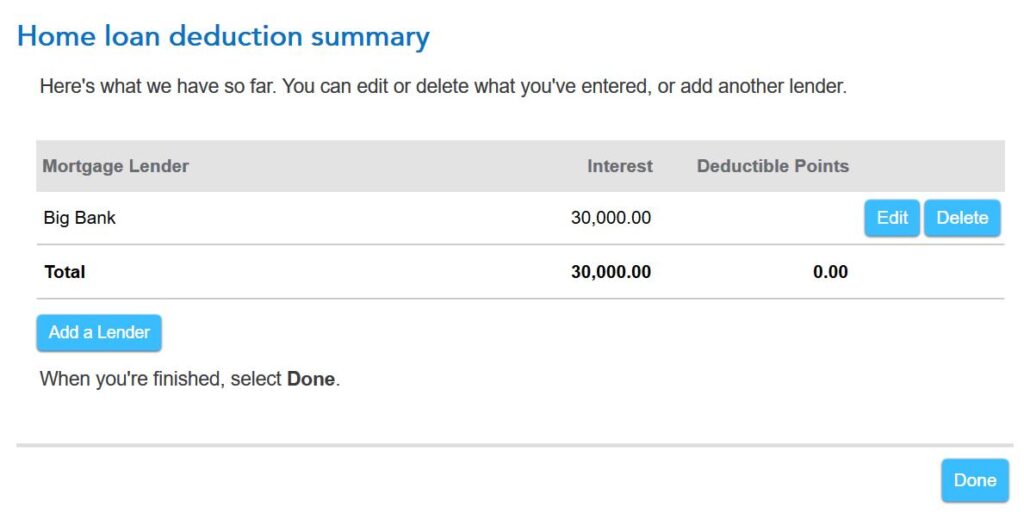

You get to this abstract after you reply a number of extra questions. Click on on Accomplished however you’re not completed but.

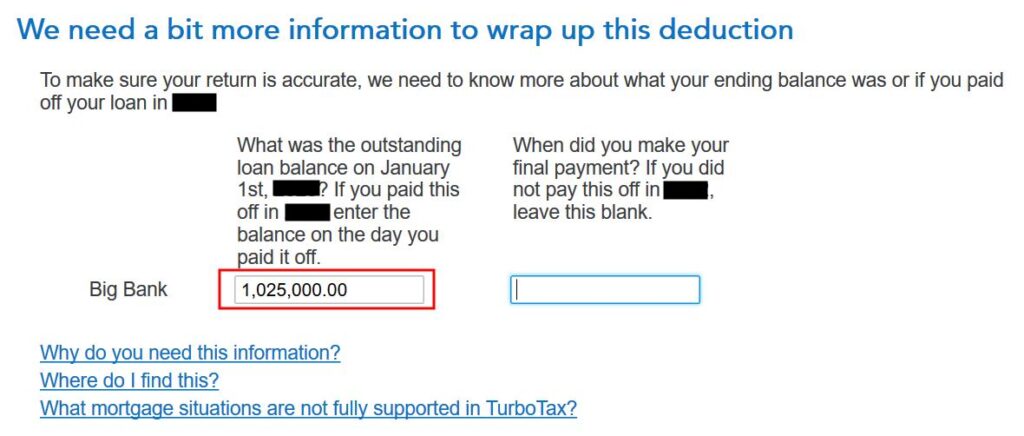

Buy Date and Ending Steadiness

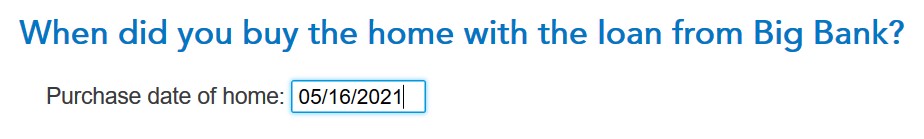

The acquisition date of the house determines whether or not you may have a $1 million restrict or a $750,000 restrict for the mortgage curiosity deduction. If this mortgage was from a refinance, you continue to enter the date whenever you initially purchased the house.

TurboTax asks for the steadiness as of January 1 of the next yr as a result of it makes use of the “common of first and final steadiness methodology” to calculate your common mortgage steadiness for the yr. This works whenever you didn’t make further principal funds throughout the yr.

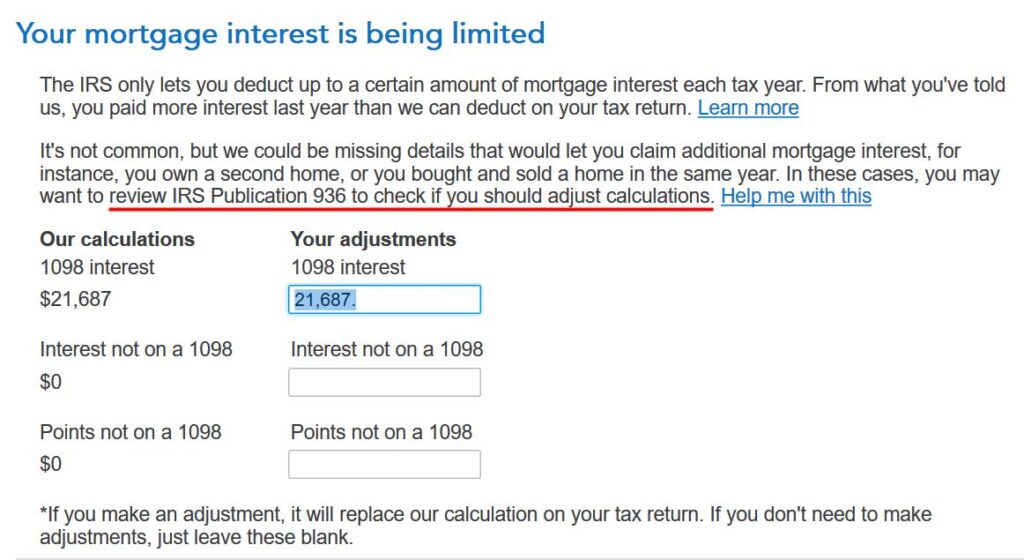

TurboTax calculates a deduction utilizing the “common of first and final steadiness methodology” however you possibly can’t legally use that methodology for those who pay as you go a couple of month’s principal throughout the yr. You have to calculate your common mortgage steadiness otherwise and provides the pro-rated deductible mortgage curiosity to TurboTax.

If You Pay as you go Principal

In case you had the mortgage for all 12 months and your rate of interest didn’t change throughout the yr, which is the case for most individuals with a fixed-rate mortgage, you should utilize the “curiosity paid divided by rate of interest methodology” to calculate your common mortgage steadiness. Suppose you paid $30,000 in mortgage curiosity and your price is 2.875%, your common mortgage steadiness is:

$30,000 / 0.02875 = $1,043,478

Your deductible mortgage curiosity is:

$750,000 / $1,043,478 * $30,000 = $21,562

In case your curiosity modified throughout the yr, you’re higher off utilizing the “mortgage statements methodology.” Obtain the month-to-month statements out of your lender. Add up your steadiness from January to December and divide by 12. That’s your common mortgage steadiness throughout the yr. Use that quantity to calculate your pro-rated deductible mortgage curiosity and provides it to TurboTax:

Mortgage Restrict / Common Mortgage Steadiness * Precise Mortage Curiosity Paid

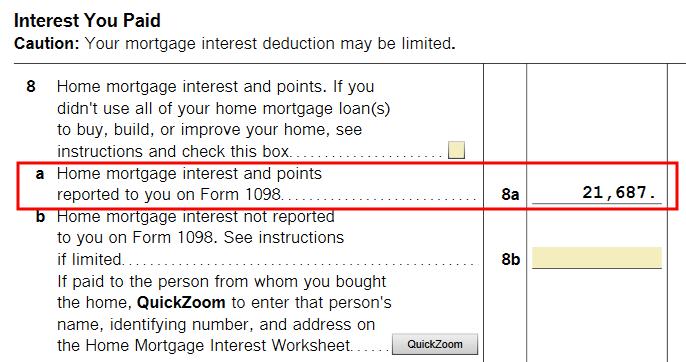

Confirm on Schedule A

To verify how a lot mortgage curiosity deduction you’re getting, click on on Kinds on the highest proper and discover Schedule A within the checklist of varieties within the left panel.

Scroll all the way down to the center and discover Line 8. You’ll see the mortgage curiosity deduction.

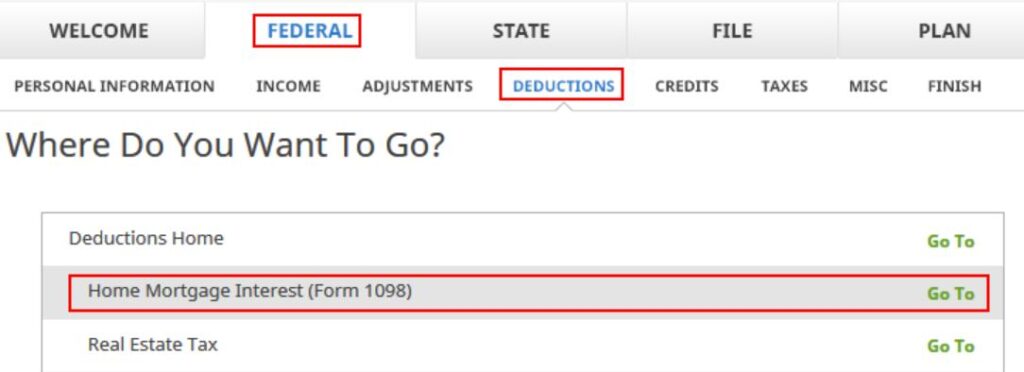

H&R Block

Mortgage curiosity deduction works in a different way within the H&R Block software program.

Discover “Residence Mortgage Curiosity (Type 1098)” beneath Federal -> Deductions.

1098 Entries

H&R Block gives a Residence Mortgage Assistant. Click on on that.

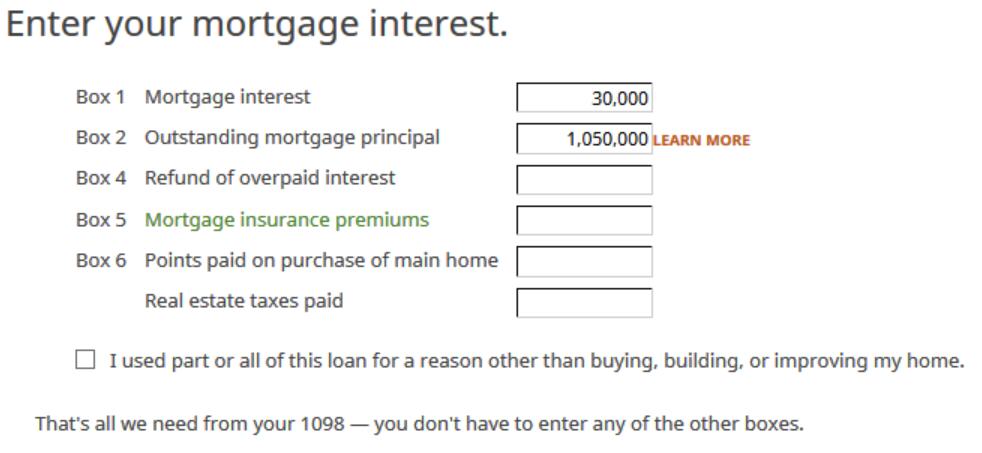

After saying we’ve a 1098 kind and getting into the title of the lender, we come to this manner to enter the numbers on the 1098 kind.

Improper!

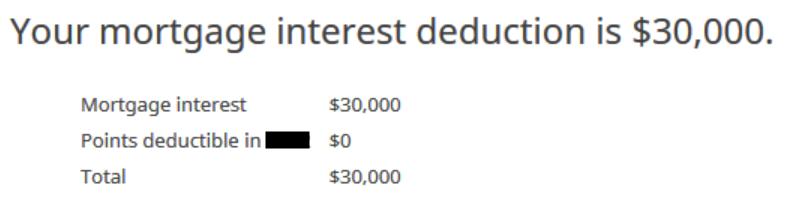

After answering some extra questions on factors and mortgage insurance coverage premiums, which we don’t have, H&R Block says we will deduct 100% of the mortgage curiosity paid.

This may’t be proper. We entered a starting steadiness above $1 million on the 1098 kind. H&R Block didn’t ask for the house buy date to see whether or not the restrict is $1 million or $750,000. It didn’t ask for the ending steadiness or the rate of interest to calculate the common mortgage steadiness. H&R Block simply makes use of the curiosity paid quantity from the 1098 kind as if the mortgage restrict doesn’t exist.

Calculate It Your self

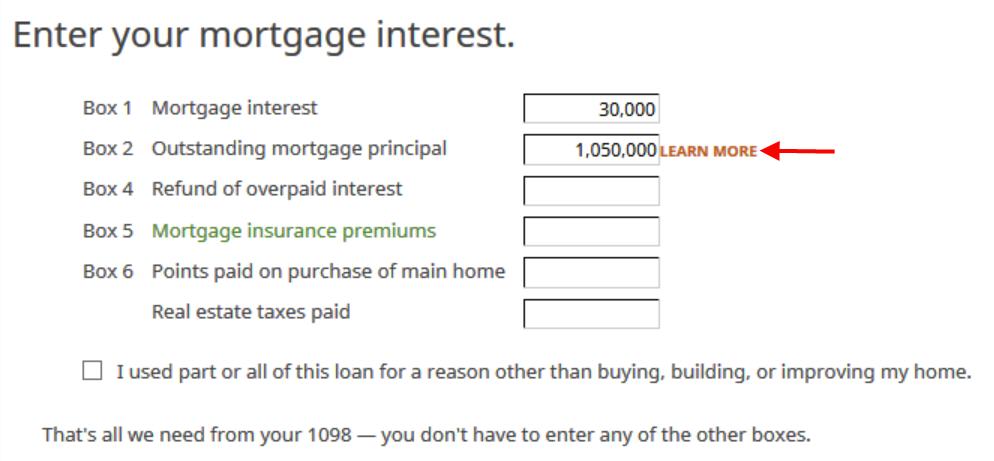

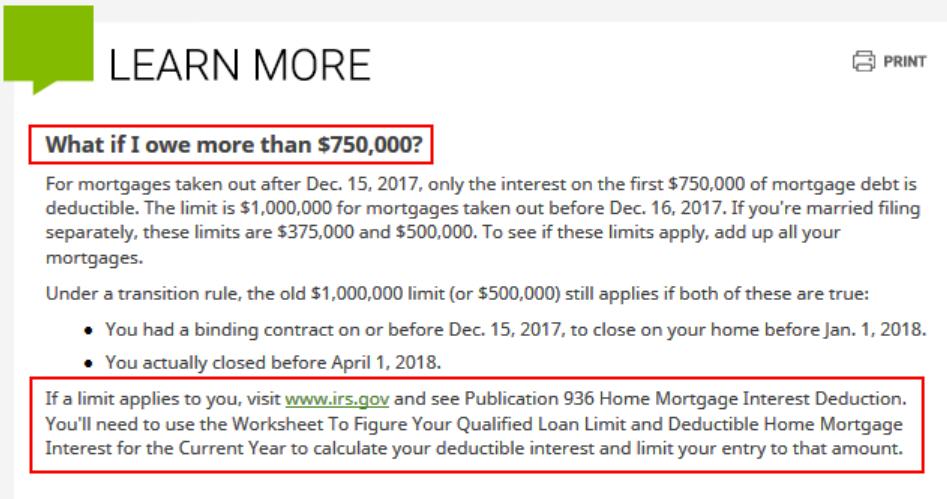

We return to the 1098 entries to see if we missed something. See there’s a Study Extra hyperlink subsequent to Field 2? What’s that?

There’s our reply. It says on the finish:

If a restrict applies to you, go to www.irs.gov and see Publication 936 Residence Mortgage Curiosity Deduction. You’ll want to make use of the Worksheet To Determine Your Certified Mortgage Restrict and Deductible Residence Mortgage Curiosity for the Present 12 months to calculate your deductible curiosity and restrict your entry to that quantity.

Translation: You’re by yourself when your mortgage is over $750,000. Calculate it your self and put the consequence right here.

Granted that TurboTax doesn’t cowl all conditions however not less than it makes an try to cowl the commonest state of affairs (solely common funds with out further principal funds). H&R Block simply washes its fingers and places all of it on you when your mortgage is above the restrict. That’s lazy. Though solely a small proportion of individuals deduct their mortgage curiosity now, amongst those that can nonetheless deduct, many have a mortgage above the restrict.

It’s unhealthy sufficient that the software program doesn’t do the required work that will help you calculate, however it’s inexcusable that it doesn’t warn you extra conspicuously you’re by yourself. Many individuals received’t discover the data hidden behind a delicate Study Extra hyperlink.

So what do you do for those who’re utilizing the H&R Block software program? Do what TurboTax does. First, calculate your common mortgage steadiness:

- In case you didn’t prepay a couple of month’s principal, get the start steadiness and the ending steadiness. Take a median.

- In case you made further principal funds and your rate of interest didn’t change, divide the curiosity paid by your rate of interest.

Then, calculate your deductible mortgage curiosity:

Mortgage Restrict / Common Mortgage Steadiness * Precise Mortage Curiosity Paid

FreeTaxUSA

I additionally checked how the web tax software program FreeTaxUSA does it.

Just like H&R Block, FreeTaxUSA places a small query mark hyperlink subsequent to the mortgage curiosity entry. Clicking on the query mark opens a pop-up window, which says towards the tip:

In case your debt is larger than the bounds, use Publication 936 to determine your deductible dwelling mortgage curiosity quantity and scale back the mortgage curiosity you enter accordingly.

You’re additionally by yourself whenever you use FreeTaxUSA. It additionally doesn’t let you know clearly that it’s essential to do some further work.

***

H&R Block tax software program is cheaper than TurboTax however this isn’t the one case the place it punts and asks you to learn the IRS directions and are available again with the reply your self. See one other instance in The way to Enter 2022 International Tax Credit score Type 1116 in H&R Block. You actually should know the place it cuts corners whenever you use H&R Block software program. It really works nicely solely when these minimize corners don’t have an effect on you. The identical additionally applies to FreeTaxUSA.

Say No To Administration Charges

If you’re paying an advisor a proportion of your belongings, you might be paying 5-10x an excessive amount of. Learn to discover an impartial advisor, pay for recommendation, and solely the recommendation.