Seasoned monetary advisors have probably labored with shoppers with all kinds of office retirement accounts, which may fluctuate when it comes to their funding choices, charges, and different traits. However on condition that the U.S. authorities is the biggest employer within the nation, it may be particularly useful for advisors to be aware of the ins and outs of (and up to date adjustments to) the Federal authorities’s personal outlined contribution plan: the Thrift Financial savings Plan (TSP).

The TSP is offered to each civilian Federal authorities workers in addition to army servicemembers, and people who have left service can select to keep up their TSP accounts (although they will not make a contribution). Whereas many options of the TSP (e.g., Roth contribution choices and employer matches) are widespread to different workplace-defined contribution plans, the TSP has sure distinctive attributes, together with decrease charges than many private-sector plans and a fixed-income funding possibility unique to the plan.

In 2022, the TSP underwent a sequence of adjustments impacting its many account holders. These embrace the opening of a “Mutual Fund Window” to complement the restricted providing of funding funds beforehand accessible to plan members (although the related bills make it prohibitively costly for a lot of members). As well as, the TSP up to date its web site and launched a smartphone app, which required members to create new credentials and confirm their private info. Notably, advisors can assist shoppers in navigating these new adjustments by serving to them resolve if investing by means of the Mutual Fund Window is sensible, strolling them by means of the registration course of for the brand new website (in the event that they haven’t already), and guaranteeing that their info (together with beneficiary info) transferred over appropriately.

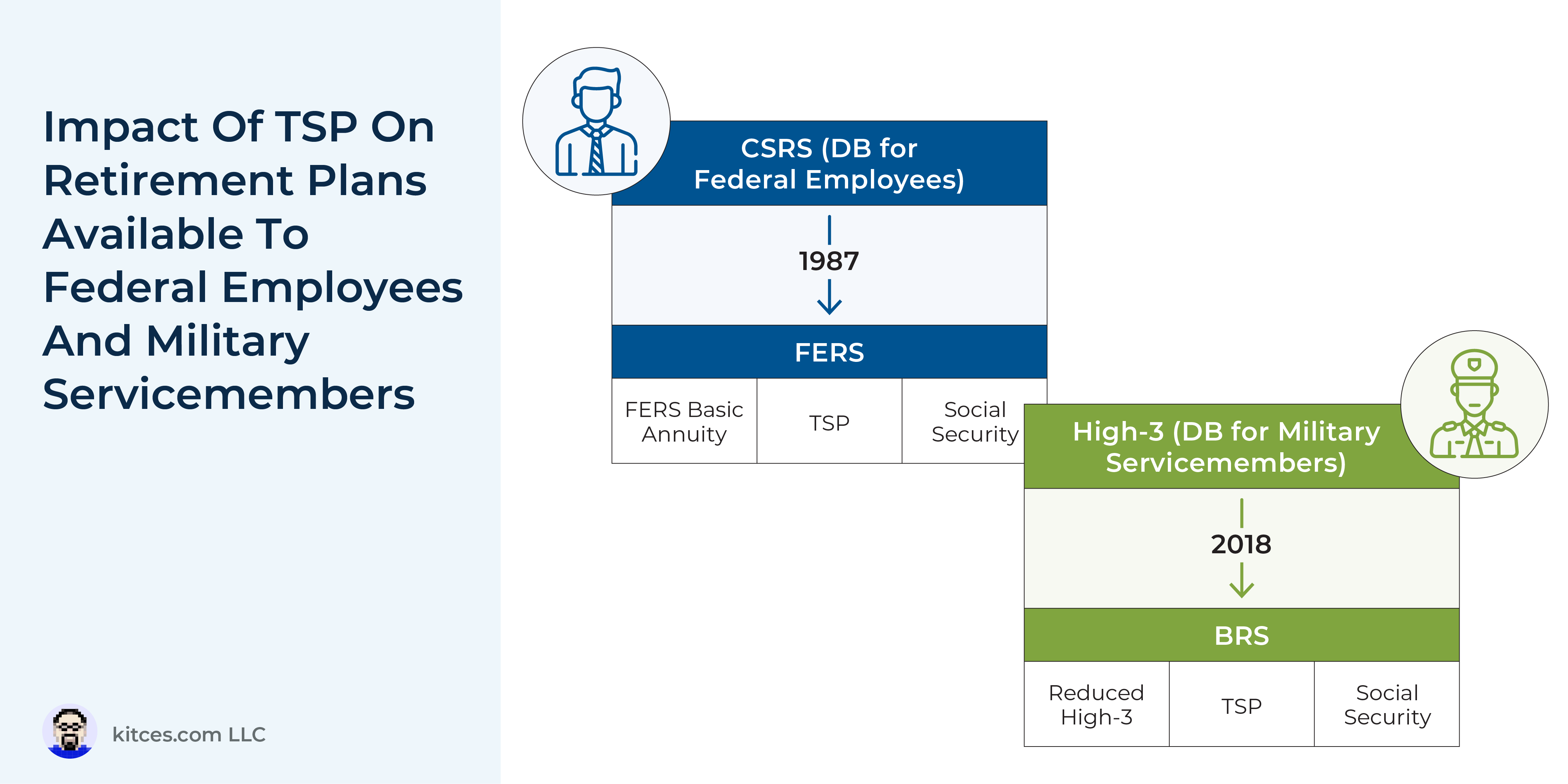

Advisors may add worth for shoppers who’re TSP members by understanding how the TSP matches throughout the Federal worker and army retirement methods, which mix the outlined contribution TSP characteristic with an outlined profit pension (although as a result of the worth of this pension has been decreased, TSP administration has elevated in significance). Additional, advisors can assist these shoppers by serving to them handle the retirement financial savings decisions that include profession transitions; for instance, as a result of many army members have ‘encore’ careers (as they’re usually eligible to retire effectively earlier than ‘conventional’ retirement age), balancing their money stream and retirement financial savings wants is essential throughout their transition interval.

Advisors working with shoppers who’ve been deployed to fight zones may add worth by being conscious of the associated TSP issues. As an illustration, as a result of earnings earned whereas deployed in a fight zone is tax-free, any pre-tax TSP contributions can lead to a commingling of tax-free fight pay and taxable earnings (although this may be prevented by making Roth contributions during times the place earnings is untaxed). As well as, the annual deferral restrict will increase considerably throughout the 12 months of a fight deployment, offering a chance to contribute much more cash to the TSP (if doing so matches throughout the shopper’s money stream plan).

Finally, the important thing level is that whereas the TSP is just like many different office retirement plans, advisors who perceive its distinctive attributes and keep updated with its ongoing adjustments can higher serve the Federal workers and army servicemembers who take part within the plan. And on condition that there are about 6.2 million TSP account holders, these people signify a big potential pool of shoppers!