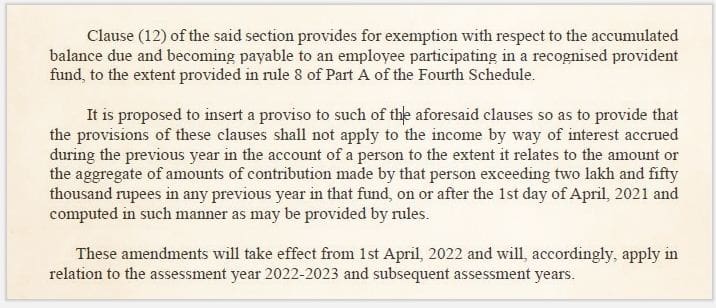

We’re all conscious that Price range 2021 (The Finance Invoice 2021) has launched one of many key amendments to the EPF Act. As per this modification, from 1st April 2021 onwards, the curiosity on any contribution above Rs. 2.5 lakh by an worker to a acknowledged provident fund is taxable.

Till FY 2020-21, the curiosity revenue earned on contributions to EPF made by the worker was utterly TAX-FREE.

Associated Article : For extra particulars, you could kindly undergo this text @ Curiosity on EPF Contributions above Rs 2.5 lakh is Taxable | Price range 2021

Along with the above modification, the central govt has determined to implement the beneath essential adjustments to the EPF act.

New EPF Guidelines 2021 | Newest Amendments

Beneath are the brand new EPF guidelines that EPF members want to concentrate on;

- EPFO Aadhar Verification necessary w.e.f. 1st June, 2021. (The final date to seed the Aadhaar quantity with UAN is prolonged from June 1, 2021, to September 1, 2021, for all EPFO beneficiaries.)

- EPFO hikes demise insurance coverage underneath EDLI scheme to Rs 7 lakh.

- EPFO permits its subscribers to avail the second COVID-19 advance (partial EPF withdrawal)

Let’s now undergo these new EPF guidelines 2021 intimately….

EPFO Aadhar Verification necessary w.e.f. 1st June, 2021

- The EPFO has instructed all of the Employers (Firm) that from June 1, if PF account is just not linked to Aadhaar or UAN is just not Aadhaar verified, then their ECRs (Digital Challan cum Return) is not going to be filed. The final date to seed the Aadhaar quantity with UAN is prolonged from June 1, 2021, to September 1, 2021, for all EPFO beneficiaries

- This implies, although workers can see their very own PF account contribution, they won’t be able to get the employer’s share.

- Additionally, if the accounts of PF account holders should not linked with Aadhaar, then they won’t be able to make use of the providers of EPFO.

So, hurry up, hyperlink your UAN to Aadhaar and get it verified.

EPFO hikes demise insurance coverage underneath EDLI scheme to Rs 7 lakh

In an one other main modification to the EPF act, the central govt has hiked the insurance coverage declare quantity underneath the EDLI scheme to Rs 7 lakh.

In a gazette notification, the Workers’ Provident Fund Organisation (EPFO) stated the minimal demise insurance coverage has been elevated to Rs 2.5 lakh and the utmost to Rs 7 lakh, from the sooner limits of Rs 2 lakh and Rs 6 lakh, respectively.

Whereas the decrease restrict of Rs 2.5 lakh is coming with retrospective impact (w.e.f. fifteenth Feb, 2020), the higher restrict has a potential impact.

The Workers’ Deposit Linked Insurance coverage Scheme (EDLI) is an insurance coverage cowl supplied by the Workers’ Provident Fund Group (EPFO). A nominee or authorized inheritor of an lively member of EPFO will get a lump sum fee of as much as Rs 6 Lakhs (now Rs 7 lakh) in case of demise of the member throughout the service interval (lively EPF member).

Associated Article : The right way to make EPF Dying Declare by Nominee of a Subscriber? | EPF/EPS/EDLI Scheme Advantages

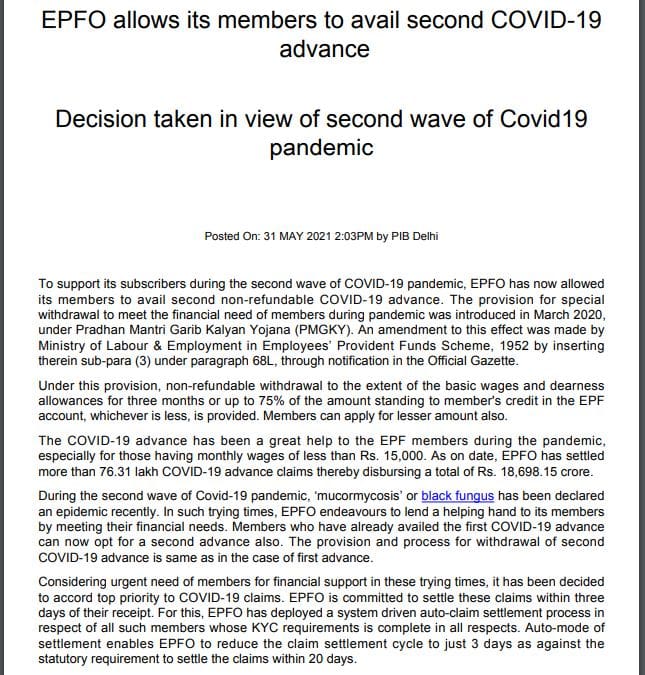

EPF advance (partial withdrawal declare) to fight Covid-19

EPFO permits all its members to avail second covid-19 advance (partial withdrawal).

Earlier final yr (2020), the EPFO had allowed its members to withdraw COVID-19 advance to satisfy exigencies as a result of pandemic. To assist its subscribers throughout the second wave of COVID-19 pandemic, the EPFO has now allowed its members to avail second non-refundable COVID-19 advance.

The members are allowed to withdraw three months primary wages (primary pay + dearness allowance) or as much as 75% of quantity standing to their credit score of their provident fund account, whichever is much less.

The EPFO has settled greater than 76.31 lakh COVID-19 advance claims thereby disbursing a complete of Rs 18,698.15 crore as on date. In case you have already availed the primary COVID-19 advance, now you can go for a second advance additionally.

Proceed studying :

- Essential & Complete record of Price range 2021-22 Amendments associated to Private Finance | W.e.f AY 2022-23

- Provident Funds – Sorts & Tax Implications

- EPF Partial Withdrawals / Advances : Particulars, Guidelines & Pointers

- Why must you Withdraw Outdated EPF Account Stability? | In-operative EPF A/c Timeline

- The right way to test if my Employer is depositing EPF quantity with EPFO / Belief?

(Put up first revealed on : 31-Could-2021)