What number of occasions have you ever approached the Union Finances with immense expectations and are available again empty handed? The motion lay elsewhere. There have been essential bulletins however in a roundabout way associated to placing more cash in your pockets.

Not this time.

The Union Finances 2023 was action-packed. So many bulletins that instantly impression the middle-class taxpayer. I listing among the finances proposals instantly impacting the taxpayers.

- Decrease tax charges beneath the brand new tax regime.

- Conventional plans with annual premiums over Rs 5 lacs introduced beneath the tax web.

- Taxpayers set off long run capital positive factors by buying a residential property. Set-off limits beneath Part 54 and Part 54F are actually capped.

- Improve in funding cap beneath Senior Residents financial savings scheme (SCSS) from Rs 15 lacs to Rs 30 lacs.

- Improve in Tax assortment at Supply (TCS) for remittance beneath LRS for journey and investments overseas.

- Antagonistic tax adjustments for REITs and Market-linked debentures

All the above adjustments should not beneficial however the unfavourable ones principally have an effect on the HNIs.

Not attainable to cowl this wide selection of matters in a single put up. Therefore, will cowl a few of these over the subsequent few weeks. On this put up, I give attention to an important one, the adjustments to the tax construction within the new tax regime.

Now that the brand new tax regime has been made extra enticing, does it make sense so that you can change from the outdated tax regime to the brand new regime?

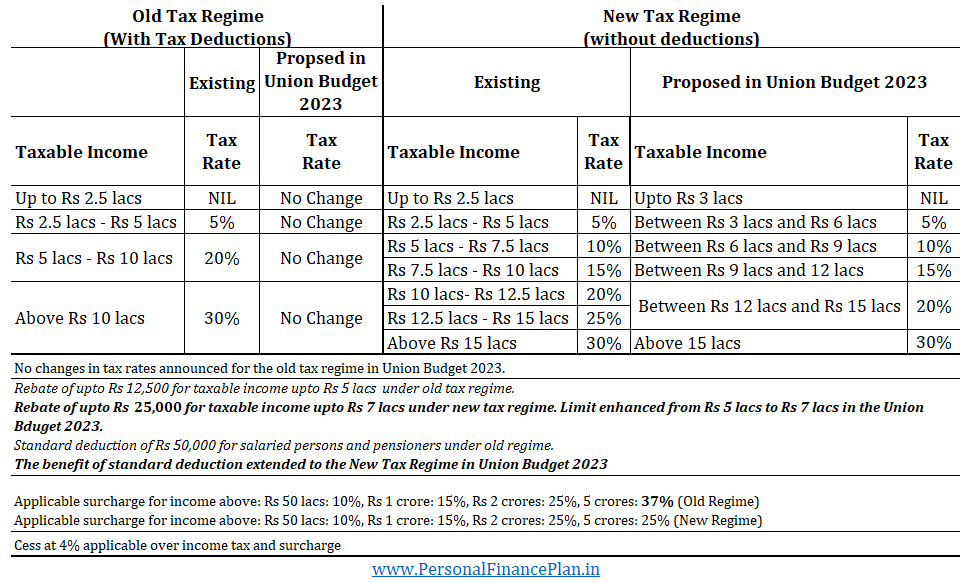

What are the brand new tax slabs?

The tax charges haven’t been modified beneath the outdated tax regime (Larger tax charge however deductions).

The adjustments are just for the brand new tax regime (decrease tax charges with out deductions).

Incentives for the New Tax Regime

- Enhancement of minimal exemption restrict from Rs 2.5 lacs to Rs 3 lacs

- The eligibility of rebate beneath Part 87A enhanced from Rs 5 lacs to Rs 7 lacs if choosing the brand new tax regime. This ensures no taxes in case your earnings doesn’t exceed Rs 7 lacs.

- Decrease tax charges

- Normal deduction of Rs 50,000 is now allowed for Salaried individuals and pensioners. Was not permitted earlier.

- Surcharge for earnings over Rs 5 crores lowered from 37% to 25%, if choosing the brand new tax regime.

- New tax regime shall be the default possibility.

No taxes if the earnings is as much as Rs 7 lacs

Should you go for the brand new tax regime and in case your earnings is as much as Rs 7 lacs, you shouldn’t have to pay any tax.

How does this occur?

By means of a provision beneath Part 87A.

Beneath Part 87A, you might be eligible for a rebate of as much as Rs 25,000 (earlier Rs 12,500) if the whole earnings doesn’t exceed Rs 7 lacs (earlier Rs 5 lacs). This modification is just for the New tax regime.

So, let’s say your earnings is Rs 6.5 lacs. As per the revised tax slabs/charges, your tax legal responsibility can be Rs 20,000. Nevertheless, for the reason that earnings is beneath Rs 7 lacs, you can be eligible for a rebate of Rs 20,000. Decrease of (Rs 20000, 25000). Therefore, zero tax legal responsibility.

In case you are a salaried worker or a pensioner, you too can take commonplace deduction. It will push the tax-free restrict to Rs 7.5 lacs.

Notice: The foundations haven’t been modified for the outdated tax regime. Beneath the outdated tax regime, the rebate continues to be capped at Rs 12,500 if the earnings doesn’t exceed Rs 5 lacs.

For willpower of complete taxable earnings, it’s not simply your wage that’s counted. The capital positive factors or curiosity earnings or some other taxable earnings should even be added to calculate the whole earnings. Even the LTCG on fairness/fairness funds of as much as Rs 1 lac have to be added since it’s not exempt earnings however taxable earnings on which no tax have to be paid.

Aid for Excessive Revenue Earners

Should you earn rather well, the Authorities asks you to pay extra taxes. The tax slabs don’t change however the surcharge kicks in.

Above 50 lacs: 10%

Above Rs 1 crores: 20%

Above Rs 2 crores: 25%

Above Rs 5 crores: 37%

Thus, in case your taxable earnings is greater than Rs 5 crores, your tax charge on your whole earnings above Rs 10 lacs is 30% * (1+37% surcharge) * (1 + 4% cess) = 42.77%

The Authorities proposes a change right here.

For earnings above Rs 5 crores, the surcharge shall be lowered from 37% to 25%, however provided that you go for the brand new regime. This reduces marginal tax charge = 30% * (1+25% surcharge) * (1+4% cess) = 39%

No change in surcharge charge for the outdated tax regime. And the speed of surcharge stays 37% if the whole earnings is greater than 5 crores.

Clearly, for such taxpayers with annual earnings above Rs 5 crores, new tax regime is a straightforward alternative regardless of the tax deductions taken.

How higher is the Proposed New Tax Regime in comparison with the Present New Regime?

The next illustration demonstrates the impression for salaried taxpayers.

Since the advantage of commonplace deduction is on the market solely to salaried staff and pensioners, the distinction will scale back for professionals.

What do you have to decide: New Tax Regime or the Previous Tax Regime?

Now to the true query.

Between the outdated and the brand new tax regime, which one do you have to decide?

The brand new Tax regime has decrease tax charges however doesn’t enable deductions.

Previous tax regime has larger taxes however permits to cut back earnings by means of tax deductions.

Subsequently, in the event you can avail sufficient tax deductions, you may nonetheless be higher off within the outdated regime.

However what’s the tipping level? What’s “sufficient”?

What must be the quantity of tax deductions to make the outdated regime extra enticing?

I in contrast the tax liabilities for numerous ranges of earnings and tax deductions for salaried staff (who will get the advantage of commonplace deduction beneath each outdated and new regime).

As you possibly can see above, the brink of tax deduction the place outdated regime turns into extra enticing than the brand new regime is Rs 4.25 lacs (together with commonplace deduction).

Subsequently, in the event you can handle tax deduction of Rs 4.25 or extra (Rs 3.75 lacs excluding commonplace deduction), you can be higher off within the outdated regime.

For non-salaried (who don’t get profit of ordinary deduction), the tipping level shall be Rs 3.75 lacs.

Now, you have to see in the event you can take tax deductions to that extent.

Part 80C: As much as Rs 1.5 lacs (life insurance coverage premium, ELSS, PPF, EPF, and many others.)

Part 80D: As much as Rs 25,000. For medical insurance premium. Should you (or your partner) are a senior citizen, the profit goes as much as Rs 50,000. As well as, in case you are paying the premium on your dad and mom, you get an extra 25,000 tax profit. If both father or mother is a senior citizen, the extra profit goes to 50,000.

Part 80CCD(1B): As much as 50,000 for personal contribution to NPS.

Normal deduction of Rs 50,000.

These numbers add as much as about 2.75 lacs.

The opposite outstanding ones are as much as Rs 2 lacs for House Mortgage Curiosity (Part 24) and home lease allowance (HRA) adjustment . In case you have taken an schooling mortgage, you get tax profit for curiosity fee on schooling mortgage (no cap on the tax profit) beneath Part 80E.

So, in case you are staying in a home you personal (self-occupied) and you’ve got repaid the house mortgage in full, you possibly can’t take profit beneath Part 24 (residence mortgage curiosity) and home lease (HRA).

In such a case, it’s troublesome to the touch that magical mark of Rs 4.25 lacs (for salaried/pensioners) and Rs 3.75 lacs (for self-employed).

And in the event you can’t hit the mark, you might be higher off within the new tax regime.

Tax Advantages which are nonetheless permitted beneath the New Tax Regime

Normal deduction of Rs 50,000. Allowed just for salaried staff and pensioners.

Employer contribution to NPS, EPF, and superannuation fund. Part 80CCD (2). Notice solely employer contributions are allowed as deduction. Not personal contribution. Therefore, you probably have been investing in NPS and taking advantage of as much as 50K beneath Part 80CCD(1B), you gained’t be capable of get that profit in the event you change to the brand new tax regime.

As well as, for a let-out property, you may nonetheless be capable of take profit for residence mortgage curiosity.

The Verdict

It’s evident that the Authorities is attempting to extend acceptance of the New Tax regime by means of incentives.

By decreasing tax charges for the middle-income earners.

And decreasing surcharge for very high-income earners.

And presumably progressively part out the outdated regime. Or if only a few individuals go for the outdated regime, it is going to mechanically turn out to be irrelevant.

And I feel the Authorities is doing it the suitable method. Slightly than abolishing the outdated regime or withdrawing tax advantages beneath the outdated regime, they’ve simply made the New Tax Regime extra enticing.

The Authorities did the identical with crypto investments. It might have banned crypto investments. As an alternative, it discouraged the funding in cryptos by means of larger taxes, TCS, disallowing setoffs, or carry ahead of loss. So, not an outright ban however a nudge to not make investments.

Going ahead, if the Authorities needs to place more cash within the pockets of the traders, it is going to merely tweak the tax charges or tax slabs beneath the brand new regime. And never contact the outdated tax regime.

With this, it’s truthful to NOT anticipate an enhancement within the Part 80C restrict. Not now and never sooner or later. Or some other particular tax advantages. I don’t anticipate any recent tax profit solely for the outdated tax regime sooner or later. If a brand new tax profit (deduction) is introduced, it might be for each the outdated and the brand new regime.

By the way in which, if we preserve including tax deductions to the brand new regime, we are going to beat the final word objective of the New Tax Regime. An easier tax construction. And the brand new regime turns into the New “Previous Regime”.

The brand new tax regime is straightforward.

Will get you out of that tax-saving mindset.

Total industries have mushroomed across the idea of tax-saving. Taxpayers purchase insipid funding merchandise simply to avoid wasting taxes. Beneath strain to make that tax-saving funding earlier than the tip of March, they purchase something with little regard to their wants and utility of their portfolios. Gross sales brokers construct their whole gross sales pitch round tax-saving. Not anymore.

I don’t deny that taxation is a vital resolution variable when deciding on an funding, however it shouldn’t be the one resolution variable.

And sure, it’s superb to get out of the tax-saving mindset. Nevertheless, don’t let go of the investment-making mindset. You should nonetheless make investments on your monetary targets.