Newest IRDA Declare Settlement Ratio 2023 was launched on twenty third December 2022. Which is the very best Life Insurance coverage Firm in 2023 (primarily based on the declare settlement ratio)? Nearly all of Life Insurance coverage Firms these days lure patrons primarily based on the IRDA Life Insurance coverage Declare Settlement Ratio. Nevertheless, is it the correct information to look into?

What’s the that means of the Declare Settlement Ratio?

Declare Settlement Ratio is the indicator of what number of demise claims Life Insurance coverage Firm settled in any monetary yr. It’s calculated as the entire quantity of claims acquired in opposition to the entire variety of claims settled. Allow us to say, the Life Insurance coverage Firm acquired 100 claims and amongst these, it settled 98, then the declare settlement ratio is alleged to be 98%. The remaining 2% of claims the Life Insurance coverage Firm rejected.

Based mostly on this, we are able to simply assume how customer-friendly they’re in coping with demise claims. Nevertheless, I warn you that this declare settlement ratio is uncooked information.

It won’t offer you a transparent image of what kinds of merchandise they settled. They might be Endowment plans, ULIPs, or Time period Insurance coverage Plans. Therefore, this isn’t the only criterion in judging the efficiency of a life insurance coverage firm.

Greater than that we don’t know for what causes the insurance coverage firm rejected the claims.

Newest IRDA Declare Settlement Ratio 2023

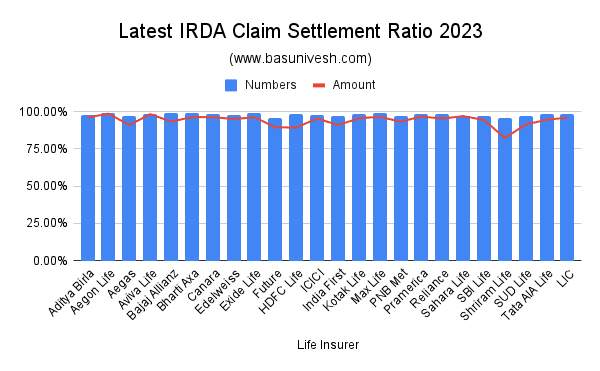

Under is the IRDA Declare Settlement Ratio 2021-22 or as much as thirty first March, 2022. Few factors to note from this Annual Report are as beneath.

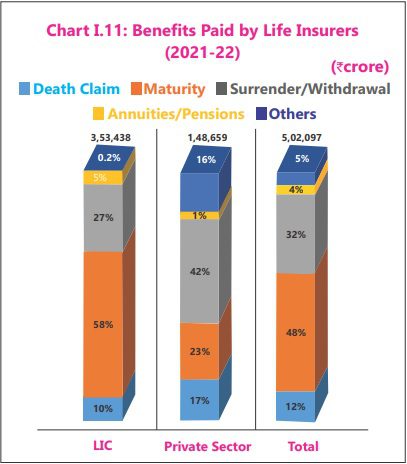

# Demise claims settled by LIC are far much less if we examine to its quantity of enterprise. You possibly can refer the beneath picture for a similar.

# Within the case of particular person life insurance coverage companies, the life trade’s demise declare settlement ratio elevated to 98.64% in 2021-22 from 98.39% within the earlier yr and the repudiation/rejection ratio decreased to 1.02% from 1.14%.

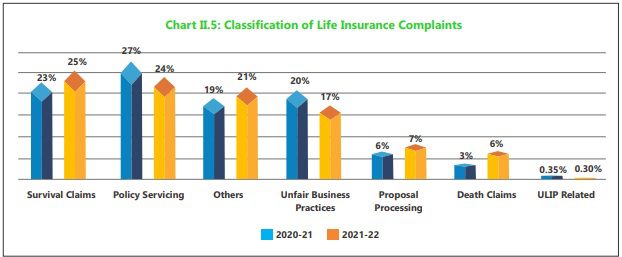

# Variety of mis-selling complaints have lowered from 25,482 in 2020-21 to 23,110 in 2021-22. The incidence of mis-selling complaints per 10,000 insurance policies bought has additionally lowered through the years. The beneath picture will provide you with readability of concerning the grievance sorts.

# Round 55% of the brand new enterprise remains to be from the brokers. On-line or direct sale remains to be at 1%.

Let me now share with you the most recent IRDA Declare Settlement Ratio 2023.

The above Google Sheet will provide you with the whole information of the most recent IRDA declare settlement ratio 2023. The green-colored values are greater than 98%. 98% to 97% is marked in purple and beneath 97% in yellow.

Now in case you have a look at the above information, you’ll be able to simply draw a conclusion of how they’re doing enterprise. To focus on the declare settlement numbers with the quantity, then we are able to draw the beneath chart.

High 5 Finest Life Insurance coverage firms in India for 2023

Based mostly on the IRDA Declare Settlement Ratio 2021-22, that are the High and Finest Life Insurance coverage Firms in 2023? I choose solely 5 primarily based on the above information. You could differ for my part and give you a distinct set of concepts. However these are my selections.

- LIC

- HDFC Customary Life

- ICICI Pru Life

- Max Life

- Aegon

Few necessary factors earlier than leaping into choosing of Life Insurance coverage Firms

# Declare Settlement Ratio is uncooked information

As I pointed above, the declare settlement ratio is simply uncooked information. It won’t give us the precise information. Therefore, by no means depend on this single information alone whereas shortlisting the insurance coverage firm.

# Focus on Product fairly than an organization

Select the product which fits your requirement and premium affordability. Declare the details correctly. By no means cover any materials details. Should you do, then an insurance coverage firm must settle for your declare. By no means give a room of suspicion to you to reject the declare.

# Part 45 of the Insurance coverage Act will guard YOU

In response to Part 45 of the Insurance coverage Act, “No coverage of life insurance coverage shall be referred to as in query on any floor by any means after the expiry of three years from the date of the coverage, i.e. from the date of issuance of the coverage or the date of graduation of threat or the date of revival of the coverage or the date of the rider to the coverage, whichever is later”.

It says so much. Even in case you shared fallacious data or hid some materials details, then additionally it’s purely the life insurance coverage Firm’s accountability to dig deep and discover out faults WITHIN 3 YEARS ONLY. After 3 years, they can not query. Notice the interval of three years, it’s from the date of issuance of the coverage, the date of graduation of threat or the date of revival of the coverage, or the date of a rider to the coverage, WHICHEVER IS LATER. So allow us to say you took the coverage right now and after a couple of years, the coverage lapsed resulting from non-payment of the premium. Nevertheless, you thought to resume it once more and paid all dues. In such a state of affairs, this 3-year interval begins from such revival date, however not from the unique coverage issued to this point.

Learn the whole particulars about this IMPORTANT act of Life Insurance coverage in my earlier submit at “Time period Insurance coverage-Declare Settlement Ratio no extra an enormous standards”.

# Disclose the details Correctly

Whereas shopping for Life Insurance coverage merchandise, you have to fill the proposal kind by yourself. By no means permit any agent or Life Insurance coverage Firm consultant to fill it. Disclose the details correctly with out hiding something. It will actually assist you in an enormous means. Additionally, it won’t give any room for insurers to reject your declare.

Do the issues correctly that are in your hand. Relaxation in HOPE for the very best.