What are the most recent Put up Workplace Curiosity Charges July – Sept 2023? What are the most recent Put up Workplace rates of interest on PPF, SSY, SCSS, FDs, MIS, NSC, KVP, RD, and put up workplace financial savings accounts?

Due to greater inflation, many banks began rising their FD charges. Therefore, many thought that this time Authorities will enhance the rates of interest of small saving schemes throughout this quarter additionally. Nonetheless, for few months, the inflation is easing slowly. Accordingly, there’s a small enhance in rates of interest for few of the short-term deposits of the Put up Workplace.

Earlier the rates of interest was introduced yearly as soon as. Nonetheless, from 2016-17, the speed of curiosity can be mounted quarterly. I already wrote an in depth put up on this. I’m offering the hyperlink to that earlier put up beneath.

Beneath is the timetable for change in rates of interest for all Put up Workplace Financial savings Schemes.

As per the schedule, Authorities introduced the rate of interest relevant to all Put up Workplace Financial savings Schemes from 1st July 2023 to thirtieth September 2023.

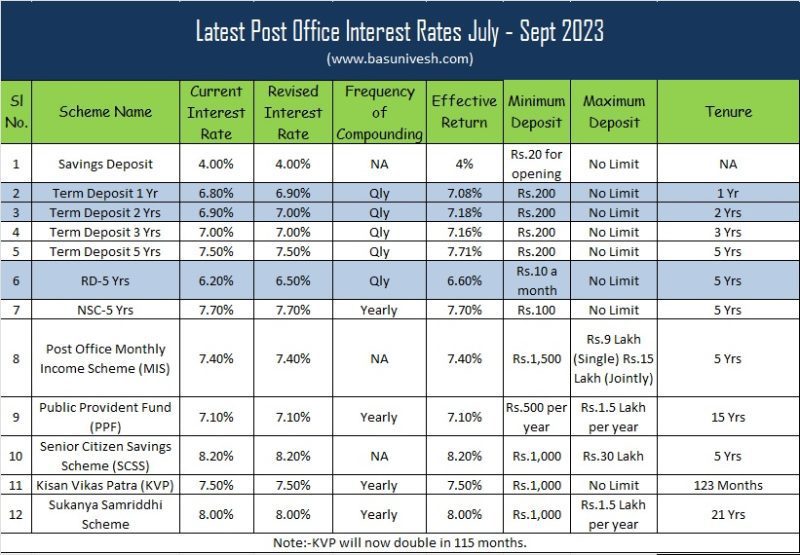

Newest Put up Workplace Curiosity Charges July – Sept 2023

As per the notification from the Division of Financial Affairs, Ministry of Finance, the beneath rates of interest are relevant for the second quarter of this monetary 12 months (2023-24).

For few merchandise, the rate of interest was modified (Time period Deposits). Nonetheless, for almost all of the merchandise, the rate of interest is unchanged. I’ve highlighted the schemes the place the rates of interest modified for this quarter within the above desk.

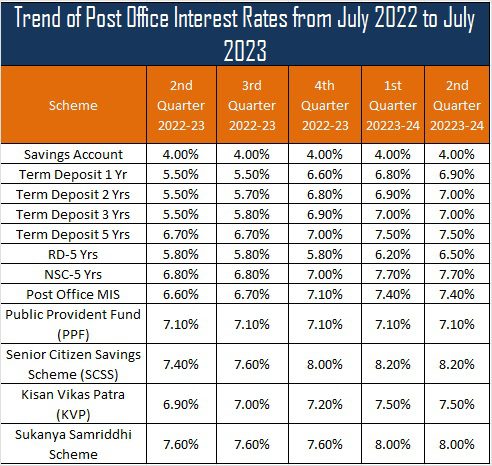

The pattern of Put up Workplace Curiosity Charges from July 2022 to July 2023

Now allow us to have a look at the pattern of Put up Workplace Small Financial savings Rates of interest of final 12 months. They’re as beneath.

Options of Put up Workplace Financial savings Schemes

Now allow us to look the Put up Workplace Small Financial savings Schemes options. This offers you extra readability on selecting the best product for you.

# Put up Workplace Financial savings Account

Like Financial institution Account, Put up Workplace additionally presents you the financial savings account to its clients. The few options are as beneath.

- Minimal Rs.500 is required to open the account.

- Account might be opened single, collectively, Minor (above 10 years of age), or a guardian on behalf of a minor.

- Minimal steadiness to be maintained in an account is INR 500/- , if steadiness Rs. 500 not maintained, a upkeep charge of 100 (100) rupees shall be deducted from the account on the final working day of every monetary 12 months and after deduction of the account upkeep charge, if the steadiness within the account turns into nil, the account shall stand robotically closed.

- Cheque facility/ATM facility can be found

- Curiosity earned is Tax-Free as much as INR 10,000/- per 12 months from the monetary 12 months 2012-13

- Account might be transferred from one put up workplace to a different

- One account might be opened in a single put up workplace.

- A minimum of one transaction of deposit or withdrawal in three monetary years is critical to maintain the account lively, else account turned silent (Dorment).

- Intra Operable Netbanking/Cell Banking facility is out there.

- On-line Fund switch between Put up Workplace Financial savings Accounts/Cease Cheque/Transaction View facility is out there by Intra Operable Netbanking/Cell Banking.

- The ability to hyperlink with IPPB Saving Account is out there.

- Funds Switch (Sweep in/Sweep out) facility is out there with IPPB Saving Account.

# Put up Workplace Fastened Deposits (FDs)

- Minimal of Rs.1,000 and in multiples of Rs.100. There isn’t a most restrict.

- FD tenure presently out there is 1 yr, 2 Yrs, 3 Yrs and 5 Yrs.

- Account might be opened single, collectively, Minor (above 10 years of age) or a guardian on behalf of minor.

- Account might be opened by money /Cheque and in case of Cheque the date of realization of cheque in Govt. account shall be date of opening of account.

- Account might be transferred from one put up workplace to a different

- Single account might be transformed into Joint and Vice Versa .

- Any variety of accounts might be opened in any put up workplace.

- Curiosity shall be payable yearly, No extra curiosity shall be payable on the quantity of curiosity that has develop into due for fee however not withdrawn by the account holder.

- The annual curiosity could also be credited to the financial savings account of the account holder at his possibility.

- Untimely encashment not allowed earlier than expiry of 6 month, If closed between 6 month to 12 month from date of Opening, Put up Workplace Saving Accounts rate of interest can be payable.

- 5 Yrs FD is eligible for tax saving functions underneath Sec.80C.

# Put up Workplace Recurring Deposit (RD)

- Minimal is Rs.100 a month and in a number of of Rs.10. There isn’t a most restrict.

- Account might be opened single, collectively, Minor (above 10 years of age) or a guardian on behalf of minor.

- Tenure of RD is 5 years.

- Account might be opened by money / Cheque and in case of Cheque the date of deposit shall be date of clearance of Cheque.

- Untimely closure is allowed after three years from the date of opening of the account.

- Account might be transferred from one Put up Workplace to a different Put up Workplace.

- Subsequent deposit might be made as much as fifteenth day of subsequent month if account is opened as much as fifteenth of a calendar month and as much as final working day of subsequent month if account is opened between sixteenth day and final working day of a calendar month.

- If a subsequent deposit will not be made as much as the prescribed day, a default charge is charged for every default, default charge @ 1 Rs for each 100 rupee shall be charged. After 4 common defaults, the account turns into discontinued and might be revived in two months but when the identical will not be revived inside this era, no additional deposit might be made.

- If in any RD account, there’s a month-to-month default quantity, the depositor has to first pay the defaulted month-to-month deposit with default charge after which pay the present month deposit.

- There may be rebate on advance deposit of at the very least 6 installments, Rs. 10 for six month and Rs. 40 for 12 months Rebate can be paid for the denomination of Rs. 100.

- One mortgage as much as 50% of the steadiness allowed after one 12 months. It might be repaid in a single lumpsum together with curiosity on the prescribed charge at any time through the foreign money of the account.

- Account might be prolonged for one more 5 years after it’s maturity.

# Put up Workplace Month-to-month Revenue Scheme (MIS)

- Most funding is Rs.9 lakh in a single account and Rs.15 lakh collectively (It’s revised through the Price range 2023). Earlier it was Rs.4.5 lakh for a single account and Rs.9 lakh for joint accounts.

- Account might be opened single, collectively, Minor (above 10 years of age) or a guardian on behalf of minor.

- Any variety of accounts might be opened in any put up workplace topic to most funding restrict by including steadiness in all accounts (Rs. 4.5 Lakh).

- Single account might be transformed into Joint and Vice Versa.

- Maturity interval is 5 years.

- Curiosity might be drawn by auto credit score into financial savings account standing at similar put up workplace,orECS./In case of MIS accounts standing at CBS Put up workplaces, month-to-month curiosity might be credited into financial savings account standing at any CBS Put up workplaces.

- Could be prematurely en-cashed after one 12 months however earlier than 3 years on the low cost of two% of the deposit and after 3 years on the low cost of 1% of the deposit. (Low cost means deduction from the deposit.).

- Curiosity shall be payable to the account holder on completion of a month from the date of deposit.

- If the curiosity payable each month will not be claimed by the account holder such curiosity shall not earn any extra curiosity.

# Put up Workplace Senior Citizen Financial savings Scheme (SCSS)

I’ve written an in depth put up on this. Seek advice from the identical at ” Put up Workplace Senior Citizen Scheme (SCSS)-Advantages and Curiosity Charge“.

Notice – Efficient from 1st April 2023, the utmost restrict is presently Rs.30 lakh. Earlier it was Rs.15 lakh. This variation occurred throughout Price range 2023.

# Public Provident Fund (PPF)

I’ve written varied posts on PPF. Refer the identical:-

# Nationwide Financial savings Certificates NSC (VIII Challenge)

- Minimal Rs.1,000 and in a number of of Rs.100.

- No most restrict.

- Account might be opened single, collectively, Minor (above 10 years of age) or a guardian on behalf of minor.

- Tax Profit underneath Sec.80C is out there.

- Tenure is 5 years.

# Kisan Vikas Patra (KVP) Account

- Minimal Rs.1,000 and in multiples of Rs.100. There isn’t a most restrict.

- Account might be opened single, collectively, Minor (above 10 years of age) or a guardian on behalf of minor.

- The cash can be double at maturity. Nonetheless, because the rate of interest modifications on a quarterly foundation. The maturity interval additionally varies as soon as in 1 / 4.

# Sukanya Samriddhi Account Yojana (SSY)

I’ve written varied posts on this. Refer the identical:-

Conclusion:- Because the inflation is easing, this time authorities cautiously elevated the rates of interest of short-term deposits however not modified something in the direction of the long-term merchandise. This I believe a sensible transfer by Authorities.