Effectively, the precise title is Edelweiss CIBIL IBX 50:50 Gilt Plus SDL Quick Length Index Fund. That’s a reasonably large title for a brief period fund. And it guarantees to supply quite a bit.

Past the advertising and marketing buzz, let’s discover out what the fund has to actually supply.

The fund is categorised “Quick Length Fund” beneath SEBI’s categorisation of debt funds.

As per the Scheme Info Doc (SID):

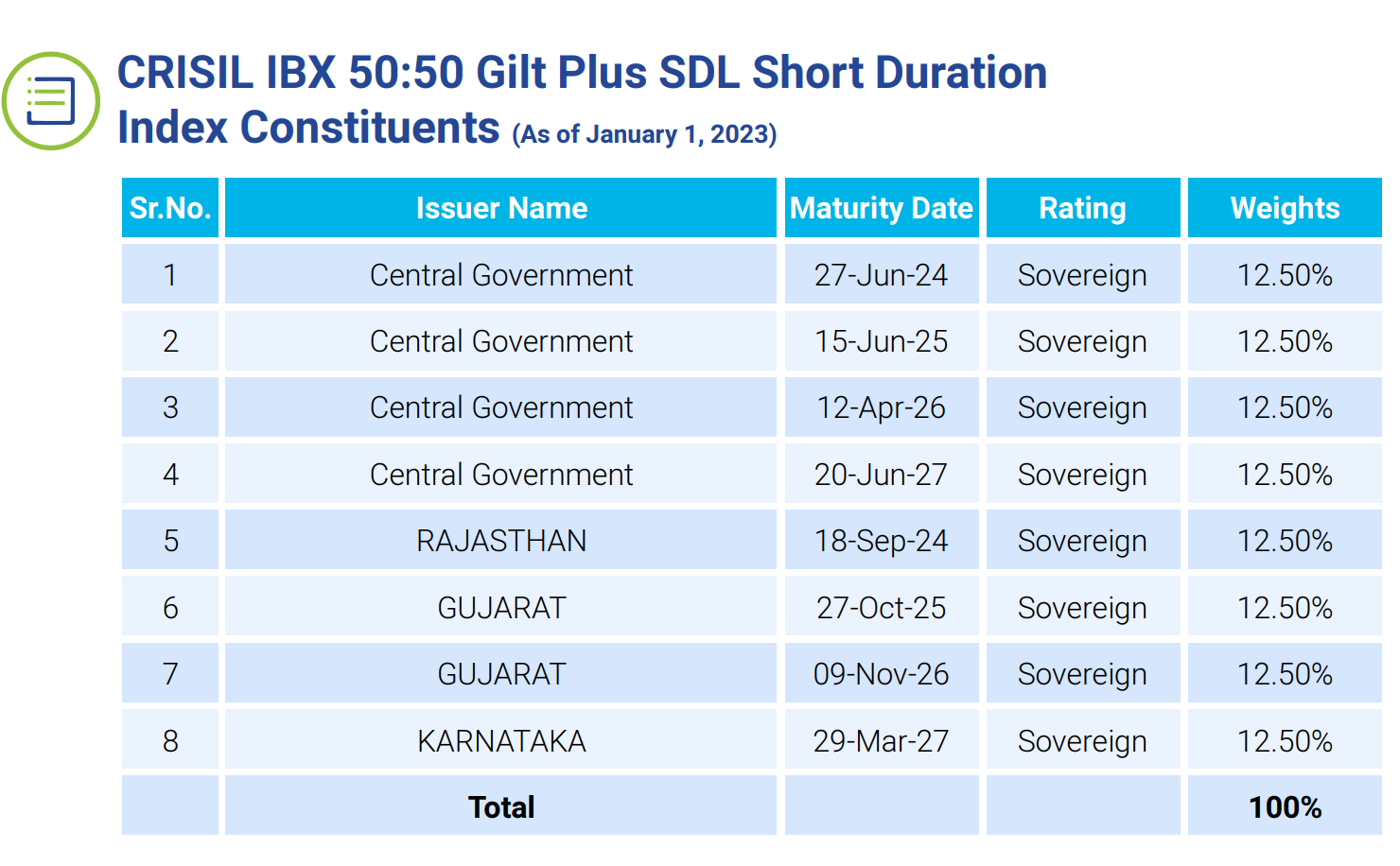

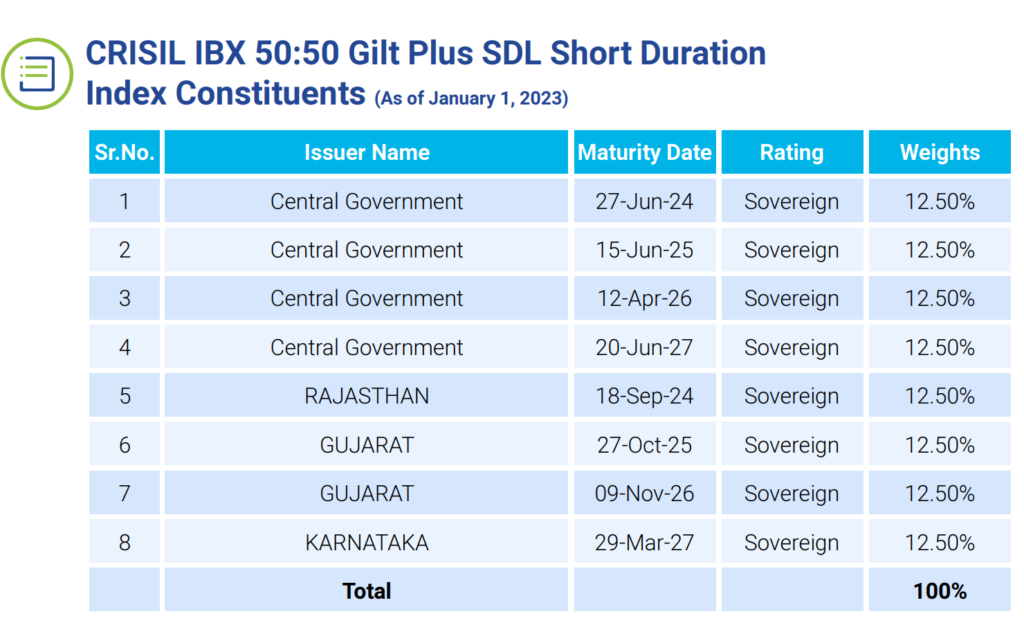

The Edelweiss CIBIL IBX 50:50 Gilt Plus SDL Quick Length Index Fund will make investments passively within the constituents of the CIBIL IBX 50:50 Gilt Plus SDL Quick Length Index. The fund could have a low credit score threat and a excessive rate of interest threat.

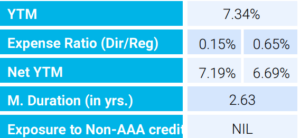

Under are a number of the quantitative parameters of the index.

There are 2 different issues that stand out on this fund supply.

#1 It isn’t taking credit score threat.

How? It’ll make investments solely within the central govt and state govt bonds they usually include state assure. So no dropping principal or curiosity there.

The fund will spend money on securities that mature in 1 to five years. The present Modified Length of the index, on which the fund relies, is 2.63 years

The YTM of the index constituents presently is 7.34%.

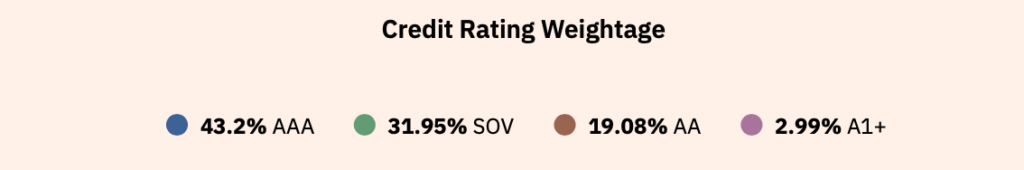

Different funds within the “brief period class” are utilizing company bonds or industrial paper together with sovereign. They goal to ship the next return however.

The next is the credit standing weightage of HDFC Quick Time period Debt Fund.

#2 The fund has a low expense ratio translating to raised returns for the investor.

The fund has not specified its expense ratio and it’s one thing that we’ll see over the subsequent few months with the disclosures. Nonetheless, as a passive fund (it’ll make investments solely within the index constituents), the expense ratio is prone to be low.

I’m prepared to imagine that it’s going to someplace round 0.15% for the direct plan and 0.65% for the common plan. These numbers are talked about for the index within the first picture on this submit.

With this assumptions, the online return with no credit score threat to the direct investor might be YTM – expense ratio, that’s, 7.34% – 0.15% = 7.29%. For normal plan it will likely be 0.5% lesser.

In distinction, HDFC Quick Time period Debt Fund – Direct Plan has an expense ratio of 0.29%. It has a present YTM of seven.72%. The web return to the investor is prone to be 7.43%.

Does that imply you spend money on the Edelweiss Shot Length Index fund?

Maintain your horses.

This fund is NOT for the cash which you want within the subsequent 1 12 months, could also be even a bit of extra. If required, you have to be prepared to sit down together with your investments for 3 years plus when the capital beneficial properties indexation profit clicks in with the long run period for debt funds.

After you have understood the time horizon, take into consideration the danger urge for food. For somebody who values security over returns, for the given time horizon, it’s a no brainer what fund to go for. This one.

Now, that is an open ended fund and doesn’t have a lock-in. So, you don’t have to speculate straight away. Observe the fund for the subsequent few months, see the portfolio disclosures after which take a name.

DON’T FORGET THE RISK related to rate of interest actions.

The fund has additionally been launched at an opportune time. The rates of interest are at close to peak ranges. So, for now, the rate of interest threat goes to play out favourably.

What occurs when the rate of interest cycle performs out on the upside and begins transferring downwards? Effectively, the fund’s present positioning of a fund to park any brief time period cash goes for a little bit of a toss there. As rates of interest go down, the portfolio is prone to ship a unfavourable consequence (like all different debt funds with the same period)

—

Word: A brief period fund is one which maintains the portfolio period between 1 and three years. Length helps perceive the riskiness of the portfolio in relation to rates of interest.

A modified period of 1 signifies that if the rates of interest go up by 1%, the portfolio worth will go down by 1%. And vice versa.

—

Learn: Parag Parikh Conservative Hybrid Fund – Do you have to make investments?

Learn: Dynamic Bond Funds