A fast notice as the primary half of 2023 attracts to a detailed, surprising the locals with its depth. Why? As a result of virtually no one noticed this rally coming.1

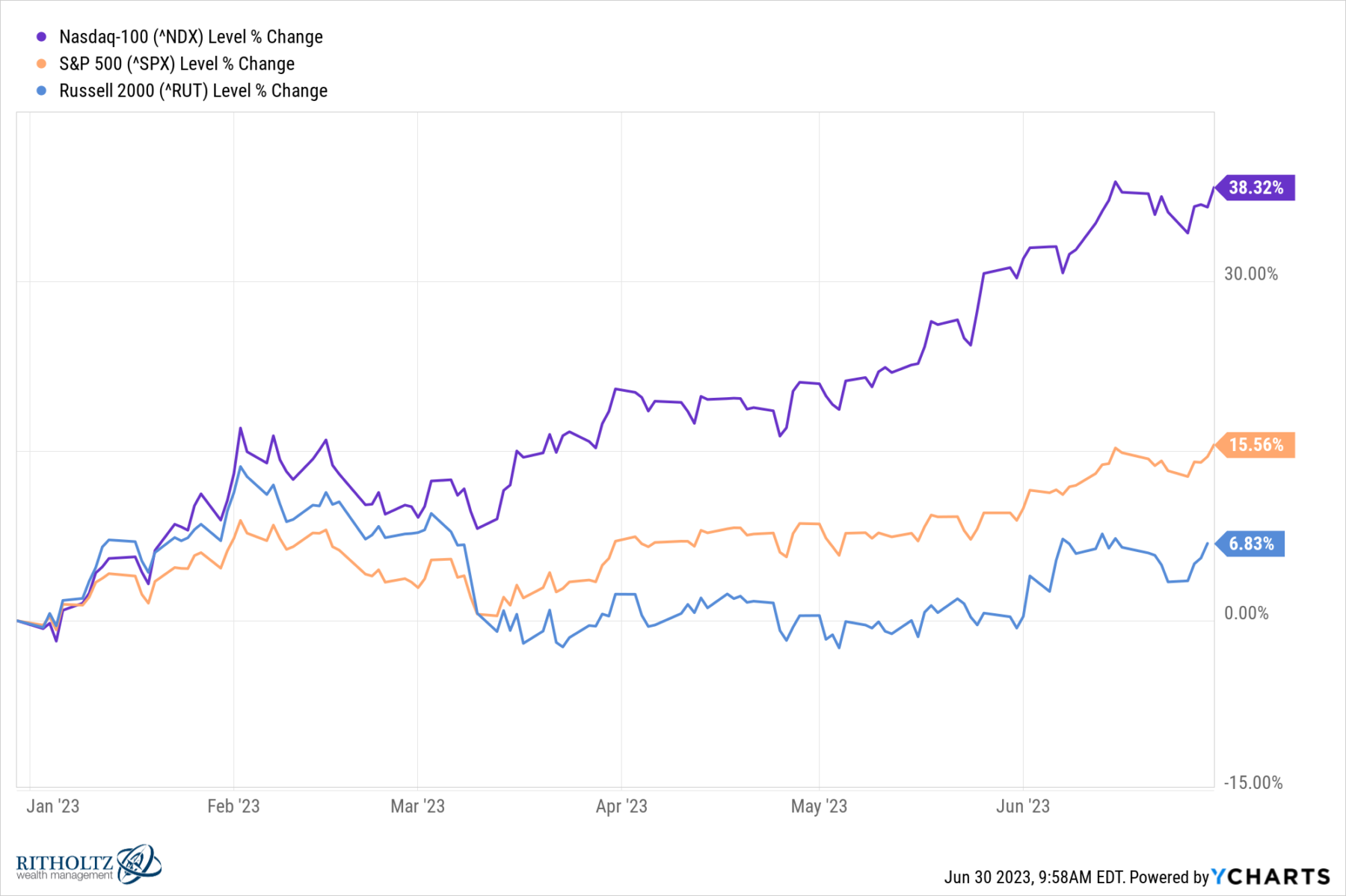

As of this second, the indices stand appreciably larger than the place they had been on January 1, 2023: The NASDAQ 100 is up >38%, the S&P 500 is up ~15.5%, and the Russell 2000 small cap index is up virtually 7%. These numbers would make for a decent yr a lot much less half that point.

Contemplate these positive factors in mild of yesterday’s dialogue about perception techniques and thought processes, Solely this time, as a substitute of referring to anti-vaxxers and insurrectionists, take into consideration all you heard from the fund managers, economists, strategists, and diverse pundits who freely opined on the place this market was going to go in 2023.

Why had been they so certain they knew what was going to occur? What had been their sources? Their course of? Did they think about the likelihood that they is likely to be incorrect?

Extra importantly, had been you counting on these individuals to tell your funding views? With their latest observe file recent in your thoughts, will you continue to depend on them sooner or later?

Having missed the large rally, this identical group of folks is now busy working round with their hair on hearth, yelling about how unsustainable this transfer is — they appear to really feel that shares are too dear, though one should surprise if they might really feel the identical means in the event that they had been taking part within the rally, quite than shouting at it from the sidelines.

Maybe for slightly context, we’d think about these indices in a broader time-frame than YTD: For instance, wanting again 2 years reveals us that the majority of those 2023 year-to-date positive factors are merely a restoration of the 2022 drop, as charges rose and fears of a revenue collapse unfolded.

Because the 2-year chart above reveals, NASDAQ 100 is up >4%, the S&P 500 is up ~3.4%, and the Russell 2000 is off 18%; these are hardly causes to have fun. And but, that’s precisely what the previous 2 years within the U.S. fairness markets have gotten you.

A rally off the lows seems to be very completely different within the context of restoration of a drawdown.

~~~

Benefit from the vacation weekend, and keep protected on the market…

Beforehand:

What Do You Consider? Why? (June 29, 2023)

Groping for a Backside (October 14, 2022)

No person Is aware of Nuthin’ (Might 5, 2016)

Too Many Bears (Might 3, 2022)

Capitulation Playbook (Might 19, 2022)

No person Is aware of Something

__________

1. A number of technicians have been pounding the desk because the June and October lows, together with Ed Yardeni, Ralph Acampora, and J.C Parets.