What are the Price range 2023 – 12 Key highlights that are going to affect our private monetary life? Let me checklist them and attempt to perceive them intimately.

Price range 2023 – 12 Key highlights impacting private finance

# Mahila Samman Financial savings Certificates

To empower ladies, a one-time new small financial savings scheme referred to as as “Mahila Samman Financial savings Certificates” is launched. It will likely be made obtainable for a two-year interval as much as thirty first March 2025. Ladies or woman little one can make investments as much as Rs.2,00,000 on this scheme. The tenure of the deposit shall be 2 years and can have a hard and fast rate of interest of seven.55. A partial withdrawal facility can be obtainable.

# Senior Citizen Financial savings Scheme (SCSS) restrict enhanced

At the moment, the utmost restrict for Senior Citizen Financial savings Scheme or SCSS restrict is Rs.15 lakh. That is now enhanced to Rs.30 lakh. This I feel is a giant booster for senior residents.

Learn a full article in regards to the SCSS scheme at “Put up Workplace Senior Citizen Scheme (SCSS)-Advantages and Curiosity Fee“.

# Put up Workplace Month-to-month Revenue Scheme (MIS) restrict enhanced

The present restrict for the Put up Workplace MIS scheme is Rs.4.5 lakh for people and Rs.9 lakh for joint accounts. This restrict is now elevated to Rs.9 lakh and Rs.15 lakh respectively.

By this, you might assume that with the speed of particular person accounts elevated, the joint accounts ought to be round Rs.18 lakh (double of the sooner restrict). Nevertheless, the federal government restricted it to Rs.15 lakh.

However nonetheless, I really feel it is a improbable transfer as it’s a big aid for a lot of traders who depend on such authorities, protected, and fixed-income merchandise.

Learn extra about Put up Workplace MIS at “Put up Workplace Month-to-month Revenue Scheme or MIS – An entire information“.

# Sec.54 and Sec.54F exemption restrict is capped

Earlier below Sec.54, and Sec.54F, there was no such amount-based cap. Nevertheless, now it’s Rs.10 Cr.

# TDS on EPF withdrawal is decreased

Earlier throughout the withdrawal of EPF (inside 5 years), if you don’t present a PAN quantity, then the TDS was at 30%. Now it’s decreased to twenty%.

Check with our earlier put up on this facet at “EPF Withdrawal Taxation-New TDS (Tax Deducted at Supply) Guidelines“.

# No Tax on as much as an earnings of Rs.7 Lakh of earnings below the brand new tax regime

Earlier, the rebate below Sec.87A was as much as Rs.5 lakh. That is now enhanced to Rs.7 Lakh. Therefore, in case your earnings is under Rs.7 lakh and choosing new tax regime, you then no must pay the tax.

# Tax charges modified below the brand new tax regime (no change within the outdated tax regime)

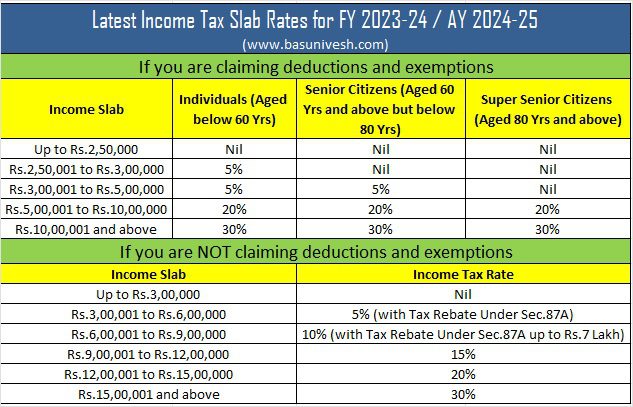

Earlier, below the brand new tax regime, there have been 6 tax slabs ranging from Rs.2.5 lakh. Now the variety of tax slabs below the brand new tax regime is decreased to five. They’re as under. Do keep in mind that there isn’t a change within the outdated tax regime.

The most recent Revenue Tax Slab Charges for FY 2023-24 / AY 2024-25 are as under.

Refer an in depth put up on this facet at “Revised Newest Revenue Tax Slab Charges FY 2023-24“.

# Introduction of ordinary deduction below the brand new tax regime

Earlier the usual deduction profit was allowed just for outdated tax regime. Nevertheless, now the good thing about the usual deduction is relevant to the brand new tax regime too. Every salaried individual with an earnings of Rs.15.5 lakh or extra will thus stand to profit by Rs.52,500.

# Surcharge for these whose earnings is above Rs.5 Cr is decreased

Earlier the surcharge on these people whose earnings is greater than Rs.5 Cr was 37%. That is now decreased to 25%. Based mostly on this the efficient tax price was decreased from earlier 42.74% to 39%.

# Depart Encashment restrict is elevated to 25 Lakh

Earlier encashment of earned go away as much as 10 months of common wage, on the time of retirement in case of an worker (apart from an worker of the Central Authorities or State Authorities) was exempt below Sec.10(10AA) as under (lowest).

- Rs. 3 lakh

- Precise go away encashment quantity

- Common wage (primary wage + dearness allowance) of the final 10 months earlier than the worker’s retirement or resignation

- Money equal of pending go away days. The go away foundation is a most of 30 days go away for yearly of service.

Now, this restrict of Rs.3 lakh is elevated to Rs.25 lakh.

# TDS on curiosity earnings of NCDs

“It’s proposed to withdraw the exemption from TDS at the moment obtainable on curiosity fee on listed debentures.”.

Earlier the curiosity you obtain from the listed NCDs is exempt from TDS. Nevertheless, it’s a must to pay the tax as per your earnings tax slab. This exemption is now eliminated. Therefore, you’ll obtain the curiosity post-TDS.

# Conventional Life Insurance coverage insurance policies the place the premium is greater than 5 lahks aren’t tax-free

“It’s proposed to supply that the place the mixture of premium for all times insurance coverage insurance policies (apart from ULIP) issued on or after 1st April 2023 is above Rs.5 lakh, earnings from solely these insurance policies with mixture premium as much as Rs.5 lakh shall be exempt. This is not going to have an effect on the tax exemption offered to the quantity acquired on the dying of the individual insured. It’ll additionally not have an effect on insurance coverage insurance policies issued until 31st March, 2023.

This I feel a giant jolt to insurance coverage corporations.

Conclusion – Contemplating all these, we will assume that the federal government in a method aggressively pushing for adopting the brand new tax regime. I hope the message is obvious to all of us. This put up is up to date with the restricted data obtainable as of now. Nevertheless, as and once I get the readability, I’ll replace this put up.