I’ve a love-hate relationship with historic market knowledge.

On the one hand, since we are able to’t predict the long run, calculating possibilities from the previous within the context of the current scenario is our solely hope with regards to setting expectations for monetary markets.

Then again, an overemphasis on historic knowledge can result in overconfidence if makes you consider that backtests might be handled as gospel.

In some methods markets are predictable in that human nature is the one fixed throughout all environments. That is why the pendulum is consistently swinging from manias to panics.

In different methods markets are unpredictable as a result of stuff that has by no means occurred earlier than appears to occur on a regular basis.

I just like the outdated saying that I might slightly be roughly proper than exactly fallacious.

Historic market knowledge doesn’t let you know what’s going to occur with regards to funding outcomes however it may possibly make it easier to perceive a wider vary of potential dangers.

It could additionally present you the magic of compounding with regards to the inventory market if you happen to get too caught up on the danger aspect of the equation.

YCharts has a software referred to as State of affairs Builder that means that you can have a look at the affect of investments, contributions and withdrawals on completely different holdings and asset allocations over time.

Right here’s a easy one:

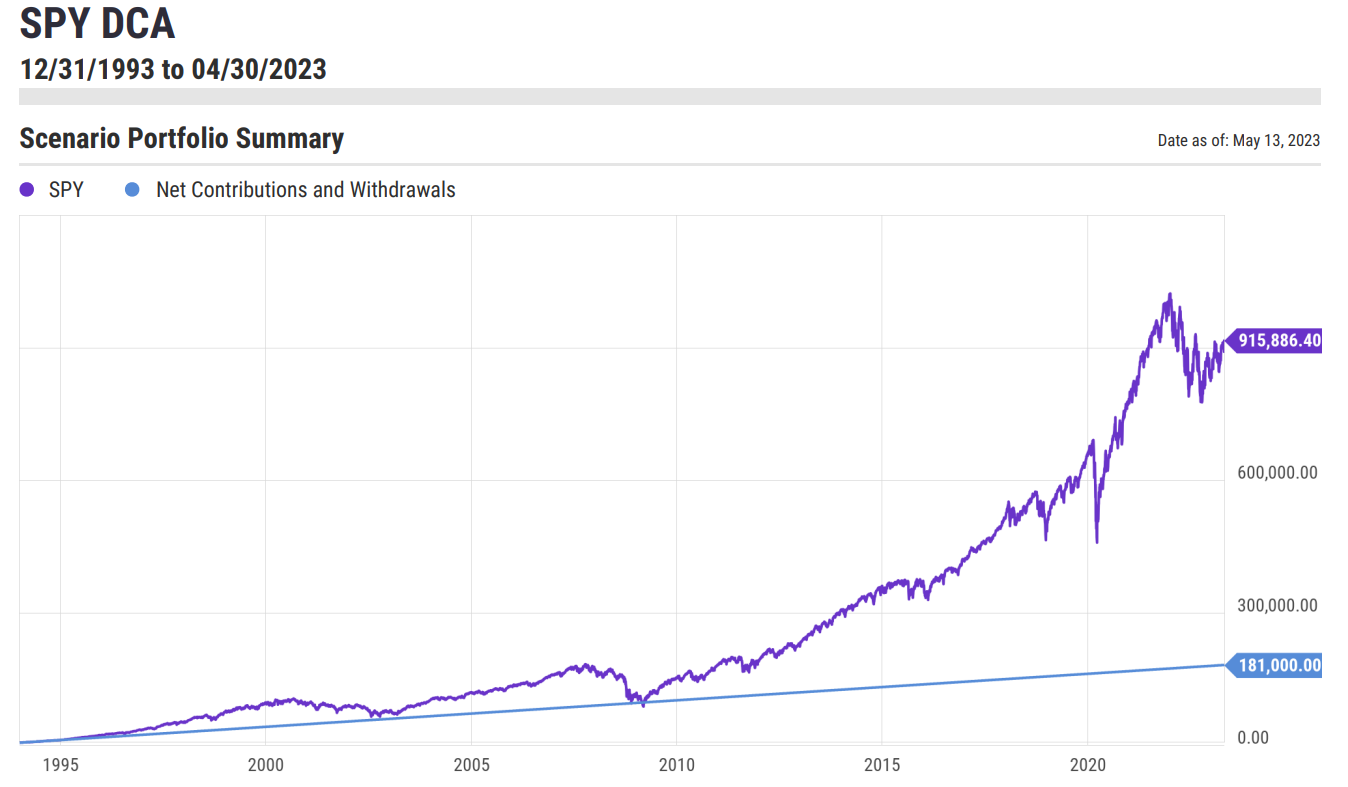

Let’s say you set $5,000 into the preliminary S&P 500 ETF (SPY) proper round when it began originally of 1994. On prime of that you just additionally contribute $500/month into the fund.

Easy proper?

Right here’s what this situation appears to be like like:

Not dangerous.

That is the abstract:

- Preliminary funding (begin of 1994): $5,000

- Month-to-month funding: $500

- Complete investments: $181,000

- Ending steadiness (April 2023): $915,886

Loads of volatility alongside the best way however this easy greenback value averaging technique would have left you with much more cash than you initially put into it.

Though issues labored out swimmingly by the tip of this situation there have been some darkish days alongside the best way.

You may see on the chart the place the purple line dips under the blue line in 2009 by the tip of the inventory market crash from the Nice Monetary Disaster.

By March of 2009 you’d have made $96,000 in contributions with an ending market worth of a little bit greater than $94,000.

In order that’s greater than a decade-and-a-half of investing the place you ended up underwater.

It wasn’t prudent however I perceive why so many buyers threw within the towel in 2008 and 2009. Issues have been bleak.

All the things labored out phenomenally if you happen to caught with it however investing in shares might be painful at occasions.

A misplaced decade sandwiched between two bull markets with a sprinkle of a bear market towards the tip labored out properly utilizing these assumptions.

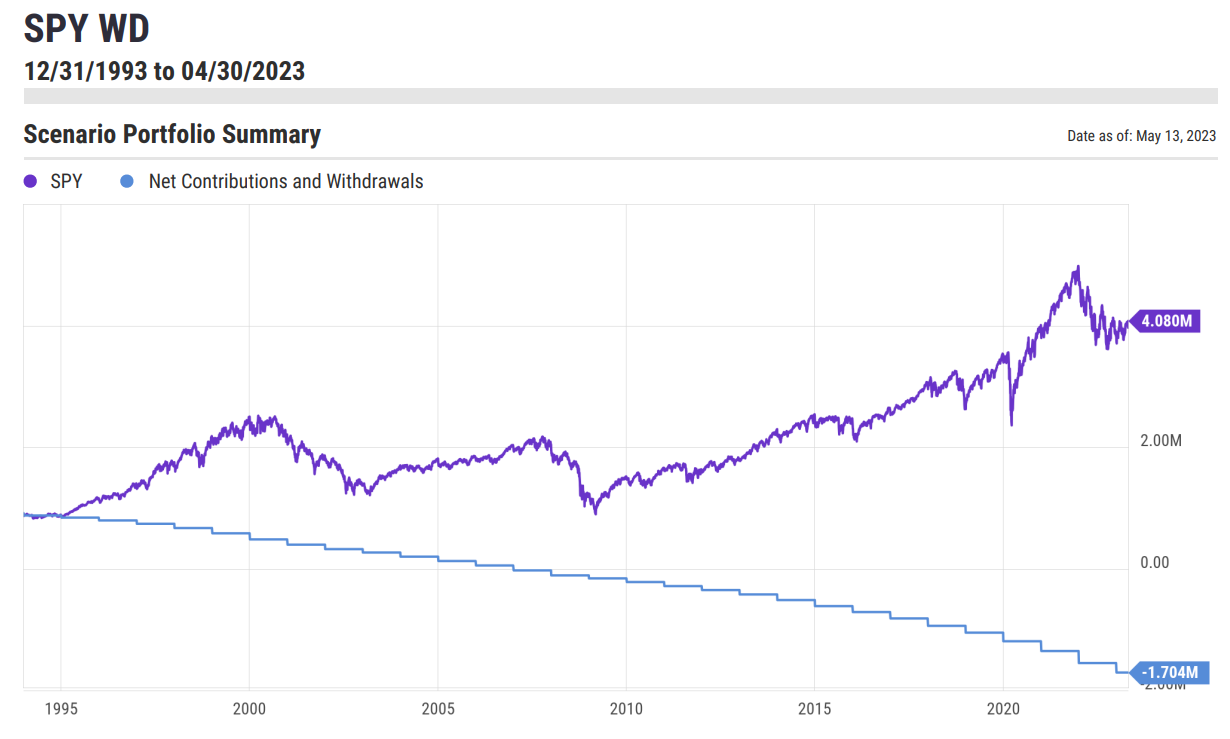

Only for enjoyable, let’s reverse this situation to see what would occur if you happen to began out in 1994 with the identical ending steadiness however now you’re taking portfolio distributions.

Like this:

- Preliminary steadiness (begin of 1994): $915,886

- Annual portfolio withdrawal: 4% of portfolio worth

I do know this isn’t precisely the 4% rule since the 4% rule assumes you set the preliminary draw at 4% after which enhance that quantity by some inflation fee. However we’re simply having enjoyable right here to see how issues look utilizing completely different assumptions.

Right here’s the chart:

An ending steadiness of greater than $4 million whereas spending $1.7 million alongside the best way from a place to begin of rather less than $1 million is fairly, fairly good.

The same old caveats apply right here — previous efficiency says nothing about future efficiency, nobody truly invests in a straight line like this, nobody invests in a single fund like this, nobody makes use of this sort of withdrawal technique in retirement nor do they make investments 100% in shares whereas doing so, etcetera, etcetera, etcetera.

However I do like the concept of making an attempt issues on for measurement with regards to stuff like this.

Life by no means works out like a spreadsheet or retirement calculator or situation evaluation software.

Issues change. Folks make or spend roughly cash. Markets, contributions or withdrawals by no means happen in a linear style.

Life is lumpy. Funds change. Danger urge for food evolves. Issues grow to be sophisticated.

However it’s not a nasty concept to map issues out a little bit with regards to your portfolio, finances, financial savings, spending or something in between.

The longer term by no means seems precisely such as you assume it would however there’s nothing fallacious with setting some goalposts after which performing course corrections alongside the best way as actuality is available in higher or worse than anticipated.

Each funding plan ought to contain setting expectations and pondering via eventualities which will or might not truly occur.

That is why monetary planning is a course of and never an occasion.

It’s a must to be prepared to replace and evolve when issues work out higher or worse than anticipated.

Additional Studying:

Backtests are Unemotional. People are Not