“Once I see a bubble forming I rush in to purchase, including gas to the hearth. That’s not irrational.”

– George Soros, 2009

I’ve spent 25 years watching, buying and selling and investing within the inventory market. The repetition of patterns is wonderful. In each technology we see new bubbles, which kind when a brand new innovation comes alongside and everybody will get excited in regards to the future. The gang will get swept away on a wave of insanity, fueled by the current good points they’ve seen for themselves (or for others) and all different concerns exit the window. Get me in, I don’t care how, I can’t miss out on this.

In December, ChatGPT started to unfold like wildfire on social media. A handful of art-related AI applications like DALL-E 2 additionally started to proliferate on Instagram and a few of the extra image-oriented websites, however ChatGPT captured the imaginations (and nightmares) of the chattering class like nothing else we’ve ever seen.

Wall Avenue has begun to take discover of the AI theme for the inventory market. It needs to be famous that buying and selling applications primarily based on earlier variations of AI have been round for many years, so the idea is a really snug one amongst analysts, merchants and bankers at conventional corporations. However now that there’s retail investor curiosity in driving the wave, you’re going to see the meeting line lurch into motion very quickly. The change has already been thrown. They’re pulling up their overalls and rolling up their sleeves. Funds, merchandise, IPOs and techniques are being formulated within the dozens as we converse. It will hit the lots of earlier than we’re by way of. It’s merely stage one.

That is Barron’s, waving the checkered flag a number of days in the past:

In a analysis be aware Wednesday, UBS analyst Lloyd Walmsley factors out that the abruptly wildly in style pure language chatbot ChatGPT, created by the start-up OpenAI, backed by Microsoft was on tempo to surpass 100 million month-to-month lively customers in January, up from 57 million in December.

Walmsley notes that it took TikTok about 9 months from launch to succeed in 100 million customers, whereas for Meta Platforms’ Instagram, it took about 2.5 years. “We can’t bear in mind an app scaling at this tempo,” the analyst provides. He says ChatGPT is averaging greater than 13 million guests a day, greater than double the extent in December.

Walmsley provides that he’s heard venture-capital buyers speculate that the marketplace for generative AI purposes could possibly be as massive as $1 trillion. He notes that the world has over one billion data employees; OpenAI fees $42 a month for the skilled model of ChatGPT. In the event you assume each a type of folks will get two accounts—one common, and one specialised—you get shut $1 trillion.

I wish to lay out a number of of the stuff you’re about to see, in order that once they occur, you perceive that that is nothing new and all a part of the traditional rhythm of the markets. An ebb and circulate that’s been with us from the primary gross sales of the South Seas firm inventory in London, or the Dutch East India Firm’s share choices, or the bubbles in canal shares in the course of the earl7 1800’s or the railroad shares within the late 1800’s or the oil and metal ventures of the early 1900’s. We repeat this time and again, all the time with the momentary amnesia that permits us to neglect how this cycle normally ends – small handful of winners, a lot of smash, rancor and recrimination for everybody else.

Let’s get into this stuff:

1. Bubbles don’t happen out of skinny air or for no cause. There’s all the time a kernel of reality round which the mania coalesces. That is what makes them so irresistible and irritating to struggle once more. The gang does have the info on its facet, at the very least within the early going. All the pieces they mentioned the web would be capable of do 25 years in the past got here true. After which some. It’s truly been extra world-changing than even the largest bulls would have thought attainable. And but, nearly not one of the firms from the late 90’s are nonetheless round. The Nasdaq had fallen by 90% from its peak even supposing, if something, we had been underestimating the web’s affect. Throw in wi-fi communications and throw in broadband know-how – all of them appeared on the identical time. The bulls had been proper on the idea however mistaken on the horses they’d wager on and method too early. So for starters, I would like you to really feel snug with the next: It’s attainable to concurrently imagine within the huge potential of AI whereas believing that the publicly traded shares engaged in AI are unworthy of funding. You possibly can imagine each issues and say each issues to folks in response to their exhortations. You aren’t backwards or previous or clueless or a dinosaur for holding this view.

2. Twitter will probably be crammed with charlatans, promoters and individuals who wouldn’t have your finest pursuits in thoughts. There’s a factor about investing within the twenty-twenties decade the place it’s not sufficient to generate profits in one thing, in addition they must belittle everybody else who wasn’t as good as they had been to get in. There’s additionally a necessity to advertise the issues they had been early too as a result of with out others coming in later, they’ve nobody to promote to. So there’s a built-in urge to evangelize and the place that is normally executed by professionals and pseudo-professionals is on Twitter (retail people use Reddit for this within the trendy period, having used avenue corners, saloons, radio exhibits, pamphlets and the Yahoo Finance message boards in earlier eras). You will note a brand new class of AI specialists construct massive followings on the web, beginning YouTube exhibits and podcasts to money in on the phenomenon. Their opinions on the every day happenings in “the AI house” will change into gospel for the mainstream media, newspapers and TV networks whereas they use this “institution” clout to advertise varied AI merchandise and platforms wherein they’ve made (or acquired) a monetary funding. That is America, there’s nothing inherently mistaken with this. However it’s coming. And you will note it all over the place you look this summer season.

3. The individuals who generate profits in AI shares will go after the conservative buyers who’ve missed out or stayed on the sideline. In the event you’re a worth investor or a financial institution CEO or another paragon of the established order on Wall Avenue, you’re going to wish to keep away from strolling in entrance of an open microphone and blurting out an opinion on these items. It’s going to come back again to hang-out you. The lottery winners who bought in early on the AI shares earlier than the doubling, tripling and quadrupling will probably be out for blood. Bear in mind, it’s not sufficient to have made cash within the twenty-twenties – now it’s about completely destroying the individuals who might have been skeptical or mistaken whilst you had been proper. There’s a illness when investing is mixed with social media, which is why each startup that engages in it will definitely flops and fades. No good can come of this.

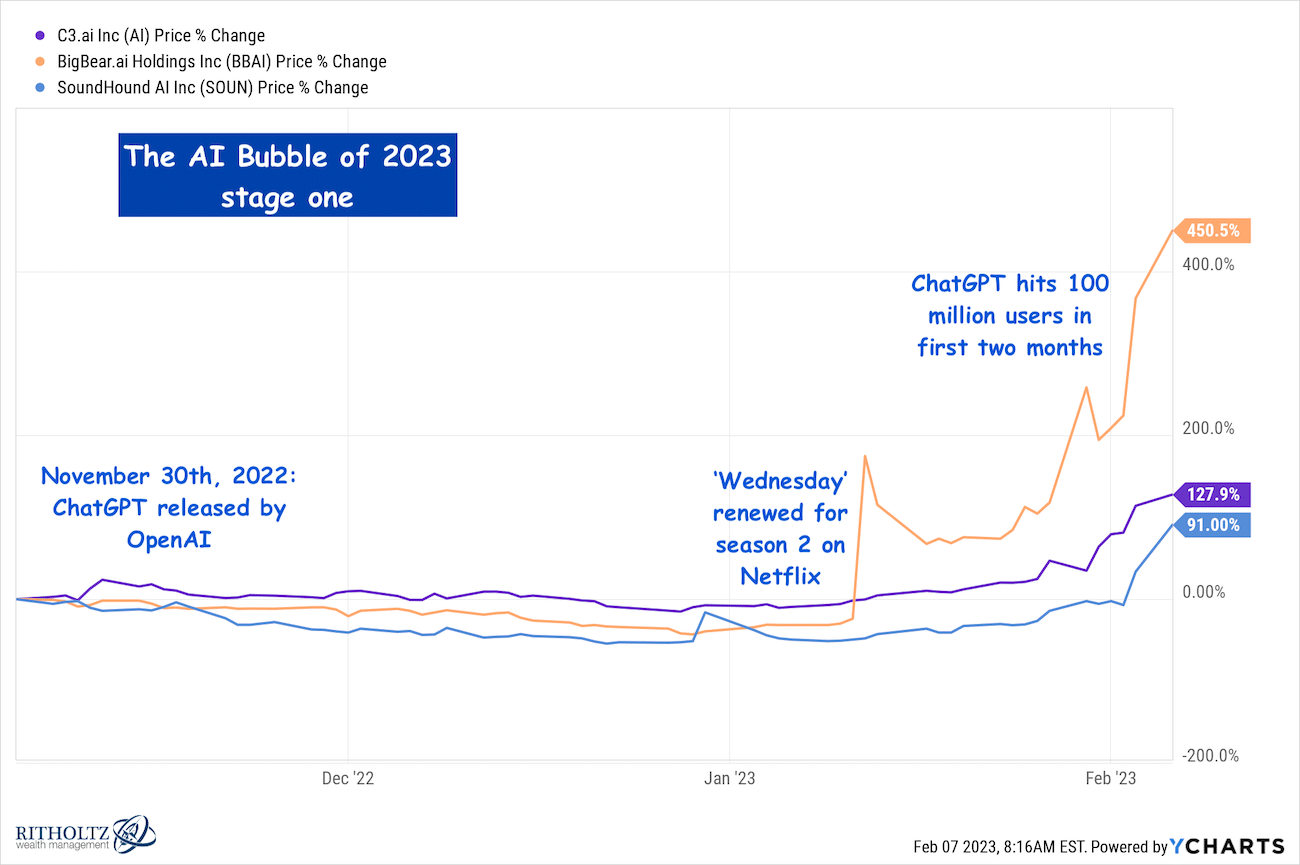

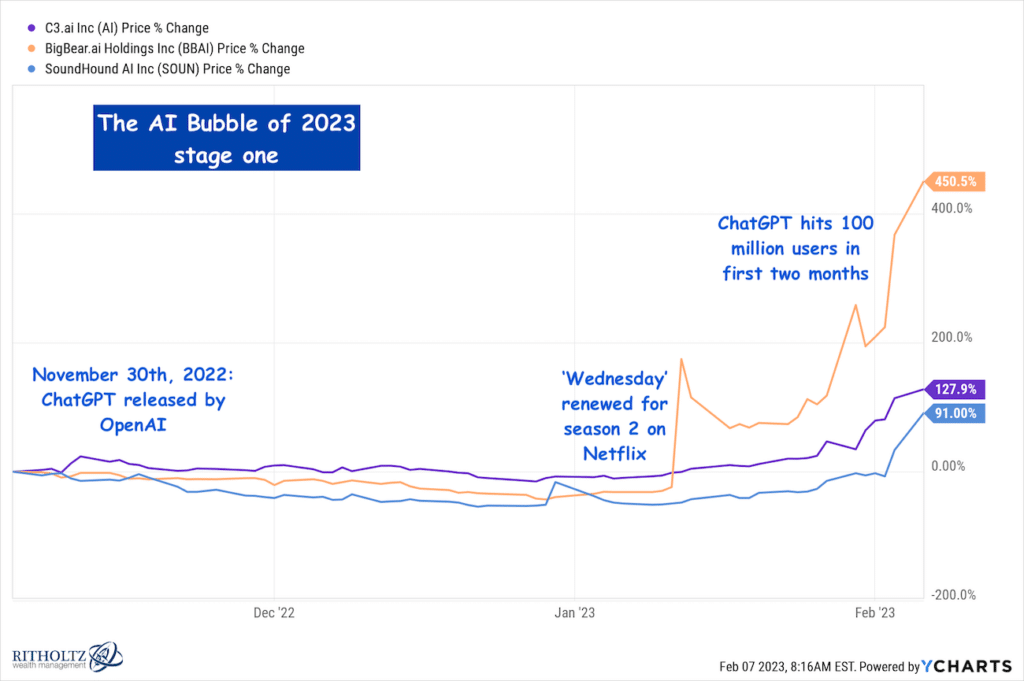

4. To start with, there aren’t sufficient shares to go round. Take a look on the chart under. These are the three pure-plays in AI that at present commerce publicly. BigBear ai has authorities contracts for synthetic intelligence (legitimacy!). C3.ai has the fitting ticker image (AI, nailed it!) and SoundHound has the time period “ai” in its identify plus a backlog of about $300 million value of tasks for company clients within the house (customer support cellphone calls, conversational AI that replaces human interplay, and many others). Their market caps are small and their enterprise fashions unproven however there aren’t any options. Retail buyers can’t name up Silicon Valley and order themselves up some shares of the following wave of AI startups. They need to content material themselves with what’s on the menu immediately.

5. The ETFs aren’t going to suffice right here. They’re loaded up with conventional tech shares like semiconductor firms and software program firms and robotics and automatic driving and all types of stuff that’s AI-related or AI-adjacent or AI-scented, however is just not fairly within the eye of the hurricane. You could find a full checklist of ETFs right here at VettaFi which have one thing to do with AI. Most of them are loaded with massive cap Nasdaq names the place AI is only a small (however rising) a part of their enterprise. By this logic, IBM is an AI inventory. Okay. You’ll additionally discover quite a lot of AI bundled with autonomous or robotics shares in these merchandise. There’s no cause they will’t work as investments, nevertheless it’s not fairly the identical factor as proudly owning a pureplay on AI that goes up as a result of extra persons are getting enthusiastic about AI. Rockwell Automation is a robotics play. It’s all of the robotics ETFs. They might use AI however they aren’t inventing AI. It’s robots for factories. Completely different secular development. I personal Nvidia, which I totally count on to be a serious participant in AI by way of the remainder of the last decade. Many of the instruments out there to builders within the AI discipline contain Nvidia’s software program and {hardware} platform. It’s already an costly inventory so I don’t count on a re-rating. I simply know that I’m glad to have been within the identify for a very long time and following their progress in AI will probably be one of many methods I hold myself sane and away from the carnival of hype.

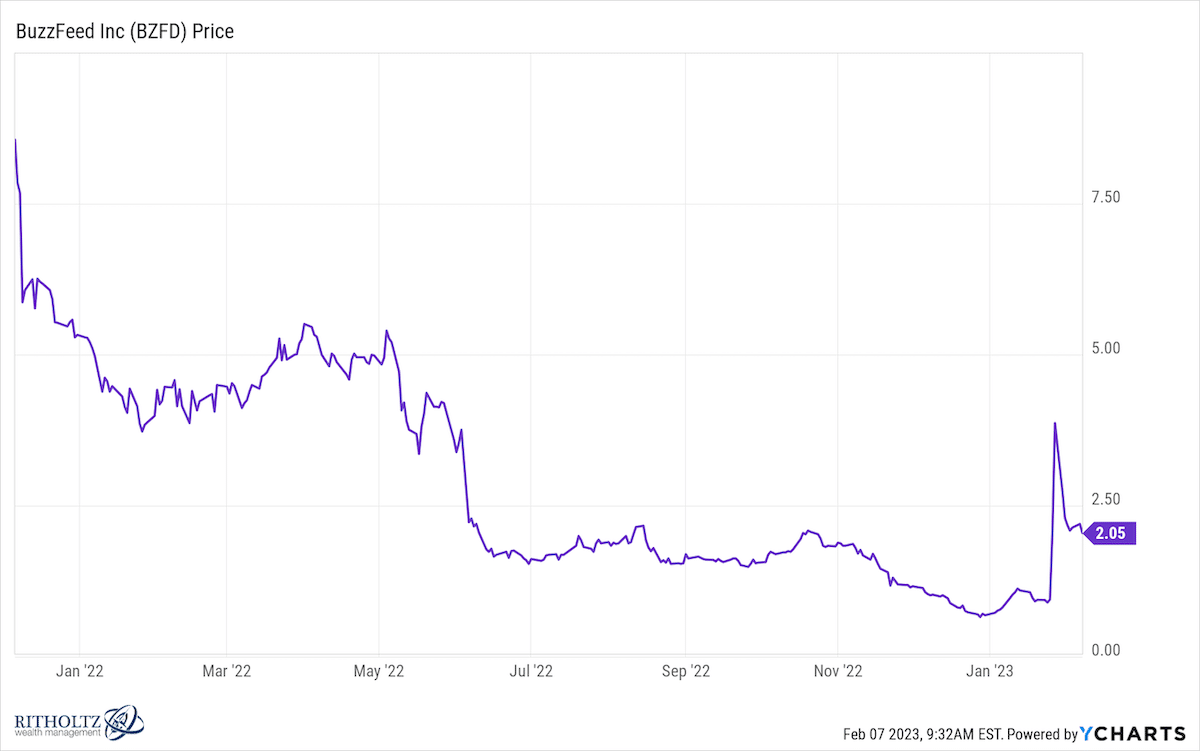

6. A number of determined firms are going to get caught up within the AI hype and begin issuing press releases. Under is a chart of Buzzfeed. Attempt to see in the event you can pinpoint the day they introduced an AI initiative:

Sure, that’s a 95 cent inventory tripling in a single day. Buzzfeed goes to start out changing their their common nugatory content material with software-generated nugatory content material. I’m unsure why that’s worthy of a pop apart from the truth that the time period “ai” was a part of the announcement. Simply as we noticed firms including the suffix “dot com” to their names within the 90’s and saying “blockchain” initiatives in 2017, so too will we now see an infinite parade of AI bulletins in 2023. Massive firms, small firms, microcaps, penny shares. It’s coming like a tidal wave. It should work at first, particularly in controversial, heavily-shorted names the place the float is small and the bears get blindsided. Finally, there will probably be too many bulletins and they’re going to lose their energy to inject pleasure. However not but. We’ve solely simply begun.

7. Some washed-up hedge fund supervisor or former tech founder goes to make use of this as a springboard again to prominence. We noticed this with Bitcoin. There have been guys (principally bearish on shares and the financial system) who had been mistaken for a decade about every part they had been saying. A lot of them “pivoted to crypto” in 2021. It rejuvenated their content material and their viewers growth with a recent new objective. All of the macro doom and gloom might now be repurposed into “and so, according to the final ten years of my money-losing, Fed-bashing, fear-mongering, non-constructive rhetoric, I’m now pivoting to crypto as a result of decentralization is the one reply!” It’s humorous that they’d the cartoon piano dropped on their heads twice – first, they’re telling folks to brief shares or keep away from the market in the course of the second finest decade for returns of all time, inflicting their followers to overlook all of the good points and even lose cash from the surplus buying and selling and hedging. Then, on the very peak of one other, much more egregious and embarrassing bubble, they go all-in and begin altering their avatars to laser eyes and dressing in costumes and whatnot. They misplaced in each instructions! Solely subscription guys can get away with this. In the event that they had been truly working cash, their AUM could be zero by now, LOL. However you’ll see – the brand new AI opportunists are going to come back from the ashes of another motion that’s already been burned to the bottom. Nobody will bear in mind or care, it’s high quality.

8. The equipment is cranking up. I discussed the meeting line above. Right here’s how Wall Avenue works: Promote the folks what they wish to purchase, once they wish to purchase it, and if a bit of of a very good factor is nice, then quite a lot of a very good factor is nice. When the geese are quacking, you feed them. That’s how we ended up with one thousand SPACs and two thousand IPOs and 10,000 crypto currencies. As a result of Previous Man Thirst is one among nature’s most dependable, renewable sources. The previous males are thirsty to capitalize on what the younger males are capitalizing on, so they are going to be filled with AI IPOs and AI ETFs till their livers are became foie gras. “Right here comes the gravy pipe, open huge you sonofabitch.” The bankers are on the cellphone with the west coast proper now, “Present me one thing in AI, Chad…” Mark my phrases, they may drown you in provide. Three publicly traded pureplays will change into 5, then ten, then fifty. It’ll occur in a single day. One or two of those firms will change into one thing greater. The remaining will fade away when the mania subsides. Are you adequate to establish the AI winners from the losers at this early stage? Go for it!

I can do extra however eight of those concepts is sufficient for now. I promise to revisit as issues get much more intense (and they’re going to).

To shut, I’ll go away you within the arms of George Soros, legendary hedge fund supervisor, giving the under speech in 2009 in the course of the aftermath of one of many greatest booms and busts in historical past…

I’ve developed a principle about boom-bust processes, or bubbles, alongside these traces. Each bubble has two elements: an underlying development that prevails in actuality and a false impression regarding that development. A boom-bust course of is about in movement when a development and a false impression positively reinforce one another. The method is liable to be examined by detrimental suggestions alongside the way in which. If the development is robust sufficient to outlive the check, each the development and the misunderstanding will probably be additional strengthened. Finally, market expectations change into to date faraway from actuality that persons are compelled to acknowledge {that a} false impression is concerned. A twilight interval ensues throughout which doubts develop, and extra folks free religion, however the prevailing development is sustained by inertia. As Chuck Prince, former head of Citigroup mentioned: we should proceed dancing till the music stops. Finally a degree is reached when the development is reversed; it then turns into self reinforcing in the wrong way.

Learn additionally: